General Interest—Quick Takes

Alaskan judge denies drilling ban in northwestern part of NPR-A

A US District Court for the District of Alaska effectively opened the northwestern part of the National Petroleum Reserve-Alaska to exploration by denying an injunction requested by groups seeking to increase wildlife protections.

US District Judge James K. Singleton Jr. of Anchorage on Jan. 10 issued a 21-page ruling saying that environmental organizations failed to make their case that US Secretary of the Interior Gale Norton violated laws by leasing NPR-A land.

The US Bureau of Land Management had a June 2, 2004, lease sale, but Singleton banned seismic activity or drilling on those leases until the lawsuit was resolved.

The dispute involved a remote 8.8-million-acre section in the northwestern NPR-A south of Barrow (OGJ, Feb. 2, 2004, p. 33).

Plaintiffs in the lawsuit included the Northern Alaska Environmental Center, Audubon Society, Wilderness Society, Natural Resources Defense Council, Sierra Club, Alaska Wilderness League, and Center for Biological Diversity.

In his denial of an injunction, Singleton ruled that BLM had fulfilled the National Environmental Policy Act and the Endangered Species Act in developing its leasing plan.

Flow starts from Mad Dog in Gulf of Mexico, Arthur in UK North Sea

Two important fields have come on stream: Mad Dog deepwater oil and gas field in the Gulf of Mexico and Arthur gas field in the North Sea.

Oil and natural gas production began Jan. 13 from one well in BP PLC-operated Mad Dog development on Green Canyon Block 826 in 4,500 ft of water 220 miles south of New Orleans in the Gulf of Mexico.

Production will ramp up to full capacity in the next year as more wells are completed and brought on line, a BP spokesman said. The facility's processing capability is 100,000 b/d of oil and 60 MMcfd of gas.

The Mad Dog development contains a truss spar equipped with facilities for simultaneous production and drilling operations. Oil from Mad Dog will be transported via the Caesar pipeline to Ship Shoal 332B, where it will interconnect with the Cameron Highway Oil Pipeline System.

Gas will be exported via the Cleopatra pipeline to Ship Shoal 332A, where it will interconnect with Manta Ray Gathering System and from there to the Nautilus Gas Transportation System into Louisiana. The Caesar and Cleopatra pipelines are part of the BP-operated Mardi Gras Transportation System.

Mad Dog, discovered in 1998, is one of three world-class BP-operated gulf deepwater developments scheduled for startup this year and in 2006.

BP owns a 60.5% working interest in the project. BHP Billiton Ltd. and Unocal Corp. own 23.9% and 15.6%, respectively.

In addition, ExxonMobil Corp. subsidiary Mobil North Sea Ltd. (MNSL) has begun natural gas production from Arthur field in the southern UK North Sea.

Arthur field, discovered in October 2003 about 30 miles east of Bacton, Norfolk, is on Block 53/02 in 140 ft of water. The field is a subsea development tied back by a new 20-mile, 12-in. pipeline and umbilical to ExxonMobil's Thames platform.

Gas production is expected to be as high as 110 MMcfd with estimated ultimate recovery of 130 bcf of gas. The gas moves to Bacton terminal through an existing pipeline.

MNSL, operator of the field, said three wells might be drilled for connection to the Arthur manifold via 8-in. pipelines and umbilicals. It plans to spud Arthur 2 soon and may drill the third well later this year.

MNSL holds 70% interest in Arthur field and EOG Resources UK Ltd. holds 30%.

Outlook bright for profitability of oil service industry in 2005

Oil service companies are expected to experience higher profitability throughout 2005 than in 2004 because of high oil and natural gas prices, strong demand, and an improving world economy, said Jefferies & Co. Inc., New York.

"The need for oil companies to find and develop new reserves will fuel rising upstream capital spending," Stephen D. Gengaro, Jefferies oil service analyst, said in a Jan. 17 research note. "We are currently projecting 2005 upstream capital spending to rise between 8-12% from solid 2004 levels."

He believes the world is "in the midst of an energy supply crisis that will help support oil field activity for at least 3-4 years, and possibly longer."

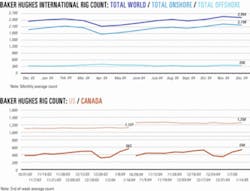

Jefferies has forecast the average US rig count this year at 1,250. Its Canadian rig count forecast is 390 rigs, and the forecast for the rest of the world is 875 rigs.

Seismic activity and prices also are improving, Gengaro said.

"Recent conversations with seismic companies confirm that activity on the marine contract market is picking up, with demand seemingly outstripping supply," he said. "A flurry of activity by the national oil companies in the Far East, which has taken up significant supply, has led to robust bidding activity for the North Sea and Gulf of Mexico."

Consequently, marine contract pricing has trended higher in recent months for work during 2005, and contract terms on new awards appear to be more favorable to the seismic contractors, he noted.

"Additionally, the upcoming lease expirations in the deepwater Gulf of Mexico and continued interest in the deep gas plays in the gulf should boost the bottom line for companies exposed to the multiclient business," Gengaro said.

US FTC monitoring price effects of past mergers

The US Federal Trade Commission is monitoring the price effects of past oil company mergers and consolidation in the petroleum industry, said FTC Chairman Deborah Platt Majoras.

On Jan. 14, panels of economists attended an FTC conference in Washington, DC, to evaluate studies of the industry.

In a May 2004 report, the Government Accountability Office said oil company mergers since the 1990s had caused a slight rise in wholesale gasoline prices.

Majoras said the FTC has devoted substantial resources to scrutinizing market activity in the oil and natural gas industry.

"We will apply careful antitrust scrutiny to market behavior, including mergers, and will not hesitate to bring enforcement actions as needed," she said.

The FTC reviews mergers, considers refinery closings, watches for potentially anticompetitive acts, and reviews gasoline price anomalies detected by the agency's monitoring project, she said.

"Changes in the price and availability of gasoline directly affect consumers. Indeed, there may be no other product for which consumers are so acutely aware of price fluctuations," she noted.

The FTC's oil and gasoline web page—www.ftc.gov/ftc/oilgas/index.html— disseminates information about market conditions and FTC actions, she said.

State awards $1 million grant to solar-cell maker

New York has awarded a $1 million grant to DayStar Technologies Inc. to scale up facilities for the commercial manufacture of low cost solar cells for consumers in the state.

The legislature last fall mandated that by 2013 at least 25% of the electric power sold in New York be generated from renewable fuel.

The Renewable Portfolio Standard Program legislation, strongly supported by Republican Gov. George E. Pataki and passed on Sept. 24, 2004, requires development of renewables from solar, wind, and geothermal sources.

The New York State Energy Research and Development Authority awarded the grant, which will be paid in phases as production milestones are met at DayStar's Half Moon, NY, manufacturing facility and at a new facility to be built at the Saratoga Technology & Energy Park.

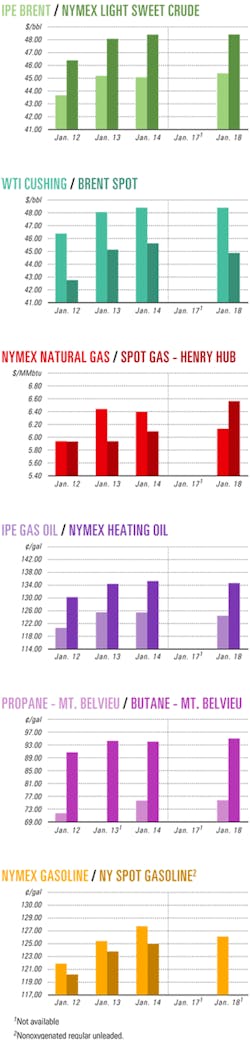

Industry Scoreboard

null

null

Exploration & Development—Quick Takes

India offers 20 exploration blocks

The Indian government has offered 20 oil and gas blocks for exploration in the fifth round of bidding under its New Exploration Licensing Policy.

The Petroleum Ministry will open bidding for 2 shallow-water sites, 6 deepwater blocks, and 12 onshore sites in nine states, including Maharashtra on the western coast for the first time. The 20 blocks cover 109,210 sq km.

The Directorate General of Hydrocarbons will present the program in New Delhi, London, Dubai, Houston, and Calgary during the year's first quarter. Companies may place bids until May 31, and the blocks will be awarded by July 15.

ChevronTexaco has oil finds off Cambodia

Chevron Overseas Petroleum (Cambodia) Ltd. (COPCL) has discovered oil in four exploration wells on its 55%-held Block A off Cambodia. Operator COPCL, along with partners Moeco Cambodia Ltd. 30% and LG Caltex Oil Co. 15%, were awarded the 6,278 sq km block, which lies in 240 ft of water, in March 2002.

Tests of the wells logged 41-139 ft of gross pay of 44° gravity oil. Additional tests will determine the potential for these finds to make Cambodia a producing country.

Pisnuka 1, which reached 11,874 ft TD, is the first of five wells in a COPCL drilling campaign that began October 13, 2004. The other wells include Sovann Phum 1, drilled to 12,232 ft TD; Sirey Sambat 1, reaching 11,712 ft TD; and Pimean Akas 1 at 11,660 ft TD. All four wells were drilled in the fourth quarter of 2004. COPCL expects the final exploration well to be completed in February 2005.

OMV discovers oil in western Iran

OMV Iran Onshore Exploration GMBH has made its first oil discovery on Mehr Block in the Zagros region of western Iran.

The well, drilled to 4,148 m, is OMV's first on the 2,500 sq km block in Khuzestan. The well flowed at a rate of 1,040 b/d of 22° gravity oil.

This year, the company plans to drill two more exploration wells on the block to define the field size.

OMV, a 34% stakeholder in the block, is the operator on behalf of Repsol YPF SA, Madrid, and Sipetrol SA, Santiago, with 33% interest each.

The company is drilling in the Zagros fold belt under a 4-year agreement signed in 2001 with National Iranian Oil Co. (OGJ Online, April 24, 2001).

Pioneer expands Alaska acreage position

Pioneer Natural Resources Co., Dallas, is expanding its portfolio of undeveloped lands on the Alaska North Slope to more than 1.6 million gross acres.

The company plans $50 million in spending this year to develop a core division in Alaska, where recent agreements give the company the state's third largest net acreage position.

Pioneer signed an exploration agreement with ConocoPhillips and Anadarko Petroleum Corp. that expands Pioneer's position in the National Petroleum Reserve-Alaska Northeast Planning Area by 452,000 acres. Pioneer's interest in the new spread is 20%. Pioneer also received rights to extensive seismic and geologic data.

Another agreement with the two companies in 2004 gave Pioneer 20% interest in 167,000 acres in the Northeast Planning Area and adjacent federal waters. Pioneer also acquired 20-30% in 808,000 acres at a lease sale.

The acquired lands "could provide a bridge [from infrastructure] to our large holdings in the northwest [NPR-A]," the company said.

A group headed by operator Pioneer targets first oil in 2008 from the 53,000-acre Oooguruk Unit in the Beaufort Sea, where it drilled three discovery wells in 2003. Pioneer has committed $5 million to front-end engineering and permitting in 2005 and, if successful, will seek development approval next year.

The company will drill two wells in the 2005-06 winter on the Pioneer-operated, 6,000-acre Gwydyr Bay Unit northwest of supergiant Prudhoe Bay field to commercialize several small oil discoveries and tie them back to Prudhoe Bay infrastructure in 2006.

Pioneer will participate with a 40% working interest in an exploration well in first half 2005 on the 14,000-acre Tuvaaq prospect northeast of the Oooguruk Unit. It is running a 3D seismic survey on the Pioneer-operated, 130,000 acre Storms Lead Area adjacent to the Prudhoe Bay and Kuparuk River units and could begin exploration drilling as early as first quarter 2006.

The company anticipates that two exploration wells will be drilled by the end of March 2005 on the 1.4 million acres in NPR-A in which Pioneer holds 20-30% interest.

Iraq calls for field studies by foreign firms

Iraq's Ministry of Oil has let contracts for integrated reservoir studies of the country's two largest oil fields—Kirkuk in the north and Rumaila in the south—to Exploration Consultants Ltd., Epsom, UK.

Shell Exploration Co. BV signed a letter of understanding with the ministry and was granted a technical support role in the study of supergiant Kirkuk oil field. BP will collaborate with the ministry on the analysis of supergiant Rumaila field. The fields account for the majority of Iraq's oil exports.

The studies are to establish an understanding of the fields' potential and estimate the investment needed to optimize production and recovery. The contracts do not include exploration and production rights.

The studies, which will be conducted outside Iraq, are to be completed in about a year.

Shell was a former 23.75% shareholder in Iraq Petroleum Co., which discovered Kirkuk oil field in 1927. Iraq Petroleum was nationalized in 1972.

Shell also will assist the Iraqi Ministry of Oil on a gas master plan.

Drilling & Production—Quick Takes

US drilling hits 19-year seasonal high

US drilling activity increased by 16 units with 1,258 rotary rigs working the week ended Jan. 14, the highest rig count for the first month of a new year since 1986, when US drilling started the year with 1,915 active rigs, dropped to 1,880 in the second week, and tumbled to a summer low of 663.

The latest US rig count is only 10 less than last year's peak on Nov. 28 and up from 1,127 a year ago, which was the previous highest level for the second week of January since 1986, reported Baker Hughes Inc.

Unlike 1986, US and world demand for crude and natural gas generally is expected to continue to grow in 2005, buoying up both commodity prices and drilling activity. US land operations accounted for all of the week's growth, up by 19 rotary rigs to 1,136 working. Offshore drilling dipped by 3 units to 98 in the Gulf of Mexico and 103 in US waters as a whole. Drilling in inland waters was unchanged with 19 rotary rigs employed.

In Canada, drilling activity jumped by 87 rotary rigs with 548 working that week, down from 563 during the same period last year.

Angostura field producing off Trinidad

BHP Billiton Ltd., Melbourne, and its partners have begun production from Angostura oil field on Block 2C about 38.5 km off eastern Trinidad and Tobago in water 40 m deep.

Oil production began Jan. 9, preceded by first gas production on Dec. 16. Initial oil production is expected to be about 60,000 b/d of oil (gross), significantly less than the originally predicted 100,000 b/d.

Start-up of Angostura represents the first oil production off northeastern Trinidad and the first from Oligocene rocks in Trinidad and Tobago. BHP has made another hydrocarbon discovery on a nearby block.

Angostura gas is being reinjected to support oil production. In Phase II, Angostura's gas resources will be produced for sale.

Angostura field has a central processing platform (CPP) with three satellite wellhead protector platforms. A subsea pipeline connects the CPP to new storage facilities onshore at Guayaguayare, where an export pipeline has been installed to allow offloading to tankers in Guayaguayare Bay.

BHP Billiton, holding 45% equity interest, is operator. Other partners in the development are Total SA 30%, and Talisman Energy Inc., Calgary, 25%.

Safety alert issued on production system

Cameron Controls president Jack B. Moore has issued a safety alert to purchasers of a production control system that contains a high-pressure accumulator used in subsea and related production control systems.

The alert followed fatal injuries Jan. 10 to an employee of Cameron Controls in the Houston-based company's Celle, Germany, facility during a routine disassembly of the high-pressure accumulator.

Internal experts and external authorities are investigating.

"While we do not believe there is a safety risk associated with the normal operation or routine maintenance of these units, we have asked that clients refrain from disassembling these accumulators until our investigation is complete," Moore said.

Human error cited for Snorre A gas leak

Statoil ASA said human error caused the natural gas leak that forced it to shut in production from the Snorre A platform and a satellite in the Norwegian North Sea Nov. 28, 2004.

The incident halted production of about 130,000 b/d of oil from the Snorre A platform and 75,000 b/d from its Vigdis satellite, which uses the Snorre A facilities for processing (OGJ Online, Dec. 2, 2004).

Statoil said its internal investigation following the loss of control over the well has been completed. The subsea template is still under investigation.

According to the inquiry report, the underlying causes of the incident were "inadequate planning and appreciation of the risk and a failure to observe governing documentation. The potential in the incident lay in the gas volumes, which leaked out and which could have been ignited," the company reported in a media release.

The direct cause, Statoil said, was "a suction effect which arose when an extra length of casing was pulled out and drew gas from the reservoir into the well. Passing via an external casing section which had suffered wear damage, the gas then escaped into the formation and out to the seabed."

Statoil on Jan. 11 notified Petroleum Safety Authority Norway (PSA) that it was able to resume partial production from the platform. The timing, the company said, would depend on PSA's consideration of Statoil's documentation and on weather because a remotely operated vehicle would monitor the start-up (OGJ Online, Jan. 11, 2005).

Processing—Quick Takes

Enterprise to expand NGL, pipeline capacity

Enterprise Products Partners LP, Houston, plans to expand its 210,000 b/d NGL fractionator at Mont Belvieu, Tex., by 15,000 b/d and will build a 60,000 b/d fractionator at the site to accommodate increased NGL production in the Rocky Mountain area.

Construction is under way to increase capacity and reduce energy costs of the existing fractionator. The capacity increase is expected to be complete in the fourth quarter.

The partnership has completed initial engineering and design on the new fractionator.

This project would facilitate increased NGL volumes available to Mont Belvieu as the partnership expands capacity of the Rocky Mountain segment of the Mid-America pipeline system.

The Mid-America Rocky Mountain pipeline segment operates at nearly full capacity, transporting as much as 225,000 b/d of NGL from major producing basins in Wyoming, Utah, Colorado, and New Mexico. The western expansion project would increase the segment's capacity to 275,000 b/d with looping and additional compression. Permitting, engineering, and design work are under way.

Pipeline construction could begin as early as the fourth quarter after permits and regulatory approvals are received. Incremental capacity on the pipeline can be placed into service as work is completed throughout the construction period.

Petro-Canada lets sulfur-complex contract

Petro-Canada let a contract to a subsidiary of Jacobs Engineering Group Inc., Pasadena, Calif., to build a sulfur recovery complex as part of the conversion of its 125,200 b/cd refinery near Edmonton, Alta., to process feedstock from oil sands.

By 2008, the refinery will switch to 100% oil sands feedstock, processing it into gasoline, diesel, and other products, Petro-Canada said. Plans call for the refinery to process 135,000 b/d of oil sands feedstock.

The $1.2 billion refinery conversion will increase the capacity of an existing coker, expand hydrogen production, and increase sulfur-handling capability (OGJ Online, Dec. 12, 2003).

Jacobs is applying proprietary technology to the planned 400 tonne/day sulfur recovery complex. It expects its front-end engineering and design phase to evolve into detailed engineering by the second quarter.

Transportation—Quick Takes

ConocoPhillips plans gulf LNG terminal

ConocoPhillips has applied to the US Coast Guard for a permit to construct an LNG regasification facility in the Gulf of Mexico 56 miles off Louisiana.

The proposed Beacon Port Clean Energy Terminal, which will have a throughput capacity of 1.5 bcfd of gas, will have two concrete gravity-based LNG storage tanks, regasification equipment, docking platforms, and other unloading and operational equipment. There also will be a separate platform adjacent to the tanks to house other related equipment, nonoperational facilities, and crew quarters.

The terminal will offload LNG from carriers, store and regasify the LNG, and move the gas through a system of pipelines, including 46 miles of new gas transmission pipeline and a riser platform that will connect to existing pipelines 29 miles south-southeast of Johnson's Bayou, La. Existing pipelines will bring the gas to shore.

The 4-year construction program could begin in late 2006, pending approvals. ConocoPhillips expects first LNG deliveries in 2010.

CNOOC to develop Shanghai LNG terminal

China National Offshore Oil Corp. subsidiary CNOOC Gas & Power Ltd., Hong Kong, and electric power company Shenergy Group Ltd., have formed Shanghai LNG Co. Ltd. to develop an LNG terminal at Shanghai.

The facility, which will contain a receiving terminal, dock, and storage tanks, along with a subsea gas transmission pipeline, will be designed with an ultimate capacity of 6 million tonnes/year of LNG.

The terminal is scheduled to begin operations under Phase I in 2008, when it will have an initial design capacity of 3 million tonnes/year.

Shenergy Group, Shanghai, owns 55% of the new company, and CNOOC holds the remaining 45%.

Contract let for Louisiana LNG terminal

Sempra Energy LNG Corp. let a $500 million contract to a consortium of Aker Kvaerner of Norway and Ishikawajima-Harima Heavy Industries of Japan for engineering, procurement, and construction of the Cameron LNG LLC regasification terminal near Hackberry, La. (OGJ Online, Dec. 22, 2004).

Start-up of the 1.5 bcfd facility is scheduled in 2008.

Sempra Energy holds a permit from the US Federal Energy Regulatory Commission to build and operate the terminal, three storage tanks capable of holding the equivalent of 3.5 bcf of gas, and a 35.4-mile pipeline to an interconnection with the Transcontinental Gas Pipeline Corp. system in Beauregard Parish, La.

North West Shelf group seeks LNG expansion

Partners in the North West Shelf Gas Project, led by Woodside Petroleum Ltd., have presented a proposal to the Western Australian government to expand the group's LNG facilities on the Burrup Peninsula.

The $2 billion (Aus.) proposal includes construction of a fifth processing train along with support fractionation, compressor, and electric power generation plants. There also will be a second LNG berth built in Withnell Bay.

The proposal calls for the new facilities to have a production capacity of 4.2 million tonnes/year of LNG—a mirror of the fourth LNG train on the Burrup, which came on stream in September 2004.

Train 5, to begin production at yearend 2008, will increase total LNG production to 15.9 million tonnes/year.

Environmental approval has been secured, but the state government must determine whether the project meets all the requirements of the North West Gas Development (Woodside) Agreement Act 1979 before the final official sanction.

The participants will make their final investment decision on whether to proceed with the expansion during the first half of this year. That decision is subject to the continued success in the group's LNG marketing efforts.

Venture forms for Mackenzie gas pipeline

Flint Energy Services Ltd., Calgary, has joined Gwich'in Development Corp. (GDC) and five construction companies in a joint venture—the Mackenzie Aboriginal Corp. (MAC)—to participate in construction of the Mackenzie Valley gas pipeline.

MAC, which will seek membership of other Mackenzie Valley aboriginal groups, will offer construction, transportation, and logistics services. The pipeline will carry gas from the Canadian Arctic to southern Alberta.

Current partners in the venture are Ledcor Industries Inc., Midwest Management (1987) Ltd., North American Pipeline Inc., Pentastar Energy Services Ltd., and Peter Kiewit Sons Co.

A holding company representing GDC owns 51% of the new venture, and the remaining 49% is held by a holding company representing the other participants.