First half drilling on uptrend in most areas of the world

The world has been basking in what could be called a drilling boom in the first half of 2005 compared with the same period of 2004.

OGJ forecasts that operators could drill more than 40,000 wells in the US for the full year, which would be a 20-year high.

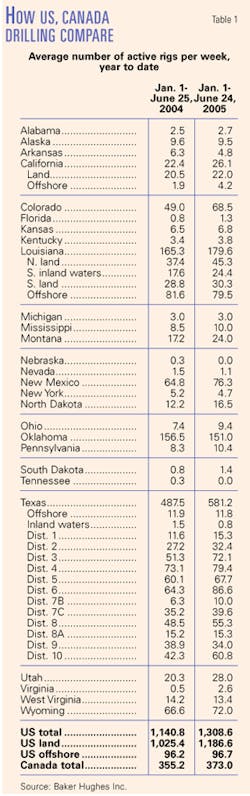

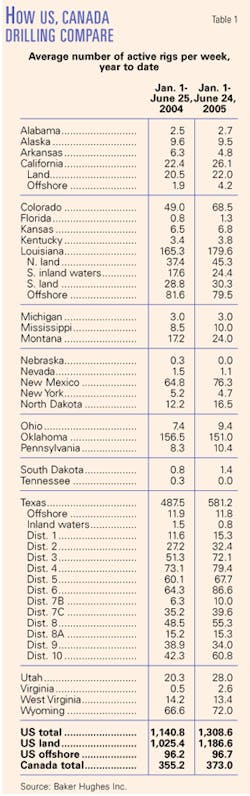

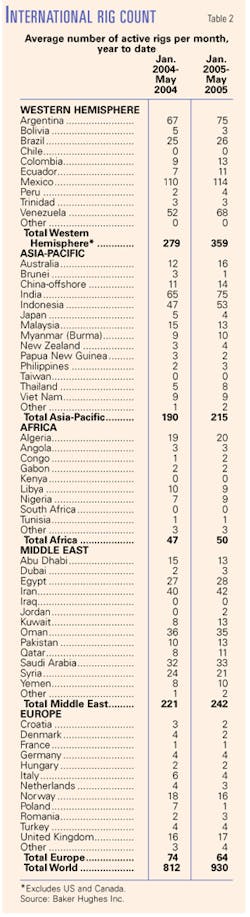

Strong year-to-year gains in the Western Hemisphere, led by the US and Canada, show that the industry is responding to historically high oil and gas prices (Table 1). The rig activity figures, however, show positive year-to-year comparisons in almost every area, including the Middle East, Africa, Asia-Pacific, and the Western Hemisphere excluding the US and Canada, according to Baker Hughes Inc. (Table 2). The exception is Europe with a substantial drop.

Here are highlights of OGJ’s midyear drilling forecast for 2005:

• Operators will drill 40,014 wells in the US this year, up from OGJ’s estimate of 37,603 wells drilled in 2004 (OGJ, Jan. 17, 2005, p. 34).

• All operators will drill 4,492 exploratory wells of all types, up from an estimated 3,000 in 2004.

• The count of surveyed rotary rigs compiled by Baker Hughes will average 1,300/week in 2005, up from 1,187/week in 2004.

• Operators will drill more than 22,000 wells in Canada, up slightly from the 2004 performance.

US drilling pace

With the Gulf of Mexico as an exception, rig counts were up year to year in January through June 2005 in most states.

Baker Hughes’s US offshore total shows a gain mainly because the figure includes the South Louisiana inland waters category, which averaged 24.4 rigs/week in January-June 2005 compared with 17.6 rigs/week in the first 6 months of 2004. Texas-Offshore posted a slight decline.

The US, home to almost half of the world’s workable rigs, looked to be on the way to a 9.5% increase in working rig count in 2005 compared with 2004 (Table 3).

If met, OGJ’s forecasted 40,014 completions would be the highest total since 1985, when operators completed 70,806 wells. It was the last down year of the drilling boom of the late 1970s-early 1980s set off by natural gas price deregulation.

States and areas with January-June 2005 rig averages lower than they were in 2004 include Oklahoma, North Texas Dist. 9, West Virginia, Alaska, Arkansas, and Nevada. All of the declines are small.

US play summary

Wyoming’s Powder River basin coalbed methane play still dominates the US rig count with the North Texas Mississippian Barnett shale play a distant second with about half as many rigs.

OGJ forecasts that more than 10% of the wells drilled in the US this year will be in Wyoming.

The Texas rig count averaged 581 rigs in January-June, 19% higher than a year earlier. Main growth areas, in addition to the Barnett, are the East Texas Bossier sand gas play, several plays in the Upper Gulf Coast, and gas drilling in the Texas Panhandle.

Colorado, with gas drilling ramping up in the Piceance basin, employed 68 rigs/week in the first 6 months of 2005 compared with 48 in the same 2004 period. OGJ estimates 2,727 wells will be drilled in Colorado this year.

Operators in North Dakota are beginning to dedicate rigs to a play for oil and gas in Mississippian Bakken shale in which more than 125 wells have been completed in Richland County, Mont., with horizontal legs of 8,000-10,000 ft.

Canada’s outlook

Operators in Canada were shepherding a 5% year-to-year gain in active rigs, according to Baker Hughes.

Seasonal considerations caused a swing from a high of about 600 rigs in February through a decline caused by spring thaw rig-move restrictions to fewer than half that in May. Baker Hughes put the January-May average at 388 rigs in 2005.

A greater share of drilling permits in Alberta targets coalbed methane and wells designed to produce bitumen, while the number of wells aimed at conventional oil and gas formations is declining. Both markets are expected to grow handsomely in coming years.

Canada is in step with an overall trend of the domination of resource or unconventional gas plays in North America.

Rest of world

Europe’s 13.5% drop to a 64 rigs/week average in January-June 2005 is the only year-on-year decline for that period in the rest of the world.

OGJ does not forecast the number of wells to be drilled in the non-North American regions, but the Baker Hughes rig numbers show good growth since 2004. The Western Hemisphere’s improvements rested with good gains in Argentina, Colombia, Ecuador, Mexico, and even Venezuela.

Iran, Kuwait, Pakistan, and Qatar had the most meaningful gains in the Middle East.

India and Indonesia both had potent gains in Asia-Pacific. ✦