Hubbert’s model: uses, meanings, and limits-2

The mathematical model of M.K. Hubbert successfully predicted the peak of oil production in the US even though the logistic growth curve on which it is based cannot account for the physical, political, and economic factors that govern actual production. The first part of this article introduced a number of those factors, which will be elaborated here to demonstrate their influence on applicability of the model (OGJ, June 6, 2005, p. 22).

These and other limitations-including the uncertain nature of resource estimates-must guide use of Hubbert’s model in production forecasts. The model nevertheless provides an important quantitative tool able to demonstrate that a global peak in oil production, contrary to assumptions that have so far guided consumer and producer behavior, is in view.

Profitability, affordability

One of the factors necessary for Hubbert’s model to be applicable is a combination of prices that consumers find affordable and that afford good profitability for owners of the petroleum resource. The market may be regulated or unregulated, but if prices are set too high, either to increase profits or for political reasons, and consumers cannot pay the price, consumption and production must decrease. If prices are set too low, there is little incentive to find and produce oil.

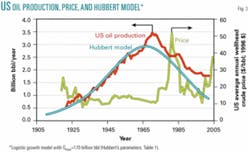

An example of what happens when consumers cannot afford oil is illustrated by events in 1979, when the Iranian Revolution disrupted production in that country and prices abruptly rose to about $50/bbl (1996 dollars; Fig. 3). The high oil prices caused US oil demand to drop by about 20% between 1978 and 1983, while world oil demand dropped by about 16%. The logistic growth model cannot cope with this type of event.

When the Organization of Petroleum Exporting Countries increased the price of oil far above the US domestic price in 1973 (Fig. 3), domestic production continued to drop, although not as rapidly as predicted by Hubbert’s model. This is due to a number of factors. One was the greater profitability of nondomestic oil production; in the early 1980s, exploration and production costs were at least 25% greater11 in the US than abroad. Another was that the most accessible resources (for the best technology available at the time) had been depleted (see accompanying story, p. 24).

Even today, with non-OPEC exploration and production costs inside and outside the US roughly comparable12 (about $6/bbl in 2001 dollars) and far below the market price set by OPEC, US production continues to decline slowly, and there appears to be no possibility of domestic production satisfying demand. This pattern may be due to companies’ desire to preserve their domestic production base and take advantage of foreign opportunities while they are still available.

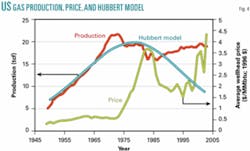

An example of too low a price for producers is illustrated by the history of US natural gas prices and production (Fig. 4). For many years, the interstate price of natural gas was set by the Federal Power Commission and in the 1960s was a factor of 3.5 below that of oil, on a per-unit energy basis. Even with high pipeline and distribution tariffs, the cost to consumers was much lower than oil. Most gas was produced in association with oil. Once oil production peaked in 1970, natural gas production peaked shortly thereafter. With gas prices so low, there was little incentive to conserve or to produce more gas. Even worse, unlike oil, natural gas could not be easily imported. The only possibility that remained was demand destruction due to supply constraints, which proved to be brutal.

Once wellhead gas prices were allowed to rise-by nearly a factor of six between 1973 and 1983-production and consumption fell but gradually stabilized as higher prices provided the incentive to find and produce more gas.

Hubbert estimated US ultimate natural gas reserves at 1,000 tcf from historical production data, following the same curve fitting methodology he used to estimate petroleum reserves. His model predicted the year of peak gas production at around 1976. As shown in Fig. 4, this approach yielded a reasonable estimate of the peak production period. However, once gas prices increased, new resources became available, and production is now about twice what the original model forecast. As with petroleum, a change in the economic conditions may, but not necessarily will, open up a greater resource base.

Stable markets, policy

The importance of public policy in setting market rules is evident from a careful examination of the production data used by Hubbert (Fig. 1), together with consumption data and an understanding of concurrent political battles. US production remained below 7.1 million b/d between 1956 and 1961; petroleum consumption, on the other hand, rose from 8.8 million b/d to 10 million b/d, a 12% increase, during this period. Even in 1958, during the second worst post-World War II recession when gross domestic product declined by 1%, demand actually increased by 300,000 b/d while domestic production decreased by 460,000 b/d, a 6.5% decrease, and imports increased by 42% (from 1 million b/d to 1.425 million b/d). Imports were readily available and made up the difference between US production and consumption.

Stagnant or declining US production was not caused by any resource constraints or delivery bottlenecks during this period but by a ferocious struggle between independent domestic oil producers and major oil companies with access to inexpensive foreign oil, which could be landed at East Coast ports for prices 60-70% below that of US crude oil.13 Voluntary import quotas, which had limited imports up to 1957, could not withstand such enormous price differentials and simply began to be ignored. Meanwhile, domestic producers were forced to restrict production to maintain the high prices that yielded such spectacular profits for others, a situation that was clearly untenable and unfair. The bitter dispute was finally resolved in favor of domestic producers-and against consumers and energy security-on Mar. 10, 1959, when the Eisenhower administration imposed mandatory restrictions on petroleum imports. US production began to increase once again. OPEC also tries to maintain oil prices far above production costs but, unlike the Texas Railroad Commission, does not have any mechanism for resolving disputes analogous to this one.

Without these restrictions (new market rules), US production would have effectively reached a maximum not in 1970 but in 1957 only because it could not compete with low cost oil from the Middle East.

This incident, as well as the skill with which the immense overproduction capacity of the US industry was managed, illustrates the political sophistication, tenacity, and power of the Texas Railroad Commission and its allies in other oil-producing states. There were powerful constituencies, such as chemical manufacturers and consumers (particularly in the Northeast) who would have benefited from lower oil prices. In addition, populist arguments against big oil companies and in favor of low energy prices had and continue to have a broad and deep resonance everywhere. In spite of these disadvantages, the independent oil producers managed to find a compromise that kept the prorationing system and maintained the high prices that they needed to survive and prosper. They made the political system work for them, which was a major accomplishment.

This also illustrates the importance of relative profitability in determining oil production. Domestic oil production was certainly quite lucrative, but the even greater profitability of foreign oil in the US market, with market prices set far above domestic production costs, would have certainly limited or eliminated any growth in the US industry regardless of resource availability.

Exponential growth

Logistic growth describes many systems in which an exponentially increasing reaction or process is supplied by a limited resource; population growth is one example of this phenomenon.

However, exponential growth of oil demand is not a certainty. As noted previously, demand dropped substantially during the Great Depression and following the large price increases in 1979. Markets may saturate long before production is slowed by resource constraints due to other factors such as a change in market rules or exorbitant price increases. In many advanced industrial countries population growth is very low or negative, removing a major cause of increasing demand.

Of course, even if demand does not increase, production of a finite resource will ultimately decline. Hubbert’s model cannot handle this situation, and as demand growth declines, the concept of a resource-constrained production peak as predicted by a Hubbert model becomes less and less useful.

On the other hand, if demand growth were to be extremely high, other factors such as transportation bottlenecks from less accessible production regions might limit supplies, and again a Hubbert model would be irrelevant.

Import availability

The role of imports deserves close attention. Imports by the US gradually rose from about 15.6% of demand in 1958 to 21% 1970, when US oil production peaked. After 1970 imports rose even faster. Without imports, domestic production would have peaked much earlier and more abruptly, as soon as domestic demand increased faster than production could increase, regardless of the size of the US ultimate oil resource. When demand, driven by increased economic activity, exceeded supply, even by a small margin, the market rules certainly would have changed as prices climbed rapidly to force demand down.

Readily available, low-cost imports allowed the illusion of unlimited supply to continue, postponing the day of reckoning when consumers would be forced to acknowledge that petroleum was indeed an exhaustible resource. In actuality, the US production peak passed unnoticed by US consumers, who continued to increase demand as if nothing had happened.

Reserves estimates

As of 2002, cumulative oil production from the US Lower 48 was about 170 billion bbl. The figure grows at a rate of about 1.76 billion bbl/year (Fig. 3). The US Geological Survey (USGS) estimated14 that US ultimate resources-mean estimate, proved, undiscovered, and reserves growth, as of January 1996-totaled at least 360 billion bbl, including natural gas liquids. Recent discoveries in the deep waters of the Gulf of Mexico may increase15 this by as much as 29 billion bbl. Resource assessments have typically assumed an oil price of $18/bbl. Current prices more than 2.5 times this level should further increase the resource base.

That current estimates of ultimate resources (now including Alaska and deep water) are so much greater than Hubbert assumed was irrelevant for the purpose of understanding when peak production might occur, which depends on how much accessible oil is available over the period of interest as well as on many political and economic factors. For example, the technology needed to extract oil from the deep waters of the Gulf of Mexico did not exist when Hubbert made his prediction. In addition, much of the US resource was in the form of reserves growth, or petroleum extracted from existing fields through infill drilling, field extensions, or new enhanced recovery technologies. This oil can be extracted much more slowly compared to the early production from a field and to a first approximation is not relevant in determining when production might peak.

With regard to natural gas production (Fig. 4), the USGS14 estimates that conventional gas resources-mean estimate, proved, undiscovered, and reserves growth, as of January 1996-totaled about 1,900 tcf, with substantial additional resources available as “unconventional reserves” in coal beds, tight sands, and shales. As with oil production, these higher resource estimates were irrelevant for estimating the timing of peak production. Only easily accessible resources capable of meeting rapidly increasing demand at a given price are relevant to this issue.

Predicting production

A crucial input to any model used to forecast world oil production must be credible world petroleum resource estimates. Until recently, these did not exist in an accessible form, and forecasters were dependent on statements of proved reserves of dubious veracity from producing countries and companies or on proprietary data bases unavailable to the general public.

Moreover, proved reserves are useless for predicting future production trends; for example, the US has had proved oil reserves equivalent to about 10 years of production for the past 30 years or more11 and still continues to produce large amounts of oil.

Growth of world oil consumption between 1990 and 2002 was about 1.2%/year, which yields a doubling time of 58 years. If these growth rates were to be maintained, and all producers cooperated completely, the ability of a Hubbert model to predict a future production peak would be questionable. A production plateau many decades in duration might occur, giving the illusion that such a state could persist forever.

The issue of producer cooperation is central to this question. In the US, as production approached a peak, domestic producers could not satisfy all of the incremental demand, and imports made up the difference. Domestic producers continued to increase production since if they did not their output share would be taken up by imports, reducing current income. That real domestic prices were declining after 1957 (Fig. 3) due to competition from low-cost oil from the Middle East made their decision even easier. In other words, US producers made rational business decisions based on their available resources and the then-current market rules.

For the case of world oil production, business decisions will be made based on a different set of rules. Because many producers already have reached plateaus or declines in production,3 remaining producers must increase production not only to satisfy increasing demand but also to compensate for production declines elsewhere. At some point it will become apparent to these producers that it makes perfect economic sense to ration a scarce resource by increasing the price, reducing demand accordingly. The timing of such a transition will depend much more on the distribution of resources (including transportation resources) among the remaining producers and their respective economic and military power than on any inherent resource constraints on production.

Transportation constraints are already limiting deliveries from Russian producers. Russian oil shipments through the Bosporus16 are being delayed due to nighttime navigation restrictions on large tankers. This shipping route, which passes through Istanbul with a population of 10 million people, would be closed by a major accident. The pipeline network through which most of Russia’s oil is exported is also reaching its maximum capacity. Russian oil exports are now a major factor in world petroleum markets; production increased by about 800,000 b/d in 2003 and 740,000 b/d in 2004. Because of the transport bottlenecks, a similar gain is unlikely this year.

In 2003, demand, driven by the rapid industrialization of China and India, increased by 2.55 million b/d, or 3.9%; 64% of this increase was supplied by OPEC with the remainder by Russia. In the first quarter of 2004, oil demand in China17 increased at an annual rate of 1 million b/d (19%). Such extraordinary increases in demand can only be supplied by the Middle East. Yet Saudi Arabia, with a current maximum production capacity of about 10 million b/d, is planning to increase its capacity to 12 million b/d only after 2010.18

Thus, the world may be facing an imminent peak in production determined not by fundamental resource constraints but by transportation limitations and producer-determined limits on production.

Econometric model

While Hubbert’s model may be applied in an operational sense to forecast peak world oil production, it should at the very least be accompanied by a discussion of the assumptions and limitations of this approach. In addition, the parameter Qmax should not be interpreted as representing the ultimate oil resource, as assumed by Hubbert, but as a free parameter that represents the most easily accessible resource given technological, political, and economic constraints. Indeed, given the importance of economic and political factors in oil production, Hubbert’s model should be considered an econometric model, with its applicability determined by how well the conditions listed above are satisfied.

Some forecasters19 20 21 have used proprietary reserves data in conjunction with Hubbert’s model or derivatives of this model to estimate future world oil production trends. It is now possible to use publicly available resource estimates based on the best available science and technology14 and different modeling approaches to estimate a peak year for world oil production.22 23 24 All of these approaches indicate that one should expect a peak in conventional world oil production due to resource constraints alone by 2025 or earlier. Non-OPEC production should peak due to resource constraints much earlier, between 2010 and 2015.

However, producer cooperation is a critical requirement for the validity of all of these models. Given the political factors associated with current world oil production, it is essential that anyone interested in future production make some attempt to evaluate the likelihood of continued cooperation as an increasing number of producing basins reach maturity and begin to decline. It seems increasingly clear that this factor, not resource-constrained production, will actually determine the time period in which petroleum supply will not match demand.

The central importance of Hubbert’s model must be emphasized, whether or not it is currently applicable to world oil production. By mathematically predicting the time interval in which production of an exhaustible resource would be unable to meet demand, it challenged the unstated assumption of consumers and producers that such an event was beyond our ability to understand and that the petroleum industry could be trusted to meet demand far into the distant future.

Acknowledgments

The author thanks D.K. Merriam, professor at the University of Kansas, for his support and encouragement.

This article is a revised version of a paper originally published in Natural Resources Research, Vol. 13, No. 4, December 2004, “Hubbert’s Petroleum Production Model: An Evaluation and Implications for World Oil Production Forecasts.”

References

- DOE-EIA, “Annual energy review (2002),” 2003.

- Baird, E., “Fossil Fuels: The Key to Sustainable Development,” World Energy, Vol.6, No. 1, 2003, pp. 34-40.

- Yergin, D., “The Prize: the epic quest for oil, money, and power,” Simon and Schuster, 1991, pp. 536-540.

- Ahlbrandt, T. (project head), US Geological Survey, “World energy resources world petroleum assessment (2000),” available at www.usgs.gov or on CD ROM from the USGS, 2000.

- Department of Interior-Minerals Management Service, “Outer Continental Shelf petroleum assessment,” 2001.

- Clark, M., “The Bosporus bottleneck,” Petroleum Economist, Vol. 71, No. 6, 2004, p. 28.

- Adkins, M., quoted in OGJ, May 14, 2004, p. 7.

- Lorenzetti, M., “Saudis refute claims of oil field production declines,” OGJ, Mar. 8, 2004, pp. 24-25.

- Campbell, C., Laherrere, J., “The end of cheap oil,” Scientific American, Vol. 278, No. 3, 1998, pp. 78-83.

- Deffeyes, K., “Hubbert’s Peak: the impending world oil shortage,” Princeton University Press, 2001.

- Ivanhoe, L.F., “Future world oil supplies: there is a finite limit,” World Oil, October 1995, pp. 77-88.

- Cavallo, A., “Predicting the peak in world oil production,” Natural Resources Res., Vol. 11, No. 3, 2002, pp. 187-195.

- Green, D., Hopson, J., Li, J., “Running out of and into oil: analyzing global oil depletion and transition through 2050,” ORNL/TM-2003/259, Oak Ridge National Laboratory, (www.osti.gov/bridge), 2003.

- Rogers, M., “Hurdles ahead for growth in non-OPEC liquids output,” OGJ, Nov. 8, 2004, pp. 16-18.