Pakistan privatizing gas production, transmission systems

For the past decade, Pakistan has been reforming various elements of its industry through regulation changes, investment liberalization, and the privatization of government-owned companies. Today this process is well advanced, and the country is experiencing an economic growth that exceeds 8%/year.

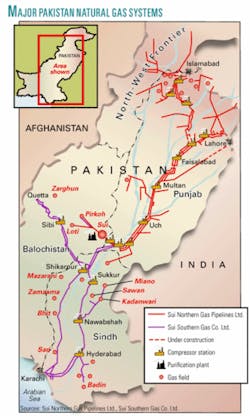

Now Pakistan is undertaking the reform and privatization of its energy industry. As part of the process, Sui Northern Gas Pipelines Ltd. (SNGPL) and Sui Southern Gas Co. Ltd. (SSGC) are being privatized through the Pakistani government’s sale of a majority shareholding and the relinquishment of management control (Table 1).

These are flagship companies in Pakistan that have significant growth opportunities. The two companies, which currently dominate the rapidly growing domestic gas market, have been profitable for many years yet have scope for further efficiency improvements.

They are listed on the Karachi Stock Exchange and have business practices that follow international standards, and they have ongoing maintenance and rehabilitation programs to assure that their facilities are always in compliance with these standards (OGJ Online, Oct. 17, 2003).

Privatization process

Pakistan is committed to the privatization of the nation’s gas industry. In addition to the transmission and distribution companies, the government also is privatizing its national gas exploration and production companies.

There currently are 22 exploration and production companies operating in Pakistan. Of these, government-owned Pakistan Petroleum Ltd. (PPL) and Oil & Gas Development Co. Ltd. (OGDC) are being privatized. The Privatization Commission received 14 expressions of interest from international investors this spring for a 51% equity stake with management control in PPL (OGJ Online, May 18, 2005).

At the completion of the privatization process, the entire gas industry from wellhead to burner tip will be private.

The Privatization Commission in Islamabad is following a sale process that has been used successfully in numerous other transactions. Parties interested in acquiring an equity share in SNGPL or SSGC will submit expressions of interest, and qualified parties will then submit a statement of qualifications (SOQ) to the commission. In the case of a consortium, the lead bidder will submit a single SOQ on behalf of the consortium.

The commission will use the information provided in the SOQs to evaluate the technical, financial, managerial, and other capabilities of potential bidders. Prequalified bidders will then be given instructions for bidding, information memorandum and sale documentation, and other documents relevant to the acquisition of an equity interest. They will be invited to conduct detailed due diligence investigations and will have access to a comprehensive data room.

The privatization process will begin shortly, with solicitations for expressions of interest followed by a prequalification of interested parties. Final bids are expected in first-quarter 2006, and finalization of the sale process is expected in 2006.

PricewaterhouseCoopers Securities Ltd. is advising the government on the privatizations of both companies.

SNGPL

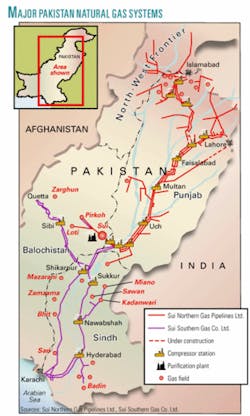

The SNGPL franchise area extends from Sui in Balochistan to Peshawar in the North West Frontier Province (NWFP), providing gas to more than 2.3 million consumers (see map).

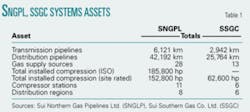

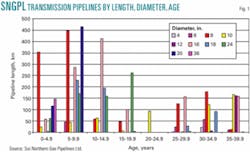

The gas networks have been designed in accordance with US industry standards, and their age profile compares favorably with the aging assets in most developed countries.

More than 70% of the SNGPL transmission pipelines are less than 20 years old, and over 40% are less than 10 years old. Fig. 1 shows the diameters and age distribution profile for the SNGPL transmission pipeline system. Generally, the older pipelines have a coal-tar pipe coating, while the newer pipelines are polyethylene (PE) coated, with coating based on British standards.

The design, construction, and maintenance standards adopted are those of the American Petroleum Institute, American Society for Testing and Materials, and American Society of Mechanical Engineers

The total current length of the SNGPL transmission system is about 6,121 km of welded steel pipeline with maximum operating pressures of 1,176-1,250 psig (80-85 bar). The steel transmission pipeline system is constructed of varying API material grades, including API 5LX Grade B, API 5LX-46, API 5LX-52, API 5LX-56, API 5LX-60, and API 5LX-70.

In addition, SNGPL is expanding its transmission system by 1,045 km, increasing the network to 7,309 km. These expansions include:

• Upgrades to meet increasing demand downstream of Multan for the Lahore, Faisalabad, and Gujranwala regions.

• Enhancement of capacity from Bhong to Multan and beyond Multan to North Central Punjab and the NWFP.

• Extension of its distribution network and supply mains by 16,650 km-to 57,234 km from 41,981 km -in both existing areas and new towns and villages.

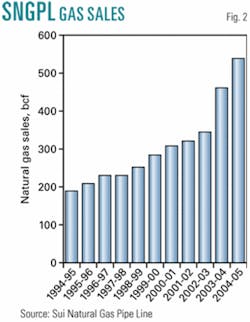

SNGPL serves a variety of customers ranging from individual homes and commercial establishments, such as restaurants, hotels, schools, and hospitals, to large industrial facilities, manufacturers, fertilizer units, and power plants. SNGPL’s net sales rose to 64.206 billion rupees for fiscal year 2004 from 42.460 billion rupees in fiscal 2003. This increase in sales resulted from the addition of new customers and expansion of the SNGPL system. (Fig. 2)

The demand for natural gas in Pakistan has continuously increased over the years due to price competitiveness and low penetration levels. Gas markets include electric power; the fertilizer and cement industries; industrial, commercial, and residential use; compressed natural gas (CNG); captive power; and company use.

Demand for gas in the SNGPL franchise area is expected to increase to 2.969 bcfd by 2009-10 from 2.056 bcfd in 2005-06, while the gas sales revenue will increase to 149.752 billion rupees by 2010 from 75.990 billion rupees projected for 2004-05.

SSGC

The SSGC franchise area comprises two provinces, Sindh and Balochistan, in southern Pakistan with over 1.7 million consumers.

The total length of the SSGC transmission system is about 2,942 km of welded steel pipeline, with maximum operating pressures of 1,000-1,298 psig (68-88 bar) for the higher-pressure transmission pipelines and 720 psig (49 bar) for the lower-pressure transmission pipelines.

Since the beginning of 2004, all of the 1.165 bscfd of capacity in the transmission network was under contract.

The design, construction, and maintenance standard used within SSGC is American National Standards Institute-ANSI B 31.8-gas transmission and distribution piping systems.

The pipelines are constructed of steel of varying API material grades, including API 5LX-42, API 5LX-46, API 5LX-52, and API 5LX-60. The older pipelines constructed during 1955-90 have a coal-tar or tape coating, whereas the newer pipelines constructed since 1993 are coated with a 3-layer PE coating.

Fig. 3 shows the age distribution profile by diameter for the transmission pipelines in the SSGC system.

SSGC plans to undertake a 42.945 billion-rupee expansion in its transmission and distribution network during the next 5 years. The company will add 608 km of transmission pipeline, expanding its network to 3,550 km by 2010 from 2,942 km this year. This will increase capacity to 1.7 bcfd by 2010 from the current 1.3 bcfd. SSGC also will add 5,236 km of distribution pipeline and supply mains, expanding its distribution system to 31,000 km by 2010 from 25,764 km this year and connecting 600 new towns and villages in Sindh and Balochistan provinces.

SSGC serves a variety of customers ranging from individual homes, restaurants, hotels, schools and hospitals to large industrial facilities, manufacturers, fertilizer units, and power plants.

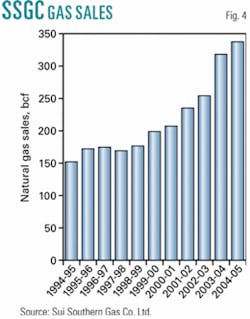

SSGC’s net gas sales rose to 44.799 billion rupees for the fiscal year ended June 30, 2004, which represents an increase of 28%, compared with the previous year’s level of 34.836 billion rupees (Fig. 4). This increase was due to the expansion of the SSGC system and the addition of new customers.

Total demand for gas in the SSGC franchise area is expected to increase to 1.527 bcfd by 2010 and to 2.032 bcfd by 2020, while the gas sales revenue will increase to 85.9 billion rupees by 2010 from 54.4 billion rupees this year.

The biggest drivers of demand in the SSGC franchise area are the power and industrial sectors. Demand for gas to replace oil as the primary fuel at many power stations is increasing rapidly due to the existing differential between the cost of gas and its substitutes. The trend of power generation is likely to continue due to this factor. Three additional power stations fueled by natural gas and furnace oil are proposed in the SSGC’s gas supply zones: Karachi Electric Supply Corp. Fast Track project, Fauji Kabirwala Power Co. Ltd., and Western Electric.

Gas use, demand growth

Natural gas plays an important role in Pakistan’s economy, meeting 50.1% of the country’s demand for commercial energy supply. Oil demand is 29.9% of the total demand; coal, 6.5%; hydroelectric, 12.7%; and nuclear, 0.8%.

The prospects for Pakistan’s future growth in gas demand are good. Gas is preferred over other petroleum products in nearly all the fuel-consuming sectors of the economy. The price is competitive with alternative fuels, and gas has achieved low penetration levels thus far.

Demand growth is driven primarily by the conversion of power producers to natural gas and by increasing penetration into the residential segment.

The biggest drivers of demand, however, remain the power and industrial sectors. The power sector is the largest consumer and accounts for 44.7% of total gas consumed, followed by the general industrial (18.4%) and fertilizer (17.6%) sectors. Residential use is 14.8%; transportation use of CNG is 1.5%; commercial use is 2.3%; and cement is 0.7%.

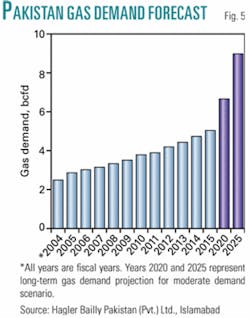

It is anticipated that cumulative total demand will increase by 42% within the next 20 years (Fig. 5).

Demand for gas to replace oil as the primary fuel at many electric power stations is increasing rapidly. This June, 207.69 bcf of gas was sold for electric power generation, compared with 47.74 bcf in mid-1999.

This trend in electricity generation sales likely will continue, producing significant cost savings from gas. The National Electric Power Regulatory Authority of Pakistan has received 35 bids from 7 local and 13 international companies for the construction and operation of three additional power stations fueled by natural gas and oil. Bidders are from the US, UK, China, Japan, Malaysia, UAE, Turkey, and Pakistan.

These stations would generate about 1,300 Mw of electricity at an estimated investment of $1 billion. The projects are:

• 400-450 Mw at the Uch-II power station in Sindh Province. It would be located at Kashmore near the Pakistan Water & Power Development Authority’s (WAPDA’s) Guddu power station. OGDC will supply the plant with gas for 25 years from Uch gas field. National Transmission & Dispatch Co. will purchase power from this station.

• 450 Mw power project at Faisalabad.This plant also will be located near a WAPDA power station, which will use pipeline quality gas and oil. SNGPL will supply the gas, while Faisalabad Electric Supply Co. will purchase the electricity.

• 350-400 Mw power project at Chichoki Malian near Lahore. It also will use pipeline quality gas and oil. SNGPL will supply the gas, while Lahore Electric Supply Co. will purchase the power.

Development plans

In order to meet this growing gas demand, the Pakistani government approved a gas infrastructure rehabilitation project in 2000-01 to enhance the gas transmission capacity of the two utility companies by about 1 bcfd. This increase of about 50% in capacity supports gas being brought into the systems to replace imported liquid fuel that costs about $700 million/year.

SNGPL and SSGC undertook these projects and completed them without financial or technical assistance from the government or foreign sources. Major components for the projects were manufactured locally.

Both companies have complete project planning, development, and execution capabilities, and the growth of natural gas utilization in Pakistan has meant that the companies always have development projects under way.

Gas supply sources

Pakistan’s Ministry of Petroleum and Natural Resources (MPNR) regulates the upstream activities of its oil and gas sector. Areas of exploration in the country are divided into zones based on their relative prospectivity and geological risk. Investors may apply for an open area, and MPNR awards the concessions.

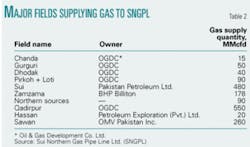

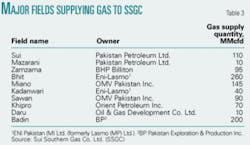

SSGPL and SNGPL serve as merchant pipelines or as common carriers, depending on the arrangement with the producers or shippers. Gas supply for the two companies originated with the development of the Sui gas field. Other gas fields were subsequently found. Today, gas is delivered from a number of fields owned by government companies PPL and OGDC and international companies operating in Pakistan (Tables 2 and 3).

SSGPL receives gas from 13 fields, and SNGPL receives gas from 28 fields. Recent new discoveries in northern Pakistan will provide gas to SNGPL’s northern customers and relieve network constraints, particularly in winter when demand is at its peak.

MPNR and the Asian Development Bank engaged consultant Hagler Bailly Pakistan (Pvt.) Ltd., Islamabad, to evaluate gas import options for Pakistan. The study included a long-term gas demand projection for a “moderate” demand scenario.

To augment domestic gas supplies, Pakistan is considering the construction of pipelines from Iran or Turkmenistan to bring natural gas into the country (OGJ Online, Jan. 6 and Apr. 18, 2005). It also is looking at the possibility of constructing an LNG terminal in Karachi.✦

For the past decade, Pakistan has been reforming various elements of its industry through regulation changes, investment liberalization, and the privatization of government-owned companies. Today this process is well advanced, and the country is experiencing an economic growth that exceeds 8%/year.

Now Pakistan is undertaking the reform and privatization of its energy industry. As part of the process, Sui Northern Gas Pipelines Ltd. (SNGPL) and Sui Southern Gas Co. Ltd. (SSGC) are being privatized through the Pakistani government’s sale of a majority shareholding and the relinquishment of management control (Table 1).

These are flagship companies in Pakistan that have significant growth opportunities. The two companies, which currently dominate the rapidly growing domestic gas market, have been profitable for many years yet have scope for further efficiency improvements.

They are listed on the Karachi Stock Exchange and have business practices that follow international standards, and they have ongoing maintenance and rehabilitation programs to assure that their facilities are always in compliance with these standards (OGJ Online, Oct. 17, 2003).

Privatization process

Pakistan is committed to the privatization of the nation’s gas industry. In addition to the transmission and distribution companies, the government also is privatizing its national gas exploration and production companies.

There currently are 22 exploration and production companies operating in Pakistan. Of these, government-owned Pakistan Petroleum Ltd. (PPL) and Oil & Gas Development Co. Ltd. (OGDC) are being privatized. The Privatization Commission received 14 expressions of interest from international investors this spring for a 51% equity stake with management control in PPL (OGJ Online, May 18, 2005).

At the completion of the privatization process, the entire gas industry from wellhead to burner tip will be private.

The Privatization Commission in Islamabad is following a sale process that has been used successfully in numerous other transactions. Parties interested in acquiring an equity share in SNGPL or SSGC will submit expressions of interest, and qualified parties will then submit a statement of qualifications (SOQ) to the commission. In the case of a consortium, the lead bidder will submit a single SOQ on behalf of the consortium.

The commission will use the information provided in the SOQs to evaluate the technical, financial, managerial, and other capabilities of potential bidders. Prequalified bidders will then be given instructions for bidding, information memorandum and sale documentation, and other documents relevant to the acquisition of an equity interest. They will be invited to conduct detailed due diligence investigations and will have access to a comprehensive data room.

The privatization process will begin shortly, with solicitations for expressions of interest followed by a prequalification of interested parties. Final bids are expected in first-quarter 2006, and finalization of the sale process is expected in 2006.

PricewaterhouseCoopers Securities Ltd. is advising the government on the privatizations of both companies.

SNGPL

The SNGPL franchise area extends from Sui in Balochistan to Peshawar in the North West Frontier Province (NWFP), providing gas to more than 2.3 million consumers (see map).

The gas networks have been designed in accordance with US industry standards, and their age profile compares favorably with the aging assets in most developed countries.

More than 70% of the SNGPL transmission pipelines are less than 20 years old, and over 40% are less than 10 years old. Fig. 1 shows the diameters and age distribution profile for the SNGPL transmission pipeline system. Generally, the older pipelines have a coal-tar pipe coating, while the newer pipelines are polyethylene (PE) coated, with coating based on British standards.

The design, construction, and maintenance standards adopted are those of the American Petroleum Institute, American Society for Testing and Materials, and American Society of Mechanical Engineers

The total current length of the SNGPL transmission system is about 6,121 km of welded steel pipeline with maximum operating pressures of 1,176-1,250 psig (80-85 bar). The steel transmission pipeline system is constructed of varying API material grades, including API 5LX Grade B, API 5LX-46, API 5LX-52, API 5LX-56, API 5LX-60, and API 5LX-70.

In addition, SNGPL is expanding its transmission system by 1,045 km, increasing the network to 7,309 km. These expansions include:

• Upgrades to meet increasing demand downstream of Multan for the Lahore, Faisalabad, and Gujranwala regions.

• Enhancement of capacity from Bhong to Multan and beyond Multan to North Central Punjab and the NWFP.

• Extension of its distribution network and supply mains by 16,650 km-to 57,234 km from 41,981 km -in both existing areas and new towns and villages.

SNGPL serves a variety of customers ranging from individual homes and commercial establishments, such as restaurants, hotels, schools, and hospitals, to large industrial facilities, manufacturers, fertilizer units, and power plants. SNGPL’s net sales rose to 64.206 billion rupees for fiscal year 2004 from 42.460 billion rupees in fiscal 2003. This increase in sales resulted from the addition of new customers and expansion of the SNGPL system. (Fig. 2)

The demand for natural gas in Pakistan has continuously increased over the years due to price competitiveness and low penetration levels. Gas markets include electric power; the fertilizer and cement industries; industrial, commercial, and residential use; compressed natural gas (CNG); captive power; and company use.

Demand for gas in the SNGPL franchise area is expected to increase to 2.969 bcfd by 2009-10 from 2.056 bcfd in 2005-06, while the gas sales revenue will increase to 149.752 billion rupees by 2010 from 75.990 billion rupees projected for 2004-05.

SSGC

The SSGC franchise area comprises two provinces, Sindh and Balochistan, in southern Pakistan with over 1.7 million consumers.

The total length of the SSGC transmission system is about 2,942 km of welded steel pipeline, with maximum operating pressures of 1,000-1,298 psig (68-88 bar) for the higher-pressure transmission pipelines and 720 psig (49 bar) for the lower-pressure transmission pipelines.

Since the beginning of 2004, all of the 1.165 bscfd of capacity in the transmission network was under contract.

The design, construction, and maintenance standard used within SSGC is American National Standards Institute-ANSI B 31.8-gas transmission and distribution piping systems.

The pipelines are constructed of steel of varying API material grades, including API 5LX-42, API 5LX-46, API 5LX-52, and API 5LX-60. The older pipelines constructed during 1955-90 have a coal-tar or tape coating, whereas the newer pipelines constructed since 1993 are coated with a 3-layer PE coating.

Fig. 3 shows the age distribution profile by diameter for the transmission pipelines in the SSGC system.

SSGC plans to undertake a 42.945 billion-rupee expansion in its transmission and distribution network during the next 5 years. The company will add 608 km of transmission pipeline, expanding its network to 3,550 km by 2010 from 2,942 km this year. This will increase capacity to 1.7 bcfd by 2010 from the current 1.3 bcfd. SSGC also will add 5,236 km of distribution pipeline and supply mains, expanding its distribution system to 31,000 km by 2010 from 25,764 km this year and connecting 600 new towns and villages in Sindh and Balochistan provinces.

SSGC serves a variety of customers ranging from individual homes, restaurants, hotels, schools and hospitals to large industrial facilities, manufacturers, fertilizer units, and power plants.

SSGC’s net gas sales rose to 44.799 billion rupees for the fiscal year ended June 30, 2004, which represents an increase of 28%, compared with the previous year’s level of 34.836 billion rupees (Fig. 4). This increase was due to the expansion of the SSGC system and the addition of new customers.

Total demand for gas in the SSGC franchise area is expected to increase to 1.527 bcfd by 2010 and to 2.032 bcfd by 2020, while the gas sales revenue will increase to 85.9 billion rupees by 2010 from 54.4 billion rupees this year.

The biggest drivers of demand in the SSGC franchise area are the power and industrial sectors. Demand for gas to replace oil as the primary fuel at many power stations is increasing rapidly due to the existing differential between the cost of gas and its substitutes. The trend of power generation is likely to continue due to this factor. Three additional power stations fueled by natural gas and furnace oil are proposed in the SSGC’s gas supply zones: Karachi Electric Supply Corp. Fast Track project, Fauji Kabirwala Power Co. Ltd., and Western Electric.

Gas use, demand growth

Natural gas plays an important role in Pakistan’s economy, meeting 50.1% of the country’s demand for commercial energy supply. Oil demand is 29.9% of the total demand; coal, 6.5%; hydroelectric, 12.7%; and nuclear, 0.8%.

The prospects for Pakistan’s future growth in gas demand are good. Gas is preferred over other petroleum products in nearly all the fuel-consuming sectors of the economy. The price is competitive with alternative fuels, and gas has achieved low penetration levels thus far.

Demand growth is driven primarily by the conversion of power producers to natural gas and by increasing penetration into the residential segment.

The biggest drivers of demand, however, remain the power and industrial sectors. The power sector is the largest consumer and accounts for 44.7% of total gas consumed, followed by the general industrial (18.4%) and fertilizer (17.6%) sectors. Residential use is 14.8%; transportation use of CNG is 1.5%; commercial use is 2.3%; and cement is 0.7%.

It is anticipated that cumulative total demand will increase by 42% within the next 20 years (Fig. 5).

Demand for gas to replace oil as the primary fuel at many electric power stations is increasing rapidly. This June, 207.69 bcf of gas was sold for electric power generation, compared with 47.74 bcf in mid-1999.

This trend in electricity generation sales likely will continue, producing significant cost savings from gas. The National Electric Power Regulatory Authority of Pakistan has received 35 bids from 7 local and 13 international companies for the construction and operation of three additional power stations fueled by natural gas and oil. Bidders are from the US, UK, China, Japan, Malaysia, UAE, Turkey, and Pakistan.

These stations would generate about 1,300 Mw of electricity at an estimated investment of $1 billion. The projects are:

• 400-450 Mw at the Uch-II power station in Sindh Province. It would be located at Kashmore near the Pakistan Water & Power Development Authority’s (WAPDA’s) Guddu power station. OGDC will supply the plant with gas for 25 years from Uch gas field. National Transmission & Dispatch Co. will purchase power from this station.

• 450 Mw power project at Faisalabad.This plant also will be located near a WAPDA power station, which will use pipeline quality gas and oil. SNGPL will supply the gas, while Faisalabad Electric Supply Co. will purchase the electricity.

• 350-400 Mw power project at Chichoki Malian near Lahore. It also will use pipeline quality gas and oil. SNGPL will supply the gas, while Lahore Electric Supply Co. will purchase the power.

Development plans

In order to meet this growing gas demand, the Pakistani government approved a gas infrastructure rehabilitation project in 2000-01 to enhance the gas transmission capacity of the two utility companies by about 1 bcfd. This increase of about 50% in capacity supports gas being brought into the systems to replace imported liquid fuel that costs about $700 million/year.

SNGPL and SSGC undertook these projects and completed them without financial or technical assistance from the government or foreign sources. Major components for the projects were manufactured locally.

Both companies have complete project planning, development, and execution capabilities, and the growth of natural gas utilization in Pakistan has meant that the companies always have development projects under way.

Gas supply sources

Pakistan’s Ministry of Petroleum and Natural Resources (MPNR) regulates the upstream activities of its oil and gas sector. Areas of exploration in the country are divided into zones based on their relative prospectivity and geological risk. Investors may apply for an open area, and MPNR awards the concessions.

SSGPL and SNGPL serve as merchant pipelines or as common carriers, depending on the arrangement with the producers or shippers. Gas supply for the two companies originated with the development of the Sui gas field. Other gas fields were subsequently found. Today, gas is delivered from a number of fields owned by government companies PPL and OGDC and international companies operating in Pakistan (Tables 2 and 3).

SSGPL receives gas from 13 fields, and SNGPL receives gas from 28 fields. Recent new discoveries in northern Pakistan will provide gas to SNGPL’s northern customers and relieve network constraints, particularly in winter when demand is at its peak.

MPNR and the Asian Development Bank engaged consultant Hagler Bailly Pakistan (Pvt.) Ltd., Islamabad, to evaluate gas import options for Pakistan. The study included a long-term gas demand projection for a “moderate” demand scenario.

To augment domestic gas supplies, Pakistan is considering the construction of pipelines from Iran or Turkmenistan to bring natural gas into the country (OGJ Online, Jan. 6 and Apr. 18, 2005). It also is looking at the possibility of constructing an LNG terminal in Karachi.✦

The authors

Inamullah Khan is director general of Pakistan's Privatization Commission in Islamabad. He has 30 years of governmental secretarial-field service in the fields of health, education, planning and development, finance, industries, local government, and agriculture. He also has worked as managing director of the Provincial Seed and Fertilizer Authority, the Small Industries Development Board, and the Tourism Corp. in Pakistan's North-West Frontier Province. Khan holds a masters degree in political science.

Agha Waqar Javed has been consultant and transaction manager of Pakistan's Privatization Commission since February. He assumed the responsibility following a position as consultant and financial analyst in the Ministry of Finance during 2004-05. Prior to that, he served as manager of Askari Commercial Bank Ltd. from December 1997 through January 2004. In addition, Javed has been a visiting faculty teacher part time since 1997. He earned an MSc in finance from the University of Strathclyde in Glasgow in 2001 and an MBA from Bahauddin Zakariya University in Multan, Pakistan, in 1996. Khan holds a masters degree in political science.