CERA: Global oil, NGL production to rise by 2010

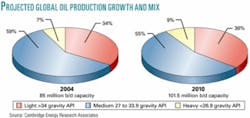

As much as 16.5 million b/d of additional production capacity for crude oil and natural gas liquids could come on stream around the world by 2010, an increase to 101.5 million b/d from 85.1 million b/d in 2004, said officials of Cambridge Energy Research Associates, Cambridge, Mass.

Based on a field-by-field study of productive capacity for crude and NGL, plus current development plans among major international oil companies, CERA said the new capacity will be almost evenly divided, with production among members of the Organization of Petroleum Exporting Countries increasing by 8.9 million b/d and non-OPEC production up by 7.6 million b/d. Moreover, it said, most of the new production will be light, sweet crudes that are most favored by refiners.

“Of the capacity additions in the next 5 years, 10 million b/d of it is light, only 4.5 million b/d is medium, with just 2 million b/d being classed as heavy, so it’s predominantly light oil coming on in the next 5 years,” said Robert W. Esser, CERA’s director of global oil and gas resources and coauthor of the report, in a June 21 teleconference.

CERA sees “20-30 new major [greater than 75,000 b/d] projects coming on stream every year to 2010,” contributing 3-4 million b/d of new liquids production capacity annually.

“Much of this increase is already approved and under development, and much of it happened at a relatively low oil price,” said Peter M. Jackson, CERA’s director of oil industry activity and the other coauthor of the study, which was to be presented at the group’s international energy conference June 28-30 in Istanbul.

Smaller oil fields and gas-liquids fields will add another 1 million b/d each year. Those fields that are expected to come on stream in 2005-07 “are already under development and essentially insensitive to oil prices,” said CERA officials. “About three quarters” of the new production capacity expected by 2008 is under development, they said.

Optimistic assumptions

Based on the optimistic assumption that no major political crises in any key producing countries will disrupt present exploration and development plans, CERA said the most significant production increases among OPEC members are expected in Nigeria, up by 1.27 million b/d, and in Iran and Iraq, each with increases of 1 million b/d. But Nigeria has been subject to multiple political and labor disputes that disrupted operations this year, Iraq is struggling to revive its prewar production, and Iran is under international pressure to abide by a nuclear suspension agreement signed in Paris and to refrain from engaging in nuclear enrichment activities.

In their study, CERA officials didn’t identify “exact political risks but rather the type of things that you might expect that could range from disruptions of political problems to slowness in decision making. Iraq has the potential to be a very big player, but its timing is very uncertain.”

The non-OPEC areas with the best prospects for increased production, said CERA, are the Caspian region, up 2.5 million b/d; Russia, slowing to 1.15 million b/d of growth through 2010 from 1.97 million b/d in 2002-05; Brazil, 1.16 million b/d; Angola, 1.35 million b/d; and Canada, 1.32 million b/d. Production declines are expected in Norway, down 330,000 b/d; the UK, 360,000 b/d; Mexico, 200,000 b/d; and the US, 470,000 b/d. CERA expects production in the Far East to be “relatively flat to increasing a little bit.”

Jackson acknowledged, “We were more optimistic [about Russian production] a few months ago, but in light of what has been happening in Russia, we did shave back our analysis in our last outlook. But we still see some expansion occurring over the next few years.” CERA reduced its projection of Russian production because of “export bottlenecks, but also because the political situation in the last 6-9 months will have an impact on the operating companies there,” he said.

CERA expects a gradual increase in Saudi Arabian production, including NGL, to 12 million b/d by 2010 from roughly 9 million b/d at present. Moreover, analysts said, “Brazil is a good example of a country like Angola or Nigeria where we see quite a dramatic increase in productive capacity of, in this case, 1 million b/d by 2010.”

North America has two world class plays, “one being the oil sands of Canada, which are expected to add over 1 million b/d by 2010, and secondly, the deepwater Gulf of Mexico, which is expected to add something on the order of three quarters of a million b/d by 2010. Many of the large discoveries made over the last few years...are coming on stream in the next few years and will add over a half-million b/d,” Esser said.

“One of the key areas for major increase in liquids [production] capacity is the deep water in four major areas, and we see that rising from about 2.5 to 9 million b/d by 2010,” Jackson said. CERA officials also noted the lower tertiary play that has developed in the Gulf of Mexico. “This is in very deep water, these wells take a long time to drill-the discoveries are very large-but production from this play is not expected until 2020,” said CERA Chairman Daniel Yergin.

“Apart from OPEC countries, Russia and the Caspian, Canada, Brazil, Angola, and to a lesser extent Malaysia, Mauritania, Sudan, and Congo will exert an increasing influence over oil supply,” CERA said in its report. “However, beyond 2010, OPEC countries will exert an increasing market influence and control over supply.”

CERA sees non-OPEC production growing by 12 million b/d in 2000-10 before production growth falls precipitously to less than 2 million b/d through 2020. At that point, “OPEC is going to need to make up the shortfall,” Jackson said.

“OPEC has the potential and resource base in place to expand capacity in all but perhaps one member country [Indonesia],” CERA reported. “With a projected increase of some 9 million b/d between 2004 and 2010, OPEC will continue to win the race with even greater influence in the supply market than it has now.”

Unconventional liquids

CERA anticipates the proportion of unconventional liquids production capacity-“gas-related liquids, condensate, NGL, extra-heavy oil, Canadian oil sands and Venezuela’s Orinoco oil, and lastly, ultradeepwater oil in water depths beyond 2,500 ft”-to jump to some 30% of total production by 2010, up from 16% in 2000.

“These special liquids, except for the ultradeepwater oil, will have no decline apparent until well after 2010,” said CERA analysts. “Gas-related liquids and heavy oil just don’t decline in the near term. Gas-related liquids also are unaffected by crude prices.”

Meanwhile, the expected increased production should lead to a softening of oil prices in 2007-08, analysts said. With world demand for oil projected at 94 million b/d, “a supply-demand differential of 7.5 million b/d in 2010 could be unsustainable.” CERA analysts added, “Although...so much of the [production] growth is already locked in, we may see a slowing of projects, particularly in OPEC countries and perhaps in non-OPEC countries.”

Still, said Jim Burkhard, CERA director of global oil market research, “We’re talking about production capacity and not necessarily actual production. OPEC could withhold production from the market in coming years to prevent prices from falling much below $40 or $30/bbl. But, longer term beyond 2010, we become much more dependent on OPEC, and therefore we see prices rising generally after 2010 because of the growing concentration of oil production capacity.”

Meanwhile, at a June North American energy and power conference in Boston sponsored by RBC Capital Markets, the investment banking arm of RBC Financial group, two thirds of the energy executives and institutional investors surveyed said they expect oil prices to fall back to $35/bbl in 5 years, while the rest said it could hit $100/bbl in the same timeframe.

Jackson said, “We don’t actually see a peak in oil production worldwide before 2020.” The report indicates that an “inflexion” point will come in the third or fourth decade of this century, but instead of a production peak, it will take the form of “an undulating plateau” that will continue for several decades.

Other factors

As for depletion rates among current and future fields, Jackson said they were now looking at it in closer detail.

“In our field-by-field analysis, we estimate depletion rates for a particular field depending on the types of reservoir, so the range of depletion rates we see are from 2-3% in some areas of the Middle East to 25% in Venezuela and some of the relatively heavy oil projects there. But we would see an average in the 5-6% range, although we haven’t really used an average in our analysis,” he said.

Yergin said, “It’s important to recognize that in the deepwater fields where you’ll have wells that typically can produce between 10-40,000 b/d, you would expect rather high depletion rates.” He also pointed out, “One of the things that is always underestimated is the impact of technology.”

Moreover, said Jackson, “What is usually forgotten is the potential for reserves upgrades in many of the mature fields around the world. A lot of work is being done by the US Geological Survey and also by our parent company that suggests that there actually has been a tremendous amount of reserves upgrade occurring in the last few years. Over the period of 1995-2003, we’ve replaced about 130% of the reserves that we’ve produced.”

Skeptics question whether the major oil companies and producing countries can obtain the investments, prospects, rigs, crews, equipment, and supplies necessary for such a rapid increase in production. However, Jackson said efforts already were under way toward many projects.

“Given that many of these projects are actually already approved and in the budgets of the major companies, I anticipate that they expect the resources and infrastructure to be available.” Still, he acknowledged, “In the light of the current oil price situation, the increase in the amount of activity, particularly from the independent groups’ increasing their E&P budgets, there will be more call on these resources and they will become more limited.” Yergin also acknowledged “a people constraint” in the lack of experienced engineers and crews, “but what we’re talking about is already pretty much in progress.”

Finding and development and operating costs have escalated this year with increased drilling that has seen the US rig count at a 19-year high. “The drilling industry continues to surprise with day rates reaching and exceeding old highs,” said Lehman Bros. analysts in a June 22 report. “Across the board, from the very deep water to the shallow water, rates have increased and have shown no [slowdown] in momentum.”

Lehman Bros. analysts noted a new $120,000/day contract for a 300-ft jack up rig in Tunisia that previously worked for $57,500/day. A standard 400-ft jack up rig in the Gulf of Mexico had a rate of $90,000/day up from a prior rate was in the $70,000s. Among semisubmersibles, they said, “Even the low specification rigs are experiencing meaningful increases and much longer contract terms. Transocean [Inc.] signed a 1,800-ft rig at $150,000/day (up from $50,000) for a 2-year contract with Shell. We also know the deepwater drillers expect to bid high-specification, fifth-generation semis at $400,000/day, with leading edge only in the low $300,000s today.”

Higher prices for rigs and services are forcing budget increases, said Lehman Bros. In a June 21 report, the company raised its midyear forecast of worldwide exploration and production spending to an increase of 13.4% among 356 companies surveyed, up from a 5.7% hike to $192 billion in its December 2004 survey.

“We continue to believe 2005 E&P expenditures suggested by our survey likely understate the actual rise in spending levels that is underway, primarily because of the extraordinary strength in oil and gas prices,” analysts said.

Refining pressured

Other industry analysts maintain that it’s not a lack of crude that has pushed up energy prices this year but rather a growing demand for petroleum products that has pushed the global refining capacity to its limits.

“The oil market is being driven by products rather than crude,” said analysts at the Centre for Global Energy Studies, London, in their June 20 monthly report. “Demand for middle distillates-jet fuel, diesel, and heating oil-is outstripping the ability of the refining system to produce it.”

Jackson acknowledged, “A higher than usual demand for middle distillates and a stark lack of refining capacity obviously have had a big impact on the oil price recently.” But CERA claims more refining capacity is coming on stream outside the US.

Because new refining operations have long lead times, said Burkhard, “We don’t see a quick turnaround with significant additions in the very near term, but in the medium term we do see capacity coming on stream, particularly in Asia.” In another segment of the teleconference, he said, “In the short term of the next 3-5 years, refining capacity, particularly in East Asia and China, is becoming more complex, with more capacity that can handle the heavier sour barrels of crude.” ✦