OGJ Newsletter

General Interest - Quick Takes

CAPP: Oil sands boosting Canadian production

Canada’s oil sands production, currently exceeding 1 million b/d, is forecast to reach nearly 2.7 million b/d by 2015, according to the Canadian Association of Petroleum Producers (CAPP). Total Canadian production is projected to increase by 1.3 million b/d to 3.9 million b/d by that time, CAPP said.

In 2004, Canada’s average total oil production was 2.6 million b/d, the group reported in its 2005 Canadian crude oil production and supply forecast.

Teikoku won’t rush East China Sea drilling

Drilling in a disputed area of the East China Sea could be too dangerous for employees of Teikoku Oil Co. Ltd. despite a recent go-ahead from the Japanese government, according to the firm’s president.

In an interview with Japan’s Nihon Keizai Shimbun newspaper on July 20, Masatoshi Sugioka also said Teikoku might apply for exploration rights in other parts of the sea along the disputed boundary with China.

Japan approved a request July 14 by Teikoku to drill for natural gas in that area of the East China Sea, prompting Beijing to warn about the possibility of worsening ties (OGJ Online, July 14, 2005).

“For now,” Sugioka said, “we have no choice but to wait for the situation to improve, although we are eager to immediately start development work in the potentially gas-rich area, even if we have to spend our own money.”

He said safety questions would deter drilling even if the Japanese government offered to finance the work.

He also confirmed that Teikoku has filed applications since 1969 to explore north of the authorized area in the East China Sea.

BP’s Thunder Horse platform returns to trim

The Thunder Horse semisubmersible platform has been restored to normal trim, BP PLC said July 19. The cause of the platform’s earlier tilt remains undetermined pending more inspections and assessments by BP and the US Coast Guard.

The drilling, production, and quarters platform, on Mississippi Canyon Block 778 in the Gulf of Mexico, 150 miles southeast of New Orleans, was discovered listing 20-30° after Hurricane Dennis passed through the area (OGJ Online, July 12, 2005). The platform is moored in 6,050 ft of water.

Thunder Horse oil field is in development. The Thunder Horse project was not due to start production until the end of 2005, and the platform is not yet connected to subsea oil wells. BP operates the development with 75% interest, and ExxonMobil Corp. has 25% interest.

BP is focused on keeping the platform storm-safe during hurricane season, a spokesman said, adding that it’s too early to determine if the project’s timetable might be changed as a result of the imbalance.

“The platform is stable, the trim is normal, freeboard is normal, and displacement is normal,” BP said. “Concern for safety and the environment remain top priorities. Operations to date have resulted in one minor injury. There have been no spills.”

Esso Angola starts Kizomba B production

Esso Exploration Angola (Block 15) Ltd. has started production from its Kizomba B deepwater project off Angola.

The $3.5 billion project involves development of 1 billion bbl of oil in Kissanje and Dikanza oil fields, which lie in 3,280 ft of water about 215 miles northwest of Luanda. Production from the fields is to peak at 250,000 b/d (OGJ, Feb. 14, 2005, Newsletter).

Kizomba B includes a tension-leg platform and what Esso Angola parent ExxonMobil Corp. calls the world’s largest floating production, storage, and offloading vessel. It has storage capacity of 2.2 million bbl.

Esso Angola completed the Kizomba B project in 31 months. Kizomba A, a nearly identical project producing from Hungo and Chocalho oil fields, required 36 months. Production from Kizomba A began Aug. 7, 2004.

Total production from Kizomba A, Kizomba B, and the Xikomba project, which went on stream in 2003, is expected to peak at more than 550,000 b/d by yearend.

ExxonMobil and partners have reported 38 discoveries in Angola, 17 on Block 15. Esso, operator, holds a 40% interest in Block 15. Partners are BP Exploration (Angola) Ltd. 26.67%, Eni Angola Exploration BV 20%, and Statoil Angola 13.33%. ✦

Exploration & Development - Quick Takes

Petro-Canada to work off Trinidad and Tobago

Petro-Canada has signed three production-sharing contracts with Trinidad and Tobago for offshore exploration.

Petro-Canada said it will invest $80 million in the 645 sq km Block 1(a) and the 518 sq km Block 1(b), both in the Gulf of Paria, as well as in the 2,968 sq km Block 22, which lies 10 km north of Trinidad and Tobago. Petro-Canada will begin a 3D seismic survey on Blocks 1(a) and 1(b) in the fourth quarter.

Two 3D seismic surveys will be shot and six exploration wells drilled over the next 5 years, said Petro-Canada. The awards mark the company’s first operated assets in Trinidad and Tobago. Trinidad and Tobago Minister of Energy and Energy Industries Eric Williams said Blocks 1(a) and 1(b) had been explored earlier by Dominion Oil, but Block 22 had never been offered under the competitive process.

Trinidad and Tobago’s oil company Petrotrin will hold a 20% stake in Block 22.

Petro-Canada holds a 17% working interest in the North Coast Marine Area-1 gas development in Trinidad and Tobago. Its share of production from the nation in 2004 averaged 72 MMcfd of gas, up from 63 MMcfd in 2003.

The increase was a result of supplying full-year production to Train 3 at the Atlantic LNG Co. of Trinidad & Tobago LNG facility. Train 3 started operations in the second quarter of 2003.

ERHC, Pioneer to explore blocks off Africa

Texas companies ERHC Energy Inc., Houston, and Pioneer Natural Resources Inc., Irving, said they would proceed with exploration in the Gulf of Guinea off West Africa despite the withdrawal of Devon Energy Corp. from two consortia that won bids for the properties.

The Nigeria-Sao Tome and Principe Joint Development Authority awarded the 692 sq km Block 2 in the Joint Development Zone to the three-member consortium May 31 and the 666 sq km Block 3 to a consortium of three groups, one of which was the three partners (OGJ Online, June 2, 2005.)

Devon later declined the bid awards because it would receive too low an interest share in the blocks.

“Pioneer and ERHC will now proceed to negotiate the joint operating agreements and production-sharing contracts,” said ERHC Pres. and CEO Ali Memon.

Pioneer will operate Block 2, and Anadarko Petroleum Corp. will operate Block 3.

Statoil to develop Tyrihans oil, gas field

Statoil ASA has submitted a development and operation plan and begun procurement for the subsea development of Tyrihans oil and gas field in the Norwegian Sea.

It plans to start production in 2009 when spare production capacity becomes available on the Kristin platform 35 km to the northwest.

Statoil will develop Tyrihans with five subsea templates, one of them for seawater injection, in 300 m of water. Statoil estimates reserves at 182 million bbl of oil and condensate and 34.8 billion cu m of rich natural gas.

For pressure maintenance, it will supplement seawater injection with injection of gas from the Aasgard development.

A 43-km, electrically heated pipeline will link Tyrihans with the Kristin platform. Tyrihans gas will flow from Kristin via the Aasgard trunkline to Kaarstoe north of Stavanger. Oil and condensate will be stored in the Aasgard C vessel for loading onto tankers.

Statoil has entered a 3-year, 2-billion-kroner agreement to use the Transocean Arctic semisubmersible for drilling and completion. It plans 12 wells, some multilateral, including 9 for production, 2 for gas injection, and 1 for injection of unprocessed seawater.

It also let a 300 million kroner contract to Butting of Germany for the December 2006 delivery of steel pipe for the pipeline, laying of which is expected to begin in 2007.

Ramboell Denmark SA will conduct engineering for the pipelines and their routes.

The Kristin platform will need alterations, although some modifications for Tyrihans were made while the platform was under construction. A 250-tonne processing module will be built and installed on the platform in 2008.

The Aasgard B platform also will require modification.

Statoil has a 46.8% interest in Tyrihans, Total 26.51%, Norsk Hydro 12%, Eni Norge 7.9%, and ExxonMobil Corp. 6.75%.

Anzon to drill Basker appraisal off Victoria

Anzon Australia Ltd., Sydney, operator of the proposed Basker-Manta-Gummy oil and gas field development in the Gippsland basin off Victoria, will spud the Basker-2 appraisal well at the end of this month.

Regulatory approval for the well was a first step toward approval of development of the fields.

The Basker-2 well will test zones not yet evaluated in Basker field and will be completed for an extended production test (EPT). The EPT will help determine the connectivity and water drive mechanisms of several zones in Tertiary Intra-Latrobe sands.

Oil reserves in Basker, Manta, and Gummy fields are estimated at 23 million bbl. Good results in Basker-2 could increase that figure by as much as 25%, Anzon said.

Basker-2, in retention lease Vic/RL-6, will be drilled by the Ocean Patriot semisubmersible, which is currently finishing a program at Casino field in Victoria’s Otway basin to the west.

Preparations for the EPT will include installation of flowlines and arrival of the Crystal Ocean floating production, storage, and offloading vessel in August and the Basker Spirit shuttle tanker in September. The latter vessel is capable of holding 650,000 bbl of stabilized crude.

Anzon has 3-year contracts for both vessels with options to extend.

Following a successful EPT, Anzon intends to proceed to full oil development with wells on Basker and Manta to commence during the fourth quarter. The aim is to be producing 20,000 b/d by the second quarter of 2006.

Basker, Manta, and Gummy fields were discovered by Royal Dutch/Shell Group in 1983, 1984, and 1990, respectively, but considered noncommercial at that time.

Basker, in 200 m of water 70 km from the Victorian coast, is the main oil field. Manta, in adjoining retention lease Vic/RL9, lies in 110 m of water a similar distance from shore and contains both oil and significant gas reserves. The smaller Gummy field, in Vic/RL10 in 150 m of water about 75 km from shore, contains mostly gas.

Shell and its partners sold the fields to Woodside Energy Ltd. of Perth in the mid-1990s. Woodside sold them to Anzon in March 2004. Anzon holds a 75% interest. Beach Petroleum Ltd., Adelaide, holds 25%.

Anzon plans to begin with oil production and reinject Manta gas. The group later will consider gas development, including development of Gummy field.

Kerr-McGee China group starts two Bohai fields

A group led by operator Kerr-McGee China Petroleum Ltd. started production from CFD 11-3 and 11-5 oil fields in western Bohai Gulf earlier this month.

First oil came on July 6, and as of July 18 two horizontal wells were making 9,000 b/d. A peak of 10,000-15,000 b/d from 4 horizontal wells is expected in late August.

The fields produce oil from three Miocene Guantao reservoirs to a single unmanned wellhead platform, then to a gathering platform, and ultimately the oil is processed on the Hai Yang Shi You (Global Producer VIII) floating production, storage, and offloading vessel (OGJ, July 11, 2005, p. 35).

Kerr-McGee plans to start up 3 more fields on Block 04/36 in 2006. Kerr-McGee holds 40.09% working interest. China National Offshore Oil Corp. holds 51%, and Ultra Petroleum Corp., Houston, holds 8.91%. ✦

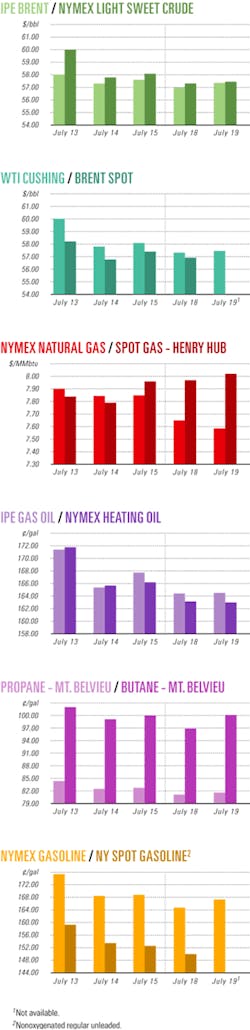

Industry Scoreboard

null

null

null

Drilling & Production - Quick Takes

Pan-Ocean starts up two Tsiengui oil wells

Pan-Ocean Energy Corp., St. Helier, Jersey, UK, has started production from two wells in Tsiengui oil field in Gabon and awaits interpretation of a 50 sq km seismic survey to assist with further development.

Pan-Ocean, operator with 100% interest in Tsiengui before a 7.5% government back-in, said wells TST-2H and TST-3H started production 9 months after the Tsiengui discovery. A third development well, TST-4H, was expected to be brought on stream by July 19.

The three wells will raise Pan-Ocean’s total productive capacity from Tsiengui and nearby Obangue fields to 5,600 b/d gross. Pipeline capacity limits PanOcean’s capacity from the two fields to 3,500 b/d gross (see map, OGJ, Nov. 8, 2004, p. 38).

Pan-Ocean will limit Tsiengui production to its current stabilized rate of 2,100 b/d. It is building a pipeline to ease the transport constraint.

Production from Tsiengui, with 31º gravity oil in Cretaceous Gamba and Dentale above 1,800 m, is expected to peak at 14,000-16,000 b/d in 2006. Further drilling is planned later this year.

Elf Nigeria awarded license off Nigeria

Elf Petroleum Nigeria Ltd. (EPNL) has signed a production-sharing contract with Nigerian National Petroleum Corp. (NNPC) for Oil Prospecting License 223 off southeast Nigeria.

EPNL will hold a 90% share and will serve as operator. NNPC subsidiary Nigerian Petroleum Development Co. will hold the remaining 10% participating interest.

OPL 223 lies in 200-1,000 m of water just east of OPL 222-also operated by EPNL-off Port Harcourt, where two discoveries in the Ukot and Usan fields are being considered for development (OGJ Online, June 10, 2002). ✦

Processing - Quick Takes

Total, Neste Oy to study biodiesel venture

Total SA has signed an agreement with Finland’s Neste Oy to study the feasibility of jointly building a new-generation biodiesel production unit in Europe.

One of Total’s European refineries would use Neste Oy’s hydrogenation technology to produce the biodiesel beginning in 2008.

Feedstock would be vegetable oils and animal fats. The European Union wants biodiesel to represent 5.75% of motor diesel by 2010 (OGJ Online, Sept. 13, 2004).

Total, which leads the European Union in the production of biofuels, is the main user of ethanol in France through its production of ethyl tertiary butyl ether and biodiesel.

Sinochem bids again for Incheon refinery

China National Chemical Import & Export Co. (Sinochem) is again bidding on South Korea’s Incheon Oil Refinery Co. Ltd. Other bidders include subsidiaries of Citigroup Venture Capital, Morgan Stanley Emerging Markets Inc., and local refiners SK Corp, GS Caltex, and S-Oil.

The renewed auction for Incheon, which is under court receivership, comes 5 months after its creditors, led by Citigroup, rejected as too small a 680 billion won ($5.09 billion) offer from Sinochem for the refiner in January. Creditors reportedly expected at least 750 billion won.

Incheon went into receivership in 2001. Sales at the 270,000 b/d refinery rose 28% to 2.5 trillion won in 2004, while operating profit reached 164.5 billion won.

The court plans to select a preferred bidder for exclusive talks by Aug. 18 and grant 1-month due diligence before closing the deal by September.

CHS to add coker at Laurel, Mont., refinery

CHS Inc., St. Paul, Minn., plans to invest $325 million to install a coker and other process modifications at its 55,000 b/d Laurel, Mont., refinery.

The coker will increase gasoline and diesel yields.

Permit applications are under way, and construction is expected to begin in early 2006 and be complete by Aug. 31, 2008.

CHS currently is completing an $87 million project at the refinery that will allow it to meet 2006 federal requirements for ultralow sulfur levels in diesel fuel. The refinery meets gasoline sulfur level requirements.

LG International buys Aromatics Oman stake

South Korea’s LG International Corp. (LGI) will invest $60 million for a 20% stake in the $300 million Aromatics Oman LLC, a joint venture planning paraxylene and benzene plants in Oman’s Sohar industrial complex. Oman Oil Co. will hold 60% of the venture, Oman Refinery Co. 20%.

Aromatics Oman plans to bring 800,000 tonnes/year of paraxylene and 200,000 tonnes/year of benzene capacity on stream in 2008. ✦

Transportation - Quick Takes

Pipelines planned between Iraq and Iran

Iran plans to finance and build pipelines to supply neighboring Iraq with oil products and to enable Iraq to supply crude oil to Iran, Iranian Oil Minister Bijan Namdar Zanganeh said July 18 in Tehran.

In a joint news conference with visiting Iraqi Prime Minister Ibrahim Jaafari, Zanganeh announced plans for three pipelines: from Iraq’s Basrah oil fields to Iran’s 400,000 b/d refinery at Abadan, accommodating 150,000 b/d of Iranian purchases of Iraqi crude; from Abadan to Basrah to carry gas oil and kerosine; and from the Iranian port of Mahshahr to Basrah to carry imported oil products.

On July 16, Iraqi Oil Minister Ibrahim Bahr al-Ouloum said a memorandum concerning the deal would be signed soon. He expects the crude oil pipeline to be operational within a year.

Atasu-Alashankou pipeline 30% complete

Construction of the Atasu-Alashankou oil pipeline between Kazakhstan and China is 30% complete, according to Nurbol Sultanov, deputy general-director for development of Kazakhstan’s KazTransOil.

At a press conference in Astana, Sultanov predicted completion of construction by December and the start of line fill in January.

Sultanov said KazTransOil has laid 200 km of pipeline, spent $300 million, and allocated a further $300 million.

The 962-km, 88-mm diameter pipeline will carry crude oil from Atasu in northern Kazakhstan to the Druzhba-Alashankou railroad terminal near the Chinese border.

It initially will carry 10 million tonnes/year, or 210,000 b/d, which eventually will be doubled.

RasGas II receives third LNG carrier

Ras Laffan Liquefied Natural Gas Co. Ltd. II (RasGas II) has received its third chartered LNG carrier, Lusai, at the port of Ras Laffan Industrial City in Qatar.

The company, a joint venture of Qatar Petroleum and ExxonMobil RasGas Inc., completed the loading of the vessel’s first LNG cargo July 14. Lusai will deliver the LNG to South Korea by July 29 and in the future will be used to deliver LNG to Europe.

The vessel, which has a capacity of 145,000 cu m of LNG, is the largest carrier to be delivered for RasGas trade. Two others, Fuwairit and Maersk Ras Laffan, were delivered in early 2004.

Samsung Heavy Industries of South Korea built Lusai, which Japan’s Nippon Yusen Kaisha (NYK Line) operates and which is owned by Peninsula LNG Transport No. 1 Ltd., a joint venture of Qatar Shipping Co. and the Japanese ship-owner consortium, Mitsui OSK Line, NYK Line, and K-Line (Kawasaki Kisen Kaisha Ltd.).

Hiroshima Gas to buy LNG from Petronas unit

Petronas subsidiary Malaysia LNG Sdn. Bhd. (MLNG) signed an agreement with Hiroshima Gas Co. Ltd. to supply as much as 82,000 tonnes of LNG to the Japanese company over 8 years.

It will ship LNG from the Petronas LNG complex in Bintulu, Sarawak, to Hiroshima Gas’s receiving terminal at Hatsukaichi in Japan.

MLNG and Hiroshima Gas have signed a memorandum of agreement with the City of Sendai for the use of the LNG carrier Aman Sendai to deliver the LNG to Hiroshima Gas. The vessel is dedicated to the transport of LNG from Bintulu to Sendai, which has been a customer of MLNG since 1997.

South Korea signs long-term LNG contract

South Korea has signed a long-term LNG contract with three foreign suppliers.

The government will buy a total of 5 million tonnes/year of LNG from Yemen LNG Co., Malaysia LNG, and Sakhalin Energy Co., starting in 2008.

Oil line starts up on Yemen’s Block S-1

TransGlobe Energy Corp., Calgary, reported start-up of the Block S-1 oil pipeline in Yemen.

The 18-mile, 10-in. pipeline connects An Nagyah oil field with the Halewah production facility and export pipeline operated by Jannah Hunt Oil Co.

TransGlobe expects An Nagyah flow, now about 8,700 b/d, to reach 10,000 b/d this month. Earlier, production of about 8,300 b/d was trucked to Halewah.

Vintage Petroleum Inc., Tulsa, operates the field and holds 75%. TransGlobe holds 25% (OGJ, Nov. 1, 2004 Newsletter).

TransGlobe said preparation is under way for drilling of the An Nagyah 16 horizontal development well. Several further horizontal wells are planned to fully develop the field.

Canadian LNG projects spawn transport pacts

Maritimes & Northeast Pipeline has signed separate agreements with Anadarko Petroleum Corp. and Repsol YPF SA for transportation of natural gas from LNG terminals the companies are building or plan in Canada.

For Anadarko, Maritimes plans to transport 813,000 MMbtu/day of gas from the Bear Head LNG terminal Anadarko is building near Point Tupper, NS (OGJ, Nov. 8, 2004, Newsletter). For Repsol YPF, Maritimes plans to transport 750,000 MMbtu/day from the Canaport LNG terminal planned by Repsol YPF and Irving Oil Ltd. near Saint John, NB (OGJ, June 13, 2005, Newsletter).

Deliveries from both terminals are to begin in 2008.

Maritimes will have to increase pipeline capacity in Canada and the US to accommodate the agreements. The company plans to start engineering design work, leading to expansion applications in late 2005 or early 2006 to Canada’s National Energy Board and the US Federal Energy Regulatory Commission. ✦