General Interest - Quick Takes

Senate committee approves ANWR leasing

Congressional authorization to issue oil and gas leases in the Arctic National Wildlife Refuge advanced a step Oct. 19 as the Senate Energy and Natural Resources Committee approved the move by a 13-9 vote.

The language’s instruction to the secretary of the Department of the Interior specifies that leasing be confined to the refuge’s coastal plain and not affect more than 2,000 acres. Supporters emphasized that operations would have to minimize environmental impacts.

“The hurricanes in the [Gulf of Mexico] underscored what Congress has known for a long time: We must produce more of our own oil, and we must diversify the places where we produce it. We must do it for our economy and our energy security,” committee Chairman Pete V. Domenici (R-NM) said.

The approved legislation is Title IV of the budget reconciliation bill that the Senate Budget Committee is scheduled to mark up on Oct. 26. The Energy and Natural Resources Committee passed Title IV in response to instructions from the Budget Committee to raise $2.4 billion in revenue for fiscal years 2006-10.

The Congressional Budget Office estimates the competitive sale of oil and gas leases on ANWR’s coastal plain would raise $2.5 billion during that time, an energy committee spokeswoman said.

Three Democrats on the committee offered amendments that were defeated. Ranking member Jeff Bingaman of New Mexico offered one to limit the authorization of oil and gas development on ANWR’s coastal plain in the same manner as in other units of the National Wildlife Refuge System. Maria Cantwell of Washington proposed ensuring direct payment to the US Department of the Treasury of half the revenues of the proposed leases. And Ron Wyden of Oregon offered an amendment prohibiting the export of oil and gas produced under ANWR leases.

Exploration tax breaks urged in Australia

Australian Minister for Industry, Tourism, and Resources Ian Macfarlane is pressing for a new set of petroleum exploration tax breaks to be incorporated in the government’s federal budget in May 2006.

Australia’s oil self-sufficiency has fallen to about 75% from a high of about 95% in the early 1990s. Forecasts state that without any significant discoveries that percentage could drop to about 22% by 2010.

One of Macfarlane’s proposals is to introduce a flow-through-share scheme that would involve changes in tax laws to make it easier for exploration companies to raise capital by issuing shares that investors can claim against their individual tax returns. Such a scheme has previously run up against opposition from the Australian Treasury, but this opposition is said to be weakening with the country’s diminishing petroleum self-sufficiency and its implications for future balance of payments now a crucial issue.

In another aspect of energy security, Macfarlane has ruled out any attempt by the government to set up a strategic stockpile of oil and product reserves. However, he wants to encourage the nation’s refiners to expand capacity. One way to do this would be to restart ExxonMobil Corp.’s 76,000 b/d Port Stanvac refinery in Adelaide, which was shuttered in 2003 in the face of competition from Asia.

ExxonMobil has previously said it would review the status of Port Stanvac in 2006.

Macfarlane also wants oil companies to support marketing of ethanol-blended gasoline to make it more attractive to the country’s motorists. Recently, there have been scare campaigns about the dangers of ethanol in vehicle engines that began when some operators added as much as 20% ethanol to the fuel mix.

Several companies, including BP PLC and Caltex, market 10% ethanol-blended gasoline, but the market for the fuel is small.

Russian oil exports by rail to China rising

Russia exported 5.7 million tonnes of crude oil to China via railway transportation in the first three quarters of 2005, an increase of 22% over the same period in 2004, according to Russian Railways Co.

Zabaykalsk, a railway port on the Sino-Russian border, exported 3.72 million tonnes of crude oil to China, increasing 34% year on year, while Naushki, a railway port on the Russian-Mongolian border, transported 1.98 million tonnes, a 4% increase over 2004.

In 2004, Russia exported 6 million tonnes of crude oil to China through its railway system, surging 68% over 2003, and it was supposed to export 10 million tonnes of crude to China in 2005, with a further increase to 15 million tonnes in 2006.

But Russia cut the 2005 figure by 30% to 7 million tonnes in August due to limited railway transportation capacity. ✦

Exploration & Development - Quick Takes

Lukoil, PDVSA to study Orinoco belt block

Lukoil Overseas Holding Ltd. and the investment division of state-owned Petroleos de Venezuela SA (PDVSA) have signed a 3-year agreement to research a section of the Junin Block (formerly Zuata) in the Orinoco oil belt in Anzoategui, eastern Venezuela.

The companies will assess heavy oil reserves in the 640 sq km Junin-3 Block.

Junin-3 is northwest of the Sincor oil development, which has been producing 140,000-160,000 b/d, with a capacity of up to 200,000 b/d, of 9o gravity crude from a 19 sq mile sector of the Zuata production area (OGJ Online, June 30, 2003).

PDVSA will coordinate the technical work of the study, while the Ministry of Energy and Petroleum of Venezuela will carry out control and supervision functions. The work results will be subject to approval by the Steering Committee established on parity basis by Lukoil Overseas and PDVSA.

After the studies, the companies will begin negotiations to establish a joint project to develop the Junin-3 Block.

PDVSA recently signed a cooperation agreement with China National Petroleum Corp. that includes a reserves assessment of the 640 sq km Junin-4 Block (OGJ, Sept. 12, 2005, Newsletter).

Newfield, ExxonMobil to explore S. Texas prospects

Newfield Exploration Co., Houston, and ExxonMobil Corp. have agreed to jointly explore and develop 52,000 gross acres of ExxonMobil’s properties in Kenedy, Starr, and Hidalgo counties in South Texas.

Newfield said the joint venture will drill 30-40 wells over the next 3 years on the properties, which lie in its core South Texas activity area.

Newfield entered South Texas in 2000 and owns interests in more than 200,000 gross acres in the region. It has increased net production to more than 200 MMcfd of gas equivalent.

Husky completes Summit Creek seismic program

Husky Energy Inc., Calgary, has completed a 200-km 2D seismic program on Block EL 397, which contains the Summit Creek B-44 discovery, in the Central Mackenzie Valley area of Northwest Territories, Canada.

Husky Energy, which on May 1 assumed operatorship of Block EL 397 from Unocal Corp. subsidiary Northrock Resources Ltd., plans in January 2006 to drill two wells in the Summit Creek area. Husky and its partners own acreage in the area totaling 2,400 sq km.

One of the planned wells will assess the size of the pool discovered by Summit Creek B-44. The other exploration well will test a separate undrilled prospect.

The Summit Creek B-44 well, the first discovery in the Central Mackenzie Valley since Norman Wells in 1920, was drilled to 3,063 m, cased to TD, and suspended.

The B-44 well tests confirmed several productive intervals in a gross hydrocarbon column of more than 600 ft. Each of two perforated intervals flowed on test at the rate of 10 MMcfd of natural gas and more than 3,000 b/d of light oil or condensate with flowing wellhead pressures of 900-1,100 psi. One zone also produced 1,000 b/d of water (OGJ Online, Mar. 31, 2005).

Series of wells possible in Paraguay

CDS Oil & Gas Group PLC, London, is preparing to spud the first of what could be a series of exploration wells in nonproducing Paraguay.

The company let a contract to Nabors International to move Rig 426 from Bolivia to drill a well to 3,200 m on the 98,800-acre Gabino Mendoza Block in northwestern Paraguay. The well, to spud this month, is in the Chaco basin, which produces oil and gas in Bolivia.

The drillsite is 200 m from Independencia-1, which CDS tested in March 2004 at 960 Mcfd of gas from 4 m of Carboniferous sandstone at 588 m. Gas is 94% methane with no sulfur.

CDS Oil & Gas has imported casing for as many as five wells.

Independencia-1 is a reentry of the Pure Oil Mendoza-1R, which briefly drillstem tested at a rate of 2.6 MMcfd of gas from 2,600 m in 1959. The well also had oil shows at 721-1,800 m and a sequence of Devonian silts and shales at 1,676-3,234 m MD, the company said.

CDS Oil & Gas holds 100% interests in the 5.7-million-acre Boqueron Block and the 1.2-million-acre PG&E Block. Of the 26 wells drilled on the three blocks, 22 had hydrocarbon shows.

Devon group plans 1,250 wells in Wyoming

Devon Energy Corp., Oklahoma City, on behalf of itself and seven other companies, has applied to the US Bureau of Land Management for approval to continue development drilling in the Creston Blue Gap II Project Area (CBGIIPA) in Carbon and Sweetwater counties of South-Central Wyoming. While an environmental impact statement is being developed, BLM said it may allow limited drilling of directional wells to continue.

The companies plan to drill about 1,250 oil and gas infill, delineation, and exploration wells at 1,000 well locations in the 184,000-acre area. Drilling-targeting the Cretaceous Lance, Lewis, and Mesaverde formations-is expected to continue for 10-15 years. The life of the project is estimated at 30-50 years.

Pearl to drill in Jasmine area off Thailand

Pearl Energy Ltd. of Singapore has let contract to ENSCO Oceanics Co. for use of the ENSCO 107 jack up in a 60-day exploration program scheduled to start in March 2006 on Block B 5/27 in the Gulf of Thailand.

Pearl plans six exploratory wells on the block, three in the area of Jasmine oil field, one to the north, and two to the south.

Jasmine field started up from Platform A in June 2005 and is producing about 10,000 b/d of crude oil.

In August, Pearl approved the installation of a second platform, Platform B, about 3 km northwest of Platform A, and a third platform, Platform C, 3.2 km south of Platform A (OGJ, Aug. 22, 2005, Newsletter).

Platforms B and C will be connected via subsea pipeline to the Jasmine Venture MV7 floating production, storage, and offloading vessel near Platform A.

Chris Gibson-Robinson, Pearl’s chief technology officer, said the firm will attempt to extend the drilling contract and drill one or more sidetracks from each surface location to establish the reserves of each prospect area.

Pearl’s 70%-owned subsidiary Pearloil (Siam) Ltd. holds 100% of and operates Block B 5/27.

Shell starts seismic survey in Libya

Shell Exploration & Production GMBH began a land seismic survey in the coastal Sirte basin near Marsa Al-Brega, Libya, and hopes to start exploratory drilling in late 2006-early 2007.

A long-term agreement signed in May 2003 with National Oil Corp. gave Shell gas exploration rights on five onshore blocks totaling 20,000 sq km. Shell plans to invest at least $187 million in exploration, starting with acquisition of 2D and 3D seismic data.

Under another segment of the agreement, Shell will invest $105-450 million to rejuvenate and upgrade in phases the Marsa Al-Brega LNG plant on the Gulf of Sidra coast and eventually hike plant output to 3.2 million tonnes/year from 0.7 tonnes/year. Preparations for the rejuvenation are on schedule, Shell said.

Shell and NOC will jointly develop a new liquefaction plant if enough gas becomes available. NOC affiliate Sirte Oil & Gas Production & Manufacturing Co. operates the plant with gas from the Sirte basin. ✦

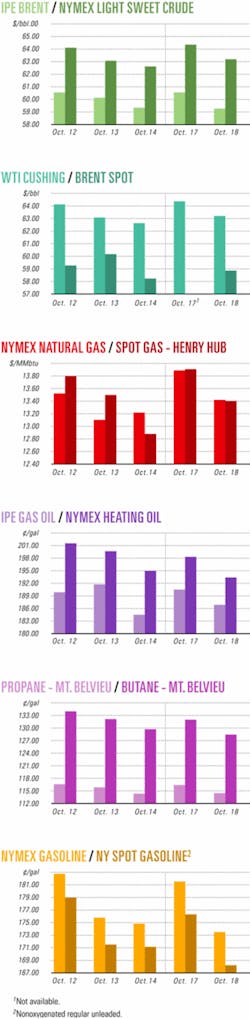

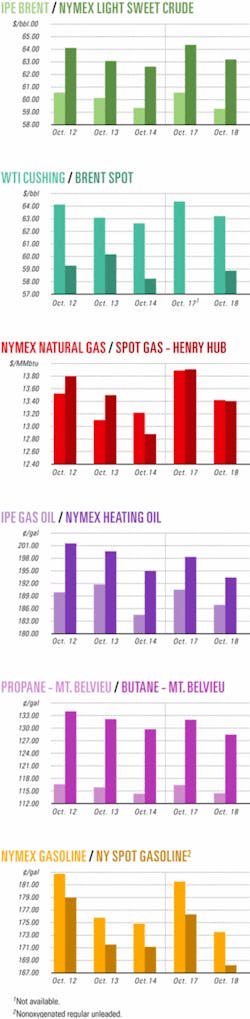

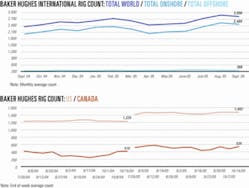

Industry Scoreboard

null

null

null

Drilling & Production - Quick Takes

Production resumes from Sleipner East field

Statoil ASA has resumed full production of 22 million cu m/day of gas and 40,000 b/d of condensate from Sleipner East field in the Norwegian North Sea.

Field production resumed Oct. 16 after being shut in following a gas leak Oct. 12 on the Sleipner A platform (OGJ Online, Oct. 14, 2005).

Gas from Sleipner field flows to Emden, Germany, and Zeebrugge, Belgium. The field’s condensate flows to the Kårstø receiving terminal north of Stavanger.

BP to double its Wamsutter field gas flow

BP America Inc. plans to invest as much as $2.2 billion to double production from its acreage in Wamsutter natural gas field to 250 MMscfd by 2010. Wamsutter field is in southwest Wyoming’s Green River basin.

The outlay includes the drilling of 2,000 wells over the next 15 years and a 2-year, $120 million technology field trial program that could lead to additional field development, BP America said. The program involves untested or relatively new exploration, production, and environmental technologies that have not yet been applied on a field-wide scale, said BP America’s Jack Rigg.

The expansion program is expected to increase the company’s share of ultimate recovery from the field by 1.8 tcf of natural gas.

The funding is part of a projected 10-year, $15 billion investment program BP plans for North American onshore operations-$5 billion of it targeted for this year.

Tony Hayward, chief executive, BP Exploration & Production, said that the program has identified 1,600 new development locations.

The 1,700 sq mile Wamsutter field is one of the largest tight gas resources in North America. Its multiple operators have produced 2 tcf of gas from more than 2,000 wells since the field’s discovery in 1958. BP, the largest Wamsutter operator, holds an interest in 352,000 acres and operates 950 wells. Other large operators are Anadarko Petroleum Corp.; Marathon Oil Corp.; Yates Petroleum Corp., Artesia, NM; and Cabot Oil & Gas Corp.

IFP, Riped to develop E&P technologies

Institut Français du Pétrole (IFP) and PetroChina Co. Ltd.’s Research Institute of Petroleum Exploration and Development (Riped) have signed a long-term cooperation agreement to develop exploration and production technologies.

The initial research and development projects have been identified and are scheduled to start in 2006.

The projects will deal with reservoir characterization and the improvement of hydrocarbon recovery through gas injection and polymer techniques. ✦

Processing - Quick Takes

Venture revives plans for Indian refinery

A letter of intent by BP PLC and India’s Hindustan Petroleum Corp. Ltd. (HPCL) to form a strategic refining partnership has revived longstanding plans for a 180,000 b/d refinery at Bhatinda in Punjab, India.

The $3 billion refinery is expected to be commissioned in 2009.

BP and HPCL have agreed to jointly study refining and marketing opportunities in India.

The JV will develop a marketing activity, which includes establishing a retail service station network, to handle products of the planned refinery. It will provide assistance in crude selection and supply for HPCL’s other refineries.

Earlier plans for the Bhatinda refinery stalled in 2000 when HPCL’s international partners-Exxon Corp., Total SA, and Saudi Aramco-withdrew from the project (OGJ, Feb. 19, 2001, p. 50).

Oklahoma refinery expansion planned

Wynnewood Refining Co., a wholly owned subsidiary of Denver-based Gary-Williams Energy Corp., plans to upgrade and expand capacity of its 55,000 b/d refinery in Wynnewood, Okla., to 70,000 b/d. When the project is complete in mid-2007, the refinery will be able to process heavy, sour crude while exceeding new environmental standards.

Koch Partners LP, an affiliate of Koch Chemical Technology Group Inc., Tyler, Tex., received an engineering, procurement, and construction contract to design and build the facilities, which will include a new crude oil distillation unit and related facilities and a new diesel hydrodesulfurization unit. Koch will provide process design, detailed engineering, project management, and field construction for the project.

The new crude processing unit will be larger than existing equipment. The work associated with it includes the addition of a vacuum distillation unit and modification to existing facilities. The diesel hydrotreater will be designed to produce ultralow-sulfur diesel, naphtha, mineral spirits, and jet fuel. ✦

Transportation - Quick Takes

USCG to review Neptune LNG port application

Neptune LNG LLC, a subsidiary of Suez LNG LLC, said its application with the US Coast Guard to build a deepwater port 22 miles off Boston has entered into a statutory 330-day review period.

Neptune LNG anticipates the project’s development phase, including regulatory and public consultation and evaluation, and a formal project application review, will take 15-18 months. Construction of the proposed deepwater port would take another 3 years.

In a related development, Neptune filed an Environmental Notification Form with the Massachusetts Environmental Policy Act unit.

Suez LNG’s subsidiary, Distrigas of Massachusetts LLC, owns an LNG receiving terminal in Everett, Mass., that has operated since 1971.

If approved, the deepwater port would operate by mooring specially designed LNG ships equipped to store, transport, and vaporize LNG. Gas would be sent through an existing subsea pipeline.

The port’s submerged unloading buoy system would involve two separate buoys to ensure a continuous flow of gas deliveries. An LNG ship typically would moor for 4-8 days, depending on market demand.

Georgian section of BTC pipeline opens

The Georgian section of the Baku-Tbilisi-Ceyhan (BTC) oil pipeline was inaugurated on Oct. 12 in the Gardabani District of southern Georgia in a ceremony attended by Azerbaijani President Ilham Aliyev, Georgian President Mikheil Saakashvili, Turkish President Ahmet Necdet Sezer, and the US presidential envoy on Caspian issues, Steven Mann.

The first leg of the BTC line was inaugurated May 25 in a ceremony at the head pump station in the Sangachal terminal near Baku (OGJ Online, June 6, 2005).

It will take some 10 million bbl to fill the entire pipeline. By yearend the 1,760-km line is expected to transport as much as 1 million b/d to Turkey’s Mediterranean port of Ceyhan.

On Oct. 10, the Joint Pipeline Security Commission (JPSC), established in accordance with the protocol between Turkey, Azerbaijan, and Georgia relating to the provision of security for the East-West energy corridor, held its first meeting in Ankara, Turkey.

Participants discussed preparedness regarding protection of the pipeline and exchanged views regarding the threat assessment, the regional security situation, training of security personnel, equipment, and cross-border cooperation in times of crises.

JPSC will hold its second meeting in Baku during the first half of 2006.

Williams to transport Blind Faith oil, gas

Williams Cos. Inc., Tulsa, has signed agreements to transport oil and gas produced for the life of the leases in Blind Faith field on Mississippi Canyon Blocks 695 and 696 in the deepwater Gulf of Mexico.

Chevron Corp. operates the field with a 62.5% working interest, and Kerr-McGee Corp. holds 37.5%.

Under terms of one agreement, Williams will spend $177 million to extend its Canyon Chief and Mountaineer pipelines, which were placed in service in May 2004 to handle production from Devils Tower field on Mississippi Canyon Block 773.

The pipelines will be extended 37 miles each to handle production from Blind Faith and the surrounding blocks. The extensions are expected to be complete by mid-2007.

The other agreement commits Williams to move natural gas from the Blind Faith discovery through its Mobile Bay, Ala., processing plant and its Transco and Gulfstream interstate pipeline systems. Also, the company has an option to fractionate recovered NGLs from Blind Faith at its facilities in Baton Rouge or Paradis, La.

Blind Faith field, which has an estimated gross resource potential exceeding 100 million boe, is expected to initially produce 30,000 b/d of oil and 30 MMcfd of gas in the first half of 2008 (OGJ Online, Oct. 10, 2005).

Contract to be signed for Vietnam gas line

Vietnam’s state-owned PetroVietnam will sign an engineering, procurement, and construction (EPC) contract on Oct. 17 with the Vietnam-Russia oil and gas joint venture company Vietsovpetro for construction of the PM3-Ca Mau natural gas pipeline, according to state media.

Under terms of the $245 million contract, Vietsovpetro will be responsible for construction of the 325 km, 457 mm line, which will connect the offshore PM3 Block with An Khanh village in Ca Mau province. The line will transport as much as 2 billion cu m/year of gas.

Construction of the pipeline entails 298 km of pipe offshore and 27 km onshore. PetroVietnam expects the line to be operational in late 2006.

The pipeline is one of three parts of the multibillion-dollar Ca Mau gas-electricity-nitrogenous fertilizer complex. The project’s other parts include construction of a 720 Mw gas-fired electric power plant and the Ca Mau fertilizer plant.

GAIL seeks Australian exploration, LNG

India’s GAIL (India) Ltd. has earmarked about $500 million (Aus.) for oil and gas investment in Australia over the next 3-5 years.

The company plans to bid for petroleum exploration permits in the next offshore bidding round, which closes in April 2006, and is interested in production assets.

India’s energy demand is forecast to increase by 4%/year over the next 2 decades. The country imports 70% of its crude oil and LNG from Qatar.

Currently it also is in discussions with the Gorgon joint venture and Woodside Petroleum Ltd. for the purchase of LNG (OGJ Online, July 1, 2005). ✦