Canadian operators, contractors adapting to year-round drilling

Canadian companies are beginning to spread their drilling cycle through the year, in place of the traditional, compressed winter drilling schedule. Although the rig fleet is increasing slightly in size, utilization is high, record numbers of wells are being drilled (particularly for natural gas), and drilling permit applications continue to rise. Year-round drilling levels the load, reduces costs, and optimizes limited drilling resources.

Canadian operators need more workers to sustain the current drilling boom. In June, the Canadian Association of Oilwell Contractors reiterated that the biggest challenge ahead is not the development of appropriate technologies but the lack of personnel. The CAODC and the Alberta provincial government spearheaded a new drilling “Apprenticeship Initiative” in 2005 to standardize skill levels for rig technicians and enhance the attractiveness of the profession in a tight labor market.

HSE

Activity in the western provinces is high. Although drilling off the West Coast remains unapproved, Canada saw no need to emulate American drilling restrictions in the Midcontinent.

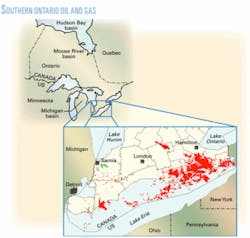

The US Congress permanently banned drilling under the US side of the Great Lakes as part of the comprehensive energy bill passed in July. Canadian authorities maintain drilling has been safe, and Canada permits offshore drilling for natural gas and directional drilling for oil. Directional drilling for oil under Lake Erie began in 1996. The Ministry of Natural Resources in Ontario now oversees production from 500 natural gas wells and 22 oil wells under the lake.1

According to reports from the Ontario Oil, Gas, and Salt Resources Library, there were 69 wells drilled to TD in the province in 1999; 112 wells in 2000; 115 in 2001; 82 in 2002; 88 in 2003; 72 in 2004; and 20 through June 2005.2 The numbers indicate a steady decline in Ontario drilling since the relatively intense activity in 2000-01. Only 59 well permits were issued in the first half of 2005 and only five rigs were actively drilling in June.

A 2002 report by the Public Interest Research Group in Michigan said that drilling in Lake Erie led to 51 natural gas leaks 1997-2001 and 83 oil spills 1990-95. It concluded: “Drilling has been neither safe nor risk-free.”1

Economist Michael LaFaive of the Mackinac Center for Public Policy, a free-market research institute said, however, that the “threat of oil spills off the Great Lakes is a phantom menace.”1

CAODC records show two fatalities and 169 lost-time accidents in land-based Canadian drilling operations during first-quarter 2005. In the Canadian Atlantic provinces, there was only one lost-time accident during first quarter (and no fatalities).

There was at least one additional fatality in southern Alberta and three workers injured when a sour-gas well owned by Calgary-based Celtic Exploration Ltd. exploded in early August. The Canadian Press reported on Aug. 10 that Precision Drilling Corp. was attempting to complete the well at the time of the explosion.

Drilling contractors

According to the Daily Oil Bulletin from Nickle’s Data Central, the top six contract drillers in Canada January-June 2005, based on number of wells and meterage drilled are: Precision Drilling (3,084 wells, 3.69 million m); Ensign Drilling Inc., a division of Ensign Energy Services Inc. (2,146 wells, 2.56 million m); Savanna Energy Services Corp. (1,266 wells, 0.92 million m); Trinidad Drilling Ltd. (633 wells, 0.8 million m); Akita Drilling Ltd. (523 wells, 0.48 million m); and Nabors Drilling (438 wells, 0.85 million m). The activity of these six contractors comprises 81% of the Canadian drilling market for the first half of 2005.

In June, Western Lakota Energy Services Inc. announced its purchase of four surface casing-core drilling rigs and related equipment from another Alberta company for $12.63 million (Can.). Western Lakota operates 22 rigs and said it would build eight more during 2005.

Western Lakota announced in early July that it had signed 3-year term contracts for five rigs, including two “ultra-heavy” 3,600-m telescoping doubles and three 3,200-m telescoping doubles.

Calgary’s Precision Drilling announced in June that it was divesting all non-Canadian assets and selling its Energy Services division and its international contract drilling division to Weatherford International Ltd. for $2.28 billion. The international contract drilling division includes the land drilling assets that Precision acquired from GlobalSantaFe Corp. in May 2004. There are 48 rigs, predominantly in the Middle East and North Africa.

On June 11, the Globe and Mail said that Precision’s President and CEO Hank Swartout confirmed in an interview that the remaining domestic operations would be spun off into an income trust.3 Swartout said in late July that the company was experiencing record activity levels and he saw no sign of a slowdown in September.

On Aug. 31, Weatherford announced that the acquisition was complete, for about $945 million and 26 million Weatherford common shares.

On Aug. 24, Tesco Corp. announced that it had agreed to sell four casing drilling rigs to Turnkey E&P Inc., a recently-formed, privately held Alberta company, for $35 million and warrants to purchase 5% of Turnkey. Turnkey will also become Tesco’s preferred supplier for North America. Tesco President Julio Quintana said, “being in the asset-intensive rig ownership business is not part of Tesco’s long-term strategy.” The sale is scheduled to close Nov. 15.

Operator activities

According to the Daily Oil Bulletin, a Nickle’s publication, the top 10 operators in Canada, based on meters drilled January-June 2005 are: EnCana Corp. (2.25 million m, 2,104 wells), Canadian Natural Resources Ltd., Burlington Resources Canada Ltd., Devon Canada Corp., Husky Energy Inc., Apache Canada Ltd., Talisman Energy Inc., EOG Resources Canada Inc., Petro-Canada, and Nexen Inc. (0.19 million m, 170 wells).

The Baker Hughes rotary rig count for the week ending Aug. 26 indicated 509 rotary rigs drilling in Canada, down 26 rigs from the week before, but up 230 rigs from a year earlier.

The busiest summer drillers as of Aug. 26 include: EnCana (55 rigs operating), Canadian Natural Resources Ltd. and Devon Canada Corp. (30 rigs each), Talisman Energy Inc. (28 rigs), and Apache Canada Ltd. (24 rigs). A remarkable 78% of the fleet was at work, up from 48% a year earlier.

According to the Daily Oil Bulletin, Aug. 10, a record 16,014 drilling permits were issued January-July 2005.

In 2004, operators drilled about 23,920 wells throughout Canada, including about 16,000 gas wells, about 4,700 oil wells, and about 3,220 dry holes, according to the Canadian Association of Petroleum Producers (CAPP).

Western Canada

According to Nickle’s Daily Oil Bulletin, industry has drilled 10,234 wells in western and northern Canada January-June 2005, with an average of 742.5 rigs in the fleet and 45% utilization.

In July, the CAODC forecast a 46-rig increase (6.2%) in the Canadian fleet during second-half 2005, growing to 780 rigs by the end of 2005, from 734 rigs in June.

The CAODC also updated its 2005 drilling forecast, saying that 24,099 wells would be drilled in western Canada in 2005 (British Columbia, Alberta, Manitoba, Saskatchewan, and Northwest Territories). Through the end of July, 10,557 wells had already been drilled, according to data from Calgary-based Drilling Records.

According to Nickle’s Rig Locator, for the week of Sept. 12, there were 751 drilling rigs in western Canada, with 582 operating and 169 down (77% utilization). There were 443 rigs drilling in Alberta, 64 in British Columbia, 67 in Saskatchewan, 7 in Manitoba, and 1 in northern Canada.

Historically, the average Canadian utilization of drilling rigs over the past 3 years has been 57.3%:

• 59% in 2004 (440 working of 703 available, average).

• 63% in 2003 (422/670).

• 50% in 2002 (315/630).

The fleet usually reaches peak utilization in February each year. In February 2005, peak utilization was 94%, up from 93% a year earlier, and up from 91% in February 2003 (Fig. 1). During first-quarter 2005, an average of 84% rigs was working, out of a fleet averaging 724 rigs (84% fleet utilization). By second-quarter 2005, the fleet averaged 731 rigs, but utilization had dropped to 37%.

The drilling success rate remains high in western Canada, although the percentage of dry holes is increasing. For the first 7 months of 2005, about 7.8% of all wells drilled were dry holes, 32% higher than the 5.9% dry hole rate in 2004 (Fig. 2).

PSAC’s Drilling Activity Forecast and Well Cost Study are broken down into 15 specific geographic areas. Area 1-Foothills-is a gas-prone area, characterized by deep, challenging, expensive wells. According to average cost data published by McIntosh-Doell and McAdam, wells drilled 0-1,200 m deep in Area 1 cost $1.035 million (Can.); wells drilled 2,201-3,000 m deep cost $2.385 million (Can.), and wells drilled 3,601-4,500 m deep cost $8.295 million.4

Eastern Canada offshore

There were four drilling rigs onshore (theee working, one idle) and four rigs drilling offshore eastern Canada, based on Nickle’s Rig Locator report for the week of Sept. 12.

According to the Canada-Newfoundland and Labrador Offshore Petroleum Board (CNLOPB) weekly public status report for Sept. 5, 2005, the Henry Goodrich semisubmersible was working on the Terra Nova drilling program for Petro-Canada and its partners, and had spud the G-90-6 well on Aug. 15. The GlobalSantaFe Grand Banks semisub and the Rowan Gorilla VI semisub were working on the White Rose drilling program for Husky Oil and its partners. The Gorilla VI spudded the B-19 well on Aug. 22 and the Grand Banks was completing the B-07-9 well.

The Gorilla VI had spud the Lewis Hill G-85 exploration well for Husky Oil on July 11 but was demobilized on Aug. 18 and moved to White Rose. The Lewis Hill well is a tight hole.

According to the Canada-Nova Scotia Offshore Petroleum Board’s weekly operations report for Sept. 5, 2005, GlobalSantaFe’s harsh environment jack up drilling rig, Galaxy II, was drilling the Venture 7 development well in 22 m water depth for ExxonMobil Canada Properties. The same rig drilled and completed the South Venture 2 well (Feb. 24) and the South Venture 3 well (June 13) earlier this year.

On Aug. 24, Ocean Rig ASA announced a 2-year contract with Esso Exploration Inc. for exploration drilling with the Eirik Raude semisub in the Orphan Basin offshore Newfoundland, to commence in early 2006.

Tapping offshore expertise

In late August, a Chinese delegation visited Newfoundland and Labrador to meet with companies with expertise in offshore drilling platforms.

The Newfoundland Ocean Industries Association reported that the visiting group was looking for expertise in the design of deepwater drilling platforms and providers of related equipment and services to help develop China’s offshore oil and gas industry.

The group included four representatives from the Chinese National Offshore Oil Corp. (CNOOC), one from China’s National Development and Reform Commission (NDRC; China’s ministry responsible for energy issues), and a representative from CNOOC’s agent in Canada.

Members of the delegation gave presentations at the College of the North Atlantic and toured facilities at St. John’s Dockyard Ltd. , FMC Technologies, and the Institute for Ocean Technology. They also visited the Bull Arm construction and fabrication site, 130 km northwest of St. John’s.

NOIA Chair Tony Goobie said that members’ expertise can be applied outside Atlantic Canada and “pursuing these opportunities will allow companies to build a stronger and more diverse client base.”

Newfoundland onshore

In June, Vulcan Minerals Inc. finalized purchase of an Ingersoll-Rand RD-10 rotary drilling rig from Rose Resource Drilling Inc., Ontario (photograph). The rig is a single with a top drive and mud system; Vulcan President Patrick Laracy told OGJ that his company has added a blowout prevention system from Integrated Drilling Management Services Inc. in St. John’s.

Vulcan Minerals’s first well with the new rig was the Storm No. 1 location, in partnership with Terralliance Technologies Canada Inc. (TTI) of London, Ont., a subsidiary of California-based Terralliance Technologies Inc.

The well reached TD of 880 m in early August. It was the first assessment of an untested Carboniferous section with evaporites; there were no petroleum shows, according to an Aug. 8 news release from Vulcan Minerals. Schlumberger Canada Ltd. logged the well and was trying to retrieve stuck tools at the end of August.

Vulcan Minerals plans to move the rig about 30 km south to test a known oil-bearing Lower Carboniferous section at the Hurricane No. 1 location.

New Brunswick onshore

Corridor Resources Inc. is engaged in the McCully drilling program onshore New Brunswick with Nabors Rig 4. The Potash Corp. of Saskatchewan Inc. (PCS) has a 50% interest. The McCully field is near Sussex, in south central New Brunswick. On Aug. 9, the company announced that they successfully completed the McCully G-67 sidetrack at 2,740 m measured depth. The sidetrack encountered 39 m of net gas pay in the Hiram Brook A and B sands.

The rig was moved from the McCully G-67 to set casing in the C-67 and K-57 wells. All three wells will be hydraulically fractured this fall, according to Corridor’s Aug. 9 press release. Then the rig will be relocated to drill and case the McCully 0-66 well, about 700 m southwest of the McCully A-67 discovery well.

Quebec, Anticosti Island

On July 6, Corridor Resources announced that it had started drilling the Chaloupe well on Anticosti Island, Que., about 1 km east of a well drilled in 1999 on the Chaloupe structure. Before completion, the rig was moved to spud the MacDonald well on July 27. Corridor drilled the MacDonald well to 627 m, set 7-in. casing, drilled the Trenton-Black River formation underbalanced with nitrogen, and reached 648 m TD on Aug. 8.

The rig was then moved back to the Chaloupe well, and on Aug. 25, Corridor announced that it finished drilling to 1,215 m TD. The Chaloupe well was also drilled with nitrogen into the Black River formation. The well was abandoned and the rig moved to drill a well at the Jupiter prospect. Drilling should be complete by the end of September and the rig demobilized off the island in October. Partner Hydro-Quebec holds a 50% working interest in the MacDonald exploration license, 25% in the Chaloupe license, and will pay 25% of the Jupiter well costs to earn a 25% working interest.

Canadian R&D

The Petroleum Technology Alliance Canada (PTAC) manages a new web-searchable research and development oil and gas projects database for western Canada.5 The new oil and gas database began on May 15 and can be searched by industry sectors or technical areas (drilling, well completions and logging, etc). On Aug. 29, there were nine drilling research projects listed.

This new database complements Atlantic Canada’s energy research and development database,6 which can be searched:

• By province: Nova Scotia and New Brunswick are currently available; the Newfoundland and Labrador site was under construction at the end of August.

• By research categories (engineering; petroleum operations-deep water, shallow water) and research topics (drill cuttings, drilling fluids, drilling operations, drilling waste, extended-reach drilling, surfactants, wellbore stability, etc.).

• By researcher name, category, topic, affiliation type, university, or government agency; or by publication, project, or funding agency.

Among the research projects related to drilling are:

• Automating and optimizing extended-reach well design, conducted by Pak Yuet at Dalhousie University.

• Documentation of ice management plan for drilling activities in the Flemish Pass, conducted by Ralph Freeman and funded by Petro-Canada.

• Epidemiological investigation of respiratory and occupational dermatitis symptoms in relation to drilling fluids exposures in North Atlantic offshore drillers, conducted by Judith Guernsey at Dalhousie University and others.

Standards review

Beginning in fall 2005, industry will begin a review of the industry recommended practice (IRP) Volume 7, standards for wellsite supervision of drilling, completions, and workovers.7

The original version was developed under the auspices of the drilling and completion committee (DACC) of the Canadian Petroleum Safety Council and sanctioned (reviewed and supported as a compilation of best practices) in March 2003.8 DACC is a joint industry and government committee, including the Alberta Energy and Utilities Board, CAODC, CAPP, the International Coil Tubing Association, the Oil & Gas Commission of British Columbia, the Petroleum Services Association of Canada (PSAC), and Saskatchewan Energy and Mines, among others.

Drilling ahead

In a July 27 update to its annual 2005 forecast, PSAC still expected annual drilling activity to reach 23,825 wells, a 5% increase over 2004, despite the heavy June rains in western Canada.

About 3,900 wells were drilled during second-quarter 2005, although PSAC had earlier estimated 5,100. Roger Soucy, president of PSAC, said that second-quarter activity was “slowed considerably by the rain and flooding in southern Alberta and Saskatchewan.”

PSAC believes that 18,464 wells will be drilled in Alberta this year, up about 5% from 2004. Saskatchewan drilling will increase to about 3,924 wells in 2005, about 8% from 2004. British Columbian drilling is expected to increase slightly to a record-breaking 1,235 wells in 2005.

By the end of July, Soucy said there were record numbers of drilling rigs back in the field, “comparable to winter levels,” and he expects drillers to “catch up on lost time by year’s end.” PSAC will announce its 2006 Canadian drilling activity forecast in October. ✦

References

1. Price, D., “Canada doesn’t follow as US bans drilling,” The Detroit News Special Report, Aug. 14, 2005, www.detnews.com

2. Ontario drilling activity compiled under license from the Ontario Ministry of Natural Resources; monthly drilling reports and summaries of completions; www.ogsrlibrary.com/activity.html

3. Brethour, P., and Ebner, D., “The siren call of the energy trust,” globeandmail.com, June 11, 2005.

4. McIntosh-Doell, B. and McAdam, D., “Forecasting 101,” 2005 Canadian Oilfield Service and Supply Directory-Forecast and Almanac, p. 6.

5. www.ptac.org/rdd1.html

6. www.energyresearch.ca

7. FAST-Line, Petroleum Services Association Canada, Aug. 4, 2005.

8. www.psc.ca