Energy Policy Act of 2005 leaves US with open issues

After 4 years of frustration, the two US houses of Congress passed the Energy Policy Act of 2005, which President George W. Bush has signed. It is the first piece of explicit energy policy legislation since 1992.

The legislation contains some clear advances in energy policy for the country, including streamlining regulatory procedures for LNG terminals, promoting improvement in electric power supply reliability, and adding some flexibility to gasoline supply logistics. The legislation also authorizes a substantial increase in the Strategic Petroleum Reserve (SPR).

There are other provisions calling for subsidies, tax incentives, and higher standards to promote efficiency, clean coal, nuclear, renewable power, and ethanol, but the legislation fails to substantially modify current energy demand or domestic supply trends, especially for oil.

Historically, legislating energy policy has been difficult because of its complexity and the many conflicting regional, environmental, producer, and consumer objectives. Many options, such as energy taxes, opening the Arctic National Wildlife Refuge (ANWR) in Alaska to drilling, or implementing corporate average fuel economy (CAFE) standards, also require long time horizons before there is a significant impact on the US supply-demand balance.

Any realistic set of policy options would still leave the country with a high degree of import dependence, particularly for oil, but to a growing extent for gas, and with a need to manage vulnerability to supply disruptions.

Although there are no magic bullets, there are policy options beyond those agreed upon in the current legislation that together could make a significant impact on the long-term US energy future.

Currently high prices for energy are not the result of a new supply interruption but of higher demand, driven by strong economic activity that has put pressure on existing supply capability and infrastructure. These high prices create incentives for corrective action, rewarding efforts to expand supply, shift to more efficient uses, and develop alternatives.

At the very least, energy policy should remove roadblocks to their influence. To some degree, the legislation does so. But there is yet a long way to go.

Energy dependence

This year, net oil imports will account for about 58% of total US oil supplies. In the Department of Energy’s most recent long-term energy outlook released at yearend 2004, the reference case projections call for net oil imports as a share of total supply to stay at about the current level through 2010 but then rise to about 65% by 2020 and 68% by 2025.

In volume terms, net imports will rise to 17 million b/d of oil from 12 million by 2020 and 19 million b/d by 2025. These projections suggest that under any realistic set of policies the US will continue to meet over half of its oil requirements through imports. Import dependence per se is not undesirable. Even at current extreme prices, availability of imports holds costs to consumers far below what they would be if the US tried to rely primarily on its own resources to meet its needs.

Import dependence, however, should not be confused with vulnerability to disruption in world oil supplies. Some degree of dependence is unavoidable, but vulnerability to supply disruption need not be.

The SPR

In these circumstances there are two policy objectives that are relevant: encouraging supply diversity to spread risks and having a large inventory of prompt replacement oil available to manage temporary disruptions that history tells us are virtually certain to occur.

Significant progress has been made in recent years in increasing the size of the Strategic Petroleum Reserve (SPR). The new legislation raises the authorized level to 1 billion bbl from the currently authorized level of 700 million bbl. However, while the legislation authorizes the higher level it does not provide funding for doing so. Additional legislation appropriating funds is required to implement the authorization.

There remain significant issues about just when to fill the reserve and when to draw from it. When oil prices are at extreme levels, such as now, and world spare capacity is limited, adding to world demand, even marginally, to build the SPR seems highly questionable. There is an international aspect to the timing of any fill.

Other countries with rapidly rising oil import requirements, especially China and India, are also concerned about supply security and interested in building their own strategic stocks from what are much lower starting points than that of the US. There is good reason to coordinate these efforts as a means of limiting their impact on already-strained markets. Currently, there is cooperation on certain aspects of strategic stocks among countries that are members of the International Energy Agency. But these are mainly industrialized nations, while most of the growth in oil imports, apart from the US, is elsewhere.

While the SPR is set to grow, the question of when and how to draw down from it should be revisited in light of recent history. Reserves were not drawn in response to the sharp curtailment of supplies from Venezuela at yearend 2003 despite the looming prospect of war in Iraq, but limited amounts of oil were withdrawn in response to smaller, more immediate, hurricane-related losses of Gulf of Mexico production last year.

While the SPR should never be used lightly, reserving its use only for major world supply crises may be too limiting. In a world of limited spare capacity and a secular downtrend in commercial stocks, even modest supply losses can have dramatic effects on the world oil market. In such circumstances, a somewhat more activist policy may be called for.

US oil production

The latest energy legislation contains incentives in the form of royalty relief for certain types of oil and natural gas production, in particular production from marginal properties-those with average production of less than 15 b/d of oil or 90 MMbtu/d of gas, production from water greater than 400 m deep, production using CO2 injection, and production from deep gas wells in shallow waters and from gas hydrates. With oil and natural gas prices at extreme levels, it’s hard to argue for further incentives.

However, explicit and potential royalty relief provisions are designed to share low-price risks rather than to add further to current market incentives. In the case of marginal properties, relief applies only if the price of West Texas Intermediate oil is less than $15/bbl (to be adjusted for inflation), or if the gas price at Henry Hub averages less than $2/MMbtu for 90 consecutive trading days, far below current prices.

Other royalty relief provisions have production volume limits from any lease, except for deep gas, thereby capping the total relief available. They also state that the secretary of the interior may place limitations on royalty relief “based on market price.” The use of the word “may” leaves uncertain what will in fact happen, but the case for some price-related limitations is strong in light of current price levels.

These steps would appear to have little influence on oil production. US oil production has been declining since the early 1970s. In 2004, US crude production averaged 5.4 million b/d, down by about 3.8 million b/d or 40% from its level in 1973, the year of the Arab oil embargo and the first drastic increase in oil prices.

DOE’s latest Annual Energy Outlook reference case projection envisions a 1%/year decline in crude production during 2003-25, with the period divided between a slight increase to 2009 followed by renewed declines.

Given this history and the projections for the world’s most intensively explored country, the chances of the US achieving a drastic cut in imports through a turnaround in oil production appear close to zero under any conceivable set of policies.

But supply-oriented policy is important. The US oil production decline since the early 1970s would have been much worse without the implementation of critical policies regarding the Alaska pipeline and the opening of broad areas of the deepwater Gulf of Mexico to exploration and development.

Currently, production from the deepwater gulf and Alaska’s North Slope are contributing about 2 million b/d-more than one third of total US crude production. However, actual and potential contributions from the two areas as they now stand are limited.

In the deepwater gulf, oil production is still rising, but the fields tend to have high production flows and high depletion rates. Moreover, most of the deepwater areas of the central and western sections have already been leased. Only the eastern section remains as a potential new frontier area, although it is subject to intense opposition similar to that which characterizes the ANWR debate.

The new legislation calls for a “comprehensive inventory of OCS oil and natural gas resources,” with the first report on the inventory, including an analysis of “restrictions or impediments” to development, within 6 months of enactment.

Alaska production

North Slope production has been in decline since the late 1980s despite achievements to date in sustaining production.

The initial Prudhoe Bay discovery in 1968 was estimated to contain 9.6 billion bbl of oil. As of 2003, the field has produced nearly 11 billion. Some 27 years after the start-up of production, it is still producing at about 400,000 b/d-substantial although well down from its peak of 1.6 million b/d.

The existence of the Trans-Alaska Pipeline System, however, and its developing spare capacity, has allowed the development of other, smaller North Slope fields that have helped limit the overall decline in North Slope production. This process is continuing, with about 160,000 b/d of production in 2003 coming from fields first brought into production in 2000-01.

Policy decisions are still critical for future Alaskan production. Policy in recent years has moved in favor of expanded leasing in the promising National Petroleum Reserve-Alaska (NPR-A). DOE already includes expanded production from this source in its long-term energy outlook.

The area, designated Naval Petroleum Reserve No. 4, has long been considered a significant oil prospect. Following the 429 million bbl Alpine oil field discovery near the NPR-A, a new federal lease sale was held in 1999. Five wells drilled during 2000-01 encountered oil and gas.

Early last year, the George W. Bush administration announced a plan that would open about one third of the NPR-A to leasing and revised rules limiting activity in the northeastern area. That plan has been challenged in the courts although with far less intensity than with ANWR.

The latest legislation also calls for the secretary of the interior to conduct competitive leasing of oil and gas in the reserve and provides for royalty and rental relief where necessary to promote development.

The most promising prospect for new North Slope production is the northern coastal area of ANWR referred to as Section 1002, where the most recent US Geological Survey (USGS) mean value estimate of recoverable reserves on the federal part is nearly 8 billion bbl.

This is slightly below the mean value estimate for the federal part of the NPR-A of about 9 billion bbl, but ANWR reserves are concentrated in a much smaller area-1.5 million acres vs. 22.5 million.

Because of greater reserves concentration, economic recoverability of ANWR reserves would be far less dependent on high oil prices, and presumably the environmental footprint involved in bringing the oil to market would be much smaller. USGS estimates that, at $25/bbl delivered to the West Coast market, economically recoverable reserves from ANWR federal areas would be 5.6 billion bbl vs. 3.7 billion for the NPR-A.

The timing of ANWR production also would coincide with declining production from the older North Slope fields, helping to maintain use of the existing pipeline.

Under current law, no leasing within ANWR can be undertaken without authorization from Congress. Although the original House version of the energy bill authorized leasing within ANWR, the Senate version did not, and the provision was dropped in conference.

However, authorization was included in the filibuster-proof Senate budget resolution passed in March, surviving by a two-vote margin an attempted amendment to delete the authorization. It thus could still win Congressional approval.

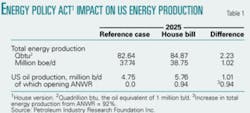

In an analysis of the House version of the bill released in July, DOE found that opening ANWR would have by far the largest positive impact on long-term US energy supply (see table).

The opening of ANWR would account for 0.94 million b/d, or about 92% of the increase in total US energy production. Eliminating ANWR effectively removed nearly all the potential energy from the final legislation.

Containing demand

Over the past 10 years, net oil imports have risen by about 4.2 million b/d or 53%, with 1.7 million b/d of the increase coming since 2000. These increases are much larger than the declines in domestic oil supplies for the same timeframes-about 0.6 million b/d and 0.25 million b/d respectively-with the differences reflecting the more substantial impact of higher demand on US import growth. A number of elements impact demand:

• Gasoline. Among the major products, gasoline stands out, with current demand almost 1.5 million b/d, or nearly 20%, above its 1995 level. About half the increase has come since 2000. The components of gasoline demand growth are well known: stagnation at about 21 mpg for the US light-duty vehicle fleet, aided by a rising market share for light trucks-minivans, vans, sport utility vehicles (SUVs), and pickup trucks-continued growth in vehicle ownership, and growth in miles driven per vehicle. Strong income gains in recent years have encouraged these trends, although the extremely high fuel prices seen this year are provoking changes.

The latest legislation contains no direct provisions to raise current CAFE standards-currently 27.5 mpg for new passenger cars and 20.7 mpg for light trucks. The light truck standard was raised to 21 mpg for the 2005 model and 21.6 mpg for the 2006 model.

CAFE standards set only a fuel efficiency floor, with no real incentives for improvement. Changes in CAFE standards impact overall gasoline demand only when the new vehicles subject to stricter standards are absorbed into the fleet-a long-term process. New vehicle sales amount to about 7.5% of the existing fleet. The median age of automobiles-where half the fleet is older and half younger-is about 9 years, and for light trucks, about 8 years.

Moreover, current CAFE regulations have had some perverse effects, especially regarding alternative fuel vehicles. The Alternative Motor Fuels Act of 1988 provided an incentive for vehicles capable of using alternative fuels, whether they actually used the alternative fuels or not.

As of 2003, there were about 5.5 million alternate fuel light-duty vehicles on the road, of which about 90% were gasoline vehicles with ethanol capability, and most were SUVs. Yet only minimal amounts of the ethanol fuel E85-a blend of 85% ethanol and 15% gasoline-were actually used.

The new legislation calls for a review of the program, including the amounts of alternative fuels actually used by the alternative fuel-capable vehicles and actual amounts of petroleum displaced. There clearly is room for adjustments in the CAFE program.

The new law does include tax incentives for advanced fuel cell, hybrid, and lean burn vehicles that link the amount of the credit and improvements in miles per gallon. There also is a provision for grants to encourage domestic production of efficient hybrids and advanced diesel vehicles.

• Diesel. The act calls on the secretary of energy to speed efforts to develop and demonstrate technologies that will enable diesel vehicles to meet the current Tier 2 emission standards for passenger vehicles and the 2007 standards coming into effect for heavy-duty vehicles.

• Taxes, high fuel prices. While CAFE standards were at least debated within Congress, higher gasoline taxes were not. The federal gasoline tax of 18.4¢/gal was last raised by just over 4¢/gal to its current level in October 1993, with part of the increase dedicated to deficit reduction.

Higher taxes, flowing into government coffers, would raise the cost of driving the current fleet of vehicles, especially the least fuel-efficient, and encourage new-car buyers to choose more fuel-efficient vehicles.

For consumers, the current impact of the extremely high gasoline prices is similar to that of a tax, and there have already been noticeable effects. New passenger vehicle sales data through May showed a slight gain in market share for cars as opposed to light trucks, with sales of light trucks down by about 2% vs. the first 5 months of 2004. The declines were concentrated in the large SUVs, where sales were off by about 20%.

These trends were reversed in June as auto manufacturers countered with heavy discount campaigns. Nevertheless, year-to-date sales of hybrids through June reached almost 93,000, about 2.5 times the 36,000 units sold in the first 6 months of 2004.

These expected shifts are modest compared with the changes in fuel prices that influenced them. Retail gasoline prices for the first 6 months of this year are up 15% vs. the same period last year and 30% vs. the first 6 months of 2003.

When gas prices are at record levels, higher gasoline taxes may look particularly unappealing to the public. But if and when prices fall back, the issue could be reconsidered.

The federal gasoline tax has fallen by about 25% in inflation-adjusted terms since late 1993. Moreover, higher ethanol use also is reducing revenues from this tax.

Ethanol and MTBE

Actions taken in the last few years by California, New York, and Connecticut to ban methyl tertiary butyl ether (MTBE) have complicated an already complex distribution system for gasoline. MTBE had been the most widely used oxygenate for satisfying the federally mandated minimum 2.1% by weight oxygenate for reformulated gasoline.

Although the required emissions characteristics of reformulated gasoline can be met without oxygenates, the federal government’s requirement meant a surge in demand from both coasts for ethanol, which is produced almost entirely in the Midwest and has special logistics requirements. It must be shipped separately, blended at the terminal rather than at the refinery, and shipped as part of the gasoline barrel.

While reformulated gasoline can be made without oxygenates, short-term supply limitations and cost factors for the alternatives would have meant a substantial role for ethanol in any case.

Thanks to strong increases in fuel ethanol production, up nearly 60% during 2002-04, feared potential shortages failed to materialize. The anticipated higher costs of the shift to ethanol have been overshadowed by the escalation in oil and gas prices.

The new legislation eliminates the oxygenate requirement for reformulated gasoline, adding needed flexibility to the current supply system.

In the act, it was noted that the fuel industry had made substantial investments in MTBE production and distribution systems in direct response to the federal oxygenate requirement, and it allows claims related to MTBE contamination to be moved to Federal District Court.

The issue of defective product was a source of conflict between House and Senate bills. The initial House version and the failed 2004 legislation provided a safe harbor from defective product claims filed after a certain date for MTBE and renewable fuels, provided there was no violation of an EPA control or prohibition.

The House bill stated clearly that protection did not apply against other claims, including negligence or liability for environmental remediation. The rationale for this treatment was that MTBE and renewable fuels were required to meet the federally mandated minimum oxygenate requirement, and that Congress understood this at the time the mandate was enacted.

The provision was not included in the Senate version of the bill. The act also dropped provisions that would have provided for a federal ban on MTBE use.

Oxygenate mandate out

The elimination of the oxygenate mandate, effective immediately after enactment in California and 270 days later elsewhere, and the denial of product liability protection create a problem for current producers, importers, and distributors of MTBE and gasoline blended with MTBE.

The elimination of the mandate removes the key defense against product liability lawsuits and raises legal risks for those continuing to be involved in its supply chain. The result could be a more rapid decline in MTBE availability-currently about 150,000 b/d-and near-term price pressures on both the supply of alternatives and on gasoline itself. Imports of gasoline blended with MTBE also are at risk.

While imports in the form of unfinished gasoline could go up, there would still be a need to find the substitutes, and have in place the logistics system to deliver them for blending. In a tight market, the net loss of 50,000-100,000 b/d of supply during the transition period could have a large, if temporary, upward effect on price.

The final legislation calls for renewable fuel volume in gasoline to reach 4 billion gal in 2006-about 2.8% of the gasoline pool-rising to 7.5 billion gal in 2012, and to maintain its 2012 share of the gasoline pool (about 4.6% of DOE’s reference case 2012 gasoline demand) thereafter.

The legislation also calls on EPA to conduct a study and report within 2 years on the environmental and health effects of increased use of ethanol and other MTBE substitutes.

Tradable credits

In the first 5 months of this year, fuel ethanol production averaged about 240,000 b/d, equivalent to an annual rate of 3.7 billion gal, not far from the 2006 required volume.

Given the inevitability of a mandatory program to promote ethanol, the method chosen has much to commend it. The program allows for tradable credits in lieu of physical per-gallon obligations, allowing the mandate to be fulfilled in the most logistically efficient manner.

The program also provides for the 1-year carry forward of credit deficits and allows temporary program adjustments in case of supply problems. However, with a more rapid than anticipated MTBE rundown, impacted terminal operators, importers, and others who might have planned to buy credits to comply in the near term with the ethanol mandate will be looking for physical volume instead, adding temporarily both to demand, and to pressure on distribution capability.

In effect, the near-term, cost-saving benefits of the tradable credit system will be reduced as a result of the more rapid rundown in MTBE.

With a growing, guaranteed market for ethanol in place, it becomes questionable whether the current federal tax incentives for ethanol-equivalent to more than 50¢/gal of gasoline-are still warranted. This issue is not addressed in the legislation.

In terms of impact on the US energy balance, the updated DOE reference case projects ethanol production during 2010-15 at about 4 billion gal. The 7.5 billion gal requirement for 2012 would amount to an increase of about 225,000 b/d of ethanol supply. However, since the btu content of ethanol is less than the average for gasoline-76,000 vs. 120,000 btu/gal-the savings in oil would be significantly less.

Refinery upgrades

The legislation provides a tax incentive for adding refining capacity, expensing of 50% of the cost of expanding capacity by 5% or more if put in service before 2012. Although refinery margins have been favorable in recent years, there are considerations that would support some incentives.

After years of global surplus, refining capacity, especially for products meeting US specifications, is tight and likely to remain so for several years, raising costs of relying on the world market to make up for domestic product supply deficits.

Moreover, US refiners have to make major investments to meet new mandates for cleaner diesel and gasoline, as well as to conform to tighter air quality regulations. (see p. 19)

To ease problems associated with boutique fuels, the legislation attempts to cap the number of such fuels at their number as of Sept.1, 2004. More importantly, it provides for temporary waivers of restrictions on use of a fuel or fuel additive in cases of “extreme and unusual fuel or fuel additive supply circumstances” and provides legal protection for those acting in response to the waiver.

The potential for problems is not confined to gasoline. Beginning in June 2006, refiners must make available at least 80% of the total pool of on-road diesel with a maximum sulfur content of 15 ppm, well below the current 500 ppm maximum, with all diesel to conform to the new specification by 2009.

Natural gas

Congress has the least difficulty reaching agreement on policy matters affecting natural gas. Most gas consumed in the US is produced here, while most imports come from Canada. But the gas market is changing, and greater policy attention must be directed to supply concerns.

Henry Hub spot gas prices averaged well below $3/MMbtu in the second half of the last decade, but in the first half of this decade supply limitations have caused a sharp price escalation averaging close to $7/MMbtu for the first half of this year and created spot spikes to levels far above these near-wellhead prices.

Rising imports have helped compensate for stagnant US production, with net imports rising to about 20% of total supply today from 14% in 1995.

However, imports from Canada, which supplied 99% of total US gas imports in 1995, have slowed dramatically. Imports, which grew by about 25% during 1995-2000, fell to 2% in 2000-04.

LNG imports are mitigating the impact of slowing growth in Canadian supplies. There appears to be ample LNG supply to meet the global market. The ability of a country to draw on this market depends on the number of LNG terminals and amount of regasification capacity in place to receive it, so policy concerns focus on what can be done to eliminate existing legislative and regulatory roadblocks to LNG imports.

In addition, last October, in the 2005 Military Construction Appropriations Act, Congress provided an expedited regulatory review process for a pipeline to bring about 35 tcf of stranded Alaskan North Slope gas to market. This is the latest USGS estimate of current gas reserves in the central North Slope, where all current oil production is occurring. The USGS estimates there is 37 tcf of undiscovered gas in the same area. All would be accessible to the route of the proposed pipeline. The USGS estimates the NPR-A contains 73 tcf of undiscovered gas and the ANWR 1002 area, another 9 tcf.

While there are still significant risks associated with a project that costs $20 billion and has a 10-year time frame, last year’s congressional action significantly improved the prospects for building the pipeline.

The latest energy policy legislation streamlines the regulatory review process for LNG terminals, which can be brought on line quicker and cheaper than the Alaska pipeline. For the foreseeable future, however, LNG will not have the same supply flexibility as internationally traded oil. Recent market developments, as well as prospective changes in the physical supply environment, suggest caution in relying too heavily on gas to supply the country’s growing energy needs. ✦

The authors

Ronald B. Gold is an energy economist, vice-president of Petroleum Industry Research Foundation Inc. (Pirinc), and a consulting senior advisor to the PIRA Energy Group. He is a principal author of most of Pirinc’s research reports and directs PIRA’s Emissions Market Intelligence Service. Gold previously was company economist and manager of the Energy Outlook Division for Exxon Co. International. Earlier, he worked for the US Department of the Treasury and Office of Tax Analysis and was an assistant professor of economics at Ohio State University. Gold received his undergraduate degree from City University, New York, and his MA and PhD in economics from Princeton University.

John H. Lichtblau is chairman and CEO of Pirinc and chairman of PIRA Energy Group. Lichtblau has served since 1968 on the National Petroleum Council and is a member of the Council on Foreign Relations. He has authored a number of publications and has been a frequent witness at congressional hearings on energy policy and a keynote speaker and lecturer at conferences and seminars. Lichtblau performed his undergraduate work at the City College of New York and graduate study at New York University.

Larry Goldstein is president of PIRA Energy Group and president of Pirinc. He has been a member of the Petroleum Advisory Committee of the New York Mercantile Exchange and a contributor to studies by the National Petroleum Council. He also has served as treasurer of the Scientists Institute for Public Information.