OGJ Newsletter

General Interest - Quick Takes

French refinery, port strikes raise costs

CGT labor union workers at Total SA’s Gonfreville L’Orcher refinery in northern France unanimously voted Oct. 12 to continue their strike, at least until Oct. 14.

Total has confirmed the strike is costing the group €1.5-2 million/day.

The strike, which was started by 70 workers in the key transfer, mix, and delivery units, caused a full halt of the site.

Meanwhile, the cost of the separate CGT union port strike to France’s refining industry has been estimated by trade group Union Française des Industries Pétrolières (UFIP) at €6 million/day for the blockaded tankers and €2 million/day for the refineries (OGJ Online, Oct. 5, 2005). Production had to be reduced, and preparations for shutdown had started, UFIP spokeswoman Christine Gastinel told OGJ.

On Oct. 10 the strike was suspended for 2 weeks. Discussions between the CGT and port authorities will take place on the basis of a protocol of agreement over the demands of the strikers for more pay and better working conditions as well as the assurance that the services in both ports would not be privatized.

Because of the port strike, the following facilities face logistical problems: Berre (Shell), La Mède (Total), Lavéra (BP/Innovene), Fos (Esso), as well as refineries supplied by pipeline, including Total’s Feyzin plant in the Rhône Valley, Petroplus’s facility in Switzerland, and other facilities in southern Germany. The industry was preparing to call on France’s emergency oil stocks just before the strike was suspended, UFIP said.

Petrochemical production also was affected. Total Petrochemicals had to declare force majeure on some of its products as it was unable to export them from the Lavéra site, where it shares a steam cracker with BP/Innovene.

On Oct. 10 there were some 45 oil and chemical tankers waiting to enter the two ports and four unable to leave harbor.

Iran’s nuclear work seen rooted in politics

The nuclear ambitions pushing Iran toward confrontation with the European Union and US have roots in domestic energy politics, says energy analyst Fereidun Fesharaki, senior fellow of the East-West Center in Honolulu.

Doubting that an oil exporter with the world’s second-largest reserves of natural gas needs to develop nuclear energy, western-nation governments suspect the work masks weapons development.

In fact, Fesharaki said in a Houston lecture sponsored by the Asia Society of Texas, East-West Center, and Asian American Chamber of Commerce, Iran needs nuclear power and was discussing it when he was an energy advisor to the shah before the 1979 revolution.

Heavy claims on Iranian gas production leave little of the fuel available for generation of electricity and for export, said Fesharaki, who also is president of the consultancy FACTS Inc.

Those claims include a large and heavily subsidized domestic gas grid, gas injection to sustain oil production, an expanding petrochemical industry, and compressed natural gas to replace gasoline, which Iran also heavily subsidizes and imports in increasing amounts (OGJ, May 9, 2005, p. 34).

Because political pressures in a nation with a young and growing population keep the government from ending fuel subsidies, domestic demand continues to grow, aggravating the energy dilemma. Fesharaki said gasoline in Iran sells for 35¢/gal, diesel 10¢/gal, fuel oil 5¢/gal, and natural gas 1¢/cu m.

Like citizens of many other oil-exporting countries, Fesharaki said, Iranians believe that with energy, “For us it should be cheap; for others it should be expensive.”

Japan warns of ‘bold action’ in E. China Sea

Japan’s Trade Minister Shoichi Nakagawa has warned that his country will take “bold action” if China is found to be building a pipeline to carry crude oil or natural gas from a disputed region of the East China Sea.

Nakagawa said Japan received information on Oct. 6 that ships carrying lengths of pipe were heading to Tianwaitian and Chunxiao fields.

Nakagawa said the information came from “reliable sources” as well as a video purporting to show a ship heading for the fields carrying a “huge heap” of pipes.

“The number of pipes was obviously too many to just [drill] down. Then what are they for? I can assume the reason, but I’d rather not speak out,” Nakagawa said, implying the possibility of a pipeline.

He said the Japanese government had made an inquiry to China about the matter but had received no response.

Last month, the Chinese government confirmed it sent warships to the disputed area on Sept. 29, a day ahead of talks with Japan over territorial claims to waters in which both sides want to drill (OGJ Online, Oct. 10, 2005).

Ex-Im Bank supports exports to Pemex

The Export-Import Bank has approved three long-term loan guarantees totaling $1 billion to support US exports of equipment and services to Petroleos Mexicanos for oil and gas exploration, development, and production in Mexico.

A $300 million loan guarantee will support exports for Mexico’s Strategic Gas Program to help meet increasing gas demand in Mexico.

Another $300 million loan guarantee will support exports for a number of development projects in Cantarell oil field in the Bay of Campeche. Related to this project, the bank already has authorized transactions supporting development of Akal, Nohoch, Chac, Kutz, and Sihil fields.

And a $400 million loan guarantee will support US exports for the New Pidiregas projects, consisting of 23 exploration sites onshore and off the northern Yucatan Peninsula.

Pakistan, Gazprom sign accord

Pakistan has signed a 1-year memorandum of understanding (MOU), effective Oct. 7, with JSC Gazprom of Russia for cooperation in oil and gas projects. Possible areas of work include gas storage, oil and gas exploration and production, development, and research of Pakistan’s untapped energy resource potential-particularly offshore-and converting diesel vehicles to CNG.

Gazprom also is interested in acquiring at least part of Oil & Gas Development Co. Ltd. and Pakistan Petroleum Ltd. It further showed interest in development of the Iran-Pakistan-India gas pipeline project.

In addition, the MOU outlined a plan for Gazprom to provide training to Pakistani oil and gas workers in Russia. ✦

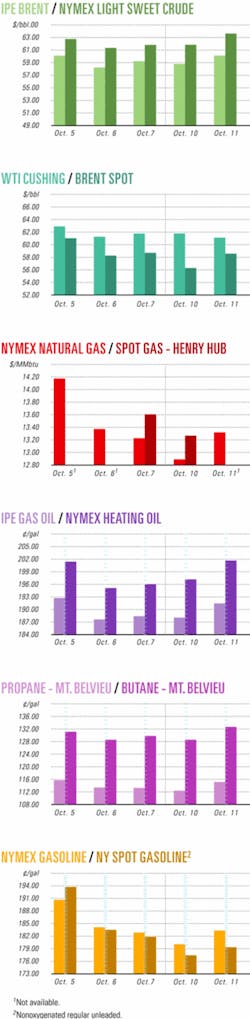

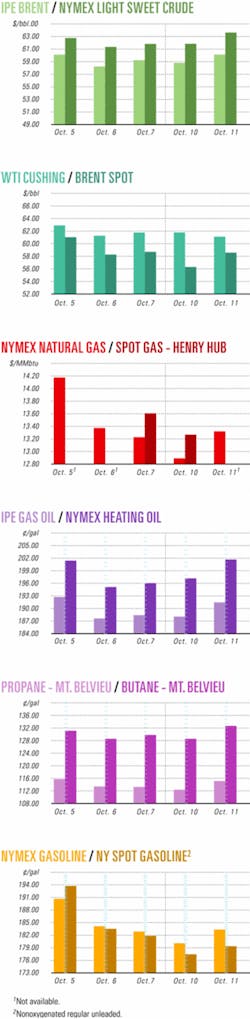

Industry Scoreboard

null

null

Exploration & Development- Quick Takes

FX Energy advances in Poland

FX Energy Inc., Salt Lake City, operator of the Wilga-2 natural gas and condensate well on the Lublin concession about 100 miles southeast of Warsaw in Poland’s Permian basin, has let contract to the Polish firm PBG SA to develop the discovery.

Wilga-2, drilled by former operator Apache Corp. in 2000, has proved reserves of 6 bcf of gas and 250,000 bbl of condensate (OGJ, Apr. 28, 1997, p. 45). The well is expected to produce 4 MMcfd of gas and 230 b/d of condensate. FX Energy holds an 82% interest, and Polish Oil & Gas Co. (POGC) holds the balance.

PBG will build surface facilities, a 17-km pipeline, and a connection to POGC’s transmission system. The project is scheduled for completion in July 2006.

In the same basin, FX Energy on Sept. 12 began drilling the Sroda-5 well 4 km southeast of the Sroda-4 well, which it completed earlier this year. Stroda-5, which has reached a depth of 1,600 m, is expected to test a Rotliegend sandstone target at 3,600 m.

The company plans to shoot 2D and 3D seismic surveys over the Sroda, Sroda Northeast, and Winna Gora structures.

Partner POGC, operator of the Lugi-1 site on the Fences I project of the basin, has a rig on location and had planned to begin drilling the Lugi-1 well by Oct. 9 as a test of the pinchout play and hopes to drill four more wells in the fourth quarter in Fences I, II, and III. POGC owns a 51% interest in Lugi-1, and FX Energy owns 49%.

Shell group finds oil, gas off Malaysia

Sabah Shell Petroleum Co. Ltd. reported that a Shell-Petronas Carigali-ConocoPhilips venture has discovered oil and natural gas on Malaysia’s Block G, its third deepwater discovery off Sabah.

The Ubah-2 exploration well “encountered significant hydrocarbon columns in high-quality reservoir rock,” Sabah Shell said. The discovery and an appraisal sidetrack were drilled to undisclosed depths in 1,430 m of water.

Block G interests are Shell Malaysia, Sabah Shell parent and operator, 35%, ConocoPhillips 35%, and Petronas Carigali 30%.

Chevron to develop Gulf of Mexico field

Chevron Corp. plans to develop Blind Faith oil and gas field in 7,000 ft of water 160 miles southeast of New Orleans on Mississippi Canyon Blocks 695 and 696.

It will install a semisubmersible able to handle production of 45,000 b/d of oil and 45 MMcfd of gas. Initial output of 30,000 b/d of oil and 30 MMcfd of gas is expected in the first half of 2008.

Topsides of the production semi will be expandable to raise capacities to 60,000 b/d and 150 MMcfd of gas if needed for production from satellites or third-party tiebacks.

The Blind Faith discovery well, drilled in June 2001, encountered more than 200 ft of net pay in Miocene sands at 20,900-24,300 ft. A 2004 appraisal well helped define the field, which has estimated gross resource potential exceeding 100 million boe.

Chevron operates the field with a 62.5% working interest. Kerr-McGee Corp. has 37.5%.

Sakhalin V area wildcat flows oil on test

CJSC Elvary Neftegas, a Rosneft and BP PLC joint venture, has drilled and tested the second exploratory well in the 6,000 sq km Kaigansky-Vasuykansky exploration license in the southern portion of Sakhalin V acreage 40 km off northeastern Sakhalin Island.

The Udachnaya well was drilled to 2,705 m TD in 100 m of water in the Okhotsk Sea by Transocean’s Legend semisubmersible. It encountered hydrocarbons in three zones. On a restricted test of one zone, the well flowed at a rate of 1,900 bo/d through a 28⁄64-in. choke.

The first well in the license was drilled in 2004 on the Pela Lache structure 15 km to the east in 114 m of water. It encountered oil and gas in a number of high-quality sandstone reservoirs.

Elvary Neftegas, operator, plans to continue exploratory drilling in 2006.

Kazakhstan, CNPC to develop Caspian field

Kazakhstan’s state oil and gas company KazMunaiGaz and China National Petroleum Corp. plan to develop Darkhan oil field in the north Caspian Sea.

Darkhan lies in 3-5 m of water 11 km west of the Bozashy Peninsula and 60 km south of the port of Bautino.

Kazakh First Deputy Energy and Natural Resource Minister Baktykozha Izmukhambetov said the companies agreed at a meeting held in Beijing in early September to conduct the joint exploration and production.

Izmukhambetov did not specify when the agreement would go into effect but said it was the first of several joint initiatives planned by the two sides.

Indian, South Korean firms to explore off Myanmar

South Korean trading firm Daewoo International Corp., in partnership with two Indian state-run oil and gas companies and a South Korean gas corporation, has signed an agreement to explore Block A3 off Myanmar.

Daewoo will have a 60% stake in the project, India’s Oil & Natural Gas Corp. will hold 20%, and Gas Authority of India Ltd. and South Korea’s state-run Korea Gas Corp. will each hold 10%.

The 6,780-sq km Block A3 is south of Block A1, on which the same consortium has made two gas discoveries, including Shwe field, thought to hold 6 tcf of recoverable gas (OGJ, Sept. 19, 2005, Newsletter).

A Daewoo official said exploration of A3 could begin as early as December.

Vintage tests Upper Lam oil in Yemen

Vintage Petroleum Inc., Tulsa, has tested 43° gravity oil from the subsalt Jurassic Upper Lam formation in An Nagyah field in Yemen.

An Nagyah-17 on Block S-1 is the fifth horizontal well drilled in the field. It reached a TD of 6,779 ft and was completed in 1,887 ft of gross oil-bearing Lam section.

The interval was tested at a stabilized, water-free rate of 3,250 b/d of oil and 1.8 MMcfd of gas flowing at 480 psi tubing pressure through a 48⁄64-in. choke. Two additional wells will be drilled this year.

The rig will move 2 miles to the An Nagyah-18 well location to drill a horizontal Lower Lam development well.

The field’s production is being carried via a recently completed 18-mile pipeline to a nearby facility for processing and on to an export terminal (OGJ, July 25, 2005, Newsletter).

The pipeline is currently transporting 10,200 gross b/d of oil. The field’s production is expected to increase to 11,000-12,000 gross b/d of oil by the end of the month.

South Louisiana deep discovery indicated

McMoRan Exploration Co., New Orleans, plans to set a production liner to attempt completion at an apparent discovery in Vermilion Parish, La.

Logging-while-drilling and wireline log data indicate that the Long Point well on State Lease 18090 cut 150 gross ft of hydrocarbon-bearing sands. The wireline log indicated excellent porosity, the company said. TD is 19,000 ft.

El Paso Production Co., from which McMoRan acquired rights to the 5,000-acre prospect, can elect to participate at casing point for a 25% interest.

Besides Long Point, McMoRan said exploration wells are in progress at JB Mountain Deep at South Marsh Island 224, Cane Ridge at Louisiana SL 18055, Elizabeth at South Marsh Island Block 230, and Cabin Creek at West Cameron Block 95. The company expects to spud at least two more prospects by the end of 2005. ✦

Drilling & Production - Quick Takes

Cost estimate raised for Syncrude expansion

Canadian Oil Sands Trust, which holds a 35.49% working interest in Syncrude Joint Venture, increased its cost estimate for third-phase expansion of Syncrude Canada Ltd.’s oil sands plant in Fort McMurray, Alta.

The trust, managed by Canadian Oil Sands Ltd., raised its cost estimate to $8.3 billion from $8.1 billion. It cited lower-than-expected construction progress resulting from competition for workers but said long-term economics of the expansion remain strong.

On schedule for completion in early 2006, the project will push capacity to 350,000 b/d of synthetic crude, gross to Syncrude, and yield an ultralow-sulfur product.

The trust cited plans, which remain unapproved by Syncrude owners, for two later expansions raising production capacity to more than 500,000 b/d (OGJ, Apr. 11, 2005, p. 22).

Northern Alberta Foothills gas flow planned

Talisman Energy Inc., Calgary, plans to bring on production of more than 35 MMcfd of sales gas net to its interests in the northern Alberta Foothills during the next 14 months.

Talisman cited test results of six wells, which will be linked to nearby gas systems with new pipelines.

In the Narraway area, one well tested 19 MMcfd of gas, and three others tested at rates of 7-12 MMcfd each. Two wells in the Grande Cache area each tested at 15 MMcfd.

Talisman’s working interests in these wells are 50-68%. The company plans to drill 10 more wells in the area by yearend 2006.

Talisman holds 56% working interest in 345,600 gross acres in the northern Alberta Foothills and recently acquired 73,100 gross (66,500 net) acres of prospective land along the trend.

The company considers the trend a new core exploration and development area between its structural plays in northeastern British Columbia and the central Alberta Foothills. It says the new play has “high deliverability, multizonal potential.”

Talisman and partners have started building the Lynx Pipeline System, which will act as the main trunk system for the Grande Cache area. The system will extend from the Findley area east of Grande Cache northwest through the trend.

It will consist of 72 km of 12-in. pipeline and have initial raw gas capacity of 130 MMcfd. The $72 million project is expected to be complete by the fourth quarter of 2006.

The Lynx system will deliver raw gas at Findley to various pipelines, including Talisman’s Central Foothills Gas Gathering System.

Talisman also plans to build the $30 million Palliser Pipeline System, which will connect wells in the northernmost part of the Narraway trend to existing pipelines that carry gas to British Columbia. The Palliser system will have an initial raw gas capacity of 45 MMcfd. Start-up is also planned for the fourth quarter of 2006.

PTTEP lets contract for Arthit platform

Thailand’s PTT Exploration & Production PLC (PTTEP) let a $110 million contract to J. Ray McDermott SA for installation of a processing platform for Arthit gas field in the Gulf of Thailand.

The deal includes procurement, fabrication, transportation, installation, hook-up, and precommissioning of the topsides, which are equipped with production and processing facilities.

The platform forms part of the offshore production complex being developed at Arthit, 230 km off the southern Thai province of Songkhla. The complex is due on stream at the initial rate of 330 MMcfd in mid-2006.

PTTEP has spent more than $609 million for Arthit’s development, which includes the installation of a quarters platform, a production platform, and five wellhead platforms. PTTEP has also drilled more than 60 appraisal and production wells.

The field, covering 3,451 sq km, is operated by PTTEP, which holds 80% interest. Other interest holders are Unocal Corp. 16% and Mitsui Oil Exploration 4%.

Attempt to set structure off Turkey fails

Toreador Resources Corp., Dallas, reported an unsuccessful attempt to set a protective production structure for the recently completed Ayazli 2 and 3 gas wells in the South Akcakoca subbasin in the Black Sea off Turkey (OGJ Online, Aug. 18, 2005).

The structure’s main caisson was damaged during installation, and operations were suspended due to weather. Toreador reported no injuries or environmental damage.

Both Ayazli wells will be redrilled if the caisson cannot be repaired.

Toreador, operator, said it doesn’t expect the incident to delay the start of production. It plans to deploy a second jack up to keep the project on schedule.

The Prometheus jack up, which was installing the production structure, will move to the next drilling location south of the Akkaya discovery. The Cayagzi-1 will be the first of the remaining wells to be drilled in the first phase of development.

Work programs and budgets are expected to be finalized shortly for second and third development phases, likely to involve up to four additional wells north of the Ayazli discovery, and up to three wells on acreage operated by Turkey’s state-owned oil company, TPAO.

Partnership equities are equal for all the development phases. Toreador holds 36.75%, TPAO 51%, and Stratic Energy Corp., Calgary, 12.25%.

Suncor completes Alberta upgrader expansion

Suncor Energy Inc., Calgary, has commissioned an expansion of its oil sands upgrading operation at Fort McMurray, Alta., increasing production capacity to 260,000 b/d of upgraded crude oil from 225,000 b/d.

The $425 million project added a vacuum unit to Suncor’s Upgrader 2. It will enable bitumen produced from the company’s in situ operation, now mostly sold, to flow through the base operation for upgrading.

Suncor plans to increase production capacity of the upgrader to 350,000 b/d in 2008. That phase of expansion will include investments in mining and in situ operations and addition of a third pair of cokers to Upgrader 2. Fabrication and placement of coke drums is complete.

Statoil extends rig contract for Tampen work

Statoil ASA has secured a 1-year contract extension for the Transocean Leader semisubmersible for exploration and production drilling in the Tampen area of the Norwegian North Sea.

The 900 million kroner extension starts September 2007.

The rig, which has been drilling for Statoil since the summer of 2004, is currently working in an exploration collaboration involving Royal Dutch Shell PLC and Norsk Hydro AS. ✦

Processing - Quick Takes

Plant planned for Princess area sour gas

Altagas Income Trust, Calgary, plans to construct, own, and operate a 20 MMcfd sour gas processing plant in the Princess area of southern Alberta.

The plant, which will process production from the northern portions of Gentry Resources Ltd.’s Princess fields, is to start up in December.

An existing 30-km sour gas gathering system will link the Princess plant to the existing Bantry plant.

Gentry, of Calgary, said the additional processing capacity will free up Princess area production capability and enable additional exploration, which has been curtailed by capacity restraints.

Contract let for petrochem plant boilers

BASF FINA Petrochemicals LP, a BASF Corp. and Total Petrochemicals USA Inc. joint venture, has let a $7 million contract to a US subsidiary of Foster Wheeler Ltd.’s Global Power Group for two custom-designed, shop-assembled package boilers for its petrochemicals plant in Port Arthur, Tex.

Each boiler will have a capacity of 250,000 lb/hr of high-pressure, high-temperature steam.

The Port Arthur plant produces 1.9 billion lb/year of polymer-grade ethylene and 1.9 billion lb/year of polymer-grade propylene (OGJ, Oct. 15, 2001, p. 56). ✦

Transportation - Quick Takes

El Paso proposes 1,000-mile US gas pipeline

El Paso Corp. has proposed a connection between its natural gas pipelines in the US West with its systems in the South and East.

The project, called Continental Connector, would involve more than 1,000 miles of new pipeline of up to 42 in. in diameter. It would link El Paso’s Colorado Interstate, Wyoming Interstate Co., and Cheyenne Plains pipelines to points on the company’s ANR Pipeline, Tennessee Gas Pipeline, and Southern Natural Gas systems. It would be able to tap gas supplies in North and East Texas.

The new pipeline is expected to have a capacity of 1-2 bcfd. It could be placed in service as early as November 2008, El Paso said.

The company is holding a nonbinding open season to gauge shipper interest. The open season, which started Oct. 4, will run through Nov. 4.

This is the second recent proposal to build a pipeline to connect Rocky Mountain gas supplies with the US Midwest and East. Earlier this year, Kinder Morgan Energy Partners LP and Sempra Pipelines & Storage, a unit of Sempra Energy, San Diego, proposed a $3 billion, 1,500-mile gas line that would originate at the Wamsutter Hub in Wyoming and extend to eastern Ohio (OGJ Online, Aug. 17, 2005).

CNPC completes gas pipeline in Kazakhstan

China National Petroleum Corp. subsidiary CNPC-Aktobemunaigaz has completed construction of a 156-km pipeline to carry natural gas from Zhanazhol oil and gas field in Kazakhstan to the Bukhara-Urals trunkline.

CNPC-Aktobemunaigaz said it invested $95 million in the pipeline, which has throughput capacity of 5 billion cu m/year.

Mitsui to double product tanker fleet

Japan’s Mitsui OSK Lines Ltd. (MOL) plans to more than double its product tanker fleet in a move led by the introduction of 8-10 double-hull 45,000 dwt-class tankers.

MOL and its subsidiary Asahi Tanker Co. Ltd. manage and operate a tanker pool of 24 45,000 dwt-class product tankers.

The companies plan another 8-10 45,000 dwt-class product tankers, bringing their total fleet to about 40 by mid-2009, with a long-term goal of 50 ships after 2010.

MOL has decided to expand its fleet of 105,000 dwt-class product tankers with nine vessels.

It said demand for clean petroleum products such as naphtha, kerosine, diesel oil, and jet fuel, the main cargoes of product tankers, is expected to grow steadily. ✦