Regional shifts in worldwide capacity, production slow

Worldwide in 2004, natural gas and related NGL production continued steady but slower growth, as worldwide demand for all types of energy pushed natural gas and crude oil production.

Despite impressive gains in drilling rig activity in the US and Canada, however, only Canada of the two countries managed to increase its natural gas and NGL production in 2004. Production of both in the US continued the decline, a trend Oil & Gas Journal has been following in the report for several years.

Natural gas processing capacity for those two countries managed barely to retain their combined lead in capacity-51.5%-over the rest of the world, while several other regions continued to expand capacity en route to overtaking the leaders, probably this year. This is the broader trend of the more specific movement in LPG production discussed in the companion article: from regions west of the Suez Canal to regions east of it (see p. 52)

Worldwide natural gas production in 2004 (OGJ, Mar. 14, 2005, p. 67) increased by slightly more than 1% over that for 2003 (OGJ, Mar. 8, 2004, p. 74), with US production falling by more than 4% as Canada managed to produce barely 1% more.

Similarly, worldwide gas processing capacity in 2004 increased by only 1% and, if the US decline is removed from the calculation, by only 1.4%, according to the latest Oil & Gas Journal data that also reflect corrections based on new information (Table 1).

Processing capacity in North America-US, Canada, and Mexico-which historically leads the world, increased fractionally in 2004 and actually dropped by nearly 1.5%, if only the US and Canada are considered.

Natural gas production, according to OGJ figures, leveled somewhat in 2004 after rebounding briskly in 2003 (OGJ, June 28, 2004, p. 46) in response to higher market demand and prices.

Although natural gas production in the US and Canada has grown only slightly, constrained in part by environmental and regulatory pressures, production in other areas has increased directly in response to higher demand in North America and Western Europe. This is plainly evident in the explosion of LNG projects in the Middle East and North and West Africa. Such projects will also be responsible for increased NGL production.

Natural gas emand in North America has fueled a frenzy in LNG terminal proposals and plans. By some counts, more than 50 terminals are in some stage of planning or development. As 2004 began, all four existing US LNG terminals were back in operation (two from mothball status) after several years of near inactivity. Each has already expanded, is expanding, or has active plans to expand.

And in March, the fifth US LNG terminal, the offshore Gulf of Mexico-based Energy Bridge, started up with its unique tanker-regasification vessel, the Excelsior, unloading its first cargo. The terminal is owned and operated by Excelerate Energy LLC, Houston, which is seeking approval for another terminal off Massachusetts.

So long as operators encounter regulatory, environmental, or public resistance to expanding exploration and production the US, especially off California and Florida, natural gas and NGL production in the US will continue to stagnate. At the same time, gas production, processing, and NGL production outside the US, especially in such areas as Africa, the Middle East, Russia, and the Far East will grow.

Not yet; but soon

A year ago, this report sagely-but prematurely-predicted that 2004 would be the year North America would lose its historical dominance in gas processing capacity or NGL production or both. In fact, when Mexico is factored into the calculation, North American dominance in capacity inched ahead in 2004.

But the trend seems clear, as more and more natural gas production comes on line in areas likely to be linked by future pipeline or LNG production to gas-hungry markets in Western Europe and the US.

For 2004, the balance in gas processing capacity remained slightly in favor of North America as US and Canadian capacity edged up to more than 51% of the world’s overall capacity from slightly more than 50% for 2003. Production of NGL in the US and Canada rose in 2004, as well, thanks to Canada’s production being up by more than 2.1 million gpd to offset the fall in US production of more 1 million gpd.

The two countries combined in 2004 to produce more than 38% of the world’s NGL, a drop from slightly more than 40% of the world’s production of NGL in 2003 and from 42% in 2002.

Adding Mexican data to those for the US and Canada (removing Mexico for the exercise from the Latin America column) reveals that North America holds:

• More than 53% of the world’s processing capacity, up slightly from more than 52% in 2003 but still off from more than 54% in 2002 and 55% for 2001.

• More than 43% of its NGL production, sliding from 46% in 2003, 48% in 2002, and nearly 52% for 2001.

With Canadian natural gas production rising and likely to continue, driven by Alberta’s heavy-oil production needs and US Lower 48 demand, and with Mexico’s production also rising, North America may yet retain its dominance in natural gas processing for a few years to come, but the trend is inexorable.

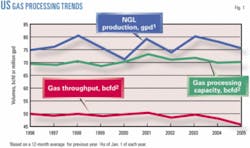

On Jan. 1, 2005, OGJ data show that US gas processing capacity stood at slightly more than 70 bcfd; throughput in 2004 averaged nearly 46.8 bcfd; and NGL production, more than 76 million gpd (more than 1.9 million b/d; Fig. 1).

Fig. 2 shows pricing differentials in the US between LPG-the most widely traded NGL on the world market-and crude oil for the first trading day of each month in 2004. The chart shows the historically normal relationship between LPG and crude oil continued throughout 2004. The market values moved generally in harmony.

Sources; the world

All gas processing activity figures in the breakout tables are based on Oil & Gas Journal’s exclusive, plant-by-plant, worldwide gas processing survey and its international survey of petroleum-derived sulfur recovery.

Canadian data are based on information from Alberta’s Energy and Utilities Board that reflect actual figures for gas that moved through the province’s plants and are reported monthly to the AEUB. For 2000 for the first time, OGJ took these data for all of Alberta and compiled annual figures and thereby created a new baseline for data comparisons thenceforth.

In addition to AEUB figures for Alberta and to operator responses to its annual survey, OGJ has supplemented its Canadian data with information from the British Columbia Ministry of Employment & Investment’s Engineering and Operations Branch and the Saskatchewan Ministry of Energy & Mines.

As 2005 began, gas processing capacity outside Canada and the US stood at nearly 115.5 bcfd, down slightly from more than 116 bcfd a year earlier; throughput for 2004 averaged nearly 74 bcfd, slightly ahead of the 73.5 bcfd for 2003; and NGL production in 2004 outside the US and Canada averaged more than 166.5 million gpd, up from more than 151.6 million gpd in 2003.

Note that in Table 1, the growth in NGL production for Asia-Pacific derives mainly from new condensate production figures from Northwest Shelf Venture.

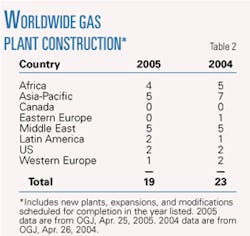

Table 2 provides a snapshot of the current state of gas plant construction in the world.

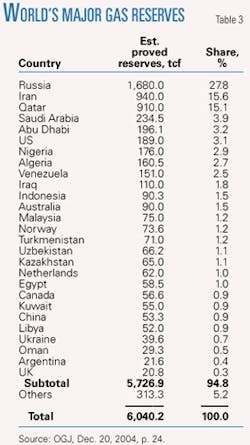

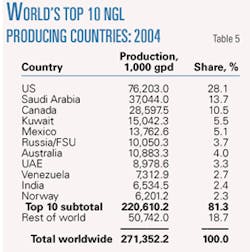

Table 3 ranks the world’s major natural-gas reserves by country at the start of 2005; Table 4, the world’s top natural-gas producing countries for 2004; and Table 5, the world’s leading NGL producers.

Regional action

As the companion article by Purvin & Gertz makes clear, recent years have seen a steady shift in the production LPG from west of the Suez Canal (mainly the US and Canada) to east of the Suez Canal as overall the world’s production of NGL has increased. One major contributor to this shift and increase is activity in the Middle East, particularly Qatar and Saudi Arabia.

Not only are more NGLs being produced from conventional gas processing in the Middle East (and elsewhere), more are being produced because more LNG capacity is starting up. And Qatar has set a goal for itself to become the world’s leading producer of LNG along with its status as site of the world’s first commercial gas-to-liquids ventures.

Qatar

Although the country has become best known in recent years for its growth as a center of LNG trade and the site of the world’s first GTL plants, Qatar Petroleum has also expanded its NGL trade with the completion in 2003 of the NGL-4 project at Mesaieed Industrial City, south of capital city Doha.

The main products of the plant are 3,200 tonnes/day (tpd) of ethane, 3,000 tpd of propane, 2,100 tpd of butane, and 780 tpd of NGL condensate (www.qp.com.qa). The ethane is feedstock for the Qatar Chemical Co. (Q-Chem) plant and Qatar Petrochemical Co. (QAPCO).

The propane is stored in a new 58,000 cu m storage tank, similar in design to the existing two tanks. The butane and NGL condensate are stored in the existing storage tanks.

Elsewhere in the small country, last month saw the official start of construction on gas processing and compression plant as part of the Dolphin project to carry Qatari gas to the UAE. The plant will come on line next year and be built under a $1.6-billion contract by JGC Corp., Japan, at Ras Laffan Industrial City, north of Qatar’s capital city Doha. JGC received the contract in January 2004.

The plant will include gas reception, dehydration and sweetening, and NGL extraction and fractionation, according to QP. Dry sweet gas will then be compressed and exported to the UAE via an offshore export pipeline.

The second contract went to J Ray McDermott, Jabal Ali in the UAE, for detail engineering, procurement, and installation of the two offshore platforms that will be installed in the Dolphin contract location, about 70 km off Qatar in the North field.

The third contract was awarded to Rolls Royce Energy Systems, UK, to supply and install six compression trains driven by 52 gas turbines at the Ras Laffan plant.

When fully developed, said the company, the project will export 2 bcfd to the UAE. The project will also produce for export more than 95,000 b/d of condensate, 3,000 tpd of LPG, and 3,700 tpd of ethane for Qatar’s petrochemical industry.

First gas is likely to flow by fourth-quarter 2006.

Saudi Arabia

Early in 2004, Saudi Aramco officially made operational the Haradh natural gas project, consisting of:

• The Haradh gas plant with sendout capacity of 1.5 bcfd of sales gas to Saudi Arabia’s Master Gas System lies 280 km southwest of Dhahran.

• Gas-oil separation plant (GOSP-3) capable of stabilizing 300,000 b/d of Haradh Arabian Light crude oil and a 140 MMcfd associated-gas gathering system.

The project also includes installation of a third gas-turbine-driven water injection pump at Haradh GOSP-2, 26 miles north, to maintain reservoir pressure, and a seawater-supply booster pump at the Hawiyah central water-injection pump station.

To transport products from Haradh GOSP-3 to processing at Abqaiq and Uthmaniyah, the project calls for construction of 162-km of crude and gas pipelines and extensions to the existing pipeline systems. Plans also call for more than 152 km of pipelines to transport seawater and produced salt water for reservoir injection.

The Haradh plant is Saudi Aramco’s second facility built primarily to process large amounts of non-associated gas; the first was Hawiyah gas plant, brought on stream in 2002 (OGJ, Mar. 28, 2005, p. 8).

In addition to the sales gas, the Haradh plant can deliver as much as 170,000 b/d of condensate to the company’s Abqaiq processing plants via a 230-km, 18 and 24-in. pipeline.

The plant can also produce 90 tpd of sulfur for export. The sulfur is degassed and trucked to the Berri gas plant, unloaded, and then pumped to the Jubail industrial complex to a sulfur pelletizing plant for export.

According to Saudi Aramco, the Haradh gas plant consists of four gas trains to process the gas, two for sweet gas and two for sour Khuff gas. Sweet gas comes from the Haradh, Ghazal, Wudayhi, Waqr, and Tinat gas fields. Khuff gas comes from the Haradh field.

Facilities at the plant, in addition to the four gas processing trains that perform gas dehydration, dew point control, and sales-gas compression, include two gas-sweetening and sulfur-recovery trains, two condensate stabilizers, and two sour-water strippers (www.saudiaramco.com).

In remarks at the dedication, Saudi Aramco’s President and CEO Abdallah S. Jum‘ah said the Haradh project is the third mega-project completed by the company over the previous 6 years. The first two were the Shaybah oilfield development in the Rub‘ al-Khali desert (completed in 1998) and the massive Hawiyah gas plant, completed in 2002.

The company says the Haradh natural gas and oil development project will help it “leverage its hydrocarbon resources to achieve maximum economic growth for the Kingdom” (www.saudiaramco.com).

Saudi Aramco says its natural gas initiative has made “substantial progress and has an ambitious schedule ahead” to implement some $25 billion in projects over the next 5 to 10 years. Progress is on three so-called “Core Ventures.”

Core Venture1 (CV1) includes ethane and NGL recovery from the Haradh and Hawiyah gas plants, additional new gas development and production, two petrochemical complexes to use ethane and NGL and two large power and water-generation facilities on the eastern coast, says the company.

The international oil company consortium selected to develop CV1 includes ExxonMobil Corp., Royal Dutch/Shell Group, BP PLC, and ConocoPhillips.

Core Venture 2 (CV2), focusing on gas development in the Red Sea and along the western coast, includes exploration, development, production, and downstream facilities, such as petrochemical and power and water plants. ExxonMobil, Occidental Petroleum Corp., and Marathon Oil Co. comprise the consortium to develop CV2.

Core Venture 3 (CV3) consists of gas exploration and production in the Shaybah-Kidan area in the southeastern part of the country. It will include downstream facilities, as well, says the company. A consortium comprised of Shell, Total, and ConocoPhillips will develop CV3.

The company reports that the three CVs cover 440,000 sq km (www.saudiaramco.com).

Abu Dhabi

In February, Abu Dhabi Gas Industries Ltd. (Gasco) and Bechtel Corp., Houston, signed an engineering, procurement, and construction agreement for onshore gas development Phase 3 (OGD-3).

The project will produce 125,000 b/d of condensate, 12,000 tpd of NGL that include about 3,200 tpd of ethane, and recycle an equal volume of produced gas into the reservoir via high-pressure gas injection system.

The agreement sets total price for the project at nearly $1.5 billion; the project is to be completed in 40 months with start-up by first-quarter 2008.

In September of last year, Gasco became sole operator of the Asab gas plant, taking over from Abu Dhabi National Oil Co. (Adnoc). The addition makes Gasco, according to company officials at the time, “one of the largest gas-processing companies in the world.” OGJ figures as of Jan. 1, 2005, show Abu Dhabi’s total gas processing capacity as nearly 2.5 bcfd.

The company’s announcement said that, with the new ownership, Gasco operates five onshore plants in Abu Dhabi: the Habshan-Bab gas complex, including the Habshan gas plant and the Bab gas plant; the Bu Hasa NGL plant; the Asab NGL plant; the Ruwais NGL plant; and the Asab gas plant.

The Asab gas plant engages in gas cycling with two trains and total capacity of 826 MMscfd.

After condensate separation, the gas is compressed and reinjected into the reservoir, while the stabilized condensate moves to refineries at Takreer.

A senior official said last year that the company was “evaluating the bids for the [associated gas development] AGD-2 and OGD-3 projects.”

Algeria

In Algeria, construction is progressing on the 1.05-bcfd gas plant at In Amenas, about 850 km south of Hassi Messaoud in the southeast part of the country. The In Amenas project is the largest wet-gas joint development project in Algeria and includes development of four primary gas fields and gas gathering and processing facilities.

Gas from In Amenas will be transported via pipeline to Hassi R’Mel and from there to the ports of Arzew, Isser, and Skikda, or via two export pipelines routed directly from Hassi R’Mel to Spain and Italy, respectively, according to reports when the project was announced in 2002.

JGC and Kellogg, Brown & Root are providing design, procurement, construction, and commissioning services in a contract initially valued at about $745 million. Completion is set for October of this year, according to partner Statoil ASA, with a plateau production of 9 bcmy as well as liquids of about 60,000 boe/day.

Sulfur production

In 2004, worldwide refining and natural gas processing’s production of petroleum-derived sulfur hit more than 85 million tpd in 2004, up more than 2% from 2003, from slightly more than 178 million tpd in capacity.

Canada and the US continued to dominate the world in 2004, holding more than 48% of processing capacity and 50% of actual production, both increases over 2003.

Canada produced more than 23.7 million tpd, an increase over production in 2003. The US produced nearly 19.5 million tpd, up by about 1% from 2003.

Canada accounted for more than 24% of the overall total capacity; the US, for nearly 24%. ✦