Australia's Reserves—2: Discoveries, pending developments spell resurgence in Australia offshore production

This is the second part of a two-part article about how Australia is converting substantial hydrocarbon resources into recoverable volumes.

In the southeastern part of Australia, the Gippsland basin contains one gas field, Patricia/Baleen, that is now producing but was classified as economic demonstrated resources (EDR) in “Oil and Gas Resources of Australia 2002.”3

Patricia/Baleen gas field is 23 km off eastern Victoria in 50 m of water (Fig. 5). The development consists of two subsea well completions connected via a 23-km offshore gas pipeline to an onshore dedicated gas treatment plant for processing and compression. The publicly estimated initial reserves are 77 bcf, while field life is estimated at 7 years.

Kipper oil and gas field has development plans under consideration. The field was discovered in 1986 by the Kipper-1 exploration well 45 km off Victoria in 100 m of water. The options under consideration assume a subsea development of the field (which extends between two titles) under unitization agreement with Esso/BHP Billiton.

A preliminary development plan for Basker/Manta oil field in the Gippsland basin has been submitted to state and federal governments. These fields are to be developed on a stand alone basis using a turret-moored floating production storage and offloading vessel (FPSO).

The Bass basin west of the Gippsland basin contains one gas and oil field, Yolla, that was classified as EDR in “Oil and Gas Resources of Australia 2002.”3 The Yolla development began construction in April 2003 and is expected to achieve full production by the end of 2005.

Yolla field is 120 km off Tasmania and 220 km southeast of Melbourne in 80 m of water. The field was discovered in 1985 by Amoco’s Yolla-1 well that intersected gas in the Intra-Eastern View Coal Measures (EVCM) reservoir units at 2,718-3,000 m. The reserves are publicly estimated at 236 bcf of sales gas, 1 million tonnes of LPG, and 14 million bbl of condensate.

The Yolla field development consists of a conventional steel platform, two deviated development wells, and a 147-km, 350-mm plain carbon steel subsea pipeline for the shipment of raw gas and condensate to an onshore treatment plant in Victoria.

The Otway basin (Fig. 6) farther to the west contains three gas fields that were classified as EDR in “Oil and Gas Resources of Australia 2002.”3 In January 2005, BHP Billiton started production from one of these, Minerva. The field is 10 km offshore in 60 m of water.

The Minerva development consists of two subsea wells and a flowline for transport of gas to the onshore gas processing plant, where gas liquids are removed prior to exporting the gas to market.

Two other offshore gas fields, Thylacine and Geographe, are under development. Nearby Casino gas field is in advanced planning. Another significant field, Henry, has recently been discovered adjacent to Casino. Due to the proximity of domestic markets, it is probable the remaining EDR field and any future large gas discoveries will be brought into production rapidly.

In the same area in April 2004 the Australian government granted production licenses to Woodside Energy Ltd., Perth, over Geographe and Thylacine gas fields (the Otway Gas Project). The fields are 55 and 70 km offshore in 80-100 m of water.

The project includes construction of an onshore gas processing plant, construction of the 11.5-km onshore pipeline from the shore crossing to the gas plant, the shore crossing, 70 km of offshore pipeline tied in to the Thylacine offshore platform, construction and installation of the offshore platform over Thylacine field, and drilling of four Thylacine production wells.

Initially the Otway Gas Project will produce 55 bcf/year of sales gas. The reserves for the combined Geographe and Thylacine fields are publicly estimated at 800 bcf of gas and 9 million bbl of condensate. Production is to begin in mid-2006.

New exploration incentives

The number of exploration wells drilled off Australia over the last decade has averaged 56/year with a maximum of 73 in 1998. In 2004, 44 offshore wildcat wells were drilled.

The industry in Australia, however, talks of the need to find a new Bass Strait (a new major oil province). This is because estimates of future production of oil and condensate suggest that at the mean expectation production rates would drop by around 50% by 2010 largely due to a drop in oil production.

Fig. 7 shows the production of crude oil and condensate from 1975 to 2003 and production forecast of crude oil and condensate from 2004 to 2025. The forecast includes production of crude oil and condensate from accumulations that had been discovered by the end of June 2004 plus production of crude oil and condensate from undiscovered accumulations.

The 2004 forecast includes 10% of production from the Joint Petroleum Development Area (JPDA). Condensate production was projected to continue to grow, but the rate of growth was constrained by gas production rates and overall by the development timetable for the major gas fields. Consequently, the rate of discovery of new oil fields was insufficient to replace the oil reserves that are being produced.3 9

The Australian government announced its new initiative largely in response to the demonstrated decline in forecast production of oil in Australia over the next 10 years. The government acknowledges that 90% of all oil exploration success in Australia since the 1940s has been directly underpinned by geoscience information and advice given by Geoscience Australia and its predecessor organizations. Consequently, the government is providing via Geoscience Australia substantial support free of charge to help industry in the search for a new oil province.

The new $25 million (Aus.) program for enhanced data access was announced in May 2003 as described by Williamson and Foster7 and has been under way for 2 years. The program aims to further stimulate industry activity in Australia.

As part of this program the government has sought to increase the ready access to exploration data. The aim of the initiative is particularly to allow for new data to promote petroleum exploration in areas that could provide the possibility of a major new oil province. Funding is over 4 years to provide vital geological and seismic data to companies considering oil exploration in Australia.

Products from the program include commercial seismic and other data that have been collected over the Bremer, Mentelle, and Vlaming subbasins off southwestern Australia that are publicly available at the cost of transfer. The results of studies of these data will be presented in a workshop in Canberra in October 2005.

Consultation had been undertaken with the Australian and international petroleum exploration industry to identify areas that show the greatest potential for containing large undiscovered oil provinces.

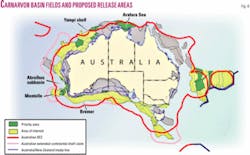

Areas have been defined in the south, west, and east of Australia as possible targets for new data collection (Fig. 8).

A new geochemical data set was collected as the seeps and signatures study on the North West Shelf and Arafura Sea. This study of natural hydrocarbon seepage and related geology in the Yampi shelf and Arafura Sea emphasized best practice methods through alliances with international groups proficient in the field. Synthetic aperture radar data was also used to investigate the presence of oil seepages.

The aim of these precompetitive surveys was to establish that a suitable geological history has occurred for large oil accumulations to have been formed and that oil is actually present in the area. The targeted areas over the next 3 years range from shelfal depths to deep water.

The likelihood of this program succeeding is helped by the very low level of total exploration around Australia. The relatively small number of wells drilled in such a large area as Australia leaves considerable opportunity for further exploration, discovery, and development.

The data collected by Geoscience Australia for this initiative will be the subject of ongoing regional studies that will be publicly available. Areas for studies by Geoscience Australia have been prioritized. Survey data will continue to be acquired over these areas over the next 2 years.

The results of precompetitive studies of these regions will be available for explorers to assess the prospectivity of acreage in the regions made available for bidding under the work program bidding system in Australia.7 10

Funding is also being provided to enable the copying of more than half a million tapes held by Geoscience Australia onto modern storage media. This preservation is necessary to ensure valuable seismic data are not lost because of the deterioration of old technology tapes.

The government allocated $25 million (Aus.) to allow remastering of seismic data in the repository and collection of new data to further stimulate exploration. Over 250,000 field tapes from previous exploration have already been remastered to high-density media and can be more conveniently loaned to industry. The tapes of field data and processed surveys are being remastered to 3590 cartridges. The greater data availability of data allowed by the remastering is now seeing more than twice the usual levels of data being loaned for assessment of petroleum exploration acreage released in April 2005.

For this part of the initiative, remastering of data began in November 2003 and will continue to mid-2007. The program is on schedule. The priority is to remaster data on older media most likely to be affected by stiction that threatens loss of data. Industry has greeted the decision as a vital step in enhancing the attraction of Australia as a place to invest in petroleum exploration.

This initiative builds on Australia’s already superior access to petroleum exploration data that began with the enactment of the “Petroleum Search Subsidy Act” in 1957, when petroleum exploration data at low to no cost became publicly available from Geoscience Australia after a brief confidentiality period.

Petroleum companies have since then used the data to assess the prospectivity of release acreage and help in decisions to take up acreage. Geoscience Australia and state and federal colleagues use the data described above and other data to promote the gazetted exploration release acreage that is announced at the Australian Petroleum Production and Exploration Conference early each year.

In addition new tax incentives were introduced in 2004 and continued in the 2005 release to further stimulate offshore frontier exploration. Nominated frontier areas offered in the acreage releases will attract 150% uplift for tax purposes. This is on top of a fiscal regime and political stability that already encourage petroleum exploration and development and have resulted in established oil and gas provinces. ✦

References

1. Nelson, R., “Time to turn the key for exploration,” in “Prospect,” June to August 2005, Western Australian Government, 2005.

2. Geoscience Australia, “Oil and Gas Resources of Australia 2003,” Geoscience Australia, Canberra, 2005.

3. Geoscience Australia, “Oil and Gas Resources of Australia 2002,” Geoscience Australia, Canberra, 2004.

4. Quantum Harris, “Offshore Petroleum Information Review Report,” prepared for Department of Primary Industry and Energy, April 1995, 80 p.

5. Powell, T.G., “Australia’s hydrocarbon provinces-Where will the future production come from?,” APPEA Journal, Vol. 44, No. 1, 2004, pp. 729-740.

6. Longley, I.M., Bradshaw, M.T., and Hebberger, J., “Australian Petroleum Provinces of the 21st Century,” in Downey, M., Threet, J., and Morgan, W., eds., “Petroleum Provinces of the 21st Century,” AAPG Memoir 74, 2001.

7. Williamson, P.E., and Foster, C., “New Australian initiatives for greater access to exploration data,” OGJ, Apr. 26, 2004, pp. 37-46.

8. Western Australian Department of Industry and Resources, 2005 (http://www.doir.wa.gov.au).

9. Powell, T.G., “Understanding Australia’s petroleum resources, future production trends and the role of frontiers,” APPEA Journal, Vol. 41, No. 1, 2001, pp. 273-285.

10. Williamson, P.E., and Foster, C., “Access to Australian exploration and production data: a critical factor in attracting investment,” APEA Journal, Vol. 43, No. 1, 2003, pp. 693-704.

The authors

Paul Williamson ([email protected]) is group leader of the innovation and specialist services group with Geoscience Australia. His interests have been in petroleum prospectivity analysis, the structure of continental margins, petroleum technical advice, identified petroleum resources, and petroleum data management and access. Current responsibilities are for specialist geoscientific and database services for assessing and promoting prospectivity.

Steven le Poidevin ([email protected]) is a senior petroleum engineer in the petroleum and greenhouse gas advice group of Geoscience Australia. His interests are in assessing Australian oil and gas reserves and identified resources and providing engineering technical advice to regulators of Australian offshore petroleum exploration and production.