Newsletter

US SPR fill to be complete by August

US Secretary of Energy Samuel Bodman reported June 10 that the planned fill of the US Strategic Petroleum Reserve will be complete in August, when the SPR reaches 700 million bbl of oil.

US President George W. Bush directed the fill in November 2001, as a means to strengthen the nation’s energy security in the wake of the Sept. 11, 2001, terrorist attacks on the US.

DOE has continuously added oil to the SPR except when deliveries were deferred due to an oil workers strike in Venezuela from December 2002 to April 2003 and when DOE made a series of small loans to refiners after supply was physically disrupted by Hurricane Ivan late in 2004.

SPR inventory stands at about 694 million bbl. Remaining deliveries under current contracts are planned for June, July, and August.

NYMEX, Dubai form energy futures exchange

The New York Mercantile Exchange Inc. and Dubai Holding, an investment arm of the Dubai government, are forming the Dubai Mercantile Exchange (DME), a 50-50 joint venture to develop the Middle East’s first energy futures exchange.

DME will fill a time zone gap in energy futures trading between Europe and Asia, said NYMEX officials. It is expected to open for trading early next year and will initially trade sour crude and fuel oil.

DME, based in the Dubai International Financial Center, will be regulated by the Dubai Financial Services Authority. Trades executed on the DME will be cleared through the NYMEX clearinghouse in New York.

DME will house open outcry and electronic trading platforms.

ConocoPhillips, MMS reach royalty settlement

ConocoPhillips and the US Minerals Management Service negotiated a $21.7 million settlement of a royalty dispute involving coalbed methane (CBM) produced from federal leases in New Mexico.

ConocoPhillips agreed to pay MMS for royalties from Jan. 1, 1989, through the end of this month. MMS will split the settlement equally with the state of New Mexico.

The issue was whether ConocoPhillips could deduct from royalty payments the cost of removing carbon dioxide from CBM. The settlement followed a June 10 decision in a separate case before the US District Court of Appeals for the District of Columbia upholding MMS’s contention that the cost related to making production marketable and shouldn’t be borne by the lessor.

HEP to buy, expand New Mexico pipelines

Holly Energy Partners LP (HEP), Dallas, plans to expand capacities of 65-miles of 10-in and 8-in feedstock pipelines in New Mexico that it will acquire from parent Holly Corp. to accommodate the planned expansion of Navajo Refining Co.’s 60,000 b/d refinery at Artesia. Holly Corp. owns Navajo Refining.

HEP will invest $3.5 million to increase the pipelines’ current capacity-84,000 b/d of crude oil, raw feedstocks, and partially finished refined products. The refinery is scheduled for completion in early 2006 (OGJ Online, Feb. 28, 2005).

HEP and Holly directors have approved the $81.5 million pipeline acquisition, and Holly has agreed to a 15-year minimum annual throughput of 72,000 b/d.

HEP will finance the transaction 90% with cash from the sale of 1.2 million HEP common stock units and up to $35 million of debt.

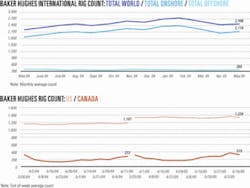

US drilling declines from latest high

US drilling activity dipped this week, falling away from the highest level so far this year by 14 units with 1,339 rotary rigs still working, Baker Hughes Inc. reported June 10.

That compares with 1,187 rotary rigs working during the same period a year ago. The previous week’s US rig count was also the highest weekly total since late February 1986.

Land drilling dropped by 9 rigs to 1,222 still working. US offshore operations were down by 4 rigs to 94, including a drop of 2 to 92 in the Gulf of Mexico. Even activity in inland waters dipped by 1 unit to 23.

Canada’s weekly rig count fell by 56 units to 319 rotary rigs working, up from 273 a year ago.

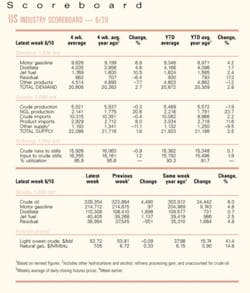

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesTotal has another Block 32 find off Angola

Total SA, operator of deepwater Block 32 off Angola, and state-owned Sonangal EP reported an oil discovery in the Gengibre-1 well.

Gengibre-1, drilled in 1,703 m of water to 4,432 m TD, flowed on test at 4,724 b/d of oil from a single reservoir. Total plans further appraisal.

The well is in the eastern section of Block 32, about 17 km from the 2003 Gindungo-1 discovery and 12 km from the 2004 Canela-1 find.

Total holds a 30% interest in Block 32. Partners are Marathon Oil Co. 30%, Sonangol 20%, ExxonMobil Corp. unit Esso Exploration & Production Angola Ltd. 15%, and Petrogal SA of Portugal 5%.

Argos plans North Falkland 3D seismic survey

Argos Resources Ltd. will shoot a marine 3D seismic survey next year on North Falkland basin acreage under an exploration license extended until November 2006 by the Falkland Island government.

The survey will cover structural and stratigraphic prospects not tested in a 1998 drilling program in the Tranche A area north of the Falklands.

A drilling campaign with a minimum of three wells is scheduled to begin early next year on Tranche A, in which Argos holds a 100% interest.

Horizon farms into Gulf of Thailand blocks

Horizon Oil Ltd., Sydney, has farmed into two permits in the Gulf of Thailand operated by Pearl Energy Ltd.

Horizon will earn a 25% interest in Blocks B12/32 and B11/38 by partially funding Pearl’s share of costs in a six-well exploration and appraisal program.

Both blocks contain gas discoveries-the Bussabong find on Block B12/32 and the Chang Daeng find on Block B11/38. They are on trend with the large Pailin and Bongkot gas fields to the northwest and southeast.

Four previous wells on Bussabong and two on Chang Daeng have found gas, with test flows of as much as 21 MMcfd of gas.

The initial drilling program consists of two trilateral wells on Bussabong (three wells from each of two locations) with the aim of proving up a viable development project. The Ensco-57 jack up will take an estimated 65 days to complete the program.

An independent assessment based on previous drilling data estimates Bussabong has 10-65 bcf of gas reserves.

Tana Exploration Company LLC, Houston, whose majority shareholder TRT Holdings Inc. has a significant shareholding in Horizon, has also farmed into the two permits for a 25% interest on the same conditions.

S. Korean firms farm into Bass Strait permits

Korea National Oil Co. (KNOC) and Seoul City Gas Co. Ltd. (SCG) have farmed into the Vic/P56 and Vic/P49 permits operated by Nexus Energy Ltd., Melbourne, in the Gippsland basin off Victoria.

KNOC and SCG will fund the initial drilling costs to $15 million (Aus.) along with most evaluation and testing costs for the first well on the Culverin-Scimitar prospects.

KNOC will earn a 30% interest in each permit, while SCG will earn 20%, and Nexus will retain 50%.

Recent 3D seismic surveys have identified reservoir potential in the Tertiary Top Latrobe formation at the Culverin prospect and Tertiary Intra Latrobe-Golden Beach at Scimitar.

The overlapping prospects, which straddle a common permit boundary, will be evaluated with one well.

Nexus hopes to drill Culverin-Scimitar during the fourth quarter.

Gulfsands to drill on Block 26 in Syria

Gulfsands Petroleum PLC plans to conduct an extensive 2D seismic program and drill the first well on 11,000 sq km Block 26 in Syria this year.

The production-sharing contract, shared 50-50 with Devon Energy Corp., Oklahoma City, requires four wells to be drilled during a 4-year term ending in 2007 (OGJ Online, June 2, 2003). Gulfsands, Houston, is operator.

The block is near fields producing more than 100,000 b/d of oil. Gulfsands said it has identified 27 prospects and leads.

IOC gets block in Iran’s North Pars field

Iran has awarded a block to the Indian Oil Corp.-Petropars consortium in North Pars gas field. The IOC consortium will use the produced gas for its 9 million tonne/year integrated LNG project.

IOC is among the few companies to be awarded blocks in the first stage of development of North Pars field, which has reserves estimated at 47 tcf of gas. IOC requires about 12 tcf for its LNG project.

The total cost of the integrated LNG project is $5.7 billion, with IOC contributing about $1.68 billion.

The field is to be developed in five stages, including a $2.2 billion upstream project, a $1.8 billion liquefaction facility, an $800 million shipping project, and a regasification facility in India costing $600 million. The fifth and final stage includes a 500-km, $300 million pipeline for the regasified LNG in India.

Cairn to further appraise block in India

Cairn Energy PLC will further appraise more than 2,884 sq km in the north and west of the Rajasthan Block under an 18-month extension of the exploration license approved by the Indian government.

The appraisal area includes Bhagyam oil field, where a 125-sq-km 3D seismic survey was due for completion in early June. Other areas include Shakti oil field, several structures awaiting appraisal, and intervening tracts of untested acreage.

A 320-sq-km seismic survey is planned between Bhagyam and Mangala oil fields. The N-I-2 well was drilled in the survey area to test the N-I structure.

The N-1-2 well encountered 21 m of net pay in high-quality Fatehgarh reservoirs.

The well flowed during a cased-hole test at a stabilized rate of 2,300 b/d of 24° gravity oil through a 48/64-in. choke.

Cairn and the Indian government are discussing extension of the southern area of the Rajasthan Block.

Spinnaker reports deepwater gas discovery

Spinnaker Exploration Co. has made a natural gas discovery on the “Q” prospect it operates on Mississippi Canyon Block 961 in 7,925 ft of water, 100 miles southeast of Venice, La.

The discovery well found 110 ft of true vertical thickness of pay in a continuous, high-quality middle Miocene reservoir at 17,644 ft. It is being sidetracked to an updip location to test sand continuity. If successful, the sidetrack will be cased for production.

The field is 12 miles west-southwest of the production platform under construction for the Independence Hub project. The facility will be able to process 850 MMcfd of gas.

“Q,” Spinnaker’s third discovery in the Independence Hub project area, is to begin production in 2007, the scheduled start-up of the Independence Hub.

Spinnaker and Dominion Exploration & Production Inc. each owns a 50% working interest in the field.

Apache completes gas well off Australia

Apache Corp. reported completion of the Rose-4 development well, part of the Harriet Joint Venture acreage 8 km east of Varanus Island off Western Australia.

It said the well, which it operates with a 68.5% interest, is producing 101 MMcfd of natural gas and 3,500 b/d of condensate from the Jurassic-Triassic Brigadier and Mungaroo formations.

Rose field is in 82 ft of water. Rose-4 was drilled as an extended-reach development well from the Linda platform to 19,906 ft MD.

Apache’s partners are Kufpec Australia Pty. Ltd. with 19.3% interest and Tap Oil Ltd., Perth, with 12.2% interest.

ESSO COMPLETES KIZOMBA B INSTALLATION OFF ANGOLA

Ocean-going tugs with escorts tow the Kizomba B floating production, storage, and offloading (FPSO) vessel from Ulsan, Korea, for positioning and tie-in to the Kizomba B tension-leg platform on deepwater Block 15 off Luanda, Angola. The development is for a consortium led by operator Esso Exploration Angola (Block 15) Ltd. (OGJ Online, Feb. 8, 2005).

FPSOlutions performed the tow, positioning, and FPSO deck operations, including rigging, heaving in, and tensioning of 13 previously laid moorings in water 1,150 m deep. FPSOlutions is an alliance of Semco Salvage & Marine Pte. Ltd. and Offshore Dynamics Ltd. Photo courtesy of Semco.

Drilling & Production - Quick TakesRowan seeks new contract for Gorilla VII

Rowan Cos. Inc. is offering the Gorilla VII jack up for work after receiving notification that Tuscan Energy (Scotland) Ltd., operator of the Ardmore oil field development in the UK North Sea, is insolvent.

The field’s production has been shut in, and abandonment and decommissioning activities are expected to be complete in 30-45 days.

The Gorilla VII began operations in Ardmore field in mid-2003.

Gulfsands gains 100% of Iraq gas project

Gulfsands Petroleum PLC, Houston, has acquired the remaining 15% interest in the Misan natural gas utilization project in southern Iraq from private Russian firm Ronexim.

The transaction gives Gulfsands 100% ownership of the project, which involves recovery and utilization of gas, currently flared, from area oil fields (OGJ Online, Feb. 21, 2005).

Privately owned Gulfsands plans to build a gathering system, a natural gas liquids (NGL) plant, and product transmission pipelines. The project is expected to produce 46,600 b/d of NGL and 338 MMcfd of dry sweet natural gas.

Pearl brings wells on stream off Thailand

Pearl Energy Ltd., Singapore, has brought on stream three wells in Jasmine oil field on Gulf of Thailand Block B 5/27.

The wells flowed at an initial combined rate of 2,000 b/d of oil. Pearl estimates Jasmine’s 2005 total production at 1.632 million bbl of oil.

Pearl is completing nine other development wells in the area. It also is evaluating data from a series of delineation wells in the field to assess the hydrocarbons in place and to determine if installation of one or two additional production platforms is warranted.

Pearl acquired the 1,931-sq-km block from Harrods Energy Thailand Ltd. in January 2004.

Shell lets ‘smart’ well contract off Brunei

Brunei Shell Petroleum Co. Sdn. Bhd. (BSP), a joint venture of the Brunei government and Royal Dutch/Shell, has awarded a 5-year contract to WellDynamics, The Woodlands, Tex., to provide intelligent well completions for the Champion West Phase III oil and gas development off Brunei. The development represents Shell’s first large-scale “smart field.”

As many as 18 wells-6 oil and 12 gas-will be drilled and completed from the CPDP-01 platform, which will be unmanned after completion. BSP will conduct operations by remote control using well-management software through surface control and automation equipment.

In Champion West field, BSP produces from multiple dipping reservoirs using horizontal wells with complex well paths. The intelligent completions are designed to ensure efficient cleanup along the horizontal wellbores, regulate gas and water influx, optimize production, and manage and maximize ultimate recovery.

WellDynamics is a JV of Halliburton’s Energy Services Group and Shell Technology Ventures.

FMC, Petro-Canada sign subsea systems deal

FMC Technologies Inc. has signed an agreement with Petro-Canada for a subsea systems frame for developments off the East Coast of Canada.

The agreement is for 3 years, with an option to extend for 3 years. It commits FMC Technologies to supply subsea systems and equipment for the potential expansion of and new developments in Terra Nova oil field, 218 miles off Newfoundland and Labrador, and other potential developments in the area.

To date, one work order has been issued under the agreement for equipment totaling $8.7 million. FMC Technologies estimates revenue from this project will total $100 million over 3 years.

Processing - Quick TakesPTT, Chevron to merge Thai refining units

Thai state-run energy group PTT PLC and Chevron Corp. signed an agreement to merge their refining subsidiaries in Thailand in a move that will create one of largest oil refiners in Asia with a processing capacity of nearly 300,000 b/d of oil.

The accord calls for PTT and Caltex Trading & Transport Corp. (CTTC), Chevron’s oil trading unit, to swap shares in the two refining units-Rayong Refinery Co. (RRC) and Star Petroleum Refining Co. (SPRC).

Following the share exchange, PTT will hold 62% of the merged company. Chevron, through CTTC, will hold the remaining 38%, according to PTT executives.

PTT owns 100% in RRC and has a 36% share in SPRC. CTTC holds 64% of SPRC. The two sides expect to complete final agreement on the share swap in the third quarter of this year.

At yearend, the merged company will offer as much as a 30% stake through an initial public offering.

Innovene, Delta study Saudi petrochem plant

BP PLC’s petrochemicals and refining subsidiary Innovene and Delta International, a Saudi-owned independent development company, signed a memorandum of understanding to begin negotiations to build a world-scale cracker and associated derivative capacity in Jubail, Saudi Arabia.

The cracker’s capacity hasn’t been determined. The project cost is estimated at $2 billion.

Innovene and Delta will be equal partners in the joint venture.

Transportation - Quick TakesBG seeks markets for Trinidad and Tobago gas

BG Group said it is seeking markets for about 3 tcf of natural gas in Trinidad and Tobago that remains uncommitted.

Of that, 1.3-1.6 tcf is gas found with the Manatee 1 well, drilled in January by BG’s partner, Chevron Corp.

Doubts had been reported that BG has enough gas to participate in future expansion of Atlantic LNG Co. of Trinidad and Tobago’s Point Fortin operations.

Sakhalin II LNG sales pact concluded

Japan’s Toho Gas Co. announced an agreement to purchase as much as 500,000 tonnes/year of LNG from Sakhalin Energy Investment Co., operator of the Sakhalin II gas and oil project.

Toho will purchase 60,000 tonnes/year during an initial 4-year period from April 2009. Purchases will increase to 500,000 tonnes/year for a further 20-year period.

Statoil completes laying Snøhvit gas line

Statoil ASA has finished laying the 143-km main gas pipeline from Snøhvit field in the Barents Sea to the Hammerfest LNG plant on Melkøya island in northern Norway (OGJ Online, Apr. 20, 2005).

The Solitaire laybarge completed laying the line on June 4. The line is being covered with gravel to reduce long free spans on the seabed.

LNG exports from Hammerfest are scheduled to begin Oct. 1, 2006.

India signs $18 billion LNG deal with Iran

India has signed a deal with Iran worth $18 billion for the import of 5 million tonnes/year of LNG for 25 years, beginning in 2009.

As part of the deal, Iran will offer participating interests in oil fields to a consortium of Indian companies, including ONGC Videsh Ltd., Indian Oil Corp., Oil India Ltd., and GAIL (India) Ltd.

The consortium is to receive a 10% stake in Yadavaran oil field and a 100% participating interest in a smaller oil field, Juffair.

The two oil deals represent 60,000 b/d of oil for import by India.

The contract price for the Iranian LNG at the Indian border is about $3.515/MMbtu. Under an earlier deal with Qatar, India pays $2.79/MMbtu for LNG.

Regency Gas to expand Louisiana gas line

Regency Gas Services LLC, Dallas, will invest $125 million to expand and extend its intrastate natural gas pipeline in northern Louisiana.

Regency will loop 40 miles of its 200-mile pipeline line with 24-in. pipe. It will increase the compression on the line by 10,000 hp.

Construction has begun on the Haughton-to-Sibley, La., portion of the project, scheduled for completion this month.

Regency also will extend the pipeline 80 miles to intrastate markets and interstate pipelines in Louisiana, including Columbia Gulf’s pipeline near Winnsboro, La. These projects and the additional capacity will be available by yearend.

Anadarko Petroleum Corp. signed a contract for firm transportation of its gas from Vernon field in Louisiana through the extended line. Regency is in advanced negotiations with other large gas producers.