CERA sees strong LNG growth, mixed commercial success

The LNG industry will grow more in the next 7 years than it did in its first 40 years, projects a study by Cambridge Energy Research Associates, Cambridge, Mass.

The business thus will represent a critical way for large oil and gas companies to achieve organic growth.

“Huge investments in LNG are under way and irreversible,” writes Michael Stoppard, CERA senior director, global LNG. “On the upstream supply side, where most of the money is spent, global needs justify major spending increases. Planned LNG supplies are not an overreaction nor an overbuild.”

He warns, however, that some LNG projects will fail to generate commercial returns and that some parts of the LNG value chain will fail to create value. “Returns will vary by project and across different parts of the value chain according to relative surpluses and constraints.”

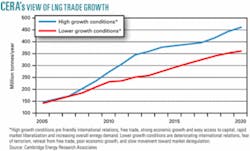

Under a high-growth set of assumptions, the CERA analysis projects growth in global LNG trade of 216% to 460 million tonnes/year by 2020.

That scenario, representing compound growth of 8%/year, assumes friendly international relations, free trade, strong economic growth and easy access to capital, rapid market liberalization, and increasing overall energy demand. CERA points out that these conditions also favor development of major international pipeline projects, some of which might compete with LNG.

Under a lower-growth set of assumptions, CERA forecasts growth in LNG trade of 150% through 2020 to 360 million tpy-compound growth of 6.5%/year.

This scenario envisions deteriorating international relations, fear of terrorism, retreat from free trade, poor economic growth, and slow movement toward market deregulation. Under these conditions, LNG has an advantage over major pipelines in terms of flexibility, security, and financing.

In the lower-growth scenario, a small group of companies with strong balance sheets will dominate gas trade. Other market participants will rely on alliances to minimize project risks.

Market evolution

The CERA analysis identifies these key conclusions as crucial to the LNG market’s evolution through 2020:

• In response to high oil and gas prices, projects have been announced with the ability to add 30 million tpy of liquefaction capacity within 10 years, pushing total potential supply to 491 million tpy-more than CERA’s trade projection for 2020. But LNG markets will remain tight for 3-5 years before new projects come on stream.

• The imminent supply response from new gas liquefaction and pipeline projects will make current gas price levels unsustainable.

• The Atlantic Basin’s LNG market growth will be strong but limited by production and liquefaction constraints resulting from logistic challenges, cost increases, partnership alignment challenges, host-country issues, and geopolitics.

• The Pacific Basin LNG market faces oversupply after 2010 because planned liquefaction capacity exceeds projected demand. But future supply depends on projects planned in Australia and Iran, without which the Pacific Basin market would be supply-constrained.

• The Middle East will balance the Atlantic Basin and Pacific Basin markets.

• The US is becoming the “central bank” for LNG as spot trade worldwide occurs with reference to US prices. As long as there is spare regasification capacity, the US market will represent “the opportunity value for spot cargoes.”

• Pressure for prices on opposite sides of the Atlantic Basin to converge will grow as LNG investments increase in both areas.

• Gas exploration, production, and liquefaction capacities probably will remain constrained by organizational capabilities of oil companies, capacities of contractors, and personnel shortages. The constraints are increasing costs.

Creating value

While LNG overall will create value, CERA says, market participants will have to identify surpluses and constraint points to realize the potential.

The analysis sees no geological constraint in gas reserves through 2020 but identifies access to reserves by international oil companies as a critical issue.

Because of the constraints it sees on supply-including industry responses and noneconomic challenges such as host-government relations, partnership alignment issues, and geopolitical risk-CERA doesn’t expect LNG to come on stream at rates that would lower prices to long-run marginal costs.

LNG shipping by itself will often be “value-diluting,” CERA predicts, but a necessary investment for integrated projects. The need for firm shipping arrangements and the availability of capital for speculative shipping investment will produce abundant shipping capacity and a liquid charter market.

Regasification will grow faster than liquefaction capacity because of its lower relative cost and the value of flexibility it creates, the analysis says. Returns on regasification investments will vary by location. A source of value will be the ability to deliver regasified LNG to constrained premium markets.

Development of some projects in the Pacific Basin may be restrained by the absence of a liquid spot market in Asia. But that won’t be the case in the Atlantic Basin, CERA says, where deeply traded spot markets can absorb large volumes. ✦