OGJ Newsletter

General Interest - Quick Takes

China, Kazakhstan form energy alliance

Presidents Hu Jintao of China and Nursultan Nazarbayev of Kazakhstan have agreed to form a strategic energy partnership by linking their two nations with oil and gas pipelines.

The immediate focus of their attention is the 998-km oil pipeline extending from Atasu, Kazakhstan, to Alashankou, in China’s Xinjiang region (OGJ Online, June 3, 2003). The line, which will begin delivering oil by Dec. 16, forms the second phase of a $700 million oil transportation project, according to a joint statement the two governments released.

The statement said the completed pipeline will have an initial capacity of 10 million tonnes/year of crude oil, increasing to 20 million tonnes/year by 2008. The statement also said that China National Petroleum Corp. is in negotiations with Kazakhstan’s national oil and gas company KazMunayGas JSC to build a natural gas pipeline linking the two countries.

President Hu was visiting Kazakhstan as the second leg of a two-nation tour, which also included Russia.

During Hu’s visit with Russian President Vladimir Putin, China and Russia signed agreements aimed at strengthening their cooperation in the exploration, production, and transportation of oil and gas (OGJ Online, July 05, 2005).

Progress noted on China’s strategic reserve

China, the world’s third largest oil importer after the US and Japan, is making progress in building a strategic petroleum reserve (SPR), said Energy Security Analysis Inc., Wakefield, Mass.

China’s first storage base in Ningbo (Zhenhai), with a capacity of 29 million bbl of crude oil, is to be complete in August and will hold crude oil before yearend.

“Last year, China imported 45% of its total crude oil, and this percentage is likely to go beyond 65% by 2020,” said ESAI oil analyst Wenchao Su. In addition, China’s import sources are highly concentrated, with 50% of imports coming from the Persian Gulf and 30% from Africa.

“With political instability in the Persian Gulf, potential conflicts with the US over Taiwan, strategic competition with Japan and India over energy, and the instability of Russian government policies, it is vital that China build the SPR in order to protect itself from any potential oil supply disruption,” Su said.

At current crude prices, the Chinese government remains cautious about filling the Ningbo base storage. Chinese government officials expect other storage bases in Dalian, Zhoushan, and Quingdao to be completed by 2007.

But ESAI believes it could be several years before these tanks are filled. The four bases together will represent total storage capacity of 102 million bbl of crude, representing about 40 days of oil imports.

The government has said it plans to increase its strategic storage capacity to 55 days of imports by 2015 and 90 days by 2020.

“China’s dramatic growing dependence on oil imports in recent years has certainly increased the sense of urgency within the central government in dealing with energy security issues,” Su said.

MMS delays Cook Inlet Sale 199

The US Minerals Management Service postponed until May 2007 the proposed Cook Inlet Sale 199, which had been slated for May 2006.

A lack of industry interest was the reason for the delay, MMS said. It will evaluate early next year whether to start planning for a 2007 sale.

Niger Delta separatists quit discussions

Nigeria’s effort to accommodate separatist forces threatening civil war fell apart July 11 when leaders from the oil-rich Niger Delta walked out of a political reform conference aimed at determining how to share Nigeria’s oil and gas wealth.

The Niger Delta’s oil and gas reserves provide the federal government with 80% of its revenues. Armed militants have demanded independence and local control of the reserves.

Delta representatives had called for Nigeria’s six oil-producing states to be given control over their resources, although they later said they were prepared to accept a simple increase in the amount of oil revenue accorded them. Conference representatives, however, decided they could not win even their minimum demands and walked out. ✦

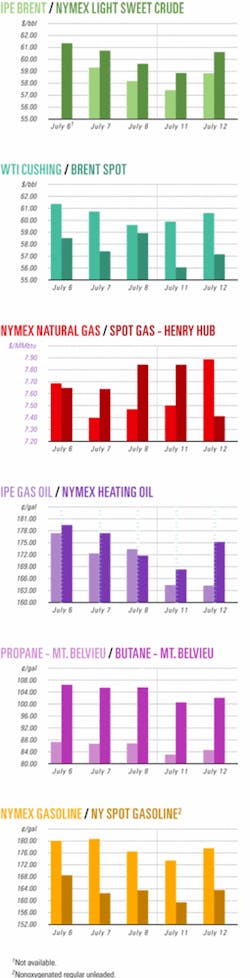

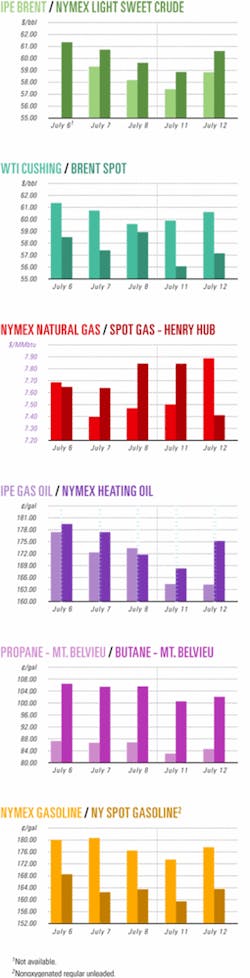

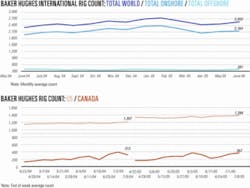

Industry Scoreboard

null

null

null

Exploration & Development - Quick Takes

Kerr-McGee to explore off Trinidad and Tobago

Kerr-McGee Oil & Gas Corp., Oklahoma City, was awarded Block 3(b) off Trinidad and Tobago.

Planning is under way for acquisition and evaluation of 3D seismic survey, a Kerr-McGee spokesman said.

Block 3(b) is east of Angostura oil field on Block 2(c), which is operated by BHP Billiton Ltd., Melbourne. Angostura is 38.5 km off eastern Trinidad and Tobago in 40 m of water (OGJ Online, Jan. 13, 2005).

Kerr-McGee has a 75% interest and is the operator of Block 3(b), covering 160,000 acres in 130-3,000 ft of water. Primera Block 3(b) Ltd., a Trinidad company, holds 25% interest.

White Nile to explore Ethiopia, South Sudan

White Nile Ltd., a Guernsey, UK, oil and gas exploration company owned 50% by the new government of South Sudan, has reached an exploration agreement with Ethiopia and has let a contract for seismic work in South Sudan.

White Nile said it had secured permission to explore a 70,000 sq km area in Ethiopia near the 15,356 sq km Block G in the Gambela basin, which is operated by Petronas Carigali Overseas Sdn. Bhd. of Malaysia (OGJ Online, June 25, 2003).

In June, White Nile raised £7 million from an additional share issue, aimed largely at the company’s exploration program in South Sudan.

White Nile let a contract to Terra Seis Geophysical Ltd., a wholly owned Calgary subsidiary of Terra Seis International, for an extensive seismic survey of its 65,000 sq km Block Ba in South Sudan.

Under the contract, Terra Seis will acquire 2,000 km of high-resolution geophysical data focused on a high-definition seismic program over a 10-month period.

The project, to start immediately, will look mainly at areas within Block Ba that are thought to be highly prospective: the extensions of the Melut and Muglad basin areas.

Terra Group Chairman Kevin Plintz said he expects data acquisition to be completed by June 2006.

The new government of South Sudan is the civil authority of New Sudan, which is being constituted as the government of Southern Sudan.

Russia, Kazakhstan sign Kurmangazy field PSA

Russian oil firm Rosneft-Kazakshtan Ltd. and Kazakhstan’s oil and gas company KazMunayGaz JSC signed a production-sharing agreement July 6 to jointly develop Kurmangazy oil field in the Kazakh sector of the Caspian Sea. The field straddles the Russia-Kazakh border (OGJ, June 15, 2005, p. 34).

The two firms will invest as much as $23 billion in the project, and each will hold a 50% share.

The agreement is for 55 years, with up to 10 years to be spent on exploration and 45 on extraction, said Baktykozha Izmukhambetov, Kazakh first deputy minister of energy and mineral resources.

Izmukhambetov said Kurmangazy’s reserves are 980 million tonnes or 7.33 billion bbl of crude oil.

Over the term of the agreement, Kazakhstan will earn more than $30 billion in taxes and other payments, Izmukhambetov said.

More drilling due for gas find off Turkey

Toreador Resources Corp. and partners plan further drilling in a western Black Sea permit area where they logged gas in Ayazli 3, a well directionally drilled to 1,335 m MD in the South Akcakoca subbasin.

The well had gas shows in multiple intervals between 725 m and 1,070 m, reported Stratic Energy Corp., a partner. Electric logs indicated gas pay in as many as six sand intervals at 743-1,070 m. Toreador estimates total pay thickness at 44 m.

The well’s bottomhole location is 1,100 m southwest of the Ayazli 1 well, which tested 15 MMcfd of gas from 16 m of pay in three zones before being suspended last September.

Toreador has run casing in Ayazli 3 and plans to drill Ayazli 2 from the same surface location to a bottomhole location 380 m southwest of Ayazli 1. It plans to test both of the new wells late this month. Toreador, Dallas, is operator with a 36.75% working interest in the permit area. Stratic holds 12.25% and Turkish Petroleum Corp., 51%.

The partners have exercised an option to extend their contract to use the Romanian GSP Prometheus jack up to drill a total of eight wells in the area. They are negotiating for another rig for further drilling this year.

Development of Enoch oil field approved

Dana Petroleum (E&P) Ltd. reported approval from the UK and Norwegian governments for development of Enoch oil field on UK North Sea Block 16/13a and Norwegian Block 15/5.

Enoch field, discovered in 1985 and later appraised by four wells, contains oil and gas in Eocene Flugga sandstone.

Development, costing £75 million, will involve a subsea well tied back to Marathon Oil Corp.’s Brae A platform 15 km away. Oil will move from Brae A through the Forties pipeline system, while gas will be sold offshore. Production is planned to start by yearend 2006 at an expected rate of more than 12,000 b/d of oil.

After Enoch field is unitized across the UK and Norway median line, Dana will hold an 8.8% interest. Paladin Expro Ltd. will operate the field with a 24% interest.

Other partners are Bow Valley Petroleum 12%, Dyas UK Ltd. 14%, Roc Oil (GB) Ltd. 12%, Statoil ASA 11.78%, Petro-Canada UK Ltd. 8%, Total E&P Norge AS 4.36%, DNO AS 2%, DONG Norge AS 1.86%, and Lundin North Sea Ltd. 1.2%.

Hydro to develop Oseberg Delta gas field

Norsk Hydro ASA has submitted a development plan for Oseberg Delta gas field in the Norwegian North Sea and has awarded a $25 million contract to FMC Kongsberg Subsea AS, a subsidiary of FMC Technologies Inc., to supply the subsea systems.

Hydro will develop Oseberg Delta as a subsea setellite to Oseberg field, which lies 8.5 km to the northeast. It will install a single, four-slot wellhead template in 102 m of water and drill two wells during the winter of 2006-07. Two 10-in. pipelines will connect the wells to the Oseberg D platform in the main field complex. A control cable will connect the satellite to the Oseberg A platform.

Oseberg Delta production will flow into the receptor facility used for output from Tune field, another Oseberg satellite. Oseberg Delta output will increase as Tune flow subsides, peaking at an expeted rate of 5 million cu m/day of gas.

Hydro estimates Oseberg Delta reserves at 8 billion cu m of gas and 2.7 billion cu m of oil and condensate. It says development, including drilling, will cost 1.8 billion kroner.

FMC will supply and install two horizontal subsea trees, a template manifold, and a production control system, beginning in July 2006. Production is to start in October 2007.

Hydro holds a 34% interest in Oseberg Delta and is operator. Other interests are Petoro AS 33.6%, Statoil ASA 15.3%, Total E&P Norge 10%, ExxonMobil Production Norway Inc. 4.7%, and Norske ConocoPhillips 2.4%.

Development eyed for gas finds off Malaysia

CS Mutiara Petroleum Sdn. Bhd. was assessing development options after making its fifth discovery in Block PM301 off the northeast coast of Peninsular Malaysia.

The 50-50 joint venture between Petronas Carigali Sdn. Bhd. and Shell Exploration & Production Malaysia BV made the latest find with the Bunga Kesumba-1 well spudded on May 28.

The well, in 55 m of water, went to TD 1,430 m and encountered multiple gas zones requiring further evaluation.

Bunga Kesumba-1 follows strikes at Bunga Kamelia, Bunga Zetung, Bunga Anggerik, and Bumi South. The well is 15 km southeast of the Bumi South gas discovery made in February.

CS Mutiara reported its fourth gas discovery on Block PM301 in April (OGJ Online, Apr. 14, 2005).

The company, formed in July 2001, operates Blocks PM301 and PM302. ✦

Drilling & Production - Quick Takes

Tanzanite appraisal well producing in Egypt

Apache Corp. has started oil and gas production from the Tanzanite 2 appraisal well on Egypt’s West Mediterranean onshore concession after tests of Cretaceous Alamein dolomite.

The well, drilled to 9,075 ft, flowed 2,846 b/d of oil and 640 Mcfd of gas through a 1-in. choke with 205 psi of flowing wellhead pressure during tests of the top 12 ft of the formation. Apache also logged 22 ft of net pay in the overlying Dahab formation.

The company connected Tanzanite 2 to production facilities in North Alamein field 1.6 miles to the southeast. The well is producing 2,782 b/d of oil and 640 Mcfd of gas. North Alamein, which Apache discovered in 1998, produces from the Alamein and Dahab formations.

Apache drilled the Tanzanite 1X discovery well in April (OGJ, Apr. 11, 2005, p. 8). The well is producing 1,050 b/d of oil and 2 MMcfd of gas through a 28⁄64-in. choke from Lower Cretaceous AEB 3A pay.

Apache plans to spud Tanzanite-3 in mid-August to accelerate AEB production updip to the Tanzanite 1X.

Apache holds a 65% contractor interest in the West Mediterranean concession, and RWE DEA AG, Hamburg, holds 35% interest.

Visund well sets record for length, Statoil says

Statoil ASA’s A-6 natural gas well in Visund oil-gas field on Blocks 34/8 and 34/7, in the Tampen area of the Norwegian North Sea, is the longest well drilled from a floating platform, the company claims. The well reached a total measured length of 9,082 m.

Statoil said 4,590 m of the well were drilled with a single bit at the rate of 102 m/day.

The Visund A-6 producer, seen as having a very high potential because it penetrates 800 m of hydrocarbon sands, will not come on stream until October.

Drilling operations were carried out in cooperation with Odfjell Drilling AS and Schlumberger Ltd., which served as the directional drilling company.

The group’s long-term goal is to be able to drill wells as long as 12,000-17,000 m in the Tampen area.

Imperial files plans for oil sands project

Imperial Oil Ltd. filed applications July 12 with the Alberta Energy and Utilities Board and Alberta environment officials for development of the joint-venture Kearl Oil Sands Project.

The proposed open-pit mine is to be located in the Kearl Lake area of the Athabasca oil sands deposit, 70 km north of Fort McMurray, on portions of oil sands leases held by Imperial and ExxonMobil Canada Properties, a partnership of ExxonMobil Canada Ltd. and its wholly owned subsidiary, ExxonMobil Resources Ltd. Imperial, is the designated operator with 70% preliminary working interest; ExxonMobil Canada Properties has the remaining 30% interest. Final working interests will be determined in 2006 following evaluation of the results of the winter coring program on the Kearl leases.

The partners plan to develop the mine in stages. The initial mine train will have a production capacity of 100,000 b/d of oil. Subsequent expansions could increase capacity to 300,000 b/d. Any future upgrading capacity to support the Kearl project would be the subject of separate applications, officials said.

If approved, construction of the Kearl Oil Sands Project mine could begin in 2007, with first production by the end of 2010. The other two proposed mine trains could start up in 2012 and 2018. Based on evaluation drilling, officials estimate total recoverable bitumen resources on the leases at 4.4 billion bbl.

Total investment in the development project is estimated at $4.5-6.5 billion (Can). It would involve a construction workforce of 2,000 and would create more than 1,000 permanent jobs when all three mine trains are operational. ✦

Processing - Quick Takes

Design funded for Sinopec refinery expansion

China Petroleum & Chemical Corp. (Sinopec) and units of ExxonMobil Corp. and Saudi Aramco agreed to finance the design work for a possible $3.5 billion expansion of a Sinopec refinery in southern China’s Fujian Province.

The proposed project also calls for the addition of a chemicals complex. In addition, ExxonMobil, Sinopec, and Aramco plan to conduct a joint feasibility study into a possible marketing joint venture.

The design agreement, signed in Beijing July 8, includes initial engineering and design, contractor selection, and finalization of cost estimates. Upon design conclusion, the parties will decide whether to proceed with project construction.

The proposed Fujian integrated project would expand the capacity of Sinopec’s Fujian refinery to 240,000 b/d from 80,000 b/d, with significant product upgrading capability. The upgraded refinery will be designed to refine and process sour Arabian crude.

In addition, the project calls for construction of an 800,000 tonne/year ethylene steam cracker, polyethylene and polypropylene units, and a 700,000 tonne/year paraxylene unit.

If the project proceeds, completion is slated for first half 2008. Sinopec and the Fujian government would own 50% while ExxonMobil and Aramco each would own 25%.

Belarus refinery to get hydrogen unit

JSC Mozyr Oil Refinery has awarded Foster Wheeler Italiana SPA a contract for basic design of a grassroots hydrogen production unit at its 323,300 b/d refinery in Belarus. Terms of the award were not disclosed.

Foster Wheeler also will supply materials for the steam methane reformer and provide technical assistance during construction, commissioning, and start-up.

The unit, scheduled to be in operation by 2007, will produce 25,000 normal cu m/hr of high-purity hydrogen.

Sulfur processing facility due in Qatar

Qatargas Operating Co. Ltd. has let a $360 million contract to a consortium of Washington Group International and Al Jaber Energy Services of Abu Dhabi for design, equipment, procurement, and construction services for a 12,000 tonne/day sulfur-handling facility in Qatar.

Construction of the Qatargas Common Sulfur project has begun at Ras Laffan Industrial City, Qatar. It is scheduled for completion in late 2008, with an intermediate start-up in 2007.

Canada awards $46 million (Can.) to ethanol plants

Canada has allocated $46 million (Can.) to five companies to build or expand ethanol plants across Canada in a second round of funding under its Ethanol Expansion Program (EEP). The awards range from $7.3 million to $15 million.

Building new plants will be Commercial Alcohols Inc. in Windsor, Ont., Husky Oil Marketing Co. in Minnedosa, Man., and Integrated Grain Processors Cooperative Inc. in Brantford, Ont.

In addition, Permolex Ltd. will expand its facility in Red Deer, Alta., and Power Stream Energy Services Inc. will convert a recently closed starch plant in Collingwood, Ont.

With this funding, along with $72 million previously allocated to six projects under the program’s first round and private investments from the involved companies, about $1 billion is being invested in Canadian ethanol production expansion.

The EEP is expected to result in production of 1.2 billion l./year of fuel ethanol by yearend 2007, bringing Canadian production to 1.4 billion l./year, said Agriculture and Agri-Food Minister Andy Mitchell. Canada plans to have 35% of all gasoline sold in Canada contain 10% ethanol by 2010. ✦

Transportation - Quick Takes

Statoil laying CO2 pipeline to Snøhvit field

Statoil ASA is laying a 151-km, 8-in. carbon dioxide injection pipeline from the Melkøya gas terminal in northern Norway to Snøhvit natural gas field in the Barents Sea.

The CO2, separated from Snøhvit gas at the terminal, will be injected back to a storage structure beneath the gas-bearing layers on the Statoil-operated field. The pipelay is being accomplished in five stages. The Skandi Navica pipelay vessel began work on the line in early June, laying 10-20 km/day of pipe, and work is slated for completion by the end of July.

Statoil has been separating CO2 from its Sleipner West natural gas production and storing it in a subsurface formation in the North Sea since 1996. The injection and storage, Statoil said, will reduce total carbon emissions from the two fields by at least 1.7 million tonnes/year, including 700,000 tonnes/year from Snøhvit.

Statoil said the pipeline to Snøhvit marks the first offshore injection of CO2 from a land-based plant.

Papua New Guinea-Australia gas line proceeds

The proposed $5 billion (Aus.) Highlands natural gas pipeline extending 3,600-km from Papua New Guinea to Queensland, Australia, has moved forward with the announcement that Sydney-based Australian Gas Light Co. (AGL) secured a long-term agreement to purchase 1,500 petajoules of gas over 20 years, starting in 2009 (OGJ, Dec. 13, 2004, p. 58).

Project partners have total commitments for 220 petajoules/year, above the threshold demand of 200 petajoules/year, in order to proceed with their plans.

AGL also reached an agreement with project participant Oil Search Ltd. to take a 10% equity interest in the project for $300 million. AGL already is in a partnership with Malaysian oil firm Petronas as preferred developer in the $25 million program to design and construct the pipeline, which will deliver gas from Kutubu and Hides fields in the central Papua New Guinea highlands.

AGL will purchase the gas over a 20-year period for $4.5 billion to supply its eastern Australian network, which includes more than 3 million customers.

The project moved to the front-end engineering and development stage in late 2004, and the partners expect to make a final investment decision during second half 2006.

With AGL’s participation in the upstream side of the project, Oil Search’s interest will drop to 44.2%. ExxonMobil Corp.’s Melbourne-based subsidiary Esso Highlands Ltd. (operator) will retain 39.4%, the Papua New Guinea government and MRDC (a Papua New Guinea company representing landowner interests) 3%, and Nippon Oil Corp. of Japan 3.4%. ✦