Investment cited as most likely limit to oil supply

Any limitations on worldwide supply of oil until 2030 will be due to a lack of the investments in development, transportation, and refining “in the correct places at the correct time,” said Kenneth J. Chew, vice-president of IHS Energy, Geneva.

Chew spoke at a seminar June 28-30 cosponsored by the Organization of Arab Petroleum Exporting Countries (OAPEC) and Institute Français du Pétrole (IFP).

The consensus at the conference was that there was no lack of global oil reserves but rather a lack of capacity to increase production through development of reserves.

OAPEC reserves

At yearend 2004, the 11 members of OAPEC-Algeria, Bahrain, Egypt, Iraq, Kuwait, Libya, Qatar, Saudi Arabia, Syria, Tunisia, and the UAE-held an estimated 650 billion bbl of oil reserves, up from 312 billion bbl in 1970, said Kuwait’s M. Mukhtar Lababidi, director of OAPEC’s technical affairs department. The countries accounted for 59% of the world’s total oil reserves.

OAPEC’s average oil production in 2004, Lababidi said, was 20.8 million b/d, yielding a reserves-to-production (R-P) ratio of 86 years.

“The cumulative production of OAPEC members at the end of 2004 was estimated at about 254 billion bbl, bringing the figure for total discovered reserves to about 904 billion bbl,” he said.

Lababidi estimated ultimate recoverable reserves (current proved reserves plus cumulative production plus undiscovered reserves) at a little less than 1.075 trillion bbl.

Country R-P ratios include Kuwait, 118 years; the UAE, 114 years, and Saudi Arabia, 80 years.

Natural gas reserves, Lababidi said, reached 53.1 trillion cu m at yearend 2004, accounting for 31% of total world gas reserves. Nonassociated gas reserves are estimated at 42 trillion cu m.

Potential undiscovered reserves “have been estimated by various sources at about 44 trillion cu m, equivalent to 83% of the existing proven reserves,” Lababidi said. The undiscovered potential is mainly in Saudi Arabia, Iraq, Algeria, Libya, and Egypt, he indicated.

Investments

In the medium to long term, Lababidi said, Iraq, Kuwait, Saudi Arabia, and the UAE would serve as the world’s main oil suppliers. But to meet future world oil demand, which is expected to increase to 111 million b/d by 2025, 9-14.4 million b/d will have to be added to the current capacity, requiring an investment of $100 billion ($5,000-10,000/bbl).

Further investments will be needed, he said, to compensate for natural production declines. The outlays will require “a secured environment,” enabling producers to be certain that “demand will materialize as well as the cooperation and access to international funds and technology.”

Global oil resources are adequate to meet demand until 2030, insisted Fatih Birol, chief economist at the International Energy Agency. According to estimates by IFP geologist Yves Mathieu, current non-OAPEC reserves stand at 460 billion bbl of oil in producing fields plus 90 billion bbl in developing fields with a “reasonable” figure of 360 billion bbl yet to be discovered. Heavy and extra-heavy oil from Canada and Venezuela add 330 billion bbl, Birol said.

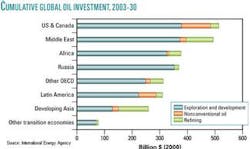

But industry will need to invest $3 trillion during 2003-30 to bring the oil to market, 70% largely to replace exhausted capacity. The highest investments will be needed in the US and Canada, the Middle East, Africa, and Russia, he stated (see chart).

Technology will boost recovery rates from an average of about 35% of oil in place now to 75%.

Chew sees potential for an additional 13 million b/d of oil production capacity through 2010. Production capacity is likely to remain unchanged in the Far East and non-OPEC Middle East and decline in Europe and Australasia. All other regions should show gains. The largest percentage increases, he said, will occur in the Common of Independent States and non-OPEC Africa, but the greatest absolute increase in capacity will come from OPEC.

During 2011-20, liquids production might move from being demand-driven to supply-limited. “In other words,” Chew said, “any crisis may turn out to be that of getting products to market rather than producing crude.” ✦