OGJ Newsletter

General Interest - Quick Takes

UK raising oil and gas taxes again

UK Chancellor Gordon Brown announced a tax increase for oil companies in a move that energy experts predicted could discourage North Sea investment (see Editorial and p. 35).

The chancellor’s Dec. 5 prebudget report called for the UK supplementary corporate tax on UK and UK continental shelf production to rise to 20% from 10%, effective Jan. 1, 2006. The supplementary charge is in addition to a 30% corporate tax.

Banc of America Securities analyst Daniel Barcelo of New York noted that it’s the second time the UK has raised taxes on oil companies in 3 years.

The UK Offshore Operators Association (UKOOA) issued a statement saying that its members were “shocked” that oil and gas producers will have to pay 50% in total corporation taxes.

“This will take an extra £6.5 billion out of the industry over the next 3 years when Treasury will already reap £11 billion in tax revenues from North Sea producers this year, double the amount paid last year, and treble the amount forecast 2 years ago,” UKOOA said.

UKOOA Chief Executive Malcolm Webb said, “I am staggered that the chancellor, who speaks of the need for stability and long-term investment, should take this action. It is almost beyond comprehension that the government has failed to grasp the vulnerability of the industry’s future in the UK.”

Webb said the tax hike “will deter investment in new fields and make older fields less attractive for increased recovery.” He said the effect would most hurt smaller oil and gas producers.

Increase in energy M&A activity predicted for 2006

Energy merger and acquisition activity likely will rise in 2006, PricewaterhouseCoopers LLP’s transactions services group said, noting that energy M&A has retreated from heights reached in the 1990s.

“We think it’s very possible the industry will see some large M&A deals next year, both in the US and globally,” said group leader Rick Roberge, Houston. During 2005, many oil companies repurchased their stock rather than making acquisitions.

“Many of the larger companies have been content to sit on their cash war chests in 2005,” he said. “But at some point, commodity prices will settle, and companies will begin drilling higher-risk projects using higher midcycle prices. That’s when consolidation will accelerate because of the need for larger balance sheets to reduce those risks.”

Few companies believe current commodity prices are sustainable, he said. As prices soared for 2 years, investment as a share of cash flow at the 20 largest oil and gas companies fell to 36% from 46%. While investment levels are higher at independents than at integrated companies, the pattern was the same at both.

Integrated companies are likely to continue avoiding major acquisitions while commodity prices remain at record levels, he said. But independents are likely to begin increasing their acquisition activity, if only because they need bigger balance sheets to offset risks associated with drilling harder-to-access, potentially less productive resources.

Roberge said virtually no company based its budget on sustained high commodity prices, and now most companies have excess cash.

“As a result, companies have put balance sheet finance decisions ahead of investment decisions,” he said. “While buying back shares is clearly preferable to raising dividends as a means of returning excess cash to investors, both are up this year as a percentage of cash flow.”

Roberge said share repurchase programs are more flexible and can be reversed quickly, while a decision to increase dividends cannot.

“The M&A wild card is the global buyer,” he said. “Often financed in part by their respective governments, national oil companies are not afraid to do deals at current price levels. Until M&A prices begin moving off their record highs, NOCs could be the most active players in the major deal marketplace.”

Roberge said analysis of the 20 largest oil and gas companies through the first half of 2005 revealed that investment levels dropped as a percentage of cash flow despite a public clamor for more US supply and for more refining capacity.

“Energy investment is a long-term proposition, and the majors simply do not adjust their plans on 1-2 year commodity price cycles,” Roberge added. “However, by now, higher midcycle prices should have brought more projects into the ‘acceptable rate of return’ zone.”

PDVSA signs agreements with BP, Shell

Petroleos de Venezuela SA has signed transitional agreements with BP PLC and Royal Dutch Shell PLC to convert their operating service agreements into joint ventures with the government.

PDVSA Pres. Rafael Ramirez, who also is Venezuelan oil minister, told reporters in Caracas on Dec. 2 that 15 companies have signed the agreements, and more companies are expected to do the same by yearend.

The government is requiring companies that operate 32 oil fields in Venezuela to convert to joint ventures with PDVSA. The transitional agreements will be valid until Venezuela approves definitive guidelines for joint ventures with PDVSA (OGJ, Apr. 25, 2005, p. 48).

Companies involved in 26 of the fields had signed transitional agreements as of Dec 2, Ramirez told the Associated Press.

PDVSA is calculating the value of each field in an effort to determine ownership percentages in the joint ventures. The amount that an individual company has invested in a particular field will be considered in determining its stake, Ramirez told AP.

In a related matter, companies also must settle outstanding tax claims before the joint ventures will be considered permanent, government officials have said (OGJ Online, Aug. 4, 2005).

French oil industry backs biofuels plan

The French oil and gas industry has indicated it will support the government’s target to increase the biofuels content of gasoline and diesel to 5.75% from its current 1.2% by 2008.

That deadline would be 2 years ahead of the European Union’s directive. A further target is to increase the biofuels share to 7% by 2010 and to 10% by 2015.

Industry Minister François Loos and Agriculture Minister Dominique Bussereau recently met with representatives of the oil, automotive, and agricultural industries to encourage partnerships aimed at achieving the 2008 production target of 3 million tonnes of biofuels. Of that total, 2.2 million tonnes would be biodiesel. Current annual output rates are 400,000 tonnes of biodiesel and 100,000 tonnes of ethanol.

The oil industry trade group Union Française des Industries Pétrolières (UFIP) indicated in a press release that it was especially interested in increasing production of biodiesel to reduce imports of middle distillates.

The group supported increased production of gasoline blendstocks able to accommodate finished fuels containing 5% ethanol by the middle of 2006. UFIP said the development of biofuels should take place with full price transparency. ✦

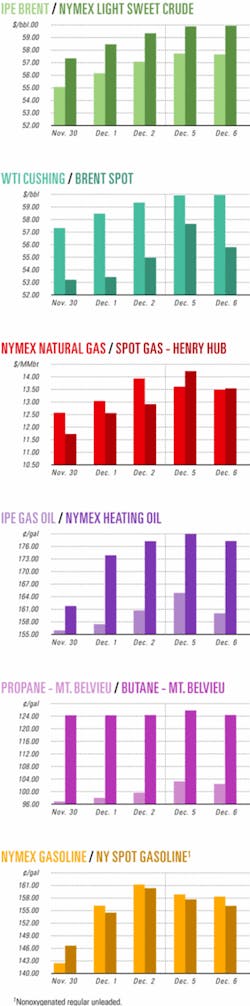

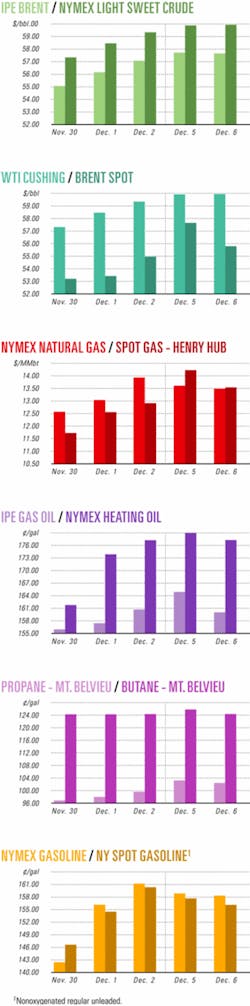

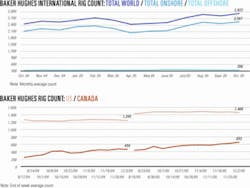

Industry Scoreboard

null

null

null

Exploration & Development - Quick Takes

Norway okays Ringhorne Øst oil development

Norwegian authorities approved the development and operating plan for Ringhorne Øst oil field on Block 25/8 in the North Sea, 180 km west of Karmøy, development operator ExxonMobil E&P Norway said Nov. 25.

Ringhorne Øst’s reserves are estimated at 47 million bbl of oil. The development involves two production licenses-PL027 and PL169. Four oil wells are to be drilled starting next month through slots in the existing Ringhorne platform, where gas production started in February 2003.

Ringhorne Øst oil production will be processed at Ringhorne field and nearby Balder field facilities. Produced gas will move through Statpipe into the Gassled system via a high-pressure line from Balder field to Jotun field. Ringhorne Øst’s total development cost is estimated at 1 billion kroner.

ExxonMobil holds 100% interest in PL027 and a 13% interest in PL169. Other PL169 interests are Norsk Hydro AS 45%, Petoro AS 30%, and Statoil ASA 12%.

Syntroleum due stake in oil find off Nigeria

Syntroleum Corp., Tulsa., signed an agreement with the Nigerian oil and gas company Britania-U Nigeria Ltd. to acquire 40% interest in an oil discovery on Oil Mining Lease 90 off Nigeria.

Chevron Corp. made the discovery in 1987, 234 km south of Lagos. On test, the Ajapa 1 well flowed at a stabilized rate of 4,210 b/d of 40o gravity crude from 100 ft of net pay in 30 ft of water. The well was suspended.

Syntroleum plans an appraisal program. Subject to completion of further agreements, government approval, and rig availability, it expects to drill the first appraisal well during 2006.

Britania-U Nigeria acquired 100% ownership of the field in 2003 from the Nigerian government.

Shell to explore deep targets in Ukraine

Ukraine’s national oil company Naftogaz Ukrainy and Shell Exploration & Production Co. signed a cooperation agreement covering deep exploration in the Dniepr-Donets basin.

Shell will earn a 50% interest in 10 Naftogaz Ukrainy licenses, excluding existing production, by acquiring seismic data and drilling deep exploratory wells over 3 years. Shell expects its total initial investment in the work, starting next year, to be $100 million.

In May, the two companies agreed to jointly study a 31,000 sq km area of the basin in central-eastern Ukraine. Parts of the area have gas production from shallower reservoirs not covered in the new agreement.

DNO spuds wildcat in far northern Iraq

DNO ASA, Oslo, has spudded a well in far northern Iraq under production-sharing agreements signed with the Kurdistan regional government in June 2004.

The operation is considered politically and legally controversial because the agreement does not involve Iraq’s formative central government. DNO signed a memorandum of understanding on training and cooperation with Iraq’s Ministry of Oil in April.

After acquiring 440 line-km of 2D seismic data on the PSA areas earlier this year, DNO spudded Tawke-1 in late November and plans to drill to 3,000 m. The location is north of Mosul along the Mardin high east of Syria and near the Turkish border.

The company identified three prospective reservoirs on the structure, near the Iraqi border city of Zakhu.

Minimum work program on the 4,000 sq km of PSAs is 250 line-km of 2D seismic and three wells within 4 years from June 2004.

DNO operates the PSAs and is the sole contractor with a 40% beneficial interest.

DNO, which has production in Yemen, signed a PSA for a minority participating interest in Block 6 onshore Syria, subject to ratification. The contract has an initial exploration commitment to DNO of about $1 million.

Well off Mauritania encounters hydrocarbons

Dana Petroleum PLC unit Dana Petroleum (E&P) Ltd. reported that its Faucon-1 exploration well, being drilled on Block 1 off Mauritania, has encountered hydrocarbon-bearing sandstone in the main Cretaceous target horizon.

Dana said drilling has been temporarily suspended at 3,536 m for acquisition of wireline logs, formation pressures, and fluid and core samples. Dana intends to deepen the well by as much as 700 m to assess the Cretaceous section.

The hydrocarbons occurred in the Cretaceous zone in which Woodside Petroleum Ltd. intersected a gross oil interval of about 8 m with the Tevet-2 well to the north of Faucon-1 (OGJ Online, Sept. 27, 2005).

At the time, Woodside said the result was encouraging for future Cretaceous exploration in Mauritanian sites it operates.

Dana is operator of Block 1 with a 36% share. Other shareholders are Gaz de France UK 24%, Tullow Oil PLC 20%, Hardman Petroleum (Mauritania) Pty. Ltd. 18%, and Roc Oil (Mauritania) Co. 2%.

Petronas makes gas discovery off Sarawak

Malaysia’s Petronas said development is possible of the Kanowit-1 natural gas discovery on Block SK306 off Sarawak.

Japan Drilling Co. Ltd.’s Naga-1 semisubmersible drilled the well to 2,029 m subsea about 180 km northwest of Bintulu in 80 m of water.

Kanowit-1 encountered “a very significant gas accumulation in a Miocene limestone reservoir,” Petronas reported.

On two production tests, the well flowed at a total rate of 72 MMscfd of gas and 3,400 b/d of condensate, with 5-10% carbon dioxide.

Nearby gas fields are Kumang, F28, and F6. ✦

Drilling & Production - Quick Takes

Oil flow starts from Bonga field off Nigeria

Royal Dutch Shell PLC reported the start of oil production from giant Bonga oil and gas field in more than 1,000 ft of water off Nigeria.

Shell plans to quickly ramp up production to 225,000 b/d of 30o gravity oil and 150 MMscfd of gas.

The 60 sq km Bonga field, on Oil Prospecting License 212, is the second deepwater field to come on stream off the West African country. The first was Eni SPA’s Abo oil field, which started production in 2003 (OGJ, Feb. 14, 2005, p. 18).

The $3.6 billion Bonga development project is expected to increase Nigeria’s oil production by 10%.

The field has 16 subsea production and water injection wells. Production flows through a 2 million bbl storage capacity floating production, storage, and offloading (FPSO) vessel. A large steel catenary riser is installed on the FPSO. The development uses a 2.3-km long dynamic flexible pipe for oil transfer to a single-point mooring offloading buoy.

Associated gas from Bonga will be piped through the 268-km, 32-in. Offshore Gas Gathering System, which Shell operates, to Nigeria Liquefied Natural Gas Ltd. for export to the US and Europe.

Australia, East Timor reach Timor Sea accord

The governments of Australia and East Timor have finally agreed to a division of the royalties from oil and natural gas resources in the Timor Sea.

The eighth round of talks between the two countries since April 2004 concluded at the start of this month with an initialed agreement and an exchange of letters on the basis of an agreed text.

Neither government would reveal full details, but Australia’s Foreign Minister Alexander Downer said the arrangements under the 2002 Timor Sea Treaty will remain in place.

“East Timor will continue to get its 90% share of revenues from the production of the joint development area,” Downer said.

In May the countries agreed to split the royalties from the proposed development of Woodside Petroleum Ltd.’s Greater Sunrise field, which straddles the boundary between the joint development zone and Australian waters, rather than the 82:18 split in favor of Australia proposed earlier (OGJ Online, May 17, 2005). In return, East Timor agreed to postpone discussion of the disputed maritime boundary for 50 years.

However, Woodside is unlikely to move towards field development in the short term. The company is concentrating on the development of Pluto gas field and Browse basin discoveries like Scott Reef and Brecknock on the North West Shelf off Western Australia.Woodside said the future of Sunrise depends on a number of factors, including the fiscal regime under which it would operate, the cost and location of any development, and the successful marketing of the gas.

Details of the new Timor Sea Agreement will not be released until the document is formally signed in January 2006.

Five Ekofisk growth project wells on stream

France’s Total SA reported that the first five wells have been brought on stream in the Ekofisk area growth project in the Norwegian North Sea (OGJ, Aug. 22, 2005, p. 36).

Started in 2003, the Ekofisk project involves the installation of a platform, new processing capacity, and the drilling of 25 additional production wells in the field. At peak, the new development is expected to produce 100,000 boe/d.

Total holds a majority share (39.9%) in Ekofisk. Its partners are field operator ConocoPhillips Skandinavia AS (35.1%), Eni SPA, Norsk Hydro AS, Petoro AS, and Statoil ASA.

First-phase Snøhvit drilling nearly complete

Statoil ASA has nearly finished drilling and completion in the first phase of the Snøhvit subsea development project 140 km northwest of Hammerfest, Norway, in the Barents Sea. The project includes Snøhvit, Albatross, and Askeladd gas and condensate fields.

The Transocean Inc. Polar Pioneer semisubmersible, on site since December 2004, has drilled and partly completed six production wells and the F-2H carbon dioxide injection well in Snøhvit field and moved south to drill three producers in the Albatross reservoir. The F-2H well will inject CO2 separated from production (OGJ Online, Jan. 26, 2005).

Two of the Albatross wells will have horizontal sections to ensure high output toward the end of the field’s producing life.

All 10 wells on Snøhvit and Albatross will be ready for production in 2006 but are not due on stream until the Hammerfest LNG plant on Melkøya is completed in 2007.

Ten more production wells will be drilled in phases in 2011 and 2014. ✦

Drilling & Production - Quick Takes

Processing - Quick Takes

Construction starts on Hawiyah NGL project

Saudi Aramco has begun construction of its Hawiyah gas processing plant near Ghawar oil field south of Dhahran (OGJ Online, Mar. 21, 2005).

The plant is designed to process 4 bscfd of gas to produce 310,000 b/d of ethane and NGL to be used as feedstock for the industrial centers at Jubail on the Persian Gulf and Yanbu on the Red Sea. Completion is expected in early 2008.

Japan’s JGC Corp. is constructing the plant and related facilities consisting of three NGL recovery trains, product surge and shipping facilities, utilities, and tank and process control system. Snamprogetti SPA of Italy will carry out gas treating and sales gas compression facility work, inlet distribution, two gas treating trains, and electrical system and support facilities.

As part of the Hawiyah NGL recovery program, Spain’s Tecnicas Reunidas, under a separate contract, will expand the Ju’aymah gas fractionation plant by constructing a fourth train to fractionate 270,000 b/d of ethane and NGL and 100,000 b/d of propane and NGL.

ENOC to upgrade Dubai condensate refinery

ENOC Processing Co. LLC (EPCL) has let an engineering, procurement, and construction management contract to a Foster Wheeler Ltd. subsidiary for a major upgrade of its 120,000 b/sd condensate refinery in Jebel Ali, Dubai (OGJ, Mar. 27, 2000, p. 59). The terms of the contract were not disclosed.

The upgrade includes a 70,000 b/sd hydrotreater to process LPG and naphtha, a 36,000 b/sd crude catalytic reformer, and ancillary processing units plus associated new or revamped utilities and offsite facilities.

The added units will allow EPCL to provide low-sulfur naphtha, a 102 research octane number reformate product stream, and operate the plant at full capacity using sour condensates. Other products will include LPG, butane, and sulfur.

Saudi Aramco adding sulfur-recovery units

Saudi Aramco has let contracts to a subsidiary of Jacobs Engineering Group Inc., Pasadena, Calif., for 13 Superclaus sulfur-recovery units (SRUs) at three gas plants in Saudi Arabia. The contract value was not disclosed.

The units will allow Saudi Aramco to achieve sulfur recovery of 98.7%.

The Kursaniyah plant will add three 900 ton/day SRUs. The Shedgum and Uthmaniyah facilities will each revamp five 550 ton/day units. ✦

Transportation - Quick Takes

Chevron takes more Sabine Pass LNG capacity

Chevron Global Gas has exercised its option to increase the regasification capacity it has reserved at the Cheniere Energy Inc. Sabine Pass LNG import terminal under construction in Cameron Parish, La., to 1 bcfd from 700 MMcfd.

The 2.6 bcfd terminal will have two docks and three LNG storage tanks with total storage capacity equivalent to 10.1 bcf. Terminal operations are expected to commence in 2008 (OGJ Online, Apr. 12, 2005). Cheniere has applied to the Federal Energy Regulatory Commission to increase the terminal’s regasification capacity to 4 bcfd.

Last month, Chevron signed a binding agreement with Kinder Morgan Energy Partners LP to ship as much as 1 bcfd of gas on a new 3.2 bcfd pipeline from the Sabine Pass terminal and 600 MMcfd on an interconnect to an adjacent pipeline (OGJ Online, Nov. 7, 2005).

Saipem to convert Saudi crude line to gas

Saudi Aramco has let contract to Saipem SPA to convert a crude oil pipeline in Saudi Arabia’s East-West system, called Petroline, to carry natural gas.

Saudi officials say the 5 million b/d Petroline has been operating at half capacity. The system carries crude from near Abqaiq to Red Sea export facilities near the industrial city of Yanbu, where a major expansion of petrochemical manufacturing capacity is under way (OGJ, Aug. 1, 2005, Newsletter). Most Saudi crude is exported through Ras Tanura on the Persian Gulf.

Under a lump-sum, turnkey contract, Saipem will decrude, clean, and purge the 56-in., 960-km pipeline and conduct detailed design, fabrication, construction, installation, and commissioning of new sections of the line and related communication facilities. Completion is due early in 2008.

The 56-in. line is a loop of the original 48-in. East-West crude line laid in 1981. Installed in 1987, the loop expanded the Saudi Red Sea export option for crude oil while Persian Gulf shipments were under threat from the Iran-Iraq war.

The 290,000 b/d Abqaiq-Yanbu NGL pipeline runs parallel to the Petroline.

Husky starts White Rose crude shipments

Husky Energy Inc. has begun crude oil shipments from White Rose field off Newfoundland and Labrador.

The first shipment of 600,000 bbl will be delivered to Irving Oil Ltd.’s Canaport Terminal near St. John, NB, and processed at Irving’s 250,000 b/d St. John refinery.

White Rose field began production of 31° gravity oil Nov. 12. It is currently producing 75,000 b/d and is expected to reach peak production of 100,000 b/d in early 2006 (OGJ Online, Nov. 14, 2005).

Valkyrie claims hydrotesting records

Valkyrie Commissioning Services Inc., Houston, claimed water-depth and pressure records for pressurizing a subsea to subsea pipeline in 5,715 ft of water in the Gulf of Mexico to 12,563 psig and remotely recording the hydrotesting data.

Valkyrie used the subsea pipeline commissioning system it calls Denizen, which it says can work in as much as 10,000 ft of water and achieve pressures up to 20,000 psig, in conjunction with a work class remotely operated vehicle. ✦