OGJ Newsletter

General Interest - Quick Takes

Survey gauges oil-price effects on US firms

High oil prices are taking a toll on US-based multinational companies, making senior executives less optimistic and more uncertain about the future, said analysts at PricewaterhouseCoopers LLP, New York.

“Many-particularly the 36% that see their companies as vulnerable to rising oil prices-are scaling back expectations for revenue growth, new jobs, and investments,” they said in the report of a recent survey. Although 82% of the surveyed senior executives still believed that the US economy is growing, only 62% were optimistic in the second quarter about prospects over the next 12 months-“a sharp 15-point drop from the prior quarter,” the report said. “One-third now counts itself uncertain, a 13-point increase.”

The decline of optimism is most prevalent among 36% of executives citing rising oil prices as a potential barrier to corporate growth. Only 56% of this group remains optimistic; 42% is uncertain, according to the survey.

The report noted flagging optimism among companies that see themselves as vulnerable to oil price increases. Currently, 66% of this group continues to be optimistic, down from 80% in the prior quarter. The survey indicates 59% remaining optimistic about the world economy-off 8 points-with one-third uncertain.

Meanwhile, surveyed executives said revenue growth is slowing, and growth targets have been reduced for the third consecutive quarter. The latest 12-month goal is a 7.2% increase, off from 8.1% in the prior quarter.

Costs are up, but pricing is not keeping pace, and gross margins are softer. Increased costs are reported by 45% of the respondents, but only 37% mentioned increased pricing. “And, although improving margins are reported by 36% (consistent with the prior quarter), there has recently been a narrowing from their strong showing in late 2004,” the report said. “Purse strings are tightening. Fewer executives are planning major new investments (47%, off 12 points from the prior quarter) and net new hiring (46%, off 11 points).”

Agencies to resist Equilon antitrust ruling

The US Federal Trade Commission authorized the staff of its general counsel’s office to file a joint amicus brief with the Department of Justice asking the Supreme Court to reverse a lower court’s finding that Texaco Inc. and Shell Oil Co.’s refining and marketing joint venture violated the Sherman Antitrust Act.

The federal departments are challenging a Ninth Circuit Court of Appeals ruling that federal antitrust laws were violated when the two parent companies of Equilon Enterprises LLC directed it to equalize prices for both brands of gasoline after merging downstream operations and effectively terminating their prior competition.

The appeals court reversed a federal district court’s finding that Equilon’s decision to unify Texaco and Shell gasoline prices did not constitute horizontal price fixing. The FTC and Justice Department’s joint brief argues that this reversal improperly extended an antitrust analysis to unified product pricing under the joint venture.

The FTC voted 3-0 to authorize the staff’s filing of the joint brief, with Chairman Deborah Platt Majoras recused. ✦

Exploration & Development - Quick Takes

Southwestern Energy to hike budget, add rigs

Southwestern Energy Co., Houston, budgeted a 13.6% hike in 2005 capital outlays to $499.5 million with implications mostly for its eastern Arkoma basin shale gas play.

The increase, contingent on the subscription of a common stock offering, is mostly earmarked for more drilling in the Arkansas Fayetteville shale play and in East Texas and the Permian basin, future gathering systems for shale gas, and fabrication of five land rigs to drill shale gas wells in addition to the five ordered earlier. Monthly rig deliveries are to start in November.

The new budget has the company spending $137.5 million on Fayetteville this year, about twice its outlays on conventional Arkoma projects.

The gathering systems will be needed as the play expands into areas beyond existing infrastructure.

Gas from the company’s first three named Fayetteville fields is delivered into the Ozark Gas Transmission system. They are Griffin Mountain field in Conway County, Gravel Hill field in Van Buren and Conway counties, and Scotland field in Van Buren County (OGJ, July 18, 2005, p. 35).

Hydrocarbons found in Miocene off India

The P1-A deepwater well on Block D6 in the Krishna-Godavari basin off eastern India became the first hydrocarbon discovery in the Miocene interval, said participant Niko Resources Ltd., Calgary.

The well, operated by Reliance Industries Ltd., Mumbai, is the 15th straight successful exploration well drilled on the block (see map, OGJ, July 18, 2005, p. 34).

Log analysis at the well, the first drilled on newly acquired 3D seismic data, indicated several hydrocarbon bearing zones over a 600-m interval, Niko said.

The partners already have discovered several trillion cubic feet of recoverable gas on the block, and the well results “have a significant impact on the future exploration potential of the D6 block,” Niko said.

“Hydrocarbons were found in the Pliocene/Pleistocene section, which confirms extension into the deeper water of the geologic environment, which contains all the hydrocarbons discovered to date in D6,” Niko said.

“Further, the deepest discovered hydrocarbons were found in the older Miocene interval and marks the first time hydrocarbons have been discovered in this time period. This opens up significant additional new exploration potential in the deeper water portions of D6.”

Premier, Shell plan wildcat off Pakistan

A consortium led by operator Shell Development & Offshore Pakistan BV plans to invest more than $40 million to drill an exploratory well on Block 2365-1 on the Indus E deepwater oil exploration license off Pakistan. The license area is in the Indus basin 150 km south of Karachi.

Shell will drill the well by the next weather window, according to Premier Oil Pakistan Offshore BV. Shell holds a 47.5% interest in the license and Premier, 23.75%. Other partners are Islamabad-based Kufpec Pakistan BV, 23.75%, and Government Holdings (Pvt.) Ltd., 5%.

Premier Oil’s Chief Executive Simon Lockett said the Shell group’s extensive 3D seismic survey helped delineate a number of prospects on the block (OGJ Online, Oct. 4, 2004). Shell has invested $12-15 million in the project.

Petrobras, Statoil win block off Nigeria

The Nigerian government has awarded an offshore production license to Petroleo Brasileiro SA (Petrobras) and Statoil ASA for deepwater OPL 315 off Nigeria.

The block, in 1,000-2,000 m of water, covers 1,030 sq km in the northeastern region of the Niger River Delta basin near Lagos. Its geological environment is similar to that of giant oil fields such as Bonga and Erha and to conditions found in Abo field, which is on production.

Petrobras will serve as operator. The two partners each received 45% in the acreage, with Nigerian Ask Petroleum System receiving the balance in line with the government’s policy to grant a 10% interest in each block to local companies.

Petrobras and Statoil offered a signature bonus of $180 million. They are committed to drilling four exploration wells.

Total taps FMC for subsea systems off Congo

Total SA let a $115 million contract to FMC Technologies Inc., Houston, for supply of subsea systems for Moho Bilondo field off Congo-Brazzaville. The field, just north of the Angolan border, lies 80 km offshore in 540-740 m of water. FMC will deliver 12 subsea trees and associated structures, manifolds, production control, and intervention systems beginning early in 2007 and completing deliveries by yearend.

“This will be the first deepwater project in this area of West Africa,” said FMC Technologies Executive Vice-Pres. Peter D. Kinnear.

Total is operator of the field, holding a 53.5% interest in a production-sharing contract with the Republic of Congo.

Oklahoma’s Postle field due EOR expansion

Whiting Petroleum Corp. has completed its $343 million acquisition of Postle oil and gas field in the Oklahoma Panhandle, setting the stage for a large carbon dioxide enhanced oil recovery project expansion.

Whiting has signed a 10-year CO2 purchase agreement to support the expansion.

Seller of the field, in Texas County, Okla., 120 miles north of Amarillo, Tex., is Celero Energy LP, Midland. Effective date was July 1.

Postle’s five producing units and one lease cover 25,600 gross acres with 88 producing and 78 injection wells. The field averaged 4,350 b/d of oil and natural gas liquids and 400 Mcfd of gas in the first quarter from Pennsylvanian Morrow sand at 6,100 ft. Two rotaries and 6 workover rigs are at work.

Considered one of Oklahoma’s smaller major fields, Postle was discovered in 1968. The former Mobil Oil Corp. developed it in the early 1960s and unitized it for waterflood in 1967.

CO2 injection started in 1996 in three units on roughly the eastern half of the field, boosting output by 8,000 b/d to more than 11,000 b/d by 1999. Mobil deferred expansion to the other units, partly because of throughput limits at a third party gas processing plant.

Whiting acquired the Dry Trails gas plant in the Celero transaction and is expanding it to 60 MMcfd from 40 MMcfd. Another addition to 80 MMcfd will take place as CO2 projects are expanded.

Whiting also acquired a 60% interest in the 128-mile TransPetco pipeline, which delivers CO2 to Postle from Bravo Dome field in Northeast New Mexico.

Postle, the fifth largest oil-producing field in Oklahoma in 2004, is the only major oil field in the state to have increased production in the last 10 years, notes the Oklahoma Geological Survey. Output has dropped sharply since 1999 but in 2004 was still double the rate of 10 years earlier, according to IHS Energy figures.

South Korean firms make entry into Gippsland basin

Nexus Energy Ltd., Melbourne, has completed its farmout deal with Korea National Oil Corp. (KNOC) and Seoul City Gas Co. Ltd. for the companies’ entry into Nexus Energy’s Gippsland basin permits Vic/P56 and Vic/P49 off Victoria.

The two South Korean companies are earning a total 50% interest in both permits in return for funding the bulk of exploration drilling costs-a total of $15 million (Aus.).

The program will begin with the drilling of a well in November on the Culverin-Scimitar prospect in Vic/P56.

Culverin is a large structure at the top of the Tertiary Latrobe formation, while Scimitar lies directly underneath in deeper Intra Latrobe sediments, analogous to Anzon Australia Ltd.’s Basker and Manta oil and gas discoveries 12 km to the north.

There is potential for the Culverin-Scimitar prospects to spill over the border into Vic/P49. Nexus will serve as the operator.

SOCO wildcat strikes oil off Vietnam

SOCO International PLC, London, said its wildcat well TGT-1X confirmed the presence of oil in sedimentary clastic reservoirs on eastern Block 16-1 off Vietnam.

Drilled on the Te Giac Trang structure, the well was the first on the H prospect, SOCO said. On a drillstem test of Miocene Lower Bach Ho at 2,701-2,760 m, TGT-1X flowed 8,566 b/d of 37o gravity crude oil and 4.86 MMcfd of gas through an 80⁄64-in. choke. An additional 33 m of net pay was not perforated due to limited equipment and time constraints.

A brief test over a deeper Oligocene interval indicated oil shows, but the formation was tight and deemed noncommercial. ✦

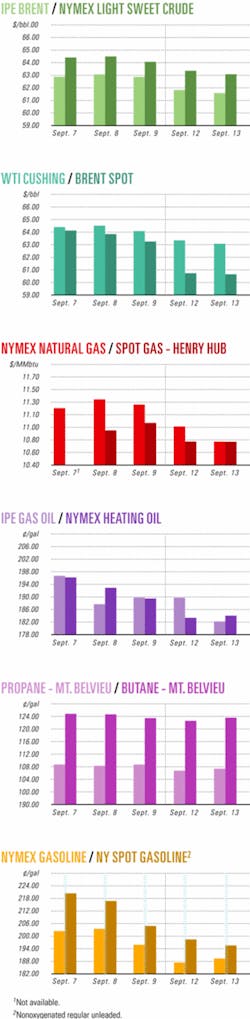

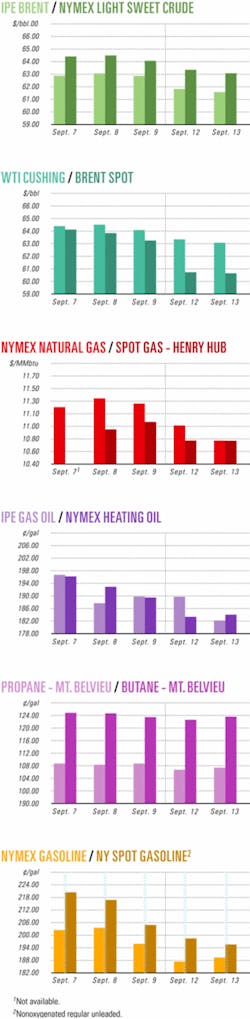

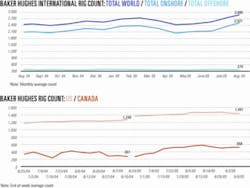

Drilling & Production - Industry Scoreboard

null

null

null

Drilling & Production - Quick Takes

Saturn gas field off the UK comes on stream

Production has started from the first of three wells in Saturn gas field in the UK North Sea, reports RWE DEA UK Ltd.

Initial production is 75 MMscfd. Output will reach 170 MMscfd when all three wells are on stream (OGJ Online, July 29, 2004).

Saturn field is on Blocks 48/10a and 48/10b, 60 miles from the Norfolk coastline. The blocks lie 18 km north of Audrey field, 12 km west of Ann field, and 37 km north of the Lincolnshire Offshore Gas Gathering System (LOGGS).

The Saturn unit comprises the Atlas, Hyperion, Rhea, and Annabel structures. ConocoPhillips is developing Atlas, Hyperion, and Rhea, while Venture Production (North Sea Developments) Ltd. operates the Annabel structure.

Production from the three-well Saturn platform flows to the Theddlethorpe gas terminal through a 14-in. pipeline via LOGGS.

Facilities under way for Falcon basin gas

PetroFalcon Corp., Carpinteria, Calif., said its Vinccler Oil & Gas CA subsidiary is building production and processing facilities capable of handling 20 MMcfd of gas and 5,000 b/d of oil at La Vela field in northern Venezuela’s Falcon basin.

PetroFalcon expects to start gas sales from La Vela into Petroleos de Venezuela SA’s 30-in. ICO gas pipeline in late October 2005 and from Cumarebo field in late 2005 or early 2006. The pipeline is to deliver gas to Paraguana Peninsula refineries.

PetroFalcon also began production testing the LV-9 and LV-10 wells drilled in 2005 and the previously drilled LV-7X well. It plans to resume drilling in Cumarebo and La Vela fields in the fourth quarter.

LV-7X flowed 5.5 MMcfd of gas and 210 b/d of oil from Miocene Pedregoso perforations at 6,804-6,958 ft through a 1⁄2-in. choke with 1,200 psi flowing tubing pressure.

LV-9 indicated production capability in excess of 300 b/d of oil from Miocene Agua Clara perforations at 3,885-3,964 ft. Agua Clara at 3,694-3,754 ft remains to be tested.

An early test at LV-10 of a 107-ft interval in Pedregoso at 7,280-7,612 ft indicated a production rate of 360 b/d of oil and 1 MMcfd of gas with 280 psi flowing tubing pressure.

LV-10 is expected to add a large number of new oil and gas development locations, PetroFalcon said. Completion will continue on more than 144 net ft of apparent pay in the Miocene Pedregoso, Socorro, and Caujarao formations, where logs suggest better quality zones remain to be tested.

Thailand in talks for Myanmar Block A1 gas

Thailand has become another potential market for natural gas from Bay of Bengal Block A1 discoveries off Myanmar (OGJ Online, May 18, 2005).

Thailand’s PTT PLC has begun preliminary discussions with the five-company consortium that holds a production-sharing contract for the block, near the border of Myanmar and Bangladesh, about delivery of 1 bcfd of gas. South Korea’s Daewoo International leads the consortium.

Discussions also include a proposal for PTT’s exploration arm, PTT Exploration & Production PLC, to have a 15% stake in the acreage and field development venture, according to a senior PTT executive.

The gas would be transported to Thailand through a 1,000-km subsea transmission line, estimated to cost $2 billion.

Current data indicate the block holds 13.4-47.3 tcf of gas reserves and can sustain production of 2.1 bcfd for 2 decades.

The PTT executive said that the earliest the gas could be delivered to Thailand is 2012, subject to early conclusion of the gas sales agreement and farm-in deal.

Enterprise set for Cooper basin gas flow

Enterprise Energy NL, Adelaide, has joined the list of natural gas producers in the Cooper basin of South Australia with the signing of its first sales agreement from the region.

The contract is based on production from its 25%-owned Smegsy-1 well in PEL106 about 45 km west of the Moomba treatment facilities. Contracts will be called in October to build a 4-km pipeline link to connect into the basin’s main gas-producing grid. Smegsy is a one-well field.

The agreement provides for the purchase of gas, LPG, and condensate on a flexible production basis for up to 3 years by the Santos-led South Australian Cooper Basin Producers (SACBP). It is the first contract of its type between SACBP and a third party.

Smegsy was found in July 2004. The well flowed on test at rates of up to 8 MMcfd from a Permian Patchawarra reservoir. Production should begin by yearend. ✦

Processing - Quick Takes

Foster Wheeler to design BP delayed coker

BP Oil Refineria de Castellon SA, a unit of BP PLC, let a contract to Foster Wheeler USA Corp. to supply a process design package for a 20,000 b/sd delayed coking plant in Spain. The contract’s value was withheld.

The delayed coker, scheduled for completion in second quarter 2008, is part of BP’s $100 million reconfiguration of its 120,000 b/sd refinery at Castellon de la Plana, Spain (OGJ Online, July 15, 2002).

Foster Wheeler, Clinton, NJ, will provide proprietary delayed coking technology.

Total plans 5-year refining upgrade program

Total SA plans to increase its refining investments to an average €800 million/year during 2005-10, announced Chairman and Chief Executive Thierry Desmarest.

Projects include increasing diesel production over the next 3 years by 3 million tonnes/year. A distillate hydrocracker at the company’s 342,000 b/d Gonfreville plant in Normandy is due on stream in mid-2006 as is a hydrocracker project at the 100,000 b/d Huelva refinery in Spain, which is being implemented by the Spanish integrated CEPSA Group in which Total holds a 45% stake.

Total will continue to upgrade its refineries to 2009 specifications and is conducting an energy reduction program at its sites. There are plans to process more high-sulfur crude at the 225,500 b/d Lindsey refinery in South Humberside in the UK as well as at the 213,000 b/d Donges refinery in France. ✦

Transportation - Quick Takes

Karachi terminal due October dedication

The liquid cargo handling of Karachi’s port will be enhanced by 8 million tonnes/year when a new crude oil terminal is dedicated in October.

The Karachi Port Trust, which constructed the 1.3-billion-rupee terminal in the lower harbor, says the facility is capable of accommodating tankers as large as 150,000 dwt.

The terminal project, inaugurated in March 2003, had been delayed for 6 months by spillage from the Tasman Spirit oil tanker, which suspended construction for 45 days, and by the unavailability of steel (OGJ Online, June 1, 2005).

Currently, Karachi port is handling 16 million tonnes/year of liquid cargo. The new terminal will replace Oil Pier-II, which was constructed in 1966. It was designed to handle products other than crude such as edible oil, tallow, molasses, alcohol, and liquid chemicals.

Facilities at the new terminal consist of a 1,000-ft pier and loading platform that will accommodate 22 common user pipelines through nine loading arms with modern loading and unloading facilities.

Contract let for Bear Head LNG storage

Bear Head LNG Corp., a subsidiary of Anadarko Petroleum Corp., signed a contract worth more than $100 million with Chicago Bridge & Iron Co. for design and construction of storage tanks for an LNG import terminal in Canada.

The Bear Head LNG terminal, planned near Port Hawkesbury on Cape Breton, NS, will serve eastern Canada and the northeastern US.

The project involves a 7.5 million tonne/year LNG terminal with sendout capacity of 1 bcfd. First gas deliveries through the Bear Head terminal are targeted for late 2008 (OGJ, July 25, 2005, Newsletter).

West African gas line installation starts

West African Gas Pipeline Co. Ltd. has begun installation of the 353-mile offshore segment of the West African Gas Pipeline system.

The $590 million project will be the first regional pipeline in sub-Saharan Africa. Gas deliveries are scheduled for December 2006.

The pipeline will transport associated gas 420 miles from Nigeria to Benin, Togo, and Ghana and reduce flaring. Capacity is expected to be 200 MMscfd initially and 470 MMscfd ultimately. The gas is expected to be consumed 85% in power generation and 15% by industry. Use of gas will back out crude oil, charcoal, and diesel (OGJ Online, Jan. 4, 2005).

Gas will flow from a 20,000-hp onshore compressor station near the Alagbado tee at Lagos, Nigeria, to a nearby beachhead and then offshore through a 20-in. pipe typically in 33-75 m of water to Takoradi in southwestern Ghana.

Total lets contract for Indonesian gas line

Total Indonesia has awarded South Korea’s Hyundai Heavy Industries an $86 million turnkey contract for a 55-km subsea pipeline from Sisi and Nubi natural gas field off East Kalimantan, Indonesia, to onshore facilities.

The project, to be completed by 2007, includes engineering, procurement, installation, and precommissioning.

Qatar Gas Transport plans new LNG tankers

Qatar Gas Transport Co. (QGTC) has enlisted international shipbuilders to construct six to eight LNG carriers at a cost of about $230 million each. QGTC expects to lease each vessel to deliver LNG to the UK.

Bids have been issued, winning firms are to be announced next month, and final agreements will be signed in October, QGTC reported. The new LNG carriers will be chartered to Qatargas II, a joint venture of Qatar Petroleum, ExxonMobil Corp., and Total SA.

South Korean shipbuilders Daewoo Shipbuilding & Marine Engineering, Samsung Heavy Industries Co., and Hyundai Heavy Industries Co. will be approached to build the ships, QGTC said. ✦