Israeli oil, gas targets spark flurry of drilling

Exploration companies report a flurry of drilling and drilling plans in and off Israel, which imports nearly all of its oil and gas. Discoveries so far have been primarily gas fields in the Mediterranean Sea off Israel and the Gaza Strip.

Potential development of gas reserves off Gaza has attracted attention since Israel’s August withdrawal from Gaza settlements. BG Group PLC holds a license covering the entire area, and commercialization of the gas remains an open question.

Previously, Israeli Prime Minister Ariel Sharon resisted Israel’s direct purchases of Gaza gas for political reasons. Industry experts say Israel also has blocked Gaza gas exports, fearing that revenue to the Palestinian Authority could fund terrorism against Israel.

Israel has some gas production. Rather than buying Gaza gas, it has bought gas from Egypt.

In August, Israel Electric Corp. (IEC) signed a $2.5 billion gas supply contract with East Mediterranean Gas Pipeline Co. (EMG) of Egypt in which IEC is to receive 1.7 billion cu m/year from EMG for 15 years.

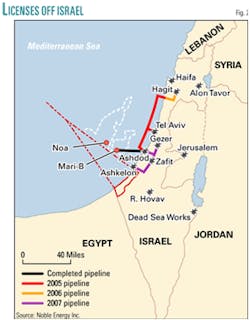

The EMG-IEC agreement calls for an 80-mile subsea pipeline to be built from Egypt’s port of El Arish to Israel’s port of Ashkelon. The pipeline is to be operational in 2007.

BG is considering El Arish as the landing point if it decides to export gas from off Gaza to Egypt. In early July, the Palestinian Authority and Egypt signed a government protocol to arrange sales of offshore Gaza gas to Egypt with plans to export it as LNG to world markets.

Gas fields

BG has gas discoveries off both Israel and the Gaza Strip. Currently, BG is examining its options to market gas from off Gaza to Egypt or Israel, BG spokeswoman Petrina Fahey told OGJ.

Several logistical factors will have to work in unison, and there is no timetable for any BG decisions on marketing that gas, she said. The London major drilled the Gaza Marine-1 and Gaza Marine-2 wells 5 years ago. The area has reserves of 1-1.5 tcf.

In 2001, a BG technical review recommended a subsea development. In May 2002, the Palestinian Authority approved a development plan for the Gaza Marine license, in which BG holds a 90% interest, which is to drop to 60% after Consolidated Contractors Co. and the Palestine Investment Fund exercise their options.

BG might build its own infrastructure to produce and transport Gaza Marine gas, Fahey said, or BG might work cooperatively with Yam Thetis, a consortium of Israeli-US companies having production facilities and a pipeline to Israel.

“We are in discussions with Yam Thetis, but I can’t say more than that at this stage,” Fahey said.

Yam Thetis has undeveloped holdings near the Gaza-Israel maritime border. Israeli members of Yam Thetis are Delek Drilling LP 25.5%, Avner Oil & Gas Ltd. 23%, and Delek Investments and Properties Ltd. 4.44%. The US member is Noble Energy Inc., Houston, which holds 47.06% interest.

Yam Thetis controls the Noa license off Israel. Noa field, also called Border field, is adjacent to the Gaza Marine license.

Noa and South Noa fields are at least 2 years away from development, said Noble spokesman Greg Panagos. Noble drilled Noa 23 miles off Ashkelon in 1999 to 6,830 ft TD in 795 ft of water. On test, it flowed at a choked rate of 33 MMcfd.

Fahey said BG had planned to drill another Gaza Marine well. “However we are not continuing with this, rather focusing on development of the main field,” she said.

In a separate decision about its Mediterranean Sea holdings off Israel near the Lebanese coast, BG relinquished Gal A (Michal) Block and Gal B (Matan) Block in March.

“We withdrew from the licenses following an internal review, which considered both technical and market issues,” Fahey said. “It wasn’t economic for BG to pursue them. This is not to say that it won’t be economic for other companies.”

Gas production off Israel comes from Mari-B field, which Noble operates. Mari-B field has gross proved and probable reserves of 1.1 tcf. The Mari-B well was drilled to 6,830 ft TD in 795 ft of water.

Gas sales began in February 2004 to the IEC, which is building and expanding infrastructure to various power plants. Mari-B partners have a 10-year contract with IEC for 170 MMcfd. In anticipation of rising gas demand in 2006-07, onshore receiving facilities are being expanded to match the Mari-B platform’s 600 MMcfd capacity.

“Noble Energy sees considerable growth potential for gas sales in Israel,” said Charles D. Davidson, chairman, president, and chief executive officer. As of Dec. 31, 2004, the company held 123,552 gross developed acres and 292,572 gross undeveloped acres 15-25 miles off Israel in 700-5,000 ft of water.

Panagos said, “We do have exploration acreage, but there are no near-term plans to drill any Israeli wells.”

Mediterranean drilling

In recent Mediterranean drilling, Isramco Negev 2 LP of Israel let a contract to Atwood Oceanics Inc. for the Southern Cross semisubmersible to drill the Gad 1 exploration well to 8,300 ft in 328 ft of water in the Med Ashdod lease.

“The purpose is to determine if there is a big gas reservoir,” said Yossi Levi, Isramco general manager. The well was expected to be spudded in September and to cost $16.5 million. Isramco is the operator with 47% interest. Palace Petroleum Corp. of the US has 30% interest. Other partners are Israeli companies.

“We also have intentions to drill an oil well, a very deep well with a budget of $60 million,” in the Med Ashdod lease, Levi said. Isramco plans to be the operator. Currently, the biggest obstacle to proceeding with the well is finding a rig, Levi said.

Isramco also has 30% interest in a project in which Delek Drilling is looking for partners to drill a gas well off Israel, Levi said.

Separately, Isramco has a stake in the Med Yavne license, operated by BG. “There are no development plans as yet for Med Yavne, but some study work is ongoing,” Fahey said.

The Med Yavne license contains the Or-1 discovery well in 695 m of water 20 miles off Israel, which flowed gas on test at a rate of 21 MMcfd in 1999. Testing conditions restricted the production rate, BG said.

Onshore drilling

Triassic discoveries in north-central Israel have encouraged exploration, which began in 1947 on a surface feature in the Heletz area of the central part of the country. Since then, 470 wells have been drilled in Israel.

Privately owned independent Zion Oil & Gas Inc., with offices in Dallas and Israel, recently was drilling a reentry on its 95,800-acre Ma’anit-Joseph License in north-central Israel (OGJ, July 5, 2004, p. 41).

Zion Pres. and Chief Executive Officer Eugene A. Soltero said drilling contractor Lapidoth Israel Oil Prospectors Corp. reached 15,482 ft on July 14 on the reentry of the Ma’anit-1 well. The two lowest zones in the well were tested and found nonproductive.

The well was plugged back to 14,610 ft, and three zones of Anisian sand were being swab-tested through drill pipe. Soltero said the tests were encouraging but inconclusive. Six different zones of Carnian age were perforated for production testing at 12,559-13,215 ft.

Soltero said there was evidence of oil and gas, although Zion is looking primarily for oil.

Separately, Givot Olam Exploration LP, Jerusalem, began drilling the Meged-4 underbalanced horizontal well on June 20. On Apr. 4, 2004, the government of Israel recognized Meged oil field as commercial and granted a 30-year production lease for an area covering 247 sq km.

Givot Olam drilled three wells in Meged field 20 km northeast of Tel Aviv during 1994-2004, confirming Mohilla A formation oil reservoirs. Analysts said Meged field required a horizontal completion for commercial production (OGJ, July 5, 2004, p. 40). The analysts included Forrest A. Garb, a consultant in Dallas, who previously consulted for Givot Olam and currently consults for Zion.

Garb, who has studied Israeli projects for 40 years, notes that most exploration has been shallow.

“There are not enough statistics to give you a lot of encouragement about the deeper zones,” Garb said. “But seismic has improved a lot in the last decade. There is something to look for.... If you are not optimistic about what you are doing, you won’t even try, and there wouldn’t be any oil fields anywhere.”

One company optimistic about Israel is Ness Energy International Inc. of Willow Park, Tex., and Nethanya, Israel.

On Sept. 20, Ness announced the Be’eri-3 well flowed on test at a rate of 100 Mcfd from the Canoman formation. The well is in the northwest end of the Negev desert near Ashkelon. Ness is the parent of the general partner of Modi’in Energy LP, which bought the well’s license in February.

Ness Chief Executive Officer and Pres. Sha Stephens said eventually Ness wants to drill a well of 20,000-25,000 ft on the southwest end of the Dead Sea. He estimates that it will be a $20 million project.

“We’re looking for oil. I feel very confident I know where it is,” Stephens told OGJ. He took over Ness after his father, Harold Stephens, died in May 2003. “Frankly, my dad had set up a one-well company. He focused all his efforts on drilling one deep well in Israel.”

The younger Stephens has shifted the strategy, and Ness now has operations in the Fort Worth basin and the coastal plains of South Texas. He said those operations are helping Ness build a solid foundation with which it can support its Israeli operations.

Harold Stephens based his efforts on scripture, while Sha Stephens said he is depending on both scripture and science. ✦