As oil demand surges, China adds and expands refineries

China’s refining industry has reorganized and expanded since the late 1990s. The reorganization led to the formation of Chinese National Offshore Oil Co. (CNOOC) and two integrated oil companies-China Petrochemical Corp. or Sinopec (together with its publicly listed subsidiary Sinopec Corp.) and China National Petroleum Corp. or CNPC (and its publicly listed PetroChina).

Sinopec-Sinopec Corp., and CNPC-PetroChina are dominating China’s refining business.

In reorganizing, China has closed small refineries and slashed inefficient capacities totaling more than 600,000 b/d since 1999; overall, the entire refining industry has been expanded, revamped, and upgraded.

The high growth of oil demand since 2003 has caught Chinese refiners by surprise. Refinery throughput thus went up by 10.6% in 2003 and 12.3% in 2004, pushing the refinery utilization rate up substantially. China has since accelerated plans to build and expand refineries.

Including locally owned small refineries, China’s total refining capacity is estimated to have reached 6.5 million b/d at the start of 2005. Sinopec-Sinopec Corp. accounted for 53% of the total, CNPC-PetroChina had 42%, and small, locally owned refineries, 5%.

Surging products demand

China’s overall oil industry and market in 2004 ended on a high note. The industry achieved the highest volume growths since the late 1970s in crude imports, refining throughput or crude runs, and petroleum products demand-including direct burning of crude oil for electric power generation, industrial use, and other purposes. China thus has made a major contribution to global oil demand and rapidly rising oil prices since late 2003, although a number of other factors, including tight global oil supply and steadily increasing worldwide demand-especially in the US and Middle East-also contribute to the high oil prices seen today.

After 10% growth in 2003, China’s petroleum product demand is estimated to have increased by a further 15% in 2004, a growth rate not seen in China for decades. China’s 2004 petroleum product consumption is estimated at 6.1 million b/d, up from 2.2 million b/d in 1990, 4.5 million b/d in 2000, and 5.3 million b/d in 2003.

Incremental demand in 2004 therefore approached 800,000 b/d, accounting for nearly one third of global incremental oil demand and more than 70% of incremental demand in the Asia-Pacific region.

The major drivers of Chinese oil demand are transportation, the petrochemical industry, residential and commercial demand, agriculture, and to a lesser extent the industry as a whole.

In 2004 China registered double-digit growth for almost all individual product categories, but for 2005 and 2006 China is likely to see more-moderate growth. The Chinese government has set 8% as the official target for real gross domestic product (GDP) growth this year, compared with 9.5% real growth in 2004.

And, after growth of more than 35% in 2004, China’s overall merchandise exports are projected to grow at perhaps less than 20% this year and 10% in 2006.

Car sales are expected to increase at a more-moderate rate in 2005-06 than in 2003 and 2004, which will affect demand for gasoline and automobile diesel.

In addition, although China continues to face a shortage of electric power this year, it may rely more on coal than on oil to meet that growing demand.

Rising oil prices may play some role in dampening overall oil demand in China. For most of 2004, the Chinese government capped domestic oil prices at levels lower than the formula prices, which are based on global oil markets. If the government loosens price controls, the negative impact of high prices on overall oil products demand will become notable.

Our base-case projections for China’s petroleum product demand growth is 8.2% for 2005 and 6.7% for 2006, or incremental demand of more than 500,000 b/d and just under 450,000 b/d, respectively, which are high compared with the rest of the world. On the upper end, it is possible for China’s demand to be up by more than 11%, with an incremental volume of 700,000 b/d for 2005.

However, under low-case scenarios, incremental demand may be lower. As such, total petroleum product consumption may be 6.5-6.8 million b/d in 2005.

Our products demand forecast for China through 2015 is bullish but much more moderate than 2003-04 demand. During 2004-15, China’s naphtha demand is forecast to have the fastest growth under our base-case scenario, followed by jet fuel, diesel, gasoline, and liquefied petroleum gas (LPG). Fuel oil use in China will continue to show growth, but its growth rate is the least among all major products.

Under our base-case scenario, China’s petroleum products demand is forecast to reach 8.6 million b/d in 2010 and 10.4 million b/d in 2015 (Fig. 1). The average annual growth rate is forecast to be 5% during 2004-15. Under alternative scenarios, China’s overall petroleum products consumption could range from 9.3 million b/d to 12.1 million b/d in 2015, reflecting huge uncertainties for the country.

Refining catch-up

Because of its refinery expansions, China’s total crude distillation unit (CDU) capacity at the beginning of this year is 50% higher than capacity registered at the beginning of 1995 (Fig. 2). However, during that period, China’s total petroleum products demand in 2004 was nearly double that of 1995 demand. In addition, despite the high nameplate capacity of 6.5 million b/d, China’s effective refining capacity is only 6 million b/d, as some inland refineries lack access to sufficient crude supplies, and some locally owned small refineries face difficulties in finding feedstock.

The government has sped up the approval process for new and expansion projects for refineries since 2003. It is expected that several Sinopec expansion projects will be completed before yearend, adding 260,000 b/d of CDU capacity. Between that time and 2010, at least six large refinery projects are expected to commence with initial or full government approval:

• Sinopec-ExxonMobil Corp.’s 80,000-240,000 b/d Saudi Fujian refinery, which is under construction and planned for completion in early 2008.

• PetroChina’s 250,000-400,000 b/d Dalian refinery, also under construction and due for completion in early 2006.

• The 160,000 b/d Hainan refinery, under construction and due to be complete in 2006-07.

• Sinopec’s 200,000 b/d Qingdao refinery, on which construction is expected to begin this year and be complete in 2008-09. Saudi Aramco wants to participate, an arrangement that the Chinese government has approved but is awaiting Aramco’s partnership finalization.

• CNOOC’s Huizhou refinery in Guangdong, where Shell’s participation is a possibility. It has been approved to process high acid crudes. Construction is to begin in 2005 and be complete in 2008.

• PetroChina’s 200,000 b/d planned refinery at Dushanzi, Xinjiang autonomous region in remote west China. PetroChina expects to complete it in 2009.

In addition, three other projects are waiting governmental approval:

• Sinopec’s 250,000 b/d refinery at Dagang, in the municipality of Tianjin.

• PetroChina’s 200,000 b/d refinery, also at Dagang, Tianjin.

• Sinopec’s 160,000 b/d refinery at Beihai, Guangxi autonomous region in southwest China.

Altogether, planned and pending additions of CDU capacity in China from the first of this year to 2010 is expected to be 2.1 million b/d. This likely will raise the Chinese refining capacity to more than 8 million b/d by yearend 2010.

Nevertheless, these expansions and new refinery projects may not be enough to meet growing product demand in China.

Crude runs, imports

China’s refining sector expansion and rising utilization rates have increased crude runs. In 2004, the country’s crude runs reached an all-time high of 5.4 million b/d, an increase of 12.3% or nearly 600,000 b/d over 2003. Where is the crude coming from?

The first source is domestic production. China’s crude production in 2004 reached 3.5 million b/d, up 2.2% over 2003, which was one of the highest growths in recent years. This growth came primarily from three sources: offshore, Xinjiang in west China, and the Ordos basin in the northwest.

Meanwhile, crude output continued to decline in China’s largest producing field, Daqing; the third largest producing field, Liaohe; and Huabei field. At the same time, production from Shengli oil field, the country’s second largest, remained flat in 2004. By 2015, our base-case projections show that China’s crude oil output will increase steadily but moderately, reaching a little more than 3.6 million b/d (Fig. 3).

Given the flat crude oil production at home, the rapid growth in crude runs by refineries is increasingly being met by rising crude imports. In 2004, China imported nearly 2.5 million b/d of crude oil, overtaking India and South Korea as the second largest crude importer in Asia.

In 2004 imports were 34% or 630,000 b/d higher than the imports of 1.8 million b/d in 2003.

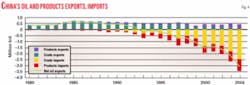

China’s domestic crude output and crude runs during 1980-2004 exceeded domestic crude output in 1995, and the gap has since been widening. China became a net overall oil and products importer in 1993 (Fig. 4).

Product balance changes

Despite the unprecedented growth in crude runs by refineries, China continues to have a products shortage, and net imports are rising. In 2004, China had net imports of nearly 700,000 b/d-nearly three times as high as those of 1995-while before 1992 China was a net product exporter.

China currently is the major fuel oil importer in Asia. Its LPG imports also are large, while diesel imports have reemerged, although the government has banned such imports for years. On the export side, China long has had a surplus of gasoline production, but gasoline exports in 2004 were down notably from 2003 levels.

Toward the end of the decade, we expect China’s net imports of oil products to increase because overall products demand is expected to outstrip growth in crude runs.

Under our base-case scenario, China’s petroleum product imports are expected to increase to more than 1.4 million b/d by 2010.

Of the total projected product imports in 2010, fuel oil is expected to account for 39%, followed by LPG at 19%, diesel at 16%, naphtha 13%, other specialized products 8%, and kerosine-jet fuel 5%.

During 2004-10, LPG and diesel imports are forecast to rise. China currently is a naphtha exporter, but we expect this to be reversed as early as this year. By 2010 China is expected to be a sizable naphtha importer, thanks to the rapid growth in its petrochemical-producing capacities. Fuel oil imports also are likely to remain large.

Overall assessment

Will China produce enough oil and have enough capacity to meet its growing demand? Domestic crude oil production remains flat and at best will not be declining over the next 10 years. Whether China will have sufficient capacity to meet product demand is more complicated. Although the government and state oil companies have sped up plans to build and expand refineries, room for expansion remains limited, and the process for new project approval and implementation is not fast enough. In addition, China’s projected demand growth remains so rapid that we project net products imports will continue to rise along with rising crude imports.

Overall, China’s net oil imports, including products, topped 3 million b/d in 2004, up sharply from 200,000 b/d in 1993, when China first became a net oil importer, and 1.5 million b/d in 2000.

In 2010, we expect that China’s net oil imports will reach 5.5 million b/d under our base-case scenario. By 2015, net imports are forecast to rise further to nearly 7 million b/d. As such, by 2010 China is expected to surpass Japan to become the largest net oil importer in Asia.

Implications for Asia

China has one of the most dynamic oil markets in Asia and the world. It is now the largest oil consumer and second largest oil importer in Asia. In 2004, China imported 2.5 million b/d of crude oil and nearly 1 million b/d of products, totaling nearly 3.5 million b/d. The country therefore contributed to more than 70% of the Asia-Pacific region’s incremental demand and nearly one third of global incremental oil demand. Though China’s demand definitely is not the sole reason that oil prices remain high today, it does play an important role. For 2005, China’s demand growth is more moderate, but its share in regional incremental oil demand is still dominant.

China’s buildup of new refineries and expansion of existing ones may not be able to catch up with the country’s rapid growth in petroleum product demand. As a result, China will import not only more crude oil but also more refined products over the next 5-10 years. The rapid change and development in China will continue to impact the regional and global oil markets in the foreseeable future.

Our outlook for Asian refining margins points toward long-term improvement. This improvement is to a great extent the result of China’s need for petroleum product imports in the Asia-Pacific region. ✦

The authors

Kang Wu (WuK@EastWest Center.org) is a fellow at the East-West Center, Honolulu. He conducts research on energy economic links, energy security, the environmental impact of transportation fuel use, and energy and economic policies in China and the Asia-Pacific region, with a particular emphasis on oil and gas. Wu received a BA in international economics from Peking University in1985 and an MA (1987) and PhD (1991) in economics from the University of Hawaii, Manoa.

Fereidun Fesharaki is president and founder of Fesharaki Associates Consulting & Technical Services Inc. (FACTS Inc.), Honolulu. He is also a senior fellow at the East-West Center, Honolulu. He is the author or editor of 23 books and monographs and numerous technical papers on energy issues. His work focuses on downstream oil markets, OPEC policies, and Asia-Pacific oil and gas markets. Fesharaki received his PhD in economics from the University of Surrey, England.