OGJ Newsletter

General Interest—Quick Takes

Oil, natural gas prices seen softening in 2005

Oil and natural gas futures prices will be volatile and likely lower by Dec. 31 than they were on Jan. 1, analysts from Foresight Research Solutions LLC said in a Jan. 11 conference call.

"Despite week-to-week and month-to-month gyrations in oil prices, I think oil prices can be modestly lower this year for a variety of reasons, including slowing world oil demand and new production coming on stream," said Bernard J. Picchi, senior energy analyst.

But on a long-term basis, he believes oil prices will remain at a higher overall level than in the 1990s largely because there currently is little or no excess oil production capacity available worldwide.

"There are some very powerful features that are likely to support oil prices over the next 5-10 years," Picchi said. "One is the continuing growth in demand everywhere in the world—most obviously in China and India."

Meanwhile, oil buyers are willing to pay a premium because of the "perceived scarcity that there is no cushion to fall back on any longer," he said.

"I think the cushion will be restored. It won't happen overnight. The oil industry does tend to move in multiyear cyclesU. We could be in a 5-10 year cycle before we have this spare production capacity restored."

He doubts that "relative tranquility" can be restored to oil markets pending the eventual restoration of excess production capacity of 2-4 million b/d.

Foresight Research natural gas analyst Steven Parla forecasts some "very painful days" during 2005 because he expects gas prices to drop, perhaps starting in February.

"I do expect a gas price crash at some point in the first half of 2005, perhaps at $3.50/MMbtu or $4/MMbtu" on the New York Mercantile Exchange, Parla said.

He cited a warm US winter and high gas inventories as among the reasons for gas price weakness. Other factors are robust drilling activity, gradually increasing LNG imports by the US, and declining industrial demand.

"Only hurricanes and a run to $55/bbl oil prevent gas prices from going substantially lower in the shoulder months this fall," Parla said. But he notes that the anticipated drop in gas prices will be short-term.

"I don't think it is tragic based on the strength of the secular supply-demand trends," Parla said.

UBS survey shows E&P spending rebound

Increases in oil and gas companies' spending plans in the US and Canada indicate robust oil service fundamentals and drilling activity levels in the near term, said UBS Warburg LLC in its latest monthly PatchWork Survey.

The survey compiles responses from oil and gas operating personnel, who are polled monthly about their expectations of price and activity levels.

UBS services analyst James H. Stone of New York also asked operators about their expectations for oil and gas prices for 2005.

Most operators expect spot prices of West Texas Intermediate crude in the $35-45/bbl range and New York Mercantile Exchange gas futures prices in the $5-6/MMbtu range.

The average implied price expectation was $36.50/bbl for oil and $5.30/MMbtu for gas, Stone said, considerably below current prices.

"Operators expect the current environment of high oil and natural gas to remain through 2005," Stone said.

"This confirms the sharp increase in expectations for seismic acquisition activity since operators will only invest in exploration if they believe that oil and gas prices will stay high long enough to reap the rewards of their investment."

The January spending index for the US and Canada increased to 55 from 45 in December. The index is a weighted average ranging from plus 100 to minus 100. The size of a positive value indicates the relative sentiment for an increase in that price or activity, and the converse is true for the negative values.

Stone attributed the December decline to seasonality.

"The spending index this month is also much higher than the spending index of 42 from January 2004," he said. "We expect the spending index to continue to rise as operators start to execute their 2005 [capital expenditure] plans."

Of the US and Canadian operators surveyed, 61% expect to increase spending during the next 60 days, while 33% plan no change, and 6% plan a decrease.

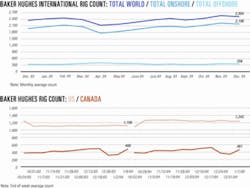

The drilling index for the US and Canada rebounded to 48 from December's value of 35, indicating robust drilling plans. The drilling index was 45 in January 2004.

"The rebound suggests further growth into 2005 in activity levels, despite high current rig utilization, which may constrict volume growth more than a shortage of demand," Stone said.

For workovers, 52% of US and Canadian respondents plan increases, 1% plan decreases, and 47% plan no change. The workover index increased to 50 from 40 in December. The workover index is close to its high of 51.

The seismic acquisition index increased sharply to 20—a record high since the survey was started in March 2002.

"The increase indicates that operators might be starting to focus more on exploration activities," Stone said. "This is a welcome trend, especially since operators have underinvested in exploration in the recent past."

Analysts see risk for US gas drilling

Weakness in Henry Hub natural gas futures prices might lower the US rig count during the second quarter, Merrill Lynch & Co. analysts in New York forecast.

"We continue to forecast 8% growth in the worldwide rig count this year vs. 2004; however, we are concerned that the US rig count may flatten or possibly decline if natural gas prices fall below $5/Mcf for more than a few weeks in the spring," said Mark S. Urness, director of oil service and drilling research (OGJ Online, Nov. 16, 2004).

If gas prices fell, the US rig count likely would decline early in the second quarter, Urness said in a Jan. 6 report.

John Herrlin, Merrill Lynch exploration and production analyst, said he is becoming increasingly concerned about the near-term risk of competition between storage gas and wellhead gas. However, his Henry Hub price forecast for the year remains $5.75/Mcf.

Barclays Capital Inc. analyst Paul Horsnell of London noted that the Henry Hub price for February delivery as of Jan. 5 was 4.6% lower than at the same time last year.

Sao Tome and Principe enacts revenue law

Sao Tome and Principe, an island country that shares a joint development zone (JDZ) with Nigeria, has enacted a law governing the receipt, investment, and use of its oil revenues.

The Nigeria-Sao Tome JDZ, established by treaty in 2001, is in the Gulf of Guinea off West Africa (see map, OGJ, Sept. 8, 2003, p. 38).

President Fradique de Menezes said that "nothing will be hidden, nothing will be wasted," regarding oil revenues. Late last month, he signed the law establishing an oil fund to be held by an international bank into which all oil revenue will be deposited. The law limits the amount of withdrawals and restricts expenditures to national development, poverty reduction, and strengthening of good governance.

The fund's activities are to be transparent, with records open to the public. Part of it will be held in permanent reserve to foster development, the law stipulates.

The Earth Institute at Columbia University, New York, assisted Sao Tome and Principe in its yearlong effort to develop and enact the law.

Jeffrey D. Sachs, Earth Institute director, said, "All too often, oil resources have been misused. This law, by creating new standards of transparency and accountability, can help Sao Tome and Principe avoid the pitfalls of being an oil exporter and ensure that its potential oil resources are used for sustainable economic development."

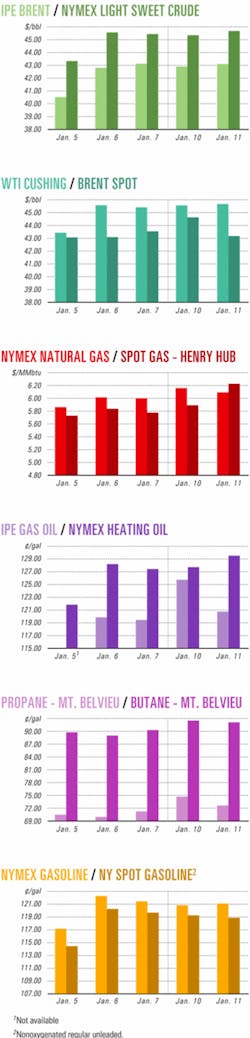

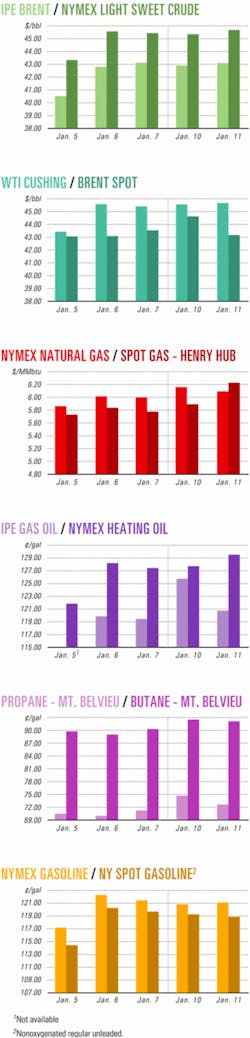

Industry Scoreboard

null

null

null

Exploration & Development—Quick Takes

Delineation well logs pay off Brazil

State-owned Petróleo Brasileiro SA (Petrobras) said a well drilled within Golfinho field boundary areas in Brazil's offshore Espírito Santo basin penetrated sandy formations about 90 m thick saturated with high-quality light oil.

The 3-ESS-156A well was drilled as part of the delineation of discoveries on the former BES-100 Block (in National Petroleum Agency's Bid Zero). Work on the well will be concluded this month. The well is 65 km off Espírito Santo state on the same block as the 1-ESS-123 well—about 12 km away—that discovered Golfinho field.

The 3-ESS-156A, in 1,322 m of water, was drilled to 3,402 m TD. Sandy formations were detected with "excellent traces of oil and natural gas," which were subsequently confirmed by electric logs. Petrobras is performing a final well evaluation.

Production from Golfinho field is scheduled for 2006.

Petrobras, which expects 50% of the new reserves in the Espírito Santo basin to be light crude, is investing $6 billion in Espírito Santo state through 2010 (OGJ Online, Oct. 1, 2004).

Total to develop field in Argentina

Total SA's Argentine arm Total Austral SA, Buenos Aires, plans to spend $100 million this year, from a project total cost of $400 million, to develop Aguanda Pichana gas field in Argentina's Neuquen province.

The company will drill 20 wells and connect them with its nearby gas processing plant. Total Austral is operator, in association with Wintershall AG, Repsol YPF SA, and Pan American Energy LLC—a company held jointly by BP PLC 60% and Buenos Aires-based Bridas Corp. 40%. The gas processing plant also receives gas from neighboring San Roque field in which Total Austral is also operator with the same partners.

In May, Total Austral will bring Carina and Aries gas fields on stream in southern Argentina off Tierra del Fuego at a combined starting rate of 7 million cu m/day to be increased subsequently to 16 million cu m/day. Total Austral is operator of these fields in association with Wintershall and Pan American Energy.

BPZ Energy to develop gas finds off Peru

A newly public Houston independent plans to develop gas discoveries on the Pacific shelf just off northwestern Peru for power generation onshore.

BPZ Energy Inc., Houston, acquired full interest in Block Z-1 near the marine boundary with Ecuador and plans to develop nearly 1 tcf of proved and probable reserves in the Corvina and Piedra Redonda gas and condensate discoveries.

Gas from the existing Corvina platform, to be refurbished, would flow through a 10-mile pipeline to supply a 140-Mw electric power plant to be built at Caleta La Cruz, Peru. Eventually, BPZ hopes to ship gas to Guayaquil, Ecuador, 90 miles north.

Orient, Zaver awarded Pakistan block

Pakistan has granted a petroleum exploration license to a joint venture of Orient Petroleum Inc. 80% and Zaver Petroleum Corp. Ltd. 20% for Sakhi Sarwar Block 2970-3, which covers 2,125 sq km in Pakistan's Punjab Province.

The venture must carry out a $14.57 million exploration program of geological and geophysical studies, 2D and 3D seismic acquisition, and the drilling of two exploration wells during Phase 1 of the initial 3-year term.

Both companies are members of the Hashoo Group, Islamabad.

Usan field find extended off Nigeria

Total SA's Nigerian operating subsidiary Elf Petroleum Nigeria Ltd. (EPNL), which operates deepwater oil prospecting license (OPL) 222 off southeastern Nigeria, has extended Usan oil field to the west.

It drilled the Usan 6 appraisal well 110 km offshore, 4 km south of the Usan 5 well in water 850 m deep. It is the fifth successful appraisal well in Usan field, discovered in 2002.

Usan 6 on test flowed oil at a restricted rate of 5,800 b/d.

Nigerian National Petroleum Corp. is concessionaire for OPL 222 under a production-sharing contract that EPNL, with a 20% interest, operates in partnership with Chevron Petroleum Nigeria Ltd. 30%, Esso Exploration & Production Nigeria (Offshore East) Ltd. 30%, and Nexen Petroleum Nigeria Ltd. 20%.

Independence Hub semi plans announced

Independence Hub LLC, an affiliate of Enterprise Products Partners LP, Houston, plans to begin in the first quarter construction of the Mississippi Canyon 920 Independence Hub semisubmersible platform destined for installation in 8,000 ft of water in the Gulf of Mexico (OGJ Online, Nov. 10, 2004).

The platform, to be operated by Anadarko Petroleum Corp., will be installed in fall 2006 to serve as a gas-gathering hub for seven fields. Peak gas production is expected to be 850 MMcfd.

The new two-deck platform, classed by the American Bureau of Shipping as an XA1 Floating Offshore Installation, will be 232 ft wide and 232 ft long and will provide 8,600 tons of cargo capacity on deck for process equipment, motor control center buildings, three-level living quarters, and other facilities.

OGDC makes discovery at Dhakni

Pakistan's Oil & Gas Development Co. Ltd. (OGDC) has made a deeper-pool discovery at Dhakni condensate field in northern Pakistan. The well was drilled to 4,500 m TD.

OGDC said it expects the new reservoir to produce 11 MMcfd of gas and 750 b/d of oil, based on initial tests. OGDC Managing Director Najam Kemal Hyder said the sweet, high-btu gas will flow into the Sui Northern Gas Pipe Line system.

OGDC had made two previous attempts at deep drilling on this block, both disappointing.

Drilling & Production—Quick Takes

Canyon Express gas flow halted by leak

Gas production from the deepwater Canyon Express system off Louisiana has been shut in since December due to a leak in the methanol delivery system, reported Pioneer Natural Resources Co.

Difficulties locating the leak delayed repair work. Production should resume in about 30 days, Pioneer said. The three-field system had been producing 330 MMcfd (OGJ, May 19, 2003, p. 64).

The cause of the methanol delivery line leak, located Jan. 1, is under investigation. The leak appears to be the result of structural damage caused by accidental impact.

Total E&P USA Inc., operator of the Canyon Express system, said several repair options are under evaluation, and the option selected will determine completion time of repairs.

Suncor oil sands fire limits production

Suncor Energy Inc., Calgary, is investigating a Jan. 4 fire at its Fort McMurray, Alta., oil sands facility that cut production to 110,000 b/d from 225,000 b/d.

It was not immediately known when full production might resume.

The fire was extinguished the same day it started at one of the facility's two upgraders, which convert bitumen into refinery feedstock and diesel.

The blaze primarily affected a coker fractionator. Although 250 employees work in the immediate area, only minor injuries related to cold weather were reported.

Talisman starts up deep Monkman gas well

Talisman Energy Inc., Calgary, has begun production of a Permian Brazion deep natural gas well in the prolific Monkman area of Northeast British Columbia and has drilled two Triassic natural gas wells slated to go on stream in second quarter 2005 (OGJ, Aug. 8, 1994, p. 72).

The Brazion b-60-E/93 well, which started production 2 weeks ahead of schedule, is flowing at a restrained rate of about 66 MMcfd of sales gas. Raw gas flow rates are more than 80 MMcfd. Talisman owns an 80% interest in the well, while Seneca Energy Canada Inc. owns 20%.

Talisman plans to drill four more deep wells in 2005. One will be a follow-up well to spud as early as the second quarter on the 60E structure. Drilling is under way at two other Paleozoic prospects.

Talisman's two new Triassic discoveries at Monkman include the 50:50 Talisman and Shell Canada Ltd. a-16-F/93 well, which tested at 19 MMcfd of gas at 2,400 psi.

This is a new pool discovery in the Spieker area and is expected to be tied in to the Talisman-operated Bullmoose dehydration facility in second quarter 2005.

A follow-up well will be drilled later this year. Facility upgrades are in the planning phase and will be implemented late in 2005 to allow the well to flow at its full potential.

The other wholly Talisman-owned c-3-A/93 well was drilled at Sukunka. This well tested at a stabilized 16 MMcfd of gas at 1,900 psi and will be tied in to the Talisman-operated West Sukunka dehydration facility, also in the second quarter.

Processing—Quick Takes

Pemex lets contract for nitrogen work

Mexican state oil company Petróleos Mexicanos has awarded a $150 million engineering, procurement, and construction contract to Techint SA, Mexico City, and Costain Group PLC subsidiary Costain Oil, Gas & Process Ltd., Manchester, UK, for a 630 MMscfd nitrogen rejection project at its Ciudad Pemex Gas Plant in Tabasco.

Costain said the facility, which will extract nitrogen used in enhanced oil recovery from produced natural gas, would be the world's largest nitrogen rejection project.

The plant will use Costain's proprietary cryogenic process for nitrogen rejection. Costain will provide process engineering for the overall facility and supply key separation equipment.

Main contractor Techint will provide detail engineering and the remaining equipment including the complete gas turbine or compressors and will also construct the facility.

ExxonMobil, Syntroleum sign GTL pact

ExxonMobil Research & Engineering Co. (EMRE) has granted Syntroleum Corp., Tulsa, a worldwide license under its gas-to-liquids (GTL) patents to produce and sell fuels from natural gas or other carbonaceous substances such as coal.

The agreement covers synthetic-gas production, Fischer-Tropsch (FT) synthesis, and product upgrading to make fuels and various processes that relate to these areas. It includes all existing ExxonMobil Corp. patents in these areas and future improvement patents over the next several years. Syntroleum will have the right to extend the terms of the agreement to its licensees.

The agreement does not include patents covering certain catalyst formulations and manufacturing steps.

Syntroleum has developed its own proprietary, patented air-based GTL process over the last 20 years, which it is using in its Catoosa demonstration facility near Tulsa.

The Syntroleum process also is the basis for its GTL Barge concept, which it is using to pursue development of gas deposits far from pipelines and markets (OGJ Online, Mar. 1, 2004).

If Syntroleum obtains patents that overlap ExxonMobil's patents after this license agreement, Syntroleum has agreed to not enforce its patents against EMRE and its affiliates in those areas.

BP to set up Texas olefins, polymers unit

BP Petrochemicals Inc. plans to set up its North American olefins and polymers operating unit in League City, Tex., as part of a move to make its olefins and derivatives business a separate, wholly owned entity.

The new entity is to be based in Chicago.

Transportation—Quick Takes

LNG terminal off Mexico receives permits

Mexican regulatory authorities have granted a ChevronTexaco Corp. subsidiary a permit to develop an LNG import terminal off Baja California. Other authorities awarded ChevronTexaco a concession to construct and operate the facility.

Mexico's Regulatory Energy Commission granted the permit. The Communication and Transport Secretariat granted the offshore concession.

Carlos Atallah, president of ChevronTexaco de Mexico, said the terminal will have an initial design capacity of 700 MMcfd.

The terminal will be more than 8 miles offshore near the Coronado Islands (OGJ Online, Aug. 6, 2003).

Gas line off Africa to carry 470 MMscfd

Initial capacity of the 420-mile West African Gas Pipeline off West Africa from Nigeria to Benin, Togo, and Ghana is expected to be 200 MMscfd and ultimately 470 MMscfd, said the project's operator ChevronTexaco West African Gas Pipeline Co. Ltd. (Wapco). The company announced earlier this month that the project is going ahead (OGJ Online, Jan. 4, 2005).

The gas, which will back out crude oil, charcoal, and diesel, is expected to be consumed 85% in electric power generation and 15% by industry.

Gas will flow from a 20,000-hp onshore compressor station near the Alagbado tee at Lagos to a nearby beachhead and then offshore through a 20-in. pipe typically in 33-75 m of water to Takoradi in southwestern Ghana.

Intervening laterals will supply gas to Cotonou, Benin, Lome, Togo, and Tema, Ghana. Horizon Offshore Inc., Houston, will lay the offshore pipeline using the DLB Sea Horizon and the LB Brazos Horizon pipelay vessels. Transmission is expected to begin in December 2006.

Nigerian gas produced by ChevronTexaco and other operators will reach Lagos via spare capacity in the existing 800 MMscfd Escravos-Lagos pipeline.

Other partners in the $590 million pipeline project are Nigerian National Petroleum Corp. 26%, Shell Overseas Holdings Ltd. 18.8%, and Takoradi Power Co. Ltd. 17%.

Dominion awards CB&I LNG expansion work

Dominion Cove Point LNG LP has awarded a lump-sum, turnkey contract to Chicago Bridge & Iron (CB&I), The Woodlands, Tex., to carry out a major expansion of its Cove Point, Md., LNG terminal.

CB&I will perform engineering, procurement, construction, and commissioning of an additional 800 MMscfd of regasification and sendout process equipment; gas turbine generation; two 160,000 cu m LNG storage tanks; new administration, control, and maintenance buildings; and all ancillary systems.

The expansion will increase the facility's sendout capacity to 1.8 billion scfd and nearly double storage capacity to 14.6 bcf of natural gas.

CB&I is supporting the permit filing process with the US Federal Energy Regulatory Commission and has received approval to begin engineering and procurement. Completion is expected in late 2008.

CB&I built the original four LNG storage tanks at Cove Point and a fifth LNG storage tank put into commercial operation in December.

The new 135,000 cu m tank increased the terminal's storage capacity to 7.8 bcf of natural gas from 5 bcf.