Digital technology initiative aligns people, processes, technology

Strategic digital technology initiatives at Burlington Resources Inc. have influenced the company’s profitability-streamlining business processes, boosting technical proficiency, and adding millions of dollars in value each year.

Burlington’s experience offers other E&P organizations facing similar challenges a practical model of process improvement.

Digital technology

Five years ago, as a result of rapid growth through mergers and acquisitions, Burlington consisted of five autonomous geographically based divisions that had a diverse range of inherited cultures and incompatible digital technologies and operating processes.

Today, the company has merged successfully these diverse people, technologies, and processes into a smoothly functioning organization that has optimized its portfolio management performance, generated some of the lowest finding costs in its industry sector, and substantially improved its exploration results.

Multidiscipline technical collaboration, once rare, is now commonplace within divisions and even across divisions. Furthermore, the standardization and modernization of the company’s analytical capabilities have improved greatly its technical and economic assessments of new business opportunities.

A key to this transformation from a technical standpoint was the development of a common set of geological and geophysical applications, database systems, data-management practices, software, training, and information technology (IT) support functions that all operating divisions would share.

The process began in 2000 with executive-level discussions of the exploration and production (E&P) and IT challenges associated with aligning Burlington’s people, processes, and digital technologies with its corporate strategy and business objective.

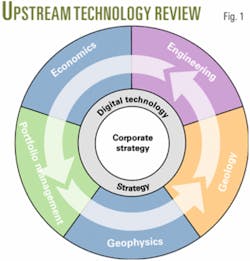

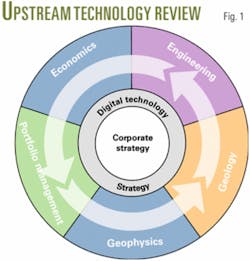

To launch the initiative, Burlington partnered with Landmark’s Consulting and Services group to conduct a comprehensive upstream technology review (UTR) of its exploration and development practices (Fig. 1). Findings and recommendations from this review enabled Burlington to implement process improvements aimed at establishing a shared-earth-modeling (SEM) culture among its asset teams (Fig. 2).

Shared earth modeling is the creation of a digital 3D representation of the earth through multidiscipline collaboration, incorporating all available geologic, geophysical, and engineering data.

Four years later, Burlington commissioned a second global UTR, partly to compare with the original review and to benchmark progress toward the SEM vision. The review identified eight areas of value creation with improved digital technology and more integrated workflows:

1. Higher exploration success rates.

2. Lower finding costs.

3. Greater reserve volumes per E&P professional.

4. Shorter cycle times for technical and economic evaluations.

5. Lower software and IT costs.

6. Increased software use and technology adoption.

7. Easier, more efficient transfer of personnel.

8. Better knowledge management.

From these cost savings and improvements in efficiency and effectiveness, Burlington originally projected a return on investment of several tens of millions of dollars/year. The company now estimates that it has realized annual returns that were two to three times greater than initially expected.

Initial UTR

In the 2000 upstream technology review, consultants met with Burlington’s vice-president of geosciences, the chief information officer, and the chief engineer to identify their major business goals. They wanted answers to two questions:

1. Where do the company asset teams currently stand in terms of adopting technologies that further its shared-earth-model vision?

2. How does the company compare with the rest of the industry in terms of its technical health, culture and vision, and IT philosophy and organization?

During several months, a multidisciplinary team of UTR consultants interviewed 25 of Burlington’s global asset teams, including more than 100 geologists, geophysicists, engineers, and geotechs in Houston, Midland, Farmington, Calgary, and London.

Interview questions focused on the details and challenges of each team’s current work processes, technology usage and data sharing-beginning with data acquisition and quality control (QC) through prospect generation and field development.

The process identified several centers of excellence. Neverthelesss, team members voiced numerous frustrations related to software, data, infrastructure, training, support, and culture. The study consolidated all comments and observations, sorted them into relevant categories, and established key findings and opportunities.

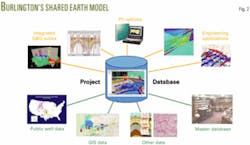

In addition, it ranked each asset team on a 1-10 scale in 11 technical areas related to shared earth modeling, based on comparison of their practices with the current state of the upstream industry (Fig. 3):

1. Digital data environment.

2. Geophysical interpretation.

3. Geological interpretation.

4. Integration of geology and geophysics.

5. Time-depth conversion.

6. Mapping.

7. Seismic attribute analysis.

8. Volumetric analysis.

9. Geologic modeling of seismic data.

10. Well planning.

11. Integration with the engineering domain.

The external consultants in this ranking process were critically important. They could draw upon extensive direct experience with and observation of asset teams and E&P organizations worldwide, thereby enabling reasonable benchmarking of Burlington.

Based on the issues raised during interviews and evaluations of team proficiency, the study identified gaps between where Burlington was and where it wanted to be at the team, division, and corporate level.

The URT team ranked recommendations for digital technology implementation, as well as training and workflow process improvement according to projected value vs. cost, amount of time required to deliver, and relative difficulty of making the change.

Global change management

To implement the UTR recommendations, Burlington personnel and the consultants developed prioritized action plans.

The first action Burlington management took upon completion of the UTR was to form the technology-enhancement team to oversee implementation of the new shared earth modeling vision. This team’s mandate was to help develop common workflows for integrating public and proprietary data, and sharing best practices in digital geological and geophysical (G&G) analysis and interpretation across multiple asset teams.

Burlington had multiple, redundant software tools deployed throughout its five divisions. Not only had the company inherited numerous legacy systems from mergers and acquisitions, but also it had purchased point products from many different vendors based on individual user preference, best of breed, or cost.

Before the UTR, it was nearly impossible to identify all licensed software. Some packages were on annual maintenance and support, while other packages were not. Burlington decided to standardize on a multivendor core suite of tools for all divisions.

In sorting through its current software resources, wherever Burlington found redundant functionality it gave preference to core applications or tools considered critical to one or more of its offices. It turned off maintenance on unnecessary software and reduced total licenses by about two-thirds, saving considerable annual general and administrative (G&A) expenses. Also, Burlington installed a software-monitoring system, enabling it to track use of each application and allowing users easily to locate licensed products with needed functionality.

The company provided training and one-on-one mentoring just in time by on site consultants. As a result, technology adoption expanded dramatically while software costs plummeted.

Burlington formed two additional teams to implement UTR recommendations. An enterprise data SWAT team addressed a variety of company-wide database issues such as standardizing data sets and naming conventions and creating automated scripts to enable more efficient data storage, browsing, and access. A geophysical technology team worked directly with asset teams to raise their technical proficiency in various aspects of seismic analysis and interpretation to ensure that they were extracting the maximum information and value from their data.

With regard to people issues, Burlington sought solutions that were constructive, evolutionary, and sustainable. E&P professionals are able to adapt best to new modes of working when they are actively engaged in the change process, their needs and frustrations are addressed, they are given adequate training and time to change along with their environment, and they do not feel personally threatened.

Tracking, fine-tuning progress

In 2004, Burlington partnered with Landmark to conduct a second review. The UTR interview team consisted of half Burlington personnel and half Landmark consultants.

Since the original review, Burlington had acquired additional assets in Canada, and the company had undergone strategic realignment. It had reorganized many asset teams and created new ones. The management objectives for this UTR, therefore, were somewhat different:

• To compare results with the 2000 UTR and benchmark progress working in the SEM environment

• To determine where to focus internal resources to further advance the use of digital technology to achieve corporate business goals

During mid-2004, the UTR team interviewed more than 100 E&P professionals from 22 asset teams at the same five locations, as before. Only 11 of the asset teams were the same as in 2000, while 11 others were new to the process.

Once again, the review recorded and categorized team goals, issues, and workflows, and then ranked each team relative to current industry practices in shared earth modeling.

The UTR team developed specific recommendations for improvement in each area, only a few global issues were left to resolve. These recommendations mostly concerned fine-tuning to achieve greater productivity and performance at the division or team level.

This time, Burlington’s technology enhancement team went back to each asset team, reviewed its ratings and recommendations, and invited its members to adjust their ratings according to their subjective perception. This 360° review gave teams greater ownership in the process and enabled management to see where teams agreed or disagreed with Landmark’s objective assessment.

Burlington staff also assigned each asset team a “team opportunity” rating, representing how much improvement they could achieve in each of the technical categories.

All these enhancements to the UTR process helped pinpoint areas for creating maximum value with the minimum amount of time, cost, and energy.

Improvements

In the 4 years that elapsed between the two reviews, Burlington’s G&G teams had made much progress in shared earth modeling. There was a significant increase in focus on digital integration and data sharing, much greater interest and participation from the engineering groups, and many positive examples in which technical integration had assisted collaboration, both internally among teams and externally with partners.

Improved efficiencies ranging from 60 to more than 200% were measured in the following areas:

1. Geological interpretation.

2. Seismic attribute analysis.

3. Volumetric analysis.

4. Digital mapping.

5. Geologic modeling.

6. Time-depth conversion.

7. G&G integration.

8. Integration with engineering.

9. Well planning.

Burlington’s average team ranking for 2004 (Fig. 3) was above the industry average in all categories of shared earth modeling-with several teams approaching “best in class” in specific categories, relative to current industry practices.

Today, Burlington has standard suites of software tools throughout its offices, company-wide data management practices, effective training and support mechanisms, and common workflows for recognizing, implementing and risking new opportunities. As such, input from the divisions to the corporate portfolio management process is much more standardized.

In terms of business results, the company identified eight different types of value associated with its digital technology initiatives.

In November 2000, Burlington had built a business case focused on five areas of improvement that would justify its investment in the change process. Three categories involved saving money by reducing the number of dry holes, finding costs, and G&G software costs (Fig. 4).

Two others involved adding value by improving well productivity and increasing reserves per E&P professional.

Note that all five measures of success are independent of commodity prices. Today’s higher commodity prices, therefore, add additional value to the company’s profitability.

Projected return on investment determined at that time was several tens of millions of dollars/year. For 2002, the first full year following implementation of UTR initiatives, total improvements reached 92% of that amount. In 2003, Burlington achieved 255% of the target and in 2004, 253%.

Certainly, other factors contributed to these improvements, such as changes to Burlington’s portfolio management process. But UTR related changes played a substantial role.

Due to the benefits derived from its two upstream technology reviews, Burlington expects to conduct similar reviews at regular intervals in the future. With increasing proficiency in digital technology and workflows, the company’s internal knowledge base should continue to grow while specific areas of technical challenge continue to change.

To benchmark Burlington’s expertise against peers and competitors, partnerships with outside consultants will continue to provide an external perspective based on evolving industry practices

Authors

Dan Shearer has been manager of Burlington Resources’ technology enhancement team for 5 years, responsible for overseeing all activities related to the company’s digital technology strategy. Before joining Burlington, he worked as an exploration geophysicist with Texaco Inc. and Mitchell Energy Corp. and as a software developer, manager, and vice president for geophysical modeling and exploration database software for Daniel Geophysical Inc. Shearer has a BS in geophysical engineering from Colorado School of Mines.

Blair D. Parker is a senior principal consultant with Landmark Consulting and Services, Halliburton Digital and Consulting Solutions division. He is responsible for assessing E&P business processes and technology usage through upstream technology reviews, as well as developing and delivering information management solutions for energy companies worldwide. Before joining Landmark, he worked in seismic processing and customer support for geophysical software and service companies. Parker holds a BS in engineering (geology/geophysics) from the University of Saskatchewan.