Although refiners in the US will have to produce both ultralow-sulfur diesel (ULSD) and ultralow-sulfur gasoline (ULSG) in less than a year, they face a number of challenges in commercializing these clean fuels. Some challenges in the supply, distribution, and production of ULSG and ULSD are known, but others will not be apparent until the fuels are actually produced and used by the consumer.

In commercializing clean fuels, refiners will require:

• Systems to handle clean fuels.

• Consistent production regulatory requirements.

• Product quality.

• Mitigation of production delays due to unforeseen events.

• Imports of diesel.

• State-of-the-art technology.

Construction and start-up of more than 60 ULSD projects are planned or under way to meet the June 2006 deadline. Each refiner in the US has unique production plans for ULSG. Cost estimates for clean fuels initiatives in the US are estimated at $9-10 billion at a time when margins are above historic levels, leading to the hope this investment can be recovered.

Global clean fuels

The EU is considering revising the current specifications that require near-zero ULSG by Jan. 1, 2009, and a regional compliance program for ULSD. The EU is considering reducing ULSD sulfur levels to 10 ppm and further reducing aromatics.

Fuel sulfur levels are being reduced in Asia. The level of reduction and timing varies by country, but the overall goal is to produce ULSG and ULSD with a 10-50 ppm sulfur level by 2010.

This will present different problems for most regions compared to the US and EU due to the increase in demand for transportation fuels, which will result in the need for new facilities. Investment capital is therefore competing between the construction of either new production facilities or revamps to existing facilities to reduce sulfur.

The clean fuels concept includes different fuel properties for different initiatives: reduce sulfur levels, add oxygenates, reduce aromatics, increase octane or cetane, and meet additive package requirements.

Requirements, deadlines

The EPA regulation regarding ULSG is extremely complicated; ULSG must meet the 30-ppm (wt) sulfur average and the per-gallon cap of 80-ppm (wt) sulfur by 2005. Commercialization of the ULSG was implemented without much public attention.

June 2006 is EPA’s ULSD refinery gate commercialization deadline. EPA’s last update on ULSD indicated that more than 95% of the diesel produced in the US will meet the standard.1 2

The challenge to refiners is to produce fuel at low enough sulfur levels to protect 2007 sulfur-sensitive diesel engines while maintaining adequate supply. It is not clear, however, if automobile manufacturers will introduce the sulfur-sensitive NOx traps in 2007; therefore, there may be flexibility on the sulfur standard during the initial period.

ULSG

ULSG includes different fuels in the US and is allowed as long as the fuel meets EPA standards. Refiners’ decisions in the US and much of the world are hampered by lack of regulatory certainty.

Local regulations in the US have produced “boutique” gasoline blends, making ULSG implementation confusing. A national mandate would reduce the number of different ULSG blends and ultimately increase regional supply and lower prices.

Production, supply

Generally, current ULSG production is sufficient for demand. Expected and unforeseen events and regulatory needs play a significant role in ULSG production:

• In 2005 refiners must meet the 30-ppm sulfur average with a maximum of 80 ppm

• ULSG will be the lowest-sulfur fuel in the distribution system, until June 2006, when ULSD will become the cleanest fuel.

• Regional blendstock demand for low-sulfur and low-toxics gasoline could cause supply disruptions. About 2-3% of the total potential ULSG production is alkylate; US Gulf Coast alkylate could be exported to California to allow them to meet the California Air Resources Board (CARB) specification. The impact of removing alkylate from the US Gulf Coast could reduce the supply there and throughout the East Coast.

• In 2004, Florida suspended the federal gasoline rules for several weeks. Refiners periodically shut down due to severe weather. Quick intervention by local state governments such as Florida will prevent these shutdowns from cascading into major supply disruptions.

• The possible phaseout of MTBE could remove 2-3% of the total gasoline pool. Ethanol is the leading substitute and the current price subsidy is 52¢/gal of ethanol blended to gasoline. Removing the subsidy will make ethanol production potentially cost prohibitive. California is in court to obtain a reversal of EPA’s 2003 decision requiring ethanol blending in CARB gasoline.

• Boutique gasoline blends are the result of local regulations, which makes ULSG implementation confusing. Without a national mandate, the number of different ULSG blends affects regional supply and price due to production and delivery constraints (OGJ, Oct. 18, 2004, p. 48).

• Automobile manufacturers have developed another standard termed “top tier.”3 This program provides a certification that exceeds EPA standards mainly by increasing the required detergent additives. More detergent additives theoretically keep engines cleaner longer and reduce emissions in the long term.

ULSG product quality

Most refiners are producing commercial ULSG; however, the sulfur species resulting from the high-severity operations required to produce ULSG are a major concern.

In May 2004, ULSG and changes in the metallurgy of sensors in some car’s gasoline tanks indicated full when they were in fact empty, or the oxygen sensor failed both of which a resulting in engine shutdown.

An ongoing effort is under way to change the ULSG specification testing to prevent a recurrence. Refiners are changing their ULSG specifications so that the product will meet a new test method.

One potential cause is elemental sulfur. Additives are being used to trap or deactivate the remaining sulfur to prevent reaction with the silver in the gasoline gauges and oxygen sensors in new cars.

Commercialization of a new product such as ULSG has the potential for unexpected problems. In this case, the lesson learned was that removing sulfur to low level may ensure clean-burning fuels but that they may not function well in new automotive systems.

ULSD

US refiners must produce ULSG while also developing processing strategies and building process units to produce ULSD. Regional ULSD regulations will different in some parts of the US. Potential regional differences could result from sulfur credits and biodiesel.

Sulfur credits generated within each PADD could result in a ULSD that has a sulfur level as high as 500 ppm. Expectations are that the credits will generally not be used except when the sulfur level slightly exceeds the standard.

The inclusion of biodiesel changes the ULSD production method while allowing refiners to meet the sulfur standard. Texas has a biodiesel program offering a 4¢/gal reduction in the state sales tax.4

A further hurdle to the biodiesel commercialization is ASTM’s rejection of the diesel blends containing 5% or 20% organically produced diesels.5 Some of the problems include:

• Oxidation instability.

• High inorganic alkali metals, which could lead to filter plugging and engine deposits.

• Free water, glycerin, fatty acids, other similar compounds, and high acid numbers that promote corrosion.

• Inconsistency with current diesel specifications.

In addition, refiners can petition for exemption from ULSD units in 2010.

ULSD production, supply

As part of EPA’s 2007 highway diesel final rule (66 FR 5002, Jan. 18, 2001), refiners are required to provide an annual update on ULSD production plans starting in 2003.

EPA explains the 2004 data from the point of view of the original Regulatory Impact Analysis conducted in 2000.1

The survey reports the number of refineries planning to make ULSD and a brief indication of refineries’ capital investment plans for producing different ULSD options. The study indicates that 60 new units are to be started up in first-quarter 2006 and agrees with earlier estimates.6

EPA projects that ULSD production will be at or above the anticipated ULSD growth for 5 years after implementation. Due to the large number of unit startups and other learning curve experiences, however, EPA expects that the initial production of ULSD will be difficult.

Fig. 1 shows the projections for highway diesel.

Pipelining ULSD was tested in 2004 by a consortium of the Association of Oil Pipelines (APOL) and API. Product handling within the transportation system increased the sulfur content by 1-2 ppm. An increase in the total sulfur content of 5-10 ppm was observed during the shipment from the US Gulf Coast to the East Coast and other regions.

Refiners are being asked to reduce the refinery gate sulfur level below the regulatory level to meet pipeline or refinery terminal production. Many current ULSD design plans are for less than 10 ppm; these design plans may require modifications to 3-6 ppm sulfur to meet the final sulfur level of 15 ppm at the pump.

Transportation-related sulfur increases are being evaluated, including:

• Internal refinery transfers can increase the blended product tankage sulfur vs. product from the process units.

• Pipeline interfaces between ULSD and other products. Mixing of these products at the interface may require more product to be downgraded than the 20% allowed by the regulation.

• Pipeline or refinery terminal piping and “deadlegs” may trap higher-sulfur products that can then leach into ULSD.

• Tank bottoms within the refinery or pipeline terminals.

APOL and API are discussing the possibility of more pipeline transfer testing to determine and overcome contamination sources. EPA is working with both organizations to develop flexibility plans.

Under the current statute, pipelines are allowed a 45-day period between June 1 and the terminal compliance date of July 15 to comply with ULSD requirements. Colonial Pipeline Co.’s response was that, in June 2006, all fuels traveling through the pipeline must have a sulfur level of 8 ppm or less.7

Colonial Pipeline plans to move the fuel to Fairfax and conduct testing to establish if the fuel can be moved farther up the coast after June 2006. Current commercial plans are being modified as new information becomes available.

ULSD sulfur

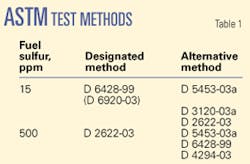

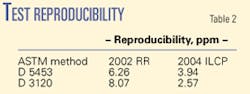

Refiners are concerned with the ability commercially to measure sulfur levels of 15 ppm (wt) or less.

Table 1 shows the ULSD sulfur test methods.2 Unfortunately, the reproducibility of these tests, although improving, is still high (Table 2).2

This means that refiners must have a 95% confidence level that the sulfur in the product leaving the refinery is less than the sulfur tested in the field with this ASTM method. If the target sulfur level is 3-6 ppm leaving the refinery terminal, then the production targets would have to be nearly zero to accommodate the testing uncertainty.

EPA has fortunately allowed a 2-ppm-sulfur downstream adjustment in addition to the 15-ppm cap, at least during ULSD introduction. EPA is also conducting a laboratory certification program to reduce testing uncertainties.8

ULSD lubricity

Lubricity is “a liquid’s intrinsic ability to prevent wear on contacting solid surfaces in the absence of any hydrodynamic lubricating films.”

This property is a concern due to problems experienced with accelerated jet engine failures when using low-sulfur jet fuels. The problem was linked to severely hydrotreated jet fuels having both low sulfur and low aromatics contents.

Removing sulfur, a natural lubricant, increases engine wear. Refiners can increase ULSD lubricity by using additives; most refiners had planned to use these products. Many pipeline companies, however, recently decided to disallow additives in ULSD citing concerns of contaminating other products. This situation is rapidly changing and more changes are expected.

The lubricity test method is part of the problem. EPA has adopted a lubricity test, ASTM D6079, High Frequency Reciprocating Rig. ULSD must have a wear rating of less than 520μ.2

A different lubricity test, ASTM D975, has been adopted by 23 states including California, Connecticut, Illinois, Louisiana, and Oklahoma.

The lubricity requirement went into effect in Jan. 1, 2005.

ULSD cetane, aromatics

Each major ULSD project, especially new unit designs, should include a sensitivity analysis to determine the equipment modifications and associated investment needed to meet possible future ULSD requirements for a higher cetane index and reduced aromatic content. Significant increases in the diesel product’s cetane index require significant reductions in its aromatics content.

Currently, the US requires a ULSD cetane index specification of 40. Future federal regulations, aimed at reducing particulate emissions, may also increase the required cetane index.

For example, Texas has proposed a requirement of 48 cetane index by Oct. 1, 2006. The low-emission diesel will be required in East Texas. Testing is under way to obtain additive approval from the Texas Commission on Environmental Quality.9

Although aromatics are not a current specification, EPA has capped ULSD aromatics at 36 wt % in 2006. Texas has proposed an aromatics cap of 10-20 wt % and California has the same cap plus a polycyclic aromatics limit of 1.4 wt %.

Although different aromatic concentration levels have been discussed as regulatory limits, a practical aromatics level for evaluation of ULSD project sensitivity cases is about 10 wt %. This value is the median aromatics limit being discussed. If a lower regulatory requirement for aromatics were to occur, improvements in catalyst would potentially provide some relief.

ULSD reliability

High unit reliability is required to meet ULSD demand consistently. Refinery maintenance and operations practices for new and exiting units affect unit operability. Limits due to clean fuels requirements restrict refiners’ operational flexibility.

Clean fuels production depends on the reliability of a few key units. If, for example, a ULSD hydrotreater shuts down for a long time, the typical refiner with one ULSD unit cannot produce diesel during this time. This creates a supply deficit and price spikes.

Some key strategic factors for successful ULSD implementation include:

• The ability to process high-sulfur feedstocks generated during ULSD production unit outages.

• An on-stream time dictated in the design and construction of the new unit.

• Alternative crude sources during unit outages or for loss of catalyst activity at end-of-run conditions.

For revamps or new units, the refinery will undergo an expansion. The intrinsic reliability of existing and proposed units has a significant impact on the overall on stream time. A comparison of the identified risks on a return-on-investment basis allows the refiner to understand and prioritize all of the risks.

The reliability of each individual clean fuels unit is a key in production of ULSD and ULSG. The outage of one of these units could lead to a refiner’s inability to deliver product. This scenario is a significant change from the past, when the refiner could still produce saleable products, although at a lower rate or price, if a single unit was shut down.

Given the clean fuels requirements, a refinery cannot produce fuels until that individual unit is repaired. The risk to the refinery is a complete refinery outage due to the shutdown of one unit. As a result, high reliability for each clean fuels unit is crucial for financial success.

To increase unit reliability, refiners should:

• Use proven technology.

• Design for 98% or higher on stream time, e.g., provide key bypasses and sparing to allow on stream maintenance of equipment that requires frequent attention.

• Avoid short catalyst cycle lengths.

• Design for flexibility to handle multiple feedstocks and rates.

• Provide accessibility for maintenance.

• Keep key, long-delivery spare parts for critical equipment in local storage.

• Buy industry standard equipment.

• Design for a facility life of 20 or more years.

• Design for the prevention and control of corrosion and fouling, such as use of better metallurgy, avoiding feed contamination with oxygen, etc. ✦

References

1. “Summary and Analysis of the Highway Diesel Fuel 2004 Pre-Compliance Reports,” Environmental Protection Agency, USEPA 420-R-03-014, September 2004.

2. 2004 EPA/NPRA ULSD Workshop, Nov. 15-16, 2004, New Orleans.

3. Meyger, “Automaker Pushing for Fuel Certification,” Houston Chronicle, Oct. 24, 2004.

4. “Texas jumps on biodiesel band wagon with Introduction of B20,” Worldwide Refining Business Digest Weekly, May 30, 2005.

5. “ASTM gives biodiesel blends B5 and B20 thumbs down,” Worldwide Refining Business Digest Weekly, Mar. 7. 2005.

6. Sayles, S., “ULSD, Are We Ready?,” Hydrocarbon Engineering, Spring 2004.

7. “Colonial Pipeline Says no room for Dirty Fuels,” Worldwide Refining Business Digest Weekly, May 23. 2005.

8. US Environmental Protection Agency laboratory testing requirements, www.epa.gov.

9. “TCEQ seeks grants for ‘alternate’ TX-LED (low emission diesel) testing,” Worldwide Refining Business Digest Weekly, May 16. 2005.

The author

Scott Sayles ([email protected]) is a principal consultant with KBC Advanced Technologies Inc., Walton on Thames, Surrey, UK. He has 28 years’ experience in refining and petrochemicals. Sayles holds a BS in chemical engineering from Michigan Technological University and an MS in chemical engineering from Lamar University, Beaumont, Tex.