US market responds to oil well cement shortages

Oil well cement consumption has increased in the US, domestic production has decreased, and imports have failed to bridge the gap, leading companies to experiment with alternate formulations and non-monogrammed cements.

In the last few years, the demand for cement in the US has increased, leading to shortages in some areas and compelling manufacturers to favor cements with high production efficiency. A resulting trend, begun several decades ago, is that manufacturers are leaving the oil well cement market. Oil well cement manufacturers and oil well cementing companies now have to look for alternative sources of materials.

Cement shortage

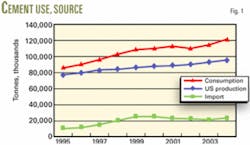

The US experienced a boom in construction during the last decade. This has led to an increasingly short supply of cement. Consumption of cement in the US has reached record levels each year in the last decade with the exception of 2002 (Fig. 1).1 2 While US production has not met the need, imported cement has filled some of the shortage.

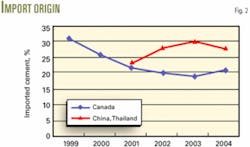

A good portion of this supplementary production has come from Mexico and Canada and recently from East Asian countries. Fig. 2 shows that cement imported from Canada (as a percentage of total imports) has declined to about 20% from nearly 30%, while imports from the Far East have risen to about 30%.1

Other countries’ economies are growing, also causing an increase in demand for cement and limiting the amount of cement available on the general market. Similar effects are seen in the metals and hydrocarbon fuels industries. There has been some increase in capacity to produce cement, but this increase has not kept up with demand. China actually consumes 100 million tonnes more cement than it produces, even while exporting cement.

Oil well cementing is a small part of the overall cement market in the US.

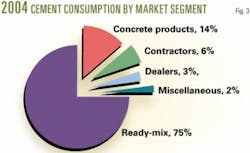

A plot of the consumption of cement in the US by market segment (Fig. 3) shows that consumption of ready-mix grew to 75% of the market in 2004 from 70% in 1999. Oil well cement is lumped into the category of miscellaneous, which is around 2-3% of the total market.1

Along the US gulf coast, in the Midcontinent, and in the Permian basin, American Petroleum Institute Class H has long been the standard cement used for oil and gas well cementing. Class H was developed specifically for use in oil and gas wells in 1971.3 Similarly, API Class G was developed and used primarily in the western US, Canada, and most other parts of the world.3 These two cements were developed as consistent quality cements, which could be used at the increasingly high temperatures found in oil and gas wells. A primary requirement of these cements was that they perform consistently in their response to additives such as dispersants and retardants.

API Class H cement clinker (the material produced in the kiln and subsequently ground to a powder called “cement”) is made under different conditions in the kiln than construction cement. The process for producing Class H cement is more difficult than that of construction cement and reduces cement plant efficiency.

All these factors contribute to the increasingly limited availability of API cement.

Oil well cement

Cement used in construction of oil and gas wells must serve several functions. It must provide zonal isolation so that oil or gas can be produced preferentially. It must also support the casing and protect it from potentially corrosive formation fluids.

Oil well cements are classified by the API as A, B, C, D, E, F, G, and H. API Classes D, E, and F are rarely used. They were replaced by Classes G and H, the workhorse cements used in virtually all applications from top to bottom in both shallow and deep oil or gas wells. Materials are added to the cement to meet temperature, pressure, and other requirements of the well.

API Classes A, B, and C are used under milder conditions, specifically lower temperatures. They are generally analogous to ASTM Types I, II, and III construction cement, respectively.

All API cements have chemical, physical, and performance specifications. Class A, B, and C oil well cements meet both ASTM performance requirements and additional requirements of API Specification 10A.4

Cement which meets the appropriate specification can be called API cement. Additionally, API licenses manufacturers to “monogram” the cement. Through the years, many manufacturers have licensed their oil well cements. Licensing requires the manufacturer to produce certain quality documents, follow procedures to ensure that the cement produced meets the specifications, and submit to quality audits by inspectors licensed by API.

In the last few years, the number of suppliers of oil well cement in the central US has declined. Several suppliers have stopped making API Class H cement. This is not a new trend, however. Three decades ago, there were dozens of suppliers of API cement in the US. Gradually, most of the suppliers of Class G cement stopped making it so that today no one in the US makes a monogrammed Class G cement.

This trend has now begun to hit the supply of Class H cement. As of January 2005, the API Composite List named only six US-based manufacturers of Class H cement (four in Texas, one in Oklahoma, and one in Illinois) and no remaining manufacturers of Class G cement.5 In Canada, there are three manufacturers of Class G and no manufacturers of Class H cement listed.

In the US, oil well service companies can get Class G cement which is not monogrammed from three manufacturers. In the last year or so, several manufacturers of Class H have stopped making it. Of those still making it, only one has committed to continue licensing its cement through the API. Although the company does not plan to continue licensing the product, several manufacturers plan to continue making cement that conforms to specifications for API Class H cement. Several other manufacturers have indicated a desire to make another type of cement that will meet the needs of the industry but is not API cement.

These matters were discussed in the Subcommittee on Well Cement at the recent API Standardization Conference in Calgary. Though manufacturers in the US indicated plans to shift from Class H cement or stop licensing their products through the API, several suppliers from Europe stated that they will continue to make oil well cement and license it as before. In fact, the number of manufacturers licensed by API outside the US and Canada has been increasing in the last decade or so.

What might be the impact of this trend on quality of cement available to the oil and gas construction industry? Manufacturers that are currently making API Class H cement have said that they will continue to make cement that will meet the API specifications or will make cement that will be similar to API cement and will be of the quality needed for cementing oil and gas wells.

At issue is whether cement, which is not an API-specified cement, can meet the requirements for cementing oil and gas wells. The requirements for well cements are that they provide zonal isolation, support the casing, and provide corrosion control for the casing.

Almost any cement can meet these requirements. Cement should also respond consistently to additives. These qualities are not unique to API classes of cement but are a result of the chemistry, manufacturing processes, and quality control measures.

In recent years, several wells have been cemented with conventional construction cement with good results, as detailed below.

Impact on the industry

The tight supply of cement could have several effects on cementing oil and gas wells. It is very likely that the supply of Class H will fall well short of need. Additionally, there will be even less Class H cement available that is licensed by API. This shortfall is coming when the price of oil has more than doubled in recent years, spurring increased well construction. Some of these wells’ architectures require a very large amount of cement.

In some areas, regulators require API cement. With the shortage and with manufacturers trying to change their product mix to improve cement plant efficiency, however, API cement may no longer be available or may be in extremely short supply.

These factors may restrict availability and delay well construction at a time when the US needs as much oil and gas as it can produce domestically.

Dealing with shortage

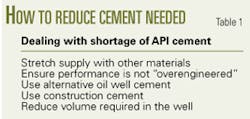

Several strategies can be employed to reduce the impact of a shortage of cement (Table 1).

There are several ways to stretch the supply of cement, including stretching it with fly ash, fumed silica,6 7 expanded lightweight aggregates, and inert-particle mixes.

The most popular method is to add bulk materials that have reactive properties. An example of this, used for many years, is fly ash. Adding a material such as fly ash to cement yields several benefits.

First of all, the addition increases the “yield” or volume of cement slurry produced from one sack of cement, thus stretching the supply. Additionally, fly ash is a lower cost material and, as such, lowers the cost of the cementing materials used in the well.

Fly ash reacts with calcium hydroxide, which is produced in the reaction of the cement with water. Performance benefits from this reaction between the fly ash and calcium hydroxide. Strength is increased, the reaction removes the calcium hydroxide from the cement matrix, and permeability is reduced. The latter two both increase brine resistance of the set cement.

Fly ash has been used in the US for many years and certain formulations have become standard in some areas. In most cases, the fly ash and cement mix functions as a lead or filler slurry with undiluted cement as the tail cement. The supply could be further stretched by use of fly ash in more applications and by its use across productive intervals in place of undiluted cement.

Another strategy for extending the supply of cement is the use of “engineered particle size distribution technology.”8 9 In this approach, cement is a minor portion of the mix, but the slurry has much enhanced strength and permeability.

Complementing these techniques of stretching the cement is ensuring that the cement formulation is not over-engineered for the application. There is a common feeling that stronger is better. This has led the industry to the use of high-strength formulations when in many cases zonal isolation and casing support could be achieved with half the strength. Requiring less strength could result in less cement being required for each well.

Another strategy to ease the tight supply of oil well cement is the use of construction cement. First of all, although API Classes A, B, and C are said to be analogous to ASTM Types I, II, and III, they are not the same, even if made from the same clinker.

Although they are not the same as API classes of cement, construction grades of cement have been used in oil and gas wells.10 11 In fact, in the northeastern US, construction cements are frequently used for cementing oil and gas wells. In recent years construction cement has been used in other areas to supplement the supply of well cement. In the northeastern US, one service company investigated the use of construction cement for deep well applications.10 A major concern was predictability and reproducibility of results. Tests were conducted for wells as deep as 20,000 ft and with temperatures higher than 200o F.

Another service company investigated the use of local cements for a project off West Africa.11 Two additives, a gelation-control additive and a flow-enhancing additive, allowed use of the local cement. At the time the paper describing the use in West Africa was written, 37 cement jobs had been done with the local cement at depths from 250 ft to 8,400 ft and at temperatures from 100o F. to 165o F.

One operator and a service company found that the use of Type III construction cement was an even better alternative than Class B or Class H cement for cementing wells in the San Juan basin of northwestern New Mexico.7

New cement grade?

Some cement manufacturers have suggested another alternative: a new grade of cement for oil and gas wells. The concept is that the cement would be made from readily available, construction-grade clinker. This would improve the efficiency of the kiln. The difference would be that the cement is made (ground) to different specifications than those of API cement. The intent would be to make cement with properties similar to API cement. This is already being done by one manufacturer in California.

The new cement would be made according to quality standards similar to those for Classes G and H. The emphasis would be on a cement that would perform consistently and would provide the required performance under well conditions. API cements, even though they meet certain performance specifications, don’t have specification performance requirements that relate very well to conditions found in the wells, that is, at higher temperatures and with additives. The new cement, in order to be useful, would have to respond to dispersants and retardants in real well conditions and should set, develop strength, and have low permeability as API cements do.

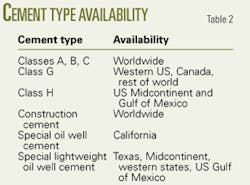

Table 2 lists types of cement currently available and their geographical availability.

Another approach to dealing with a tight cement supply is to drill wells which require less cement. This is already being done, though on a limited scale. Expandable tubulars are being used, allowing a well to be drilled that has minimally telescoping casing sizes.12 13 With expandable tubulars, the well can have close to the same dimensions from top to bottom, avoiding the very large casings required at the top of the well for conventional well construction. Large casings require large amounts of cement.

Some of these changes may require some action by regulators. Regulations requiring API cement may have to be changed to requirements based on performance. This could allow the use of unlicensed API cements, or it might allow new grades of cement, which are designed specifically for well-cementing applications, but are not classified by API.

The rest of the world

The rest of the world is apparently not in the same situation as in the US. At the recent API Standardization Conference, European suppliers of API well cement stated that they have an adequate supply of API cement and don’t anticipate shortages.

Suppliers from the Middle and Far East did not attend the API conference, however. One can anticipate that as the economies of countries in the Middle East, Africa, and the Far East continue to grow, supplies of well cement may become tight in some of those regions as well.

No one wants to face the problem of not having cement available when the well is ready for the casing to be cemented. In order to avoid that possibility, operators, service companies, and cement manufacturers will need to work together to employ the proper strategies to ensure that the wells are designed to economize on the amount of cement used, to stretch the cement used, and to find alternative methods of supplying cement which meets the requirements of the wells and can be produced efficiently. Regulators must be looking ahead to anticipate these requirements and make adjustments where warranted so that wells can be drilled. ✦

References

1. US Geological Survey, US Department of Interior, Reston, Va.; minerals.usgs.gov/minerals/pubs/commodity/cement/index.html.

2. Zwicke, D., Economic Research, Skokie, Ill.: Portland Cement Association.

3. Worldwide Cementing Practices, First Ed., January 1991, Dwight K. Smith, project leader, American Petroleum Institute, p. 11.

4. API Specification 10A, Specification for Cements and Materials for Well Cementing, 23rd Edition, April 2002.

5. American Petroleum Institute, The API Composite List, Vol. 13, No.1, Jan. 1, 2005.

6. Mueller, D.T., and Dillenbeck, R.L., “The Versatility of Silica Fume as an Oilwell Cement Admixture,” SPE paper 21688, 1991 Production Operations Symposium, Oklahoma City, Apr. 7-9, 1991.

7. Brown, D., and Ferg, T., “The Use of Lightweight Cement Slurries and Downhole Chokes on Air-drilled Wells,” SPE paper 84561, SPE Drilling and Completion, June 2005, pp. 123-132.

8. Rucker, R., Sauvageau, K., and Randolph, T., “A New Approach to an Old Problem - Lightweight Liquid Concrete,” SPE paper 67193, SPE Production Operations Symposium, Oklahoma City, Mar. 24-27, 2001.

9. Watson, P., Kolstad, E., Borstmayer, R., Pope, T., and Reseigh, A., “An Innovative Approach to Development Drilling in Deepwater Gulf of Mexico,” SPE paper 79809, 2003 SPE/IADC Drilling Conference, Amsterdam, Feb. 19-21.

10. Myers, R.R., and Mack, D.J., “Experimental Data in Support of Type I Cement for Use in Deep-Well Applications,” SPE paper 72363, 2001 SPE Eastern Regional Meeting, Canton, Ohio, Oct. 17-19.

11. Hunter, B., Ampuero, H.W., Faul, R., Caveny, B., McLoone, J., “Oil Well Cementing Offshore West Africa with Local Cement,” presented at Sixth Annual Offshore West Africa Conference, Abuja, Mar. 20-22, 2002.

12. Fischer, P.A., and Snyder, R.E., “Expandable technology and application growth continues,” World Oil, July 2004, pp. 57-61.

13. Fischer, P.A., “Expandables and the dream of the monodiameter well: a status report,” World Oil, July 2004, pp. 63-64.

The author

Tom Griffin (tjgriffin2@

discover.earthlink.net) is president of Griffin Cement Consulting LLC, Richmond, Tex. He has also served as research chemist, product development supervisor, and completions engineer at Schlumberger. Griffin holds a BS in chemistry (1967) from Wake Forest University. He is a member of SPE and API Subcommittee 10 (well cements).