Identifying roles, responsibilities optimizes refinery scheduling process

Computer-based technologies can enhance the quality of refinery monthly schedules. These tools are critical elements of the scheduling professional’s toolkit; however, they are no substitute for an inclusive and comprehensive scheduling process that promotes well-reasoned interpretations of scheduling model results.

It is the process that provides cogent input to the mathematical scheduling model and then converts the model results into robust schedules. This article presents insights that will assist in optimizing the scheduling process at a refinery.

The analysis and recommendations presented here are applicable to other process industries, such as petrochemicals, as well as refining.

Some of the key organizational characteristics leading to successful refinery scheduling are:

• All stakeholders contribute with meaningful participation.

• Participation in the process focuses on value-added activities.

• Technical ability is carefully blended with intuitive knowledge.

Stakeholders are defined as individuals and groups within the entire company who are affected by the final product from the scheduling process. This is a broad definition and, for many refineries, the optimum number of participating stakeholders is more than those who actually participate on a regular basis. That is, the involvement across an organization may be too narrow or too focused.

Although one group may lead a task within the process, several other groups are frequently needed in support roles for the same task. Also, a more broadly supported effort is frequently required for certain roles, such as developing pricing assumptions, than many refiners seem willing to invest.

The backgrounds of the stakeholders participating in the various roles are varied, but this is usually helpful in synthesizing a schedule from a system that has high calculation accuracy but difficulty developing repeatable and relevant guidance.

An important characteristic of the refinery scheduling process is that it is both continuous and repetitive. It is continuous in that programs must be adjusted as refinery operational changes and major pricing changes occur. It is also repetitive in that new production programs must be generated every month.

Notwithstanding this apparent drudgery, development of an optimized and accurate refinery schedule is integral to a plant’s financial success.

Roles, responsibilities

All stakeholders in the refining scheduling process have roles. The stakeholders all need to agree on those roles and endorse them for the value they add.

Table 1 outlines typical scheduling roles for stakeholders within a refining organization.

In this scenario, a stakeholder may have more than one role, but each task has only one primary stakeholder responsible for that task. Each stakeholder may also have some level of expertise that can add value to each task.

A real-world solution is to recognize that most of the tasks require input from more than one group. It is also reasonable to ask whether all of the stakeholders are represented in this typical case.

Pricing

Many arguments regarding the validity of the schedule proposed by the scheduling group (or the accuracy of their model, etc.) may actually represent disagreements over price assumptions. Instead of viewing the pricing input as data provided by a third party, all stakeholders should thoroughly vet the pricing in an assumptions review meeting before schedule development.

As a practical solution to this issue, the scheduling group should translate the absolute price estimates provided by the supply and trading department to differentials that are both more stable and more predictable than the absolute numbers.

In an open commodity market, absolute prices can and do experience wide swings daily. The price relationships between different refined products, however, generally exhibit less variation than the absolute prices and are more predictable seasonably.

In the US, for example, the price differential between regular unleaded gasoline and diesel fuel in December usually differs from the differential the preceding June. Yet, the differential in December of one year normally approaches the differential of the preceding December.

Both of these relationships are frequently correct even though the absolute value of crude, and therefore of the products, may be 50% higher or lower one year vs. the next.

Fig. 1 shows how a price differential, in this case between gasoline and crude oil, has a much lower standard deviation than the absolute price for either of the individual commodities.

All stakeholders in the scheduling process should be aware of these and other important historic pricing relationships so that the pricing scenario proposed by the supply and trading department and the scheduling group can be reality-tested and agreed upon.

Yield assumptions

Clearly, the scheduling, operations, and technical services groups should agree upon the yield assumptions. Frequently, however, the scheduling group becomes the primary steward of this information when technical services really should have the lead role. The reason for this is fairly simple: Schedulers deal in barrels and technical services’ engineers deal in pounds.

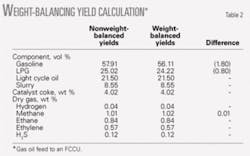

It can be difficult, for example, for a scheduler to determine the validity of an FCCU yield pattern that is only reported in volume percent. Table 2 shows an example of an actual FCC yield report that appears quite logical on a volumetric basis but is clearly inaccurate when weight balanced.

Using the set of yields that were not weight balanced would have overstated the volumetric FCC gasoline and LPG yields by 2.6 vol %. In a crude pricing scenario of $40-50/bbl, the yields that were not weight balanced could overvalue this FCC feedstock by $1-1.50/bbl. The real method to validate that vector is to have it firmly rooted in a weight-balanced test run or kinetic model simulation.

Inventory control

Always an important task, inventory control and prediction become even more critical during the end of the year when inventory-based taxes and profits are calculated. This subject also allows introduction of other important stakeholder groups to the mix: marketing, tax, and financial accounting groups.

Accurate estimates of customer demand are needed from marketing to ensure that yearend inventory targets are achieved.

Backcasting

Backcasting has been applied at many locations as a method of comparing linear program (LP)-generated yields vs. actual operations that use the actual pricing scenario for the just-completed month. This process helps calibrate both the model and the intuition of current and future refinery leaders. It is not just an exercise for the scheduling group, however.

The monthly backcasting meeting or backcasting portion of the monthly scheduling meeting needs input from tech services and supply plus the wisdom usually resident in refinery management.

During the backcasting process, it is important to review both the volumetric and financial agreement between the model and history. The performance of process facilities and their management teams are judged on whether they achieve their volumetric plans and their financial plans.

Variation or change?

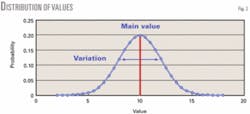

Though often underutilized or misunderstood, the intuition and experience of seasoned managers fulfills a critical role in ferreting out the difference between random variation and actual change when evaluating the degree of cause and effect (Fig. 2).

A true change implies that the mean value of data points is different. Much of the data in a refinery LP model is frequently and necessarily based on a limited number of “trials.” It is difficult to determine whether a given trial has identified a change (i.e., a repeatable result that is different from previous indications) or whether only a variation has occurred and the system has actually not changed.

A statistician would say that the limited number of trials renders much of the input data statistically insignificant. Yet, many LP models accurately predict refinery operations while simultaneously determining the optimum operation. This occurs not only because of backcasting but more importantly through the use of intuition and experience to distinguish true change from variation.

Although most stakeholder groups can and should have input when determining variation vs. change, the lead for this activity may very well rest with refinery management’s subjective opinion. This is an activity that requires a significant dose of judgment and experience.

In reality, separating random variation from actual change is a critical part of the “quality control” process related to data input to the LP model and the overall scheduling effort.

The same judgment and experience are needed for determination of the validity of the results from the refinery schedule LP. “Intuition should never be ignored,” is a commonly used phrase that holds merit in this scenario.

Even though these so-called “management topsides” can appear arbitrary, they are often needed to keep schedules consistent when it is unclear whether the data are supporting the existence of a bona fide change in operation.

Revised roles, responsibilities

Table 3 shows revised scheduling process roles. Lead responsibilities are now indicated along with support needs.

Note the extensive “support” role of refinery management. Its key role is to determine whether a proposed assumptions change is significant or if decreasing variation will obviate the need for a change in forecast assumptions.

Any group that helps to “find the mean in a system” is providing a necessary and valuable service. In Table 3, it is expressed as a “variation vs. change” activity and has been added to the continuous scheduling process.

The precision of the mathematical tools used in the refining industry’s scheduling process exceeds current ability to forecast daily commodity market pricing and the ability to generate statistically valid yield and other data. An inclusive and comprehensive scheduling process will help close the gap between the accuracy of price and other data and the precision of mathematical tools.

Individuals in the process need to use their own experience and intuition plus the wisdom of others to develop schedules that are most likely to represent truly optimum operation and are supported by all stakeholders. ✦

The authors

David Freyman (dgf@

BarnesandClick.com) is a vice-president for Barnes & Click Inc., Dallas. He joined the firm in 2000 after 23 years with Mobil Oil Corp. and ExxonMobil Corp. where he held a number of assignments of advancing responsibility in corporate planning, refining supply and logistics, and refinery operations. Freyman holds a BS in chemistry and a BS in chemical engineering from Syracuse University, NY, and has completed graduate studies in business at Rutgers University, NJ.

Mark Brumbaugh ([email protected]) is the president of Principle Based Management Solutions LLC, Spring, Tex., and is an associate consultant for Barnes & Click Inc. He has 30 years’ experience in short range and strategic planning, pricing, financial analysis, commerce, joint ventures, and the synergies of refinery and chemicals production facilities. Brumbaugh previously held senior management positions with ExxonMobil Corp., Fina Oil & Chemical Co., ATOFINA, and Total AS. He holds an MS in chemical engineering from Rice University, Houston.