US oil, gas firms’ 1Q earnings gain on vigorous prices

High oil and natural gas prices during the first quarter of 2005 fueled the earnings of US-based producers as well as service and supply companies.

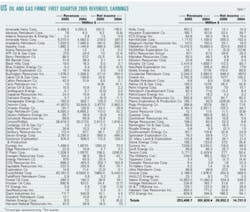

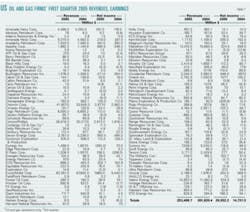

OGJ sampled the financial results of 99 oil and gas-producing firms. Collectively these companies improved first quarter net income 40% from a year earlier as revenues increased 26%. Rather than ramping up their capital budgets, many operators continued to use excess cash to purchase shares of their stock.

Meanwhile, a group of service and supply companies reported collective first quarter earnings more than tripled from dismal earnings in the first 3 months of 2004.

A group of Canadian oil and gas firms, however, reported a collective decline in earnings from a year earlier, although revenues were up 12% (see related story, p. 35).

Integrated firms

The large, integrated oil and gas firms mostly reported higher earnings in the first quarter, but reduced downstream margins, reduced production volumes, as well as other factors served as a drag on some of the companies’ results.

Despite lower production volumes during the first quarter, ExxonMobil Corp.’s earnings gained on the strength of oil and gas prices, refining margins, and chemicals. ExxonMobil recorded net income of $7.86 billion, up from $5.44 billion during the first 3 months of last year.

ExxonMobil sold its 3.7% stake in Sinopec on Mar. 1, which had a positive impact of $460 million on the company’s first quarter earnings.

Upstream earnings were a record $5 billion, up $1 billion from first quarter 2004 results, while downstream earnings were $1.1 billion, an increase of $139 million from a year earlier, as weaker marketing margins partly offset improved worldwide refining conditions. Chemical earnings were a record $1.3 billion, up $718 million from first quarter 2004 on higher margins.

ExxonMobil’s first quarter spending on capital and exploration projects were flat from a year earlier at $3.4 billion, with upstream spending up 4%.

During the first quarter, ExxonMobil purchased 64 million shares of its common stock for $3.6 billion. In April, the corporation increased its rate of share purchases and expects that further purchases to reduce outstanding shares will increase to about $3.5 billion in the second quarter from $2.5 billion in the first quarter.

ConocoPhillips also recorded big gains in revenue and income as compared with a year earlier but concedes that results could have been better if not for unplanned downtime in both its exploration and production segment and its refining and marketing segment.

ConocoPhillips’s first quarter net income gained 80% year-on-year to reach $2.9 billion, and its revenues climbed 29% to $38.9 billion.

Amerada Hess Corp. reported lower net income of $219 million for the quarter, as upstream earnings gains were not enough to overcome declines in the downstream segment.

Exploration and production earnings for Amerada Hess were $263 million, up from $207 million a year earlier. The company’s oil and gas production was 358,000 boe/d during the quarter, up 3% from the first quarter of 2004.

In the first quarter of 2005, Amerada Hess’ average worldwide crude oil selling price increased from the first quarter of 2004 by $4.48/bbl to $31.31/bbl, while its average US natural gas selling price was $6.15/Mcf, an increase of 95¢/Mcf from a year earlier.

The company’s refining and marketing earnings in the recent quarter were $63 million vs. $112 million in the first quarter of 2004. Refining earnings decreased $32 million, mostly as a result of maintenance activities and increased taxes, and lower gasoline margins reduced results from retail gasoline operations, while income from trading activities was $7 million lower.

Independent operators

Many independent oil and gas producers reported improved results because of higher production volumes coupled with stronger commodity prices. While a handful of firms recorded a loss in the first quarter, overall results were fairly improved.

Range Resources Corp. announced first quarter record highs in production, revenues, cash flow, and net income. Production was up 29% over the prior year period, and revenues gained 70%. Net income jumped 274% to $22 million, the Fort Worth independent reported.

The company’s average gas price rose 24% during the first quarter, as its average oil price rose 49% year-on-year. Operating expenses increased 10¢/Mcfe to $0.72/Mcfe due to higher oil field costs and workovers, and production taxes rose 2¢/Mcfe due to higher prices.

First quarter development and exploration expenditures totaled $54 million, funding the drilling of 135 wells and 23 recompletions, Range Resources said. By the end of the quarter, 71 of the wells (41 net) had been placed on production, with the remainder in various stages of completion or waiting on pipeline connection. First quarter capital expenditures were funded by internal cash flow, while the company used excess cash flow to reduce debt by $11 million.

With total production up from a year earlier, Exploration Co. reported a first quarter loss while revenues moved up 29%. The company attributes its $3.3 million loss to unsuccessful hedging.

The San Antonio-based company’s loss was due to $3.6 million in hedging-related losses, including a $3.4 million noncash mark-to-market charge. In the year-earlier quarter, when the company did not hedge or have any derivatives, net income was $69,000.

Excluding hedging losses, Exploration Co. reported that net income would have been about $262,000 for the recent quarter. The company’s total revenues were $14.6 million, as higher commodity prices and gas production more than offset a decline in oil production.

Service-supply firms

A group of oil field service and supply companies posted a 239% gain in year-on-year earnings, as they all improved on their first quarter 2004 net income.

The biggest earnings gainer for the first 3 months of 2005 in this group is GlobalSantaFe Corp. The Houston-based offshore drilling contractor reported that earnings were $50.2 million, up from $8.7 million a year earlier.

Operating income from GlobalSantaFe’s contract drilling segment benefited from higher rig utilization and dayrates, partially offset by higher repair and maintenance expenses. During the first quarter of 2005, average rig utilization increased to 91% from 82% in the same 2004 quarter.

Also, the company reported that for the recent quarter, GlobalSantaFe’s drilling management services and oil and gas segments reported improved operating income, primarily reflecting improved average margins on 26 turnkey projects and higher oil production following the initiation of production from Broom field in the North Sea in August 2004.

All eight of the firms in this sample that reported losses for the first quarter of 2004 reversed those losses in the first 3 months of this year. Among these firms were Diamond Offshore Drilling Inc. and Rowan Cos. Inc., each of which posted robust earnings on higher dayrates and strong rig utilization.

Geoff Kieburtz, analyst with Smith Barney, commented that the lack of newbuild activity suggests that positive day rate trends will continue, with just two deepwater upgrade projects in progress now.

Kieburtz said this is in sharp contrast to the jack up market, which is expected to see an influx of more than 30 premium units over the next several years.