Natural gas storage levels may be up, but the Natural Gas Supply Association expects upward price pressure this summer as US demand grows amid unchanged overall import levels and a return to normal summer weather.

“We exist in an environment of higher sustained natural gas prices, and we expect it to continue into the 2005 summer cooling season,” NGSA Chairman Joseph A. Blount told reporters in Washington, DC. Demand should increase 4.5%, pushed by the electric sector, which accounts for two thirds of the growth, he indicated.

The association, which represents gas producers, does not forecast prices or ranges. The US Energy Information Administration said in its May Short-Term Energy Outlook that gas supplies could remain tight through the summer, with spot prices of $6.50-7/MMbtu.

EIA officials suggested that predictions in June would not be substantially different from those in May, which include prices averaging more than $7/MMbtu at Henry Hub in 2005 and 2006.

“Mild weather this spring mitigated any price increase. Cooling demand could pick up if we have a hot July or August,” EIA economist Neil Gamson said. “In the third quarter of last year, we had 723 cooling degree days. We’re calling for 780 this time, about 8% more.”

NGSA’s Blount, president of Unocal Corp.’s midstream and trade division, noted that weather is always the largest single factor affecting gas prices-and the most difficult to predict.

He said the National Oceanographic and Atmospheric Administration expects this summer to be warmer than normal in the South and West and cooler than normal in the northern Great Plains. “If accurate, the above-normal temperatures will lead to more natural gas-fired electricity generation than last summer,” he said.

Power generation has become the least predictable summer demand component, according to Blount. “There are concerns about possibly low hydroelectric production in the Pacific Northwest, which could affect demand for gas,” he said.

As in 2004, NOAA also is forecasting an above-normal hurricane season, with seven to nine storms, Blount added. Three to five of these predicted hurricanes are expected to be Category 3 storms or above, with winds of more than 111 mph, he said. A single storm, Hurricane Ivan, was responsible for more than 170 bcf of production curtailments late last year, he noted.

EIA doesn’t try to incorporate hurricane predictions into its forecasts, Gamson said. “But it’s fairly obvious that if there’s another hurricane in the gulf, it would have a major impact. We’re still recovering from the last one,” he said.

Hurricane Ivan, with winds up to 140 mph, seriously damaged 31 platforms, several of which were destroyed, in September 2004.

Gas storage at the approach of summer is at its third highest level since 1994. With the industry expected to maintain weekly injections averaging about 67.7 bcf, inventories should match the 2004 record level of about 3.3 tcf when the 2005 heating season begins, Blount said.

Inventories “seem very adequate,” said Gamson. “Except for the Southwest, where it has been hot, the weather has been fairly mild. We’ve seen prices come down about $1 from their peaks in the last month.”

EIA also expects gas prices to continue dropping the next several months, he said. “But if the winter is close to normal compared to last winter, which was mild, demand could be strong,” he said.

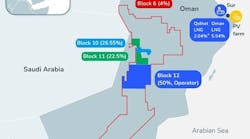

Blount said NGSA expects the role of LNG as an imports component to increase nearly 31% this summer to more than 2.1 bcfd from 1.6 bcfd a year earlier.

“Canadian imports, which supplied approximately 15% of our natural gas demand in 2004, are expected to decrease by 4% this summer, as our storage needs are lower and a slight increase in Canadian demand is expected,” he said.

Citing an estimate by an independent consultant, Energy & Environmental Analysis Inc. (EEA), Blount said NGSA expects total net gas imports, including modest amounts from Mexico, to stay at approximately 9.7 bcfd.

US economic growth is expected to slow. Blount said Global Insight, an economic forecasting firm, projects a 3.5% increase in gross domestic product this summer, compared with 4.4% growth a year earlier. Unemployment should drop to 5.2% from 5.5% year-to-year, while industrial production will grow 3.6% compared with 4.8%, he said.

The upshot, said Blount, is that upward natural gas pressure is growing, and policymakers are not responding adequately.

“From a legislative standpoint, we’re not seeing a lot of movement,” he said. “Access is important. But we also have to look at streamlining the permitting process, particularly for LNG terminals.”