Iraqi oil-1: Production now a fraction of potential

Studies attempting to quantify Iraq’s oil reserves potential have in the past varied widely.

The Organization of Arab Petroleum Exporting Countries, in a study published by Abdulatif al-Zarouk and Bouys in 1983, estimated reserves to be 19.5 billion bbl. However, C.D. Masters and his US Geological Survey team the same year put them at 56 billion bbl, which they reduced in 1993 to 35 billion bbl.

In 1994, using an empirical mathematical method, this author estimated Iraq’s total reserves potential to be more than 280 billion bbl from oil that could result from the drilling of more than 400 unexplored structures.

Petrolog and Associates, in a joint venture with London-based Centre for Global Energy Studies, in 1996-97 carried out a comprehensive study of “Iraq’s exploration potential, production, capacity, and the economics thereof.” They identified 440 structural anomalies, 224 of which were conservatively considered sufficiently credible to be adopted in the group’s reserves estimate.

Potential reserves were estimated to be 455 billion bbl, which, if discovered at 47.5% exploration success-the average of a 70% initial success rate and 25% end-of-exploration-period rate-would result in 216 billion bbl of potential reserves.

This figure agrees closely with former Iraqi Oil Minister Thamir al-Ghadban’s 1995 reserves estimate of 212 billion bbl and the US Energy Information Administration report of 215 billion bbl in February 1998.

Iraq’s oil resource base

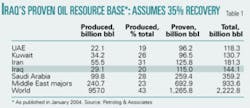

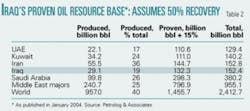

Iraq’s oil resource base may constitute 30% of the five major Middle Eastern producers’ total and some 21% of world total reserves (Tables 1-4).

Generally accepted published reserves and cumulative oil production figures for January 2004 were used in the tables. Potential oil reserves addition has been estimated at 20% for all except Iraq, where Petrolog’s assessment of 216 billion bbl has been used, because the exploration effort in Iraq is in its infancy compared with other Middle East countries.

Reserves figures were used as published and revised by the addition of 15% to adjust for assuming a higher recovery of 50%, which is believed to be well within proven technology today. The tables, therefore, should be viewed not as absolute figures but for comparison.

Generally, a number of conclusions are noted in comparing Iraq’s oil with that of other Middle East producers and with world reserves.

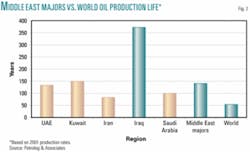

Although Iraq began producing 7 decades ago, its cumulative oil production to date is only 8% of its total oil resource base. This puts Iraq production at or lower than that of the UAE, which started producing 30 years after Iraq began (Tables 3 & 4).

Iraq oil reserves are on par with those of world production leader Saudi Arabia, and its oil resources base is not far behind (Tables 3 & 4 adjust the reserves for potential discovery).

Oil production capacity

Production capacity is a function of existing proven reserves, potential reserves, and the rate at which the latter are discovered. The production-to-reserves (P/R) ratio (annual production divided by the total reserves) is a reasonable yardstick used to gauge likely production capability. Iraq’s historical maximum production rate of 3.5 million b/d represents a 4% annual depletion rate for its published 31 billion bbl of reserves but only 1% of its currently estimated proven reserves of 115 billion bbl.

Iraq, like other major Middle East oil producers, has been producing oil at a low annual reserves depletion rate of about 1%. This practice was a holdover from the concession era when multinational majors held enough reserves to produce much more oil than the market required. The companies, which had a virtual monopoly over oil industry operations in these countries, adopted a low depletion rate in order to maintain a stable crude oil price and at the same time satisfy their host countries.

Later, Iraq’s nationalized industry inherited the practice of low depletion rates from Iraq Petroleum Co. and took upon itself a policy of crude oil stabilization by regulating production through the Organization of Petroleum Exporting Countries.

In the meantime, international oil companies (IOCs) in non-OPEC countries had to establish much higher depletion rates in order to enhance payback and return on their investment, particularly when investing in countries where production costs were considerably higher.

The 2001 depletion rates of the major producers in non-OPEC countries averaged 4.5%. In the UK North Sea, the depletion rate was 18%; in the Norwegian North Sea, 8%; the Russian Federation, 5%; the US, 9%; Canada, 11%; and Mexico, 5%.

Iraq oil potential

Because of Iraq’s currently dire need for capital, it is expected that the country’s present oil reserves will enable production capacity build-up to take precedence for many years over future oil exploration, which will become a secondary priority.

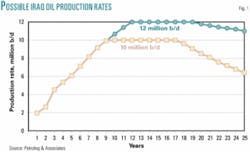

The production life of a field or group of fields assumes a symmetrical, bell-shaped curve, referred to as the Hubbert curve, whose peak at midpoint is followed by an exponential decline. The life of the peak or plateau depends on the size of the proven reserves along with added discoveries to sustain peak production.

Several production scenarios are possible for Iraq to extend its production.

• With proven oil reserves of 115 billion bbl, Iraq should be able to develop and maintain a peak production of 10 million b/d at a P/R ratio of 4-5%. This could be increased to 12 million b/d when potential reserves are developed and plowed in to sustain the peak (Fig. 1).

Adopting a depletion rate for Iraq of 4-5%-well within good reservoir management practice for large fields-would permit Iraq to increase its production rate to a peak of 10 million b/d, maintain that for 9 years, and then allow a natural decline. At the end of 25 years, the production rate would be 6.4 million b/d, but the reserves would have declined to 42 billion bbl from its current level.

• On the same depletion rate basis, Iraq could lift the plateau to 12 million b/d and maintain it for 8 years, provided that 60 billion bbl of additional new discoveries are added. This represents only 28% of the likely potential reserves. The plateau could be maintained for 8 years, as new reserves are added at the rate of 3 billion bbl/year, starting on the seventh year. By the end of the 25th year, production would have reached 11 million b/d, with 88 billion bbl remaining.

Iraq and the other Middle East majors, whose cumulative production thus far is only 22% (Table 3) to 26% (Table 1) of their total reserve resources, will be able to sustain upward production rates for many years. And Iraq can continue its upward production rate to 12 million b/d and beyond when other Middle East majors would have passed their reserve midpoint and started to decline.

Iraq’s oil resource base may constitute 30% of that of the five major Middle Eastern producers and some 21% of total world reserves.

• Restoration and rehabilitation to reach a production capacity of 3-3.5 million b/d could be achieved by 2007, assuming favorable conditions and the return of law and order. Expansion to a production capacity of 5-6 million b/d could occur perhaps by 2014.

The latter capacity would imply that Iraq manages to export at an annual incremental growth rate of about 500,000 b/d, which amounts to about 50% of the world’s annual growth of past years but less than 25% of the bullish recent market, which may continue for the near future.

Transportation

Iraq is an almost land-locked country. Under optimal conditions it has sufficient pipeline carrying export capacity for its medium term needs. The north export system to the Mediterranean has some 3 million b/d capacity. It is split almost equally between the Ceyhan terminal in Turkey, the Banias terminal in Syria, and the Tripoli terminal in Lebanon.

Its current southern pipeline carries 2.8 million b/d, which is divided between 1.6 million b/d at Mina al-Bakr and 1.2 million b/d in Kor al-Amya.

The southern system has an additional 2.15 million b/d capacity that could deliver oil to Saudi Arabia’s Yanbu terminal on the Red Sea. Currently, however, Saudi Arabia is out of reach, with the use of its outlets there denied, and Syria’s partly salvaged system requires rehabilitation to be brought to full capacity.

In the medium term, the pipeline and export system would not be a restrictive factor. A strategic pipeline connects the northern and southern pipeline systems, with a northern flow capacity of 1.5 million b/d and a southern flow capacity of 800,000 b/d.

Limitations

Before it can achieve its production goals, however, Iraq has many limitations to overcome.

It has the need to correct its work philosophy, restructure its oil ministry, and reestablish Iraq National Oil Co.

Because it must plan, build, maintain, and supervise fast-track exploration and development-with or without partnership of IOCs-it must also select a new generation of technical and managerial recruits on the basis of merit and train personnel in advanced technology and management. Realization of this goal may prove difficult, although it is not insurmountable.

Moving from a selective negotiating approach with IOCs to a well-planned and scheduled strict tendering system, with transparency and accountability for oil and gas contracts with local content, is another difficult challenge the ministry of oil must meet.

In addition, Iraq should abandon its confrontational attitude and repair relationships with neighbors Saudi Arabia and Syria and especially ensure a good relationship with Turkey, which can subject Iraq to damage from potential Kirkuk and Kurdish disputes.

Iraq, a founding member of OPEC, rightly adopts its policy of crude oil price stabilization and conservation through control of its oil production and exports. Thus far and perhaps until Iraq production reaches its maximum in recent years of 3.5 million b/d, the country may remain outside OPEC’s production quota.

Thereafter, Iraq would have to choose between price and volume. OPEC’s quota could impinge on Iraq’s open-production policy, especially when there are IOCs that need to produce to optimum capacity to enhance return on investment.

Iraq’s potential oil reserves are of the order of 330 billion bbl. It would take 300 years to exhaust that supply at its rehabilitated production of 3 million b/d, 180 years at 5 million b/d, and 90 years at 10 million b/d (Fig. 2).

In addition to its other challenges, Iraq today is in a state of transition to a democratic, parliamentary and federal state. The transition is proving to be much more difficult and is taking longer than originally visualized. The present stage of drafting a constitution, electing a government, and creating plans and policies may meet with increased resistance and acts of sabotage. The key has been and remains to be in the area of stability and law and order where there is yet much to be desired.

These issues will be addressed in parts 2 and 3 of this series.

Next: Iraq’s successful oil future rests in the reestablishment of Iraq National Oil Co. ✦

The author

Tariq Ehsan Shafiq (tshafiq4 @aol.com) is a petroleum technology and economic consultant with London-based Petrolog & Associates. He also is chairman of Fertile Crescent Oil Co. and al-Mansour Petroleum Co. Shafiq has worked in the oil and gas industry worldwide for 52 years. In Iraq, he was a founder and director of Iraq National Oil Co., of which he served as vice-chairman and executive director during 1964-67. Prior to that, he served with Iraq Petroleum Co. in various technical capacities in Iraq and London during 1954-64, including as head of petroleum engineering in 1963-64. He also worked with M.W. Kellogg Corp. on construction of the Dora refinery in 1953-54. Shafiq has a BS in petroleum engineering from the University of California-Berkeley.