OGJ Newsletter

General Interest - Quick Takes

ANWR leasing advances in House, Senate

Both sides of the 109th Congress have moved closer to authorizing federal oil and natural gas leasing in the Arctic National Wildlife Refuge as part of the budget reconciliation package on Oct. 26.

House and Senate Republicans portrayed ANWR leasing as an important new revenue source to reduce the federal budget deficit as well as a major domestic energy source. Democrats generally reiterated a view that it would harm an environmental treasure while producing few energy and economic benefits.

The Senate Budget Committee approved a budget bill by a 12-10 vote that included ANWR leasing authorization language previously passed by the Energy and Natural Resources Committee.

In the House, the Resources Committee passed a budget package by a 24-16 vote that included a provision to increase coastal states’ influence on energy activity in adjacent federal waters as well as ANWR leasing authorization.

Sen. Pete V. Domenici (R-NM), the Energy and Natural Resources Committee chairman, said that the ANWR provision in the current budget bill “will bring more than 10 billion bbl of oil to the Lower 48 states in the next several years.”

The ANWR provision in the Senate bill projects $2.5 billion of federal bonus bid receipts during 2006-10 from oil and gas leasing of 2,000 acres of the wildlife refuge’s coastal plain.

Federal oil and gas royalties from production in the area could exceed more than $1 billion/year once production begins, the Energy and Natural Resources Committee said in a statement.

House Resources Committee Chairman Richard W. Pombo (R-Calif.) said the bill approved there would raise $2.4 billion from ANWR leasing authorization and more than $800 million over 5 years from the OCS-related provision.

The measure also includes a provision that develops a revenue-sharing program with local governments and a leasing program to attract investment in oil shale projects, he added.

Costs up in western Canada’s oil, gas fields

Operating costs for oil and gas fields in western Canada have increased “significantly,” according to Ziff Energy Group, Calgary.

The largest cost increase in 2004 was for gas fields, Ziff said in its 2005 study of 200 fields. The study uses data from 10 producers, including majors, energy trusts, and midsized independents.

The study said the weighted average operational expenditures for gas fields increased 12% to more than 80¢ (Can.)/Mcf. Ziff said the main contributors to the hike were increased service costs due to the high levels of activity as well as higher energy costs.

Operational expenditures for oil fields ranged from $5.70/bbl to more than $10/bbl in the four strategy areas studied by Ziff.

Gas operating costs in seven areas studied peaked at as high as $1.40/Mcf in a shallow gas region.

The study examined the effect of different well productivity levels and quantified specific potential savings for each field assessed. In each cost category, the study found that 2005 costs are expected to rise even more as operators strive to maximize sales.

The study found that both majors and trusts have executed successful programs to manage costs in fields with declining production.

Project Manager Gordon Clarke said, “Currently, energy management is of great interest to producers as they try to produce more with less energy, lower product losses, and reduced emissions.”

In the major Central Alberta oil-producing group, average well productivity has declined from 60 boe/d/well to 40 boe/d/well. Producers have been able to improve their labor productivity from an average of 11 wells/person to 15 wells/person through enhanced communications, automation, and improved well reliability.

Independent CEOs see challenges with high prices

Chief executive officers of four US independent exploration and production companies noted during a panel discussion in Houston that the high commodity prices currently boosting their profits also create challenges.

“In the [price] environment that we’re in today, it’s important to execute,” Newfield Exploration Co. Pres. and Chief Executive Officer David Trice said at the annual meeting of the Independent Petroleum Association of America.

Mergers and acquisitions among independents over the last few years have contributed more to companies’ growth than the drilling has, the executives agreed.

With acquisitions, Chesapeake Energy Corp. is “more willing to overpay than most,” joked the company’s Chairman and Chief Executive Officer Aubrey K. McClendon. He added that recent acquisition margins for the oil and gas E&P industry are the best ever. However, he noted, “Where you make the most money in this business is at the point of discovery.”

Attracting talented workers while maintaining a company’s business culture also remains a concern among the executive panelists.

James J. Volker, Whiting Petroleum Corp. chairman, president, and chief executive officer, said his company retains talent through a production participation plan (PPP). Under the plan, nonexecutive employees participate in as much as 2-5% of net operating income-depending on oil and gas prices-from any well drilled or acquired during a given year.

If cashed out today, Volker said, the PPP account would be worth about $80 million. Whiting currently employs about 260 workers.

Newfield’s Trice said E&P companies are paying for performance. “We’re all on the dollar for people,” he said, adding that Newfield actively recruits at US colleges.

Caribbean nations want PetroCaribe change

Three Caribbean governments have asked Venezuelan President Hugo Chavez to reconsider some of the terms of the PetroCaribe agreement that the governments say run contrary to the spirit of the Caricom treaty.

Prime Minister Patrick Manning of Trinidad and Tobago, Jamaica’s Prime Minister P.J. Patterson, and Barbados Prime Minister Owen Arthur met in Barbados to discuss the PetroCaribe agreement and decided that the arrangements had to be reviewed.

Under the agreement, Caribbean countries are to receive crude oil and oil products at significantly reduced prices with the difference converted into a loan that can be paid out in cash or with other commodities, such as bananas and sugar.

This would mean that the region got its supplies from Petroleos de Venezuela SA (PDVSA) as opposed to Trinidad and Tobago’s state-owned company Petrotrin, thereby breaching the Caricom agreement, which states that items produced outside Caricom that are available in one of the islands should attract a common external tariff.

After the talks, Arthur said that although Barbados had not signed the controversial PetroCaribe deal, it had teamed up with Jamaica, which had, as well as with Trinidad and Tobago, to lobby for a rewrite of the agreement.

Arthur said Trinidad and Tobago’s Prime Minister would soon take a proposal to Chavez.

Arthur hinted that Barbados and Jamaica were aiming to get Trinidad and Tobago to play a greater role in the PetroCaribe arrangement, importing crude from Venezuela, refining it, and passing it on to Caribbean nations.

“I feel that both Trinidad and Venezuela should be part of the deal,” he told journalists, “and, quite frankly, if people want to help us with energy at a time when energy costs are rising and will continue to rise, I think people should join together and collaborate in trying to help the region, rather than people having separate arrangements.”

Arthur continued, “So that a Trinidad-Venezuela agreement should be approached in such a way that it would be entirely consistent with the [Caricom] Treaty-that is the way to go. We don’t want to have a relationship with Venezuela that would destroy our relationship with Caricom.” ✦

Exploration & Development - Quick Takes

Deepwater Angola block has ninth oil strike

Angola’s Sonangol and BP PLC reported the ninth oil discovery on deepwater Block 31 off Angola.

The Hebe-1 well flowed on test at a maximum rate of 5,956 b/d of oil through a 2-in. choke.

The GlobalSantaFe Jack Ryan drillship drilled the well to 4,823 m below sea level TD in 2,008 m of water 361 km northwest of Luanda.

Hebe-1 is 16 km southwest of the Ceres discovery reported earlier in the year (OGJ, Apr. 11, 2005, Newsletter). Other previous discoveries on the block are Plutao, Saturno, Marte, Venus, Palas, Juno, and Astraea (OGJ, Aug. 22, 2005, Newsletter).

BP said it is evaluating development concepts for the southeastern region of the block.

Sonangol is the concessionaire of Block 31 where BP, operator, holds 26.67%. Other interests are Esso E&P Angola (Block 31) Ltd. 25%, Sonangol EP 20%, Statoil Angola AS 13.33%, Marathon International Petroleum Angola Block 31 Ltd. 10%, and Total SA subsidiary TEPA (Block 31) Ltd. 5%.

Angola will offer seven blocks in three basins in a licensing round opening Dec. 13 (OGJ Online, Oct. 20, 2005).

EnCana extends Chinook discovery off Brazil

Kerr-McGee Oil & Gas Corp. reported another successful appraisal of a Campos basin oil discovery on Block BM-C-7 in 350 ft of water 75 km off Brazil.

The EnCana Corp. 3-ENC-4-RJS appraisal well extended Chinook field to the northeast by 1.5 miles. Kerr-McGee increased its estimate of the field’s resource to 150-250 million bbl from 100-200 million bbl.

The appraisal well, drilled to 7,692 ft TD updip of the discovery well, encountered 80 ft of net pay in the Cretaceous Carapebus formation.

An earlier appraisal well, 3-ENC-3-RJS drilled 2.5 miles southwest of the discovery well, tested at rates of 1,400-1,800 b/d of 14o gravity oil (OGJ Online, Sept. 15, 2005).

Feasibility studies are under way to evaluate the commerciality and development options for Chinook field.

EnCana operates the 133,000-acre block with a 50% interest. Kerr-McGee holds the remaining 50%.

Pioneer makes deepwater Gulf of Mexico find

Pioneer Natural Resources Co., Dallas, reported a discovery on the Clipper prospect on Green Canyon Block 299 in the deepwater Gulf of Mexico.

Pioneer, which operates the block with a 55% interest, said it couldn’t disclose details of the discovery because the block is part of a deepwater Gulf of Mexico divestment program it has begun. The program also includes production from Canyon Express, Devils Tower, and the Falcon Corridor, discoveries under development at Ozona Deep and Thunder Hawk, and 90 exploration blocks.

Pioneer opened the divestment data room during the week of Oct. 17. It expects the deepwater Gulf of Mexico sale to close by yearend.

Pioneer had planned to follow the Clipper drilling with a well in the subsalt Paladin prospect in the deepwater Garden Banks area. It said Hurricanes Katrina and Rita delayed the Paladin drilling, which it now seeks to defer because of the divestment plan.

Record-length wells eyed in Alaskan Beaufort

BP PLC is studying feasibility of developing its Liberty oil discovery in the Beaufort Sea off Alaska with extended-reach wells of possibly record lengths.

A conceptual drawing shows 10 wells that would be drilled from shore to the reservoir at about 12,000 ft true vertical depths. The wells would have “equivalent departures” or displacement of 25,000-40,000 ft.

An official with the Alaska office of the Minerals Management Service displayed the graphic at a presentation last month to the Resource Development Council for Alaska Inc., Anchorage.

A BP predecessor discovered and appraised the field, an eastern satellite of supergiant Prudhoe Bay oil field, in 1997. Liberty is in federal waters 5 miles off the coast and 11 miles southeast of giant Endicott oil field.

The longest Liberty wells would be more than twice the length of the longest wells BP drilled from an artificial island to develop nearby Northstar field in 1990.

There was no indication of when BP might seek development approval. ✦

Drilling & Production - Quick Takes

Contract let for export system off Brazil

Petroleo Brasileiro SA (Petrobras) has let a contract valued at $210 million to France’s Technip for engineering, procurement, construction, and installation for a subsea pipeline and free-standing hybrid riser (FSHR) for deepwater oil export in the Campos basin off Rio de Janeiro.

Technip is responsible for the oil export system from semisubmersible platform P-52 to PRA-01, a shallow-water collection platform, as well as an FSHR in 1,800 m of water.

Installation of the 56 km, thermally insulated, 18-in. rigid line and the riser, to be carried out by Technip’s deepwater pipelay vessel Deep Blue, is to begin in the first quarter of 2007. The operations will use the J-lay deployment method in 100-1,800 m of water.

Technip’s engineering center in Rio de Janeiro will be responsible for the overall project management, with technical support from Technip Offshore UK and Technip USA.

The contract falls within the framework of Campos Basin Oil Outflow and Treatment Plan (PDET), which aims to increase oil flow capacity in the Campos basin by as much as 630,000 b/d.

In March, Petrobras announced the signing of contracts worth $910 million to finance its PDET plan for the Campos basin (OGJ Online, Mar. 14, 2005).

Toreador secures jack up for work off Turkey

Toreador Resources Corp., Dallas, has secured an option on Petromar’s Saturn jack up for drilling in the South Akcakoca subbasin off Turkey.

The jack up is available to begin work in the area in December as Toreador and partners work to start gas production from the subbasin in the second half of 2006.

Included in the work by Saturn and a sister rig, Prometheus, is redrilling of the Ayazli 2 and 3 gas wells, which recently sustained damage during an unsuccessful attempt to set a protective production structure (OGJ Online, Oct. 5, 2005). Later the rigs will set production platforms.

The Prometheus is on location to drill Cayazli-1 south-southeast of the Akkaya-1 delineation well about 3 km from shore. Drilling there is expected to be complete late this month.

Also, Toreador has signed a letter of intent for the Atwood Oceanics Southern Cross semisubmersible to drill exploration wells in the Eregli subbasin and deeper water wells on the Akcakoca and adjacent structures to the north of the Ayazli and Akkaya gas discoveries. That work is to begin next April.

Project partner Stratic Energy Corp., Calgary, said details of the exact locations, objectives, and numbers of wells will be determined shortly. ✦

Processing - Quick Takes

Marathon plans to expand Louisiana refinery

Marathon Oil Corp. plans to expand the capacity of its Garyville, La., refinery to 425,000 b/d from 245,000 b/d at an estimated cost of $2.2 billion.

It plans to add a crude distillation unit, hydrocracker, reformer, kerosine hydrotreater, delayed coker, additional sulfur recovery capacity, and other infrastructure.

Upgrading capacities now in place at the refinery include 32,800 b/cd of delayed coking, 115,000 b/cd of fluid catalytic cracking, and 46,600 b/d of catalytic reforming, according to Oil & Gas Journal’s Worldwide Refining Survey (OGJ, Dec. 20, 2004, p. 46).

“Marathon will essentially build an entirely new refinery at this site and leverage off the infrastructure already in place at Garyville,” said Gary R. Heminger, executive vice-president of Marathon and president of the company’s refining, marketing, and transportation operations.

Construction could begin as soon as 2007 and be complete by the fourth quarter of 2009. A final investment decision depends on completion of front-end engineering and design and acquisition of permits.

The expansion will enhance the refinery’s feedstock flexibility and raise its yield of light products by nearly 6 million gal/day.

The Garyville refinery, built in 1976, represents the most recent grassroots refinery construction in the US.

Neste plans Porvoo biofuel, diesel upgrade

Neste Oil Corp. has begun construction of a 170,000 tonne/year biodiesel plant at its 200,000 b/cd Porvoo, Finland, refinery, which it plans also to upgrade to produce high-quality diesel from heavy fuel oil.

Neste will spend €100 million for a facility to produce biodiesel from 100% renewable raw materials in the form of vegetable oils and animal fats.

The plant is expected to come on line by summer 2007. It might enable Finland to beat by 3 years the European Union’s 2010 targets for biofuel use.

Government measures such as tax breaks are needed to ensure that biofuels can come to the market, Neste said.

Neste also is investing €600 million in a new production line at the Porvoo refinery to produce over 1 million tonnes/year of high-quality diesel fuel from heavy fuel oil. The line is due to be commissioned in the fourth quarter of 2006. ✦

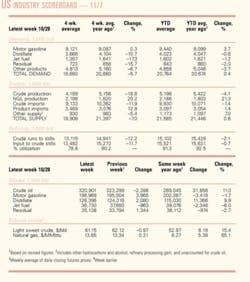

Industry ScoreBoard

null

null

null

Transportation - Quick Takes

BP executive clarifies BTC line start: early ‘06

The Baku-Tbilisi-Ceyhan (BTC) oil pipeline could begin operating by early 2006, according to Tony Hayward, chief executive of the BP PLC exploration and production division. He said the line is expected to start up between yearend and the third week of January 2006.

The BTC pipeline is being developed by an international consortium of 11 partners, led by BP and the State Oil Co. of Azerbaijan (Socar).

Hayward’s statement, made to journalists on the sidelines of BP’s Oct. 25 earnings conference, clarified earlier confusion over the start-up date of exports from the pipeline’s export terminal at the Turkish Mediterranean port of Ceyhan.

BP Azerbaijan Pres. David Woodward was quoted recently by Azerbaijan state media as saying the target to launch full operations by the end of this year was “challenging” because of extensive testing and commissioning in the Turkish section of the pipeline.

Citing Woodward, Azerbaijan’s Turan news agency said the first tanker carrying crude from the Azeri oil field would leave Ceyhan in first quarter 2006 instead of this year’s fourth quarter.

But Turan also quoted Socar Pres. and Chairman of BTC Co. Natiq Aliyev as saying there was still a possibility of dispatching the first tanker with Azeri crude from the port of Ceyhan before yearend. “The BTC Co. has not yet officially changed the schedule of dispatching the first tanker,” he said.

On Oct. 12, the Georgian section of the BTC oil pipeline was inaugurated in the Gardabani District of southern Georgia in a ceremony attended by presidents of Azerbaijan, Georgia, and Turkey, as well as Steven Mann, the US presidential envoy on Caspian issues (OGJ Online, Oct. 18, 2005).

Linefill of the BTC pipeline began at the Saganchal oil terminal in Azerbaijan on May 10.

ConocoPhillips, Alaska agree on gas line

ConocoPhillips has agreed to fiscal terms proposed by the state of Alaska for a natural gas pipeline to the Lower 48, Alaska Gov. Frank H. Murkowski said Oct. 21 during a news conference in Fairbanks.

The state is in contract negotiations with the other two North Slope producers: BP PLC and ExxonMobil Corp.

“This is a significant milestone-and there are other positive signs on the horizon. Additional work remains,” Murkowski said. “Until we have reached agreement with all three producer companies, I cannot discuss the details of the contract due to confidentiality.”

On Oct. 6, Murkowski announced that he had delivered a contract term sheet to the producers. At that time, he said the state was “closer now than ever before” to reaching an agreement on a gas pipeline.

The gas pipeline that Murkowski and ConocoPhillips propose would run more than 3,000 miles through western Canada into the US Midwest and carry 4 bcfd of gas from the North Slope. The pipeline is expected to cost $20 billion.

Challenger Capital Group Ltd. of Dallas, along with Credit Suisse First Boston and UBS, were selected to serve as financial advisors for the state of Alaska’s participation in construction of the gas line.

Progress sought on Siberia-Pacific oil line

Russian Prime Minister Mikhail Fradkov-in an effort to speed up implementation of the Eastern Siberia-Pacific Ocean pipeline project-has directed relevant ministries and departments to prepare a detailed proposal by Nov. 10.

Fradkov’s directive said: “The setting up of the Eastern Siberia-Pacific Ocean (ESPO) pipeline system has dragged out without good reason. One of the priority projects for the country’s economic development is practically not being implemented.”

Fradkov issued the directive to Russia’s Industry and Energy Ministry, the Federal Technical Oversight Agency, the Natural Resource Ministry, the Economic Development and Trade Ministry, and the Regional Ministry.

He ordered them to work with state-owned pipeline monopoly Transneft to decide on the positions of government and local authorities regarding construction of the ESPO line.

Fradkov’s directive calls for work to be organized to agree on the main outlines of a feasibility study for the project to include the route, technical solutions, and financing.

To monitor progress, Fradkov also ordered the relevant ministries to submit quarterly reports to the government on the project’s implementation.

Fradkov signed a resolution on Dec. 31, 2004, to build the Eastern Pipeline, with Transneft as its designer and builder.

The first stage of the project calls for a 2,400 km oil pipeline from Taishet to Skovorodino and a rail oil terminal on Perevoznaya Bay. The second stage, which depends on development of East Siberian oil fields, involves further construction from Skovorodino to Perevoznaya.

In August, Boris Govorin, governor of the Irkutsk Region, said Russia would begin construction this fall of the first leg of its planned 4,130 km crude oil pipeline from Taishet in eastern Siberia to the Sea of Japan (OGJ Online, Aug. 10, 2005). ✦

Correction

A story in OGJ, Oct. 24, 2005, p. 26, misidentified the headquarters of PetroHawk Energy Corp. PetroHawk is based in Houston.