High oil prices dampening Asia-Pacific product demand

Asia-Pacific petroleum product demand growth in 2004 was unusually strong; incremental demand for oil products was 1.1 million b/d, the highest recorded level in more than 3 decades. In 2005, however, persistent high oil prices have started dampening the region’s product demand.

Demand growth will ease to about 700,000 b/d (a 3.2% increase) in 2005 and 800,000 b/d (a 3.5% increase) in 2006, compared to a 5.2% increase in 2004.

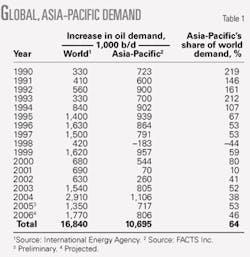

Asia-Pacific will continue to play an important role in global demand growth-the region will account for 38-46% of incremental global demand during 2004-06.

In the long term, the region’s oil demand will grow an average of 3.3%/year through 2010 and 2.7%/year in 2010-15.

China’s unprecedented growth in 2004, nearly 800,000 b/d, accounted for more than 70% of Asia-Pacific’s total. China’s growth, combined with that of the US, was almost half the global demand increase in 2004.

China’s incremental oil demand in 2005 will ease to about a 6% increase (365,000 b/d) from nearly 15% in 2004, mainly because increases in government-regulated oil product prices (and diesel in particular) will gradually cool demand, although those prices will still be lower than those prevailing on the international market.

China’s oil demand will increase 6.7% in 2006 and 5.5%/year during 2005-10.

Two major oil consumers in the region, Japan and South Korea, reported decreasing demand in 2004. Japan’s demand dropped 154,000 b/d because the increase in crude burning and fuel-oil consumption in 2003 subsided due to the recommissioning of nuclear plants and additional use of LNG.

Japan’s demand will continue to decline slightly (less than 0.2%) in the next decade. On the other hand, although South Korea’s demand dropped 21,000 b/d in 2004 due to high oil prices and its weak economy, its demand should rebound to 1.6%/year (about 28-44,000 b/d) until 2010.

Reversing the demand stagnation in 2000-03, India’s consumption growth in 2004 surged past 100,000 b/d, primarily due to strong performance in its agricultural sector. India will maintain a steady growth rate of 80-100,000 b/d/year.

Indonesia and Thailand increased consumption by more than 80,000 b/d in 2004, the highest growth rate since the Asian financial crisis of 1997-98. Indonesia’s oil product demand will grow rapidly, more than 50,000 b/d in 2005 and 2006.

Thailand’s growth, however, will be less than 40,000 b/d in 2005-06 because its government has stopped subsidizing gasoline and diesel, high oil prices have taken a toll on the economy, and a persistent drought has decreased demand from the agricultural sector.

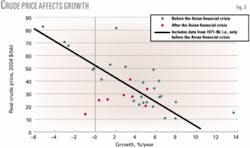

Demand growth for fuel oil and kerosine (nonjet fuel) will be weaker because countries are substituting coal and natural gas for higher-priced oil products for electric power generation and heating. In contrast, because no immediate substitutes are available for transport fuels (i.e., diesel, gasoline, and jet fuel), demand for these products will continue to grow rapidly, by about 3%/year or more through 2015.

Although the current share of LPG and naphtha in the consumption mix are lower than diesel or gasoline, demand for these two products will also rise about 3.0-3.5%/year through 2015 due to continuous growth in the residential sector and rising demand for petrochemical feedstocks.

Asia-Pacific

Although oil prices have reached record highs, the Asia-Pacific region achieved unprecedented growth in 2004. The outlook, however, for the region’s demand varies across countries and products and is uncertain.

Demand in China and India has surged, and Indonesia and some middle-sized countries are also seeking more oil. Meanwhile, Japan and South Korea, who used to drive the region’s oil demand, are likely to sustain their economies without consuming more oil.

Oil products used for electric power generation (mainly fuel oil) and heating (kerosine) tend to be substituted with natural gas or other energy sources, but further substitution will be more sensitive to the relative prices of energy sources.

Because no immediate substitutes are available for transport fuels such as gasoline, diesel, and jet fuel, demand for those products will continue to grow rapidly. Many countries in the region, however, are enforcing stricter product specifications.

In several countries, governments regulate domestic product prices, which have been lower than international prices because oil prices in the international markets have been rapidly rising. Such market distortions make it difficult to predict the region’s oil product demand as a whole because the impact of rising oil prices will vary by country.

Unprecedented growth

In 2004, Asia-Pacific incremental demand for petroleum products exceeded 1 million b/d for the first time since 1973 (Fig. 1), largely due to China’s unprecedented growth, which was nearly 800,000 b/d and accounted for more than 70% of the region’s total.

Meanwhile, demand in two major consuming countries, Japan and South Korea, actually decreased by about 150,000 b/d and 200,000 b/d, respectively. This implies that several other countries contributed significantly to the region’s growth in 2004.

India’s consumption growth increased more than 100,000 b/d in 2004 due to strong demand from its agricultural sector, which still dominates the economy. Both Indonesia and Thailand increased their consumption more than 80,000 b/d, the highest recorded since the Asian financial crisis of 1997-98. Demand grew about 200,000 b/d for the rest of the region in 2004.

Although the region experienced record-high oil demand growth, oil prices have maintained an upward trend since 2003. The price of West Texas Intermediate (WTI) Cushing reached a high of more than $56/bbl in October 2004. This upward trend continued in 2005-after a couple of fluctuations, WTI rose past $60/bbl and touched $70/bbl in the summer of 2005.

It is remarkable that Asia-Pacific achieved its demand growth while oil prices were rising quickly.

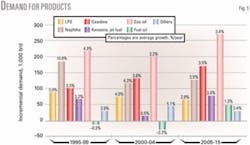

Fig. 2 shows the region’s oil demand growth rate and real prices of Arab Light crude during 1971-2004. The historical data of “real” oil prices indicate that current oil prices are still much lower than the historical peak in 1980 (more than $80/bbl in 2004 dollars).

The increase in oil consumption in 2004 was the highest recorded since 1970 in absolute terms, but moderately high in terms of the growth rate (5.2%). Yet, the growth rate in 2004 was the highest since the Asian financial crisis, and the price of oil in real terms was the highest since the Gulf War in 1991.

Fig. 2 shows that the growth rate was inversely related to crude prices until the mid-1990s (oil consumption increased when oil was cheap). After 1998, however, a positive relationship between growth and price emerged; i.e., demand continued to grow despite rising oil prices.

When oil demand stagnated during the Asian financial crisis and right before the outbreaks of the wars in Afghanistan and Iraq, oil prices fell sharply.

Fig. 3 shows the change in the relationship between the price of oil and the region’s oil consumption growth. A negatively sloped straight line describes the overall price-demand relationship until the mid-1990s, but the relationship no longer exists from 1998 to the present.

This change in the region’s oil market might be due to the fact that global oil demand growth, of which Asia-Pacific and the US are primary forces, started outpacing the expansion of global crude production capacity after the mid-1990s.

Table 1 presents global demand and Asia-Pacific’s incremental oil demand. Although global oil demand excluding the Asia-Pacific was actually declining until 1994, it began to grow rapidly in the mid-1990s. During 1995-2003, annual worldwide demand growth increased 1.4-1.63 million b/d/year because the global economy was healthy.

Asia-Pacific usually generated at least half of the global demand at those times. The region’s growth is likely to be more synchronized with the rest of the world in the future.

In 2004, an unprecedented growth in global demand occurred-up 3.7%, an increment of 2.9 million b/d. Demand growth had never exceeded 1.8 million b/d in the previous 2 decades. Demand pressures in 2004 were extraordinarily strong, pushing up oil prices.

Oil demand growth, prices

We expect oil prices to continue rising despite short-term fluctuations. Persistently high oil prices, in turn, should eventually discourage oil demand and encourage energy conservation as well as the use of alternative energy sources.

Oil demand growth in several countries, such as China, however, did not slow down as expected in late 2004. One of the reasons for the anomaly is that government-regulated prices distorted the market.

In several countries in Asia-Pacific, including China, governments regulate oil product prices, particularly diesel and gasoline, to protect energy-intensive sectors and consumers from volatile market prices. Because international prices were rapidly rising, government-regulated domestic prices were much lower.

Because domestic prices were low relative to international prices, oil demand in China did not slow down in 2004. This price distortion significantly affected not only China’s market, but the whole region because China is its largest oil consumer.

Another contributing factor was the depreciation of the US dollar. In 2003 and 2004, the US dollar depreciated against the euro and the Japanese yen by 24% and 16%, respectively. Several other floating currencies, including the Korean won, the Thai baht, and the Singaporean and Taiwanese dollars, also appreciated against the US dollar, while China, Hong Kong, and Malaysia adopted fixed-exchange-rate policies.

This implies that oil in US dollars was cheaper for those countries. The impact of the rising crude and product prices was actually less severe if the depreciation of the US dollar is taken into account.

Country prospects

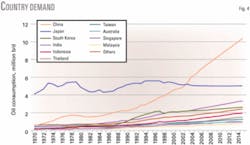

Fig. 4 shows the historical and forecast data for oil product consumption for 10 countries in Asia-Pacific. Japan dominated the region’s oil demand in the 1970s and 1980s. China’s oil demand started growing rapidly, especially during the last decade, passing Japan in 2003.

China has the biggest influence on Asia-Pacific’s oil demand growth, whereas Japan’s oil consumption has declined since 1995. The impact of swings in Japan’s demand, however, should not be underestimated when forecasting the region’s near-term demand.

South Korea also rapidly grew (14%/year) from the late 1980s until the mid-1990s. After a sharp fall in its oil demand due to the Asian financial crisis, South Korea has maintained slow growth (1%/year).

India has maintained steady but strong oil demand growth, with the exception of the slump during 1999-2003. India’s total oil consumption is currently almost the same as South Korea’s, but will continuously grow at its historical pace of 3%/year or more.

Other large consuming countries will grow about 3.5%/year by 2015, except for Australia, which will grow less than 2%/year. The “other” countries in Asia-Pacific as a whole rank fifth in terms of total consumption and will grow more than 3%/year.

Oil demand growth in the region will be moderately strong in the near future, about 700-800,000 b/d. China is the primary driving force, followed by India and Indonesia. In contrast, because Japan’s oil demand is declining and Korea’s market is becoming mature, these markets are large but unlikely to drive demand growth in the region.

Product perspectives

Fig. 5 shows the history and a forecast of the average annual growth of each product (in absolute and relative terms). Fig. 6 shows consumption of each product in 2005.

Recent crude price spikes do affect oil product demand, but the degree varies depending on the product. For example, some major countries are thinking of alternatives like natural gas, which has led to more interest in LNG.

As oil prices rise, oil products used for electric power generation (mainly fuel oil) and heating (kerosine) tend to be substituted with coal and natural gas if available. Demand growth for fuel oil and kerosine, therefore, will be weaker. Fuel-oil demand growth will increase about 1.4%/year during 2005-10.

In contrast, because no immediate substitutes are available for transportation fuels such as gasoline, diesel, and jet fuel, demand for these products will grow at the fast pace of about 3%/year or more through 2015.

Because low-sulfur-diesel specifications (50 ppm or less sulfur) are becoming popular in a few countries (Japan, South Korea, and Singapore), gas-oil demand continues to increase at faster rates. Growth rates for gasoline and gas-oil demand should be about 3.3-3.9%/year until 2010, and jet-fuel demand will grow more than 4%/year.

LPG and naphtha made up only 8% of total demand a decade ago. But the demand for each product has been growing.

Fig. 5 shows that the growth rates of LPG and naphtha were highest among oil products in the last decade. Demand growth for naphtha will be 5.5% in 2005 and should continue to be about 4%/year through 2010 due to greater demand as a petrochemical feedstock.

LPG demand growth seems to be mixed. LPG use in the residential and industrial sectors should continue to grow rapidly (3%/year or more), but LPG demand in the power sector will decline significantly.

Demand for LPG and especially naphtha differs significantly in different countries (Fig. 6). Naphtha’s share of demand in most large countries-Japan, S. Korea, India, Thailand, Taiwan, and Singapore-are in the double digits, while demand in other countries is limited.

Future trends

China will continue to be the main influence on regional demand growth; India and Indonesia will also be important. Meanwhile, persistent high oil prices have started decreasing oil demand in some countries-high oil prices will discourage demand and encourage energy conservation or the development of alternative energy sources.

Unlike the mid-1980s, alternative energy sources (natural gas, coal, and nuclear power) are either expensive or face difficult regulatory hurdles; therefore, interfuel substitution is becoming more sensitive to price. Oil product demand will therefore depend on the price of crude relative to other energy sources.

Because strong global demand growth is the main reason for high oil prices, demand management on a global level is needed to stabilize oil prices. There are still ways to manage the fast-growing demand, such as eliminating subsidies or government-fixed pricing systems to resolve market distortions and imposing higher taxes to encourage the development of alternative energy sources and new technologies to conserve oil. ✦

The author

Keiichi Nemoto (KN@ FACTSinc.net) is a senior consultant with Fesharaki Associates Consulting & Technical Services Inc. (FACTS). He has various experiences in behavioral analysis on exploitation of natural resources. He previously served as economist with the Joint Institute for Marine and Atmospheric Research. Nemoto holds a MS and PhD in natural resource and environmental economics from University of Hawaii.