OGJ Newsletter

General Interest - Quick Takes

Japan protests Chinese plans for gas field

The Japanese government has issued a new protest to China over Chunxiao natural gas field in the East China Sea, saying Beijing has the means to start producing from the disputed area.

“We found that possibilities are high that the Chinese side has placed a pipeline and is ready to put it to practical use at any time,” Japan’s Economy, Trade, and Industry Minister Shoichi Nakagawa told a news conference in Tokyo on Aug 10.

“We have protested to the Chinese government through diplomatic channels, but we have not received any satisfactory reply,” Nakagawa said.

Japan claims Chunxiao field might extend into areas to be explored by Teikoku Oil Co. and is concerned about drainage.

In July, China formally protested the decision by the Japanese government to award drilling rights in the area to Teikoku (OGJ Online, July 15, 2005).

PDVSA signs agreements with oil companies

Petroleos de Venezuela SA has signed transitional agreements with eight oil companies to convert their operating service agreements into joint ventures with the government.

PDVSA Pres. Rafael Ramirez, who also is Venezuelan oil minister, signed the agreements Aug. 4 in Caracas. He said negotiations are under way with 14 other companies that must enter joint ventures by yearend (OGJ, Apr. 25, 2005, p. 48).

“Next year, there will not be any operating agreements in the country,” Ramirez told reporters in Caracas.

The eight firms that signed the agreements are involved in 13 oil fields total. The agreements will be valid until Venezuela approves definitive guidelines for joint ventures with PDVSA. Companies also must settle outstanding tax claims before the joint ventures will be considered permanent, government officials said (OGJ Online, Aug. 4, 2005).

Companies signing the agreements include Repsol YPF, China National Petroleum Corp., Hocal (owned by Knightsbridge Petroleum Ltd.), and Harvest Vinccler CA (Venezuelan subsidiary of Harvest Natural Resources Inc., Houston).

Venezuelan companies signing the agreement are Suelopetrol, Vinccler Oil & Gas, Inemaka, and Open.

Six companies win MMS royalty-in-kind oil

Six companies bought 97,265 b/d of royalty-in-kind (RIK) oil from the Gulf of Mexico in an unrestricted sale, the US Minerals Management Service reported.

Chevron Products Co., ExxonMobil Oil Corp., Morgan Stanley Capital Group Inc., Sempra Energy Trading Co., Shell Trading Co., and Plains Marketing Co. received the 6-month contracts, with delivery scheduled to begin Oct. 1.

MMS said the sale included RIK oil previously exchanged to fill the Strategic Petroleum Reserve to its 700 million bbl capacity. The service completed its last exchanges under the administration’s SPR fill initiative in July, freeing a portion of the RIK oil for the unrestricted sale.

The sale also included oil from unrestricted lands off Louisiana, which joined MMS through a memorandum of understanding in a joint federal-state partnership, the federal agency said.

While 98,585 b/d of oil were offered in the sale, bids on a small portion were not accepted after MMS determined that it could achieve a better return by taking the royalties in value (as cash payments), it said.

KeySpan seeks rehearing for LNG upgrade

KeySpan Corp. formally asked the US Federal Energy Regulatory Commission to reconsider its July order denying authorization for an upgrade of the existing Fields Point LNG peaking plant in Providence, RI.

FERC is required to respond to the rehearing request within 30 days with an order either granting or denying further consideration. KeySpan wants to convert the plant from a truck-fed peaking facility to a ship-fed base-load facility.

KeySpan Vice-Pres. David Manning said, “The FERC agreed with much of our reasoning for proposing this project, including the need for energy supply in Rhode Island, the lack of significant environmental impacts (such as dredging), and the lack of environmentally preferable alternatives.”

The Aug. 4 rehearing filing questioned FERC’s assertion that several aspects of the KeySpan upgrade proposal make it unique among LNG projects.

KeySpan pointed out that FERC authorized upgrades and expansions at four other LNG terminals during 1999-2004 without requiring them to satisfy new construction standards mentioned in FERC’s KeySpan order.

Several of those facilities were first constructed and operated in the 1970s, when the Providence LNG facility was built, KeySpan said. ✦

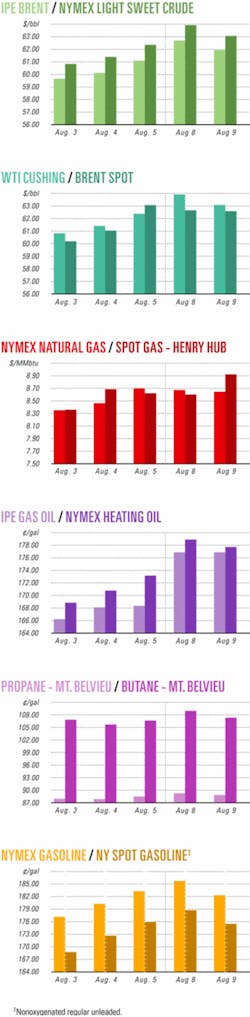

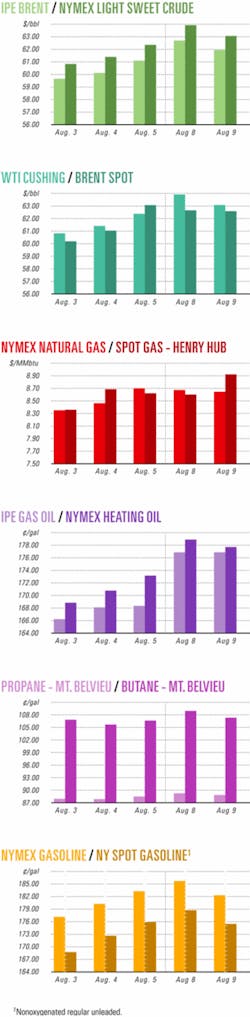

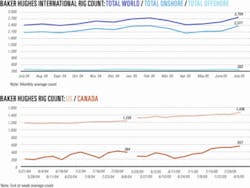

Industry Scoreboard

null

null

null

Exploration & Development - Quick Takes

Indonesia presses Aceh gas find development

The Indonesian government is pressing ConocoPhillips and ExxonMobil Corp. to either develop a large carbon dioxide and methane field in Northeast Sumatra or give up their rights to the block, press reports said Aug. 8.

The companies are 50-50 holders in Block A in Aceh Province along the Strait of Malacca coast, where a ConocoPhillips predecessor discovered Kuala Langsa field in 1992 (see map, OGJ, July 20, 1992, p. 36). Medco Energi International, Indonesia’s largest private oil concern, has expressed interest in participating in the field’s development.

The former Asamera Oil (Indonesia) Ltd. and a partner cut more than 700 ft of net gas pay in Miocene Peutu limestone at 10,825 ft. The Kuala Langsa-1, in the southern North Sumatra basin, flowed at rates of 81-83% CO2 and 17-19% methane. The field is 110 km southeast of ExxonMobil’s Arun natural gas liquefaction and processing plant.

Asamera successor Gulf Canada Resources Ltd. was negotiating to sell 100-120 MMcfd of methane from Block A to international LNG and domestic fertilizer buyers in 1998 before it was acquired by Conoco Inc. in mid-2001. Field size information was not available.

One official said Indonesia offered in May to take 50% of project revenue instead of the usual 70% but had received no response from operator ConocoPhillips. ExxonMobil has offered to sell its interest, he said, and domestic fertilizer plants could take the gas by 2008.

CNPC prepares for drilling in Niger rift

China National Petroleum Corp.’s affiliate in Niger will hold a technical meeting in the fourth quarter to review seismic data and choose drillsites for the 17.3 million acre Tenere Block in the Termit-Tenere rift basin.

The work commitment calls for the drilling of three wells before 2008 (OGJ Online, Feb. 10, 2005).

CNPC International (Tenere) Ltd., with 80% interest, and TG World Energy Corp., Calgary, with a 20% carried interest, reported satisfaction with the quality of 1,687 line-km of seismic data.

CNPC, now processing the data in a purpose-built center in Niamey, shot the survey during Jan. 11-June 18, despite unseasonably severe heat in the Tenere desert. TG World has independently processed certain data in Calgary for purposes of comparison and control.

Most of the acquired data were prospect or lead-specific. Before forming the partnership with CNPC, TG World had mapped 35 closed structures, of which 10 had container size in excess of 500 million bbl of recoverable oil.

Petronas of Malaysia and an ExxonMobil Corp. unit have discovered an estimated 350 million bbl of oil equivalent on the contiguous Agadem Block to the south.

Meanwhile, Sonatrach International Petroleum Exploration & Production Corp. signed an exploration concession in June for the 23,700 sq km Kafra Block north ofTenere. The subsidiary of Algeria’s national oil firm committed to acquire 1,000 line-km of seismic data in the contract’s first 4-year period.

OMV, Ukraine firms to seek Black Sea block

OMV AG, Austria, and Ukrainian oil and gas companies NJSC Naftogas and NSC Chornomornaftogaz have signed an agreement to jointly bid this year for a production-sharing agreement in a Black Sea block off Ukraine.

The area of interest is the Skifska Block, between the Ukraine-Romania border and the Crimean peninsula. Water in this area is 100-2,000 m deep.

NJSC Naftogas and NSC Chornomornaftogaz have worked with OMV since 2002.

Tub-Karagan abandons Kazakh Caspian wildcat

Tub-Karagan Operating Co. BV abandoned the first exploration well on the Tub-Karagan Block in the Caspian Sea off Kazakhstan after drilling to the planned TD of 2,500 m.

The operator ran a full suite of geological and geophysical logs and ran geological and geochemical analyses of core samples, formation fluid samples, and drill cuttings.

“Based on the results of the studies, the well log did not demonstrate any oil and gas-bearing reservoirs and targets of commercial value,” Tub-Karagan said.

The well, drilled from the Astra jack up in a zero-discharge operation, was to have evaluated Jurassic, Cretaceous, and Triassic sediments on the 1,372 sq km block (OGJ Online, Dec. 22, 2004).

Tub-Karagan Operating is a combine of KazMunaiTeniz and Lukoil Overseas, 50% each. ✦

Processing - Quick Takes

US second-quarter petrochemical output down

US petrochemical production in the second quarter was down 3% from the same quarter in 2004 and down 5% from the first quarter of this year, reported the National Petrochemical & Refiners Association (NPRA) in its quarterly inventory survey released July 27.

Total production of 15 petrochemicals surveyed and reportable was 50.4 billion lb in second quarter 2005, down from 51.8 billion lb in second quarter 2004 and down from 53.1 billion lb of the same petrochemicals in first quarter of this year.

Second quarter inventories of the six petrochemicals reportable were 4.2 billion lb, compared with 3.4 billion lb in the second quarter of 2004 and 3.9 billion lb in the first quarter this year.

Petrochemicals surveyed include ethylene, propylene, butadiene, benzene, and mixed xylenes and the largest volume first and in some cases, second derivatives of these petrochemicals.

Veris Consulting LLC conducts the quarterly survey for NPRA.

Upgrader to get UOP hydroprocessing unit

North West Upgrading Inc., Calgary, has selected UOP LLC, Des Plaines, Ill., to design and license a new hydroprocessing unit to upgrade synthetic crude from Canadian bitumen. The unit will be part of an upgrader North West Upgrading is building 45 km northeast of Edmonton in Sturgeon County, Alta.

UOP will design an integrated distillate Unionfining and Unicracking unit to produce a synthetic crude oil blend. The unit will have parallel reactors for hydrotreating 31,750 b/sd of naphtha and distillate-range feedstock and partial conversion hydrocracking 27,200 b/sd of distillate and vacuum gas oil-range feedstock. A common section will stabilize reactor effluent and compress recycle gas.

The first stage of the three-phase project is to be complete in early 2010. It will have a design capacity of 50,000 b/d of bitumen, plus pipeline diluent.

The second and third phases, each having the same capacity, will proceed as markets develop.

Petrobras exporting ethanol to Venezuela

Brazil’s Petroleo Brasileiro SA has shipped 25,000 cu m of fuel ethanol produced from sugar cane to Venezuela’s Petroleos de Venezuela SA under a new long-term contract.

The contract initially involves shipment of about 25,000 cu m/month.

PDVSA is adding ethanol to gasoline in the eastern part of the country. Venezuela recently passed a law phasing out the use of tetraethyl lead to boost gasoline octane.

The Venezuelan government intends to encourage the expansion of sugar cane plantations and the production of fuel ethanol.

Brazil has used fuel ethanol for many years. Last year, about 70,000 Brazilian farmers produced 385 million tons of sugar cane, and the country’s refiners made 4 billion gal of alcohol fuel.

According to the mines and energy ministry, Brazil has around 1 million vehicles running on ethanol blended with gasoline and vehicles that run just on alcohol. This is the second largest such fleet in the world after Argentina’s ✦.

Drilling & Production - Quick Takes

RasGas WHP 5 on stream off Qatar

Ras Laffan Liquefied Natural Gas Co. Ltd. (RasGas) has begun production of 4.7 million tonnes/year of natural gas equivalent from its Wellhead Platform 5 (WHP 5) on Ras Laffan Block B in North field off Qatar.

The gas will feed LNG Train 4 at the company’s onshore LNG liquefaction plant. As construction on Train 4 nears completion, WHP 5 and WHP 7 gas will feed Train 3.

RasGas, a joint venture of Qatar Petroleum and ExxonMobil RasGas Inc., produces LNG and other related hydrocarbon products from gas from North field, which has estimated reserves of over 900 tscf. It is the largest offshore nonassociated natural gas field in the world.

Veslefrikk, Huldra back on stream

Statoil ASA resumed normal production of 35,000 b/d of oil Aug. 8 from Veslefrikk oil field in the North Sea.

The field had been shut down since July 23 for reinforcement of the superstructure of six freefall life boats after an internal crack was found on one (OGJ Online, Aug. 4, 2005).

Personnel on Veslefrikk will be reduced until all skid boats are back in service.

Huldra gas field, which produces 6 million standard cu m/day of gas and is remotely operated from Veslefrikk, was expected to resume production Aug. 9, when the Heimdal platform was to be ready to receive Huldra gas for processing. Norsk Hydro AS operates Heimdal.

Etame ET-6H well on stream off Gabon

A consortium led by Vaalco Energy Inc., Houston, has started up the Etame ET-6H well off southern Gabon and tied it in to Etame oil field’s floating production, storage, and offloading vessel.

The well is producing 6,100 b/d of oil through a 1-in. choke from Cretaceous Gamba sandstone. It was drilled horizontally through the upper portion of the Gamba for 460 m and completed with a gravel-packed liner. The well was completed at the highest point of any well in the reservoir, Vaalco said.

The well brings total field production to 24,000 b/d. Over the next few days the consortium said it would “evaluate the effect of the well on existing wells in the pool before making further adjustments to field production rate.”

Vaalco next plans to drill two wells to develop the Avouma-South Tchibala discoveries in the Etame Marin permit area, south of Etame field (OGJ Online, July 21, 2004). The consortium has begun construction of a production platform for Avouma-South Tchibala development and plans installation during second quarter 2006. These wells are expected to add 10,000 b/d to production.

Vaalco’s Africa Vaalco Energy Inc. unit is operator and holds a 28.07% interest in the field. Other consortium partners are PanAfrican Energy Gabon Corp.-a subsidiary of PanOcean Energy Corp. Ltd., St. Helier, Jersey-which owns a 31.36% working interest; Sasol Petroleum West Africa (Ltd.) 27.75%; Sojitz Etame Ltd. 2.98%; Manila-based PetroEnergy Resources Corp. 2.34%; and Tullow Oil PLC’s Energy Africa Gabon unit 7.5%.

ATP retrofits semi to produce Gomez field

ATP Oil & Gas Corp., Houston, will use a retrofitted Rowan Midland semisubmersible to handle production from Gomez oil and gas field, on Mississippi Canyon Block 711 in the western Gulf of Mexico.

ATP, operator of Gomez with a 100% working interest, plans to install the semi in about 3,000 ft of water during the third quarter and start production from two wells in the fourth quarter. Prior to movement to the field, the unit will be in Sabine Pass for installation of production facilities.

ATP last December tested the Mississippi Canyon No. 4 ST1 well, a reentry of a 1997 discovery, at a rate of 13,610 b/d of oil, with flowing tubing pressures of more than 3,500 psi and very little reservoir drawdown. The well logged 157 total net ft of oil and gas pay in Lower Pliocene sands (OGJ, Dec. 6, 2004, Newsletter).

Korea National Oil to assist Iraqi drilling

South Korea’s state-run Korea National Oil Corp. (KNOC) signed a memorandum of understanding with the Iraqi government to provide technological support for oil development.

KNOC will provide the Iraqi oil ministry drilling technology and work with the government to study Iraqi oil blocks.

Samsung to build two semisubmersible rigs

Norway’s Eastern Drilling ASA has let a contract to Samsung Heavy Industries (SHI), Seoul, to build two $465 million semisubmersible drilling rigs. SHI will complete construction of the rigs by October 2007.

The rigs will weigh 30,000 tons each and will have a depth rating of 12 km, SHI said. They will be used in deep North Sea waters. ✦

Transportation - Quick Takes

Tangguh group charters seven LNG carriers

Tangguh Production Sharing Contractors, a consortium led by BP Berau, awarded contracts to three carrier groups to provide seven vessels to transport LNG from Indonesia’s Tangguh project.

The BP consortium awarded the contracts to Kawasaki Kisen Kaisha Ltd. (K-Line); Nippon Yusen Kaisha (NYK); and Teekay Shipping Corp.

Three South Korean shipbuilders will manufacture the vessels. The charters are to begin in late 2008 and early 2009. The vessels will transport LNG to South Korea and Mexico.

K-Line will provide three 153,000 cu m carriers to be built by Samsung Heavy Industries.

NYK will supply two 145,000 cu m carriers to be built by Daewoo Shipbuilding & Marine Engineering Co. Teekay will provide two 155,000 cu m vessels to be constructed by Hyundai Heavy Industries Co. Ltd.

BP Berau is a unit of BP PLC, which leads a consortium ofTangguh project stakeholders.

Terasen to expand Corridor heavy-oil system

Terasen Pipelines Inc., Calgary, has initiated engineering, environmental, and consultation activities on its proposed expansion of the Corridor pipeline system in Alberta.

The move followed the announcement that Kinder Morgan Inc., Houston, planned to acquire Terasen Inc. in a $5.6 billion deal approved by both companies’ boards (OGJ, Aug. 8, 2005, p. 26).

The Corridor proposal includes building a 42-in. diluted bitumen (dilbit) line and upgrading pump stations along the existing 306-mile pipeline from the Muskeg River Mine north of Fort McMurray to the Scotford upgrader near Edmonton.

The Corridor system is integral to the Athabasca Oil Sands Project (AOSP) and has carried dilbit-heavy crude oil and bitumen blended with condensate-diluent, and synthetic products since April 2003.

Corridor Pipeline’s current dilbit capacity is 260,000 b/d. The upgraded pump stations and new pipeline will increase dilbit capacity to 500,000 b/d by 2009. The new capacity is designed to accommodate the first expansion of AOSP. Further capacity expansions are possible through the addition of intermediate pump stations.

Terasen Pipelines will file an application for the project with the Alberta Energy Utilities Board and Alberta Environment this fall. Pending regulatory approval and a decision by AOSP to proceed with the expansion, construction would begin in late 2006.

AOSP is a joint venture of Shell Canada Ltd. 60%, Chevron Canada Ltd. 20%, and Western Oil Sands LP 20%. Last September, Shell said it intended to expand AOSP’s mining and upgrading facilities to 300,000 b/d by 2010, eventually achieving production in excess of 500,000 b/d.

China to limit LNG terminal construction

China has ordered that only one LNG terminal will be built in each of its coastal provinces in order to prevent duplication of large energy infrastructure projects, the South China Morning Post reported Aug 8.

National Development and Reform Commission Vice-Minister Zhang Guobao told petroleum executives June 9 that only Guangdong would be allowed a second LNG terminal for the time being.

Zhang said, “Guangdong was an exception because the project in Daya Bay was a pilot for the whole nation so it would count in the one-per-province scheme,” the paper reported.

The as-yet unpublished edict would mean that of China’s 18 proposed and continuing projects at least six planned by China National Offshore Oil Corp., one by PetroChina, and one by China Petroleum & Chemical Corp. will be shelved.

Kazakhstan to sign BTC pipeline agreement

Kazakhstan will sign an agreement on joining the Baku-Tbilisi-Ceyhan oil pipeline project in October, according to Energy Minister Vladimir Shkolnik.

Shkolnik said a pipeline section from the Kazakh port of Aktau to the BTC pipeline’s origin at Baku would work as an independent part of the larger line.

Kazakhstan will construct a terminal about 76 km south of Aktau at Kuryk. Pipelines connecting Kuryk with the Aktau extension also will be constructed, Shkolnik said.

Line fill of the 1,100-mile pipeline began in June (OGJ, June 27, 2005, p. 61). ✦