IEA underscores technology’s contribution to future oil supply

The oil and gas industry faces “very considerable demands” on its “human, financial, and intellectual capabilities” as it converts hydrocarbon resources into the fuels the world needs in growing amounts, says the International Energy Agency, Paris.

In a new report, Resources to Reserves, IEA traces the challenges of providing the 1.5 trillion boe of oil and natural gas projected to be required worldwide over the next 25 years-an amount about equal to cumulative production over the last century.

Dismissing the “peak oil” notion that conventional oil is entering a period of inevitable decline, IEA Executive Director Claude Mandil asserted that “technological progress has always been the key factor to prove the doomsayers wrong.” He added, “Technology will enable new resources to be developed cost-effectively, and it will accelerate the implementation of new projects.”

He said IEA’s new study isn’t a demand projection but rather an indication of the challenges facing the energy industry.

“There is no shortage of oil and gas in the ground,” he said. “But quenching the world’s thirst for them will call for major investment in modern technologies.”

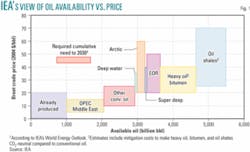

The world, according to the study, contains at least 20 trillion boe of oil and gas, about half of it conventional and 5-10 trillion boe now technically recoverable. Of that, proven reserves, considered to be both technically and economically recoverable, total about 2.2 trillion boe.

The challenge is to make technically recoverable oil and gas economically recoverable as well. This means turning resources into proven reserves through breakthrough technologies as well as incremental improvements.

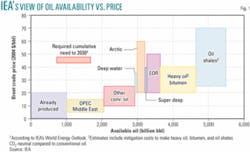

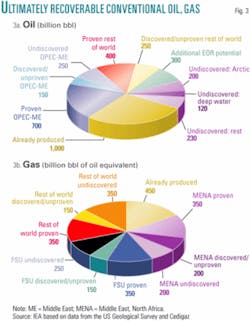

The study expresses confidence that private industry can deliver the required technical progress and is likely to do so despite reduced investments in research and development over the past 20 years. It also says that most of the world’s recoverable resources should become economic at oil prices “significantly below current prices,” somewhere around $30/bbl (Figs. 1-2).

The study notes that most oil and gas companies base long-term investment decisions on long-term oil prices of $20-25/bbl. Its estimates suggest that “accepting a long-term price of, for example, $30/bbl would make an appreciable difference to the economic recoverability of large amounts of oil.”

Governments can help by providing the framework favorable to investment in new types of resources and by ensuring cooperation between “the technology developers in IEA countries and major resource holders,” the study says.

Public policy can help, it adds, by improving investment conditions, supporting research, and promoting safety.

Although conventional oil and gas will continue to dominate supply to 2030, production increasingly will come from “technologically demanding” areas such as deep and ultradeep water; deeply buried, complex reservoirs; arctic regions; the few remaining remote, unexplored basins; and the smaller prospects that remain to be explored in known areas (Fig. 3).

At the same time, the supply contribution of nonconventional resources promises to increase from current, already climbing levels.

In its assessment of technological progress essential to future oil and gas supply, the study focuses on oil, for which extraction represents the dominant cost, rather than gas, with its transportation-dominated economics.

Technological areas

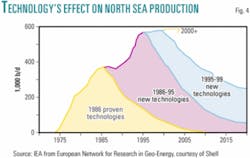

Using North Sea production gains to highlight the contribution of technological advances, the study highlights these technological areas as “central to ensuring future supplies” (Fig. 4):

• Improved ability to characterize reservoir heterogeneities and to image fluid movements, particularly in large carbonate reservoirs.

• Low-cost wells.

• A range of information technology-based, intelligent “e-field” systems allowing real-time management of reservoirs.

• A more streamlined, standardized, “assembly-line” approach to all operations in oil and gas fields.

• Renewed emphasis on better-performing enhanced oil recovery techniques, including the use of carbon dioxide to combine oil recovery with climate-change mitigation.

• Improving deepwater technologies to secure viability in water as deep as 4,000 m.

• Technologies for safe and environmentally sound operations in arctic regions.

• Technologies for economic production of nonconventional resources, in particular heavy oils, bitumen, oil shales, and nonconventional gas.

• Technologies to minimize the environmental footprint of all oil and gas operations.

• Technologies and actions to ease shipping bottlenecks.

• Technologies that reinforce the safety of installations.

Specific technologies

Because wells and surface facilities claim the largest share of the costs of oil extraction, the study notes, among examples of specific technologies of interest, two recent high-potential innovations that could open the way to long-sought monobore completion: casing-drilling and expandable casing.

I-field or e-field technologies, which rely on advances in electronics and information and communication technologies, can be expected to transform the industry over the next 20 years, the study says. They will drive down costs, ease workforce strains, and increase recovery factors.

The potential for systematically streamlining operations in mature fields to achieve scale economies will be important to technical development, the study predicts.

To improve recovery rates, the industry will explore the potential for techniques not now widely used, such as polymer and microbial enhanced oil recovery (MEOR). For by-passed oil, the study points to seismic or electromagnetic cross-well surveys as well as 4D seismic techniques and behind-casing logging.

The study also notes several other technologies recently combined to improve access to oil bypassed by earlier production: reentry drilling, multilateral completions, and coiled-tubing drilling. Miscible CO2 injection could become attractive as tax credits or other inducements become available to encourage sequestration of the greenhouse gas.

The study points to MEOR as a focus of much current research and says a breakthrough in this area might increase worldwide recovery by 5 percentage points, adding reserves equal to those of Saudi Arabia.

Improvement in recovery from carbonate reservoirs depends greatly on technology transfer between oil companies based in member countries of the IEA and state companies of the Middle East, where many fields produce from carbonates.

Challenging environments

As exploration and production water depths increase, innovations will continue in methods for linking small-field development with infrastructure installed for large initial discoveries. Areas of potential advance especially useful to deepwater operations include drilling-problem avoidance, improved wellbore stability control, faster drilling to mitigate the high daily cost of rigs, mud-to-cement technology, casing-while-drilling, and monobore wells.

With continued progress over the next 25 years, the study says, essentially all deepwater resources should become economic at long-term oil prices of $20-35/bbl.

Arctic areas are estimated to contain 25% of remaining worldwide undiscovered conventional hydrocarbon resources. Many of the challenges are similar to those in deepwater areas. But costs remain high, at three to five times those of equivalent projects in temperate areas.

So far only a handful of arctic projects have been developed. They suggest, says the study, a steep learning curve in finding new approaches that reduce capital and operating costs.

The study assumes that most arctic conventional resources will eventually become economic at long-term oil prices of $20-60/bbl.

Current resource estimates show limited potential below 4,000 m sediment depth whether on or offshore. But there is no reason why deep sediments should not contain hydrocarbons, the study says. Historically, the technology to drill superdeep wells has been pioneered by public scientific projects.

Nonconventional resources

Nonconventional oil resources-heavy oil, bitumen, oil sands, and oil shales-have been estimated at 6 trillion bbl, of which 2 trillion bbl may be ultimately recoverable, the study says. Production and processing costs have plummeted in the last 20 years.

Recent improvements to heavy oil production, traditionally mined or produced by steam injection, include steam-assisted gravity drainage (SAGD) and cold heavy oil production with sand (CHOPS). Those techniques will continue to raise heavy oil production, the study says.

It says technological progress will enable most of the heavy oil resources of Canada, Venezuela, and elsewhere to be economic at oil prices of $20-40/bbl, including the cost of mitigating CO2 emissions associated with production. However, simply mobilizing the capital for exploiting a significant fraction of these resources is likely to take several decades.

Oil shale, a large resource for which production is very energy-intensive, might be economic at crude prices of $25-70/bbl for the best-performing projects.

Investments and policy

Rather than limits on geological resources, the study says, the “overriding questions” about future oil supply relate to technologies, prices, and policies.

Past IEA studies have estimated the industry will need investments totaling $5 trillion in the next 30 years. The investment, the new study says, must be accompanied by “a widespread and determined R&D effort.”

Public policy can encourage the effort, the study says, by:

• Providing a framework favorable to investment in new resources, including appropriate licensing, taxation, royalties, and support for demonstration projects.

• Providing a policy climate that ensures continued active cooperation between technology developers in IEA countries and hydrocarbon resource-holders in member countries of the Organization of Petroleum Exporting Countries.

• Taking the lead in promoting technology development and facilitating investments that can reduce shipping bottlenecks.

• Actively participating in developing and facilitating the implementation of technologies that involve the safety of installations.

• Ensuring that CO2 emissions reduction is given sufficient value to foster more widespread CO2 EOR.

• Supporting basic science in the biology and ecology of subsurface bacterial systems, which can trigger breakthroughs in use of biotechnologies to enhance recovery or transform heavy hydrocarbons.

• Vigilantly supporting the industry’s efforts to reduce its “environmental footprint” and thus to access resources in new areas.

• Continuing to spearhead science and technology advances linked to future exploitation of methane hydrate deposits, while ensuring strong industry participation.✦