Resource plays, CBM to fuel drilling upturns in US, Canada

Drillers had a busy year in the US in 2004, and a good gain is likely in 2005, OGJ predicts.

A 2005 gain is also probable in Canada.

With oil and gas prices at the wellhead still robust, OGJ looks for a 5.6% climb in the number of wells drilled in 2005. This forecast is an attempt to estimate the number of wells drilled in search of oil, gas, and coalbed methane.

Multirig plays are active in several Rocky Mountain and Midcontinent states, and more plays are taking shape.

Resource plays for so-called unconventional gas are keeping dozens of rigs busy in several states. This is a trend that may continue for a number of years.

Key discoveries and producing property sales also appeared to be leading to more drilling. New operators plan drilling several giant oil fields in which they have acquired interests.

The latest estimates, if borne out by the eventual filing of completion reports, could indicate a slight upturn in exploratory drilling in the US.

Here are highlights of OGJ's early-year drilling forecast for 2005:

- Operators will drill 39,726 wells in the US, up from an estimated 37,603 wells drilled in 2004.

- All operators will drill 3,242 exploratory wells of all types, up from an estimated 3,000 last year.

- The Baker Hughes Inc. count of active US rotary rigs will average 1,250/week this year, up from 1,187/week in 2004.

- Operators will drill 22,080 wells in western Canada, up from an estimated 21,380 in 2004.

US drilling

OGJ's estimate of 2004 and 2005 drilling would be the highest numbers of wells since the late 1980s.

The 2005 estimate would be the highest since 70,806 wells in 1985 as estimated by the American Petroleum Institute (Table 1).

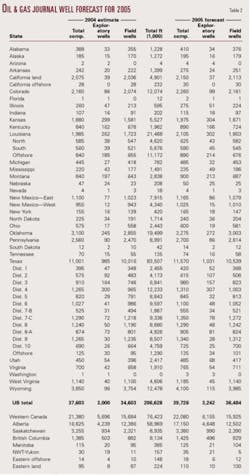

OGJ estimated that Texas operators drilled more than 11,000 wells in 2004 and will top 11,500 wells this year (Table 2).

Wyoming, with a vast shallow CBM play, has overtaken Oklahoma year to year for second place in the number of wells drilled among US states. However, Oklahoma's footage of nearly 20 million ft far exceeds Wyoming's footage.

Wyoming CBM and oil and gas drilling totaled 3,850 wells in 2004, and 4,100 wells are likely this year. The Wyoming efforts add up to more than 12 million ft of hole, compared with more than 80 million ft in Texas.

A unique combination of emphasis on conventional drilling, resource plays, and CBM has pushed Colorado footage above 12 million ft/year. State officials said Colorado appeared to be issuing a record number of drilling permits in 2004.

Based on applications through mid-November and expectations for the rest of the year, the total was likely to be around 2,700.

US drilling snapshot

Wyoming and North and East Texas still dominate drilling in the US.

OGJ's forecast for Wyoming is more conservative than that of the state oil and gas supervisor, who estimated 2004 drilling at 3,180 CBM wells, 800 other gas wells, and 165 oil wells. The supervisor looks for 3,300 CBM wells, 900 other gas wells, and 160 oil wells to be drilled in 2005 unless oil and gas prices drop dramatically.

The Fort Worth basin Barnett shale gas play, confined to North Texas Dist. 9 for several years, is beginning to spread south into Dists. 5 and 7B. It is the state's busiest play in terms of rigs running and number of wells being drilled.

Anadarko Petroleum Corp., Houston, largest operator in the Jurassic Bossier gas play, said gross production averaged 302 MMcfd in East Texas and 325 MMcfd in Vernon field, North Louisiana, in the quarter ended Sept. 30. The company is infill drilling on 40 and 20-acre units in Dowdy Ranch and Dew/ Mimms Creek fields in East Texas.

Unconventional plays dominate gas drilling in the Rocky Mountains. EnCana Corp., Calgary, which operates in the western Canada and US Rockies, said production from the so-called "resource plays" grew to nearly 75% of its North American production in 2004 from 60% in 2003.

The company drilled more than 2,250 wells in January-September 2004 in seven resource plays, three of which are in the US. EnCana drilled more than 2 wells/day on average in 2004 in Mamm Creek field in Colorado's Piceance basin in 2004.

In an emerging Midcontinent resource play, Southwestern Energy Co., Houston, plans 160-170 wells in 2005 to Mississippian Fayetteville shale in the Arkoma basin. It drilled 23 wells there in 2004 and began producing gas. The play area covers at least four counties in Arkansas.

Canada's outlook

OGJ looks for a little more than 3% year-to-year gain in drilling in Canada.

Most of the larger operators in Canada have increased 2005 capital budgets.

The Canadian Association of Oilwell Drilling Contractors estimate eclipsed OGJ's western Canada estimate of 22,080 wells for 2005. CAODC forecast in October 2004 that operators would drill 24,205 wells in Canada in 2005.

Drilling for CBM could involve as many as 10-12% of the wells drilled in Canada in 2005. Alberta has been estimated to have 2,500 CBM wells drilled at yearend 2004 and be producing 100-150 MMcfd of CBM (see map, OGJ, Dec. 13, 2004, p. 41).

Canada's CBM production is forecast to rise to 450 MMcfd by the end of 2006, when 2,100 CBM wells are likely to be drilled, according to a study by Canada's National Energy Board. The entire volume would come from the Horseshoe Canyon coals in south-central Alberta.