Australia's Reserves-1: Discoveries, pending developments belie 2004 slide in Australia oil, gas reserves

Australia can now claim to be shedding its reputation for stranded gas fields with the advent of significant new and proposed liquified natural gas (LNG) projects.

Recently petroleum companies in Australia have moved to establish substantial new LNG capacity at the Northwest Shelf Project (North Rankin and associated fields) and Darwin LNG (Bayu/Undan field) on the back of political stability and an enviable record for delivery of over 1,600 LNG cargoes from the Northwest Shelf Project.

As part of the LNG development, it is considered credible that three of the other known supergiant gas fields that occur off Northwest Australia could be producing by 2015. This coincides with development of other oil and gas fields.

Of particular note, this activity coincides with Australia recently having one of the highest rates in the world for discovery of barrels of oil equivalent per year.

The activity in LNG has resulted in an emerging realization of the need to find more gas to meet projected future needs.1 Australian petroleum resources have recently benefited from large new discoveries, and government estimates of proven reserves and economic demonstrated resources (EDR) have sustained their levels over recent years.

In this respect an article that reported the Australian government’s severe downgrading of Australia’s oil and gas reserves simply reflected a different use of estimates of Australian reserve and resource numbers (OGJ, Dec. 20, 2004, p. 18).

About 95% of Australian oil production and 80% of gas production is from offshore.2 In the last ten years the nation has maintained 65-85% self sufficiency in oil. A level of 85% is projected for 2007.3 Australia has also better than 100% sufficiency in gas as a net gas exporter through LNG.

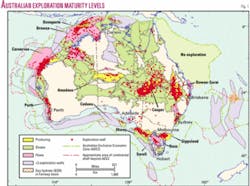

Australia nonetheless remains significantly underexplored, with less than 10,000 wells drilled nationwide in an area of over 12 million sq km. This is in spite of a competitive advantage Australia has established in encouraging petroleum exploration by almost unequalled ready access to data from previous exploration and production.

According to independent assessments, Australia is one of the best worldwide in providing petroleum exploration and production data to potential and current explorers.4 Access to petroleum exploration data has been subject to legislation since the 1950s and requires exploration and production data to be submitted for public release after a relatively brief confidentiality period.

Type, format, form, and media for lodgement of petroleum data are decided by government in consultation with industry and geophysical contractors. To further facilitate the access to data, the Australian Spatial Information and Data Policy announced in 2001 makes data available for the cost of transfer, including access by use of the internet to digital petroleum data bases from Geoscience Australia.

To seek to further increase exploration there was a redoubling of efforts, announced in the Commonwealth Government Budget of May 2003, to make Australian petroleum exploration and production data even more readily available to current and potential explorers. The Australian government has dedicated $25 million to these activities.

Seismic data from previous exploration is being remastered to high-density media for easy access. Over 250,000 seismic field tapes have been remastered to 3590 cartridges. These data are available at the cost of transfer (the cost of copying the high density tapes). To date 2,700 km of new seismic data have been collected over the Bremer, Mentelle, and Vlaming subbasins off Southwest Australia. These data are also publicly available at cost of transfer.

As an additional measure, five of the petroleum exploration areas offered in the release of 2005 attracted 150% uplift for tax purposes as a stimulus for frontier exploration. This program began in 2004 and was continued in 2005.

Recent discoveries

New oil and gas fields have been discovered both in the southeast and northwest of Australia, including supergiant gas fields. Deeper water exploration has also occurred including in areas adjacent to major gas and oil production in the Carnarvon basin on the Northwest Shelf.

The Carnarvon basin is Australia’s premier producing basin for both oil and gas. It has been explored for 40 years and shows no decrease in the rate of oil discovery.5 Significant oil discoveries at Exeter/Mutineer, Laverda, Vincent, and Enfield have been made, and many tens of trillion cubic feet of gas have been discovered at Gorgon and the more westerly Io/Jansz deepwater fields.6

Substantial gas discoveries have also been made recently at Pluto and at Wheatstone. To the north in the Browse basin the Japanese company INPEX has discovered an estimated at 10 tcf of gas and 500 million bbl of condensate in place in Gorgonicthys, Titanicthys, and Dionicthys fields.7

In the Otway basin in southeastern Australia the recent significant gas discovery at Henry has added to the burgeoning gas province there that helps service the southeastern domestic markets.

The recently discovered fields add to those discovered in an early phase of exploration prior to 1974 that defined the current major petroleum producing basins in Australia (Fig. 1). Supergiant fields containing both oil and gas were discovered in the Gippsland basin. These fields are producing to markets in the southeast and east of the country.

Supergiant fields were also discovered in the Carnarvon basin where the Rankin and Perseus fields are producing for domestic markets and for LNG export, mainly to Japan via a four train Woodside facility that may soon expand to five. A major LNG export agreement has been agreed with China.

The onshore Cooper-Eromanga basin was discovered in the early exploration phase and has become the source of gas for a number of major Australia cities. Recently the basin has had numerous commercial oil and gas discoveries made mainly by small operators.

Reserves and resources

Australian government estimates of reserves have remained fairly consistent over recent years, but as described earlier the large new gas discoveries are generating excitement.

Australian government reserve and resource estimates are those reported by Geoscience Australia, the Australian government agency responsible for producing official data on oil and gas resources, in its publication “Oil and Gas Resources of Australia.”

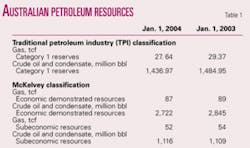

Category 1 proved plus probable reserves are for fields that are in production or have been declared commercial. For this category, the reserves have been sustained (Table 1).

In addition to Category 1 reserves, there are much larger additional resources which are judged to be economically extractable mainly from deepwater fields. These include condensate and gas in some of the recently discovered supergiant gas fields in the Bonaparte, Browse, and Carnarvon basins, for which delineation and planning for development is proceeding.

Using the McKelvey system of resource classification, they are also included in “Oil and Gas Resources of Australia” with producing reserves in the category referred to as economic demonstrated resources or EDR [Category 2 (noncommercial reserves)].

As at Jan. 1, 2003, EDR of oil and gas for Australia were 2,845 million bbl and 89 tcf, respectively. In the year to February 2005 since the reporting on which the OGJ numbers were based, five fields in the EDR category are now producing as will be described below.

Australia’s EDR for oil and gas have decreased slightly in the latest figures. These figures are not proved reserves but appear to be comparable in terms of reporting practices to those shown for other countries with substantial undeveloped gas resources.

In addition, as shown in Table 1, there are substantial resources in the subeconomic demonstrated resources category [also Category 2 (noncommercial reserves)]. Some of these resources may also become economic in the future as technology and infrastructure develop.

The totals in the McKelvey classification and the Traditional Petroleum Industry classification are the same as the McKelvey classification simply reallocates the TPI resources on the basis of their potential for commercialization. In the Traditional Petroleum Industry classification: Category 1 comprises current reserves of those fields that have been declared commercial. It includes both proved and probable reserves; Category 2 comprises estimates of recoverable reserves that have not yet been declared commercially viable. They may be either geologically proved or waiting further appraisal.

In practice, only offshore fields are considered for EDR classification under the McKelvey classification. Typically, due to the presence of infrastructure in most highly prospective onshore areas, commercially attractive discoveries enter production rapidly.

When considering offshore fields for EDR status, a number of factors are reviewed. Foremost is the proximity of infrastructure, followed by access to market and the quality of the resource. As all reserves numbers considered are proved plus probable, the certainty of occurrence is not a factor.

Additionally, drilled, nonproducing extensions to producing fields are included in the category. This typically includes resources in adjacent fault blocks and shallower and deeper pools. EDR are resources for which the quantity and quality are computed partly from specific measurements and partly from extrapolation for a reasonable distance on geological evidence.

Subeconomic demonstrated resources are similar to EDR in terms of certainty of occurrence and, although considered to be potentially economic in the foreseeable future, these resources are judged to be subeconomic at present.3 For comparison with the EDR numbers, BP in its 2004 Statistical Review of World Energy gives reserves for Australia for end 2002 of 3,700 million bbl of oil and 90 tcf of gas.

Further details on reserves in some of the recent gas discoveries can be found on the internet at: http://www.doir.wa.gov.au/documents/mineralsandpetroleum/Reserves_0304(1).pdf, and http://kakadu.nt.gov.au/pls/portal30/docs/FOLDER/DBIRD_ME/PUBLICATIONS/OIL_and Oil and Gas Resources of Australia is online at http://www.ga.gov.au/oceans/projects/ogra.jsp

Recent field developments

Those fields that were classified as having EDR in “Oil and Gas Resources of Australia 2003”2 are operated by companies having advanced plans for development or with existing infrastructure.

Four of those fields including one supergiant gas field are now producing and another is due to begin production.

The Carnarvon basin in the Northwest Shelf (Fig. 2) contains a number of supergiant and giant gas and gas-condensate fields.

Of Woodside’s gas discoveries classified as EDR in the Northwest Shelf area, one is now producing and a number are being developed or will be developed in the near future. These include Perseus (producing), which was classified in the EDR, Angel (preliminary field development plan submitted), Searipple, Tidepole, Gaea, Dixon, and Dockrell. Perseus is a supergiant gas pool.

Mutineer-Exeter oil field began production in March 2005 but was classified as an EDR only in 2003. Also in March 2005, a preliminary development plan for Enfield oil field containing heavily biodegraded oil of 22° gravity was submitted.

A number of exploration areas in the Carnarvon basin were released for bidding in April 2005 with closing dates of October 2005 and April 2006 depending on the size and exploration maturity of the acreage. Information and data on these areas can be obtained from Geoscience Australia at [email protected] or www.ga.gov.au/oceans/ss_Acreage.jsp.

The Greater Gorgon area is 130 km off the northwest coast of Western Australia in the Carnarvon basin. The fields in that area contain in excess of 40 tcf of gas.8

The Gorgon field development plan is well advanced. It involves the installation of a subsea gathering system and a 70 km subsea pipeline to Barrow Island.

A gas processing facility located on the Barrow Island would process the gas. Carbon dioxide would be removed and reinjected into deep saline reservoirs below the island, and the liquid hydrocarbon product would be transported by ship to international markets. Natural gas would be delivered via a subsea pipeline to the Western Australian mainland for use in industrial and domestic gas markets.

The initial development is a two-train LNG processing facility on Barrow Island, producing 10 million tonnes/year of LNG and delivering 280 MMcfd of gas to existing mainland domestic gas infrastructure.

This development is also planned to include the Io/Jansz supergiant gas field. The construction would be phased over 3-15 years. Io/Jansz was discovered in the Carnarvon basin in 2000 and has an in place gas resource estimated at 20 tcf.8 Other nearby gas discoveries include Geryon, Orthrus, Maenad, Dionysus, and Chrysaor.

Scarborough gas field is located in the Exmouth plateau west of the Carnarvon basin off Western Australia on acreage held by Esso Australia Resources Ltd. (Esso) and BHP Billiton Petroleum (North West Shelf) Pty. Ltd. Gas in place is estimated at 5 tcf.

BHP Billiton has proposed an onshore site for the Pilbara LNG project to develop the Scarborough resource. A number of concepts are considered technically feasible for development of this resource depending upon the available technologies and markets when the project commences. The primary concepts are subsea, with LNG facilities based onshore or on a remote island, floating LNG processing capability, and pipeline development for third party gas sale.

Most of the undeveloped fields in the Carnarvon basin are relatively remote from existing infrastructure and/or in deep water. Additionally, they contain dry gas, usually with moderate to high carbon dioxide content.

In the Browse basin to the north (Fig. 3) INPEX Browse Ltd. drilled three exploration wells in the exploration permit WA-285-P during 2000, Dinichthys 1, Gorgonichthys 1 and Titanichthys 1 (Ichthys complex) and discovered as mentioned earlier a promising gas and condensate structure. Gas in place is estimated at 10 tcf and condensate in place is estimated at 500 million bbl.7

INPEX Browse is looking toward not only LNG development but also new technologies associated with gas to liquids and dimethyl ether.

Brecknock and Brecknock South fields in the western Browse basin are held under retention leases by Woodside (operators of the North West Shelf LNG facility).

Due to the remoteness these fields Woodside is considering a wide range of development concepts and emerging technologies. Concepts include the production and export of LNG as well as sales gas into domestic markets and gas supply to an onshore gas-to-liquids (GTL) facility. Gas in place is estimated at 9 tcf.8

Woodside is embarking on an aggressive appraisal program to assess the feasibility of development. The Browse basin, however, contains no resources classified as EDR as its four giant to supergiant fields contain dry gas (except for Ichthys) and high carbon dioxide and are remote with few onshore facilities to assist early development. Both onshore and offshore development options are being studied.

A number of exploration areas in the Browse basin were released for bidding in April 2005 with a closing date of October 2005. Information and data on these areas can also be obtained from Geoscience Australia at [email protected] or www.ga.gov.au/oceans/ss_Acreage.jsp.

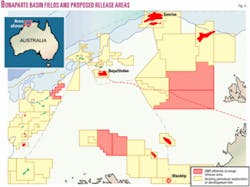

The Bonaparte basin (Fig. 4) contained one gas-condensate field Bayu/Undan that has subsequently been developed but was classified as having EDR in “Oil and Gas Resources of Australia 2002.”3 On Feb. 15, 2004, the first condensate production was achieved from the Bayu/Undan gas recycle phase of the project following the successful commissioning and start-up, and the first shipment of 340,000 bbl of condensate was completed on Mar. 30, 2004.

Bayu/Undan field is 500 km northwest of Darwin in the Joint Petroleum Development Area (previously known as Area A of the Zone of Cooperation) in the Timor Sea. The reserves are publicly estimated at 400 million bbl of condensate and LPG and 3.4 tcf of gas.

The field is being developed in two phases. The first phase is a $1.8 billion (US) gas-recycle project, where gas liquids are removed and the dry gas reinjected. The second phase involves an onshore LNG project called Darwin LNG. The LNG project is expected to commence production in the first quarter of 2006.

Greater Sunrise, comprising the Sunrise and Troubadour gas fields, contains around 9 tcf of gas (Woodside estimate) and has the capacity to supply long-term gas contracts for more than 30 years. The field is 500 km northwest of Darwin and 150 km south of East Timor.

The Sunrise joint venture participants-the operator Woodside with 33.44%, ConocoPhillips 30%, Shell 26.56%, and Osaka Gas 10%--have so far spent nearly A$200 million working on a series of scenarios to bring the projects on stream. The project is currently on hold pending agreement with East Timor.

Planning has been under way for development of Blacktip gas field involving a pipeline to sell the gas onshore. Exploration areas in the Bonaparte basin were released for bidding in April 2005 with closing dates of October 2005 and April 2006 depending on the size and exploration maturity of the acreage.

Next: The authors list recent discoveries and developments in southeastern Australia and continued efforts to make exploration data available to the industry and other exploration incentives. ✦