DRILLING MARKET FOCUS: Drilling assets stabilize offshore northern Europe

Demand for rigs to accomplish planned drilling programs has led to new contract strategies for rigs and rig fleet acquisitions in northern Europe.

Statoil ASA spearheaded an operator-led drilling consortium earlier this year to lock up contracts for mobile offshore rigs. Norwegian investors have both speculated on new build rig contracts, and moved to acquire substantial shares in several drilling contractors. KCA Deutag, a subsidiary of the UK’s Abbot Group, has solidified its position in the North Sea platform rig market through its recently announced intent to purchase Prosafe Drilling Services AS.

North Sea fleets

According to GlobalSantaFe Corp.’s summary of current offshore rig economics, the profitability of offshore rig rates in the North Sea has been the highest in the world for 6 months. The North Sea SCORE for June 2005 was 86.3, up nearly 15% from the previous month and increasing nearly 99% from June 2004.

The SCORE compares profitability of day rates to those of 1980-81, when the SCORE averaged 100 and new contract day rates equaled operating costs plus $700/day profit per $1million invested.

The worldwide SCORE for June 2005 was 75.6, up 9.2% worldwide from the previous month and up 69% from June 2004. In the past 5 years, the worldwide SCORE has increased only 154%, while the North Sea SCORE has increased 322%.

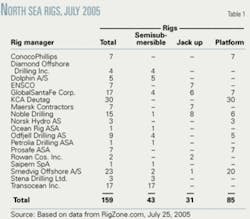

According to RigZone, 152 of 159 rigs (96%) are operating in the North Sea, including 43 semisubmersibles, 31 jack ups, and 85 platform rigs (Table 1). Transocean Inc. controls the largest share of the semisubmersibles in the North Sea (17), followed by Dolphin A/S (5), Diamond Offshore Drilling Inc. (4), GlobalSantaFe Corp. (4), Odfjell Drilling AS (4). Noble Drilling (8), ENSCO (7), and Maersk Contractors (7) control most of the jack up rigs. KCA Deutag (30) and Smedvig Offshore A/S (20) control the majority of the platform rigs.

According to the Baker Hughes International rig counts for July 2005, there were 53 rotary rigs drilling off Europe, 51 of them in the North Sea: Denmark (2), Netherlands (3), Norway (22), and UK (25).

Utilization of semisubmersible drilling rigs in the North Sea is now effectively at 100%. According to Rigzone, between July 2003-July 2005, there have been 28-30 semisubs available in the North Sea. Activity has ranged from a low of 18 rigs contracted (59%, February 2004), to 30 rigs contracted (100%, May-July 2005).

Lehman Bros. analysts see day rates doubling for North Sea jack ups. “Leading edge rates are in the $100,000/day range now for North Sea jack ups, up from old contracts in the $50,000s,” said Angeline M. Sedita.

Norway, Hydro

The Norwegian Petroleum Directorate released its short-term (2005-09) and long-term (2005-25) forecasts on July 20 and July 25.

In the short-term, the NPD expects 40% of the total offshore investments to be spent on drilling development wells (nearly 25 billion NOK). Over the long term, the NPD anticipates a rise in total production until 2008, followed by a decrease of about 3%/year.

Two-thirds of the production during this 20-year period will come from fields already in production or approved for development. An additional 11% will be from improved recovery in the same fields.

Jan Andreassen, a principal engineer and downhole specialist at the Petroleum Safety Authority Norway, sees a need for increased technology commitment in light well intervention (LWI) and pressure control for underbalanced drilling.1 He said, “We now have to drill further out, in prospects...with more difficult pressure and temperature conditions than we’ve been used to.” Well problems and the risk of well kicks “are among the principal challenges” on the Norwegian continental shelf (NCS).

LWI solutions might include ships fitted for wireline work to replace conventional drilling rigs for subsea workovers.

Norsk Hydro Produksjon AS experimented with several advanced drilling technologies to develop thin reservoirs in the giant Troll gas field. Hydro has drilled more than 100 wells, including 35 multilaterals in the Troll West field. In May 2004, the first 5-branch multilateral well came online offshore Norway, tied back to Troll C. Hydro uses “barefoot” branches without standard completion equipment, to exploit small accumulations economically.2

Troll is among seven major projects planned on the NCS; the others are Åsgard, Ekofisk, Snøhvit, Snorre, Heidrun, Oseberg, Grane, Valhall, and Visund.

Looking ahead, Norsk Hydro expects drilling on the NCS in 2005 to be double that in 2004, to realize drilling plans delayed by the strike in 2004 (see below), and to test new acreage acquired in recent licensing rounds. Hydro anticipated more than 30 wells being drilled.

Norway, Statoil

Statoil said that it had contracts to cover its 2005 drilling program, but the rig strike, bad weather, and technical problems had delayed its overall program. Statoil operates the Troll East field, among others.

In July, Statoil announced plans to develop the Tyrihans field in the Norwegian Sea for about $2.1 billion. Subsea wellheads will connect via a heated pipeline to the Kristin platform, about 20 miles away. Statoil has a 3-year contract worth 2 billion NOK for the Transocean Arctic semisubmersible rig for drilling and completions work at the Tyrihans field.

The Tyrihans South field was discovered in 1983 during exploratory drilling with the Dyvi Delta semisub (now Odfjell’s Deepsea Delta), and an appraisal well was drilled with the Stena Don semisub in 2002.

The Tyrihans North field was discovered during exploratory drilling with the Dyvi Delta semisub in 1984 and an appraisal well was drilled from the Byford Dolphin semisub in 1996.

Statoil is drilling on the Norwegian shelf with the Borgland Dolphin semisub, and has exercised its option for a $68 million, 12-month extension beginning Dec. 31, 2005 to drill in the Tampen area.

In February, the NPD said that operators planned to drill 25-35 exploration wells on the Norwegian continental shelf this year, but warned that a rig shortage was likely and it would affect their ability to realize the drilling plans. The NPD said that the 2004 resource replacement rate was only 8% for the year. According to the US Energy Information Agency, drilling activity on the NCS in 2004 was the lowest it had been in a decade. Only 17 wells were drilled on the NCS in 2004, partly due to an extended rig workers strike.

Norway on strike

The Norwegian oil industry has been plagued with strikes.

In June, the Lederne union, representing management and supervisors, threatened a strike by as many as 541 members on Statoil platforms. Late on June 21, the union reached an agreement with the Norwegian Oil Industry Associated.3

Three unions represent offshore workers in Norway: OFS, NOPEF, and DSO. In July 2004, OFS called a strike after it failed to reach an agreement with the Norwegian Shipowners Association, which represents rig owners in Norway. The strike affected Statoil ASA, Norsk Hydro, Transocean Inc., Odfjell Drilling AS, Dolphin AS, PGS, and Smedvig Offshore AS. According to the Norwegian Shipowners Association, the strike cost companies about $119 million as of early October.4

Bjoern Tjessem, deputy leader of the Federation of Oil Workers’ Unions said the strike was over job security, because rig owners were hiring contract workers outside the country. “The rigs are filled with foreign contractors at the same time there are several hundred jobless ex-Norwegian workers,” he said.4 The 4-month work stoppage on the NCS finally ended on Oct. 25, 2004, after the government demanded compulsory arbitration to halt the strike.

OFS had called a prior strike in September 1997 that affected about 500 workers on rigs and support vessels on the Norwegian continental shelf. OFS had 800 members on 20 floating systems at the time.

Norway, projects

In the first 7 months of 2005, five wildcat and three appraisal wells were completed off Norway by Hydro (three), Statoil (two), ENI (two), and Shell (one). Two additional wells were spudded in June, by Statoil and Hydro.5

In late June, Norway’s Ocean Rig AS notified the Petroleum Safety Authority Norway (PSA) that the company would not maintain the Acknowledgement of Compliance (AoC) system for its Leiv Eiriksson semisubmersible. Without an active AoC, the rig will not be allowed to operate on Norwegian Shelf. The PSA granted an AoC to the Leiv Eiriksson on April 15, 2002, although the system was not mandatory for mobile drilling facilities until Jan. 1, 2004. Pride International Inc. manages the rig.6

The Leiv Eiriksson is currently drilling six wells off Angola. In late June, Total E&P Angola extended the contract for a year, at a rate of about $370,000/day.

Ocean Rig’s Eirik Raude semisub continues to operate off Norway. In June, the rig finished drilling the Obelix wildcat (69 days) for Norsk Hydro off Finnmark, in 394 m water depth. The Eirik Raude also drilled the Guocva well for Statoil.

On July 22, the PSA announced that it gave Norsk Hydro consent to use the Bideford Dolphin semisubmersible for drilling four production wells and two injection wells at Fram Øst, as well as a production well at the Fram Vest field on the Norwegian shelf. Dolphin AS, a subsidiary of Fred Olsen Energy ASA, owns the rig and announced Hydro’s letter of intent for the 9-well, 19-month drilling program in October 2004.7

Seadrill, Seatankers

John Fredriksen, the chairman, CEO, and president of Frontline Ltd., the world’s largest tanker company, appears to be building a new power in the offshore drilling rig market. Fredriksen’s Cyprus-based Seatankers Management Co. Ltd. has two jack ups under construction in Singapore, one at Keppel FELS and the other at the PPL shipyard, to be delivered in third-quarter and fourth-quarter 2007, respectively.

Seatankers also has two semisubmersible drilling rigs under construction at Jurong Shipyard in Singapore, a wholly owned subsidiary of SembCorp Marine. The contract to construct the sixth-generation Friede & Goldman ExD rigs is worth $780 million.

Fredriksen also controls publicly-traded SeaDrill Ltd., based in Bermuda. According to MarineLog.com, Seatankers will give SeaDrill the right to acquire the two F&G semisubmersibles.

SeaDrill manages five drilling rigs, and will probably assume control of the two jack ups under construction for Seatankers. SeaDrill has also been consolidating its interests in several Norwegian companies.

On June 20, SeaDrill announced its purchase of 23.38% of Bergen-based Odfjell Invest ASA, which controls Odfjell Drilling AS, a contract drilling company operating nine offshore rigs (four semisubs, five platform rigs) in the North Sea. Odfjell also has two KFELS Mod VB jack ups under construction at Keppel FELS in Singapore and holds an option for a third. Odfjell’s Deepsea Ambassador jack up will be delivered April 2006 and the Odfjell II in second-quarter 2007.

Also on June 20, SeaDrill purchased 6.69% of PetroJack AS, a Norwegian company with an interest in two new jack ups under construction at Jurong and an option for a third rig. Petrojack I will be delivered in May 2007 and Petrojack II in January 2008 (OGJ, July 4, 2005, p. 55).

In mid-July, SeaDrill announced that it had purchased 24.5% of Stavanger-based Ocean Rig ASA from various investors for 1.39 billion NOK. Ocean Rig owns two fifth-generation, harsh-environment, Bingo 9000 class semisubmersibles, the Leiv Eiriksson and the Eirik Raude.

On July 22, SeaDrill announced that it had acquired between 32% and 37% of Indonesia’s PT Apexindo Pratama Duta Tbk for as much as $65 million. Under a newly signed memorandum of understanding, SeaDrill will use Apexindo to market and operate SeaDrill’s offshore rigs in the Middle East and Asia.

Denmark

According to the Danish Energy Authority, only four exploration and appraisal wells have been completed off Denmark this year, all with ENSCO jack up rigs.

ConocoPhillips Petroleum International Corp. Denmark (30%) drilled the Hejre-2 well with the ENSCO 101, completed in February in 68 m water. Partners included Petro-Canada (25%), Norsk Hydro (25%), and Danish Oil and Natural Gas (DONG) E&P A/SE (20%).

State-owned DONG then drilled the NA-7 well with the same rig, completed in May. DONG also used the ENSCO 70 to drill the Sofie-2 well and 2A sidetrack (58 m water depth; completed in January) and the Sissel-1 well (58 m water; completed in March). Partners in the Sofie-2 and Sissel-1 wells included Paladin Oil Denmark Ltd. (30%) and Denerco Oil A/S (20%).

Most of the drilling during the year has been production wells, detailed in the monthly drilling overviews issued by the DEA. Jack up rigs operating in the Danish sector this year include the Noble Byron Welliver, Maersk Endeavor, and the Maersk Exerter, for Maersk Olie og Gas AS. Overall, 11 production wells were drilled in five fields off Norway: Halfdan, Dan (three wells in each); Sif, Nini (two wells in each); and Tyra (one well) during the first-half of the year.

Maersk has three other jack ups drilling off Norway, and one in the UK North Sea.

As of July, the ENSCO 70 and 101 moved to the UKNS from Denmark, but the ENSCO 71 jack up came to Denmark to serve as an accommodation vessel for Maersk.

Although detailed well information is normally confidential for 5 years in Denmark, the confidentiality period is limited to 2 years for licenses granted in the first licensing round or later. Information from released wells is available through the Geological Survey of Denmark and Greenland (GEUS).

UKNS

ENSCO had six jack ups drilling in the UKNS in July, for ConocoPhillips (three), BHP Billiton Petroleum Great Britain Ltd., British Gas, and Centrica PLC.

GlobalSantaFe reactivated its column-stabilized Arctic II semisubmersible for the North Sea market after the rig had been cold-stacked since May 2003. It’s one of four midwater-depth semisubs owned by GSF, photographed recently at Invergordon, Scotland (Fig. 1).

The Arctic II is one of five Friede & Goldman L-907 enhanced Pacesetter design semisubs owned by GSF. Sweden’s Gotaverken Arendal AB built the rig in 1982. The Arctic II is scheduled to drill a well in August in the UK sector of the North Sea, under a $165,000/day turnkey contract with new independent Endeavour International Corp. Endeavor announced its $30 million 2005 capital expenditure program in March. In addition to the UKNS well, it has allocated about $8 million to drill as many as nine wells on its Njord and Brage interests in Norway.

The Bredford Dolphin semisub was drilling in the UK North Sea for Total UK Ltd. in May-June, and began a contract with Peak Well Management Ltd. in July, including a 30-day, single well extension for $4.35 million.

Total SA has been drilling a highly deviated, high-temperature (200˚ C.), high-pressure (1,100 bar) well at the Glenelg gas field in the central North Sea since early in the year. Rowan’s super Gorilla V jack up is being used for the Glenelg drilling, with a planned TD of 5,500 m, under contract to Total for about $130,000/day until December of this year (Fig. 2).

In July, Glenelg drilling interrupted gas flow from the neighboring Elgin and Franklin fields, which produce about 15.5 million cu m/day of gas. In a July 20 news release, the company anticipated repeated production interruptions into 2006, until the Glenelg well is completed.

In April, Glenelg project leader and senior drilling engineer Yannick Marcillat of Total E&P (UK) PLC gave a presentation on the engineering issues faced in the Glenelg well for the Northern Group of Professional Engineering & Technology in Aberdeen (PET Scotland).

The Glenelg 29/4d-4 discovery well was drilled in 1998-99 with the Transocean Nordic jack up. Glenelg is a tilted fault block structure in the Central Graben area and the reservoir is Upper Jurassic Fulmar sandstone, found below 5,400 m. Glenelg partners include Total, BG Group PLC, Eni SPA’s UK unit, Ruhrgas AG, and Gaz de France.

More Gorillas

On June 3, Rowan Cos. Inc. announced that the Gorilla VII cantilevered jack up would be released from work in the Ardmore oil field, in the UK North Sea, due to the insolvency of operator Tuscan Energy (Scotland) Ltd. (OGJ, June 20, 2005, p. 9). Ardmore was the first offshore field developed in the UK sector of the North Sea, which began production as the Argyll field in 1975, and was later abandoned in 1992 after producing 73 million bbl oil. The Gorilla VII began working in the field (renamed Ardmore) in mid-2003, and Rowan reduced the day rate in March 2004.

As of June 2005, Rowan had received $74 million from Tuscan, with $19.7 million still outstanding. According to Rowan’s Bill Provine, the rig finished shut in and abandonment procedures at Ardmore and was at the Dundee docks on July 25.

On June 27, Rowan announced that Maersk Oil & Gas AS snapped up the Gorilla VII under a new 1-year contract to work in the southern North Sea, estimated to be worth $65 million, beginning August 2005, with an option for a second year extension. According to Rowan’s July 20 fleet report, the day rate is in the low $180,000s, up from about $120,000/day. The new contract includes a 9-month minimum work commitment. Provine told OGJ that the rig will be on location off Denmark by the first week of August (Fig. 3).

Three other Gorilla rigs are under contract in the Gulf of Mexico. The Gorilla VI is working in the Grand Banks area off Newfoundland for Calgary-based Husky Energy Inc. This is the first jack up allowed to drill on the Grand Banks, due to a better understanding and control of ice flow in the area.

David R. Taylor, vice-president of exploration with Husky Energy, discussed the project in a “Husky World Overview” at the Newfoundland Ocean Industries Association (NOIA) conference in St. John’s, Newf. in late June. Husky holds 11 exploration licenses off Canada’s east coast. In 2004, Husky spent $539 million (Can.) on east coast and frontier projects, accounting for about 25% of its upstream budget. In 2005, the company plans to increase this to $556 million (Can.).

The Gorilla VI will be working at several shallow-water drill sites (about 120 m deep) in Husky’s Jeanne d’Arc basin drilling program. The company plans to drill two wells and has an option to drill a third.

The first well is the Lewis Hill prospect in the South Whale basin, south of the Avalon Peninsula, in which Husky has 100% working interest. According to the Canada-Newfoundland Offshore Petroleum Board, the Husky Oil Lewis Hill G-85 well spud on July 11. The second well is a delineation well planned in the White Rose field. Each well will require about 40 days to drill and 20 days to test.

The Gorilla VI was towed from Louisiana to Nova Scotia aboard the Mighty Servant heavy lift vessel, arriving in Halifax Harbor in late June. ✦

References

1. Rasen, B., “Focus on Technology: No more dream wells,” Norwegian Continental Shelf magazine, No. 1, Apr. 20, 2005, www.npd.no.

2. Rasen, B., “The Troll field: A bit of a triumph,” Norwegian Continental Shelf magazine, No. 1, Apr. 20, 2005, www.npd.no.

3. Mellgren, D., “Talks avert Norwegian oil field strike,” June 21, 2005, MaconTelegraph.com, www.macon.com.

4. “Wider Norway Strike To Cut Output 55,000 B/D,” Oct. 7, 2004, www.rigzone.com.

5. Norwegian Petroleum Directorate, www.npd.no.

6. “Ocean Rig ends AoC updates for the Leiv Eiriksson,” Petroleum Safety Authority Norway, HSE News, June 20, 2005, www.ptil.no/English.

7. “New drilling contracts for Bideford Dolphin and Borgland Dolphin,” Scandinavian Oil-Gas Magazine, Oct. 18, 2004, www.scanoil.com.