SPECIAL REPORT: US production relies greatly on strippers

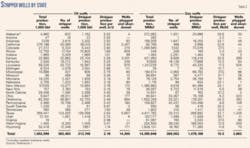

Marginal or stripper wells contribute significantly to US oil and gas production, as shown in the Interstate Oil and Gas Compact Commission’s (IOGCC) latest study.1 In 2003, the study shows, the US had about 400,000 stripper oil wells producing 314 million bbl/year and about 260,000 stripper gas wells producing about 1.5 tcf/year (Table 1).

IOGCC defines stripper wells based on the volume of oil and gas produced. It classifies oil wells as strippers if they produce 10 bo/d or less. Stripper gas wells are those that produce 60 Mcfd or less.

Other definitions of marginal wells take into account the economic limit for operating a well rather than only volumes, but statistics on these wells are unavailable. Small independents, so called “mom and pop” companies, typically operate stripper wells.

IOGCC says “...incentive programs are a key factor in the development of this truly American resource. States have encouraged domestic oil and natural gas production by maintaining programs that protect the public while allowing responsible owners to operate their wells in an efficient and profitable manner.” It sees research as another key for marginal well production, although often the small independent producers cannot afford this work. Therefore, funding this research often falls on the federal and state governments working through consortia that may involve universities.

For instance, a recent US Department of Energy announcement said that a DOE-backed consortium delivered six new commercially ready stripper-well technologies.

But not all stripper production relies on government-funded research. The recent increase in oil prices has allowed companies such as Cano Petroleum Inc., a Fort Worth independent, to invest in marginal oil fields.

To take advantage of the higher commodity prices, Cano has purchased several marginal fields in which it plans to improve oil recovery through alkaline-surfactant-polymer (ASP) flooding, waterflooding, or surfactant flooding (OGJ, Mar. 28, 2005, p. 39).

IOGCC study

IOGCC has surveyed production from stripper wells since 1941. Its latest study shows that in 2003 marginal wells contributed more than 7% of the natural gas production in the US, representing more than 10% of onshore US production (Table 2). While the total US natural gas production increased by almost 1% in 2003, production from marginal natural gas wells increased more than 4% from the previous year.

Regarding oil, the study shows that marginal oil wells provide about 15% of US oil production or 25% of production in the Lower 48 states. But on average, each well produces only 2.18 bo/d.

In 2003, IOGCC found that 14,300 oil and 3,883 gas wells were abandoned in the US. In this tabulation, IOGCC does not include temporarily abandoned wells. It includes only permanently plugged wells. Also IOGCC does not include orphaned wells in the abandoned category. These wells are not producing and have not been plugged but their owners are either insolvent or cannot be located.

The IOGCC survey shows that the number of gas wells and total production from stripper gas wells have steadily increased during the past decade (Table 1), while average daily production has declined slightly.

It notes that the total number of plugged gas wells in 2003 increased for the third consecutive year, while demand for natural gas continues to rise.

IOGCC does caution that its numbers do not always present the entire picture. It says that in Colorado, for instance, one can attribute the decline in marginal and natural gas production to successful refracs of wells in the Denver-Julesburg basin that moved the wells out of the 60 Mcfd or less production category. IOGCC estimated that 2.2 billion bbl of the oil reserves remained to be produced from stripper wells (Table 3). About half of these reserves are recoverable through primary methods, while the remainder would require secondary recovery.

New technologies

DOE recently announced the development of six new technologies for stripper wells by the Stripper Well Consortium. This is an industry-directed group that receives co-funding for research, development, and demonstration projects from DOE through the National Energy Technology Laboratory’s Strategic Center for Natural Gas and Oil.

DOE says the six new technologies are commercialized or nearly commercialized and can increase production, raise efficiencies, or lower costs for producing marginal wells.

The consortium also has been involved in more than 55 additional technologies, some of which are approaching commercial readiness, according to DOE.

The six current technologies that are ready are:

1. A gas-operated automatic lift (GOAL) PetroPump from Brandywine Energy & Development Co.

DOE describes this gas-operated automatic plunger-lift tool as increasing production by removing fluids from stripper wells.

The system operates automatically with an on-tool, pressure-activated valve that is preset to retrieve and deliver a fixed volume of fluid during each run. The tool automatically returns to the well bore for additional fluid when required.

Maintenance and service are limited to changing the cup seals after several months of operation and is inexpensive to operate because it requires no external energy source and limited manpower, according to DOE.

2. Vortex flow tools from Vortex Flow LLC.

These tools change the flow regime in a pipe to accelerate the water velocity and reduce the friction that causes pressure drops as fluids flow through a pipe. DOE says these tools increase production and lower maintenance costs.

Test results show that Vortex surface tools eliminate water buildup in low spots in flow and gas gathering lines, reducing upstream pressures. In downhole applications, the tool reduces the pressure drop up in the tubing, thereby reducing the gas flow needed to lift liquids up the wellbore.

3. Hydraulic diaphragm, electric submersible pump from Pumping Solutions Inc., now part of Smith Lift LLC.

These pumps have a hydraulic-driven diaphragm that can tolerate fines and allow the placement of the pump inlet below the perforations in sandy wells. DOE cites such advantages for these pumps as:

- Handling coal fines and solids at higher concentrations than traditional systems.

- Pumping gas-liquid mixtures.

- Operating dry or pumped-off with no damage within the motor limits.

- Pumping fluids with high or low viscosity.

- Having constant output with depth.

- Being highly efficient with reduced electric costs.

4. Weatherbee pump from W&W Vacuum & Compressor Inc.

This pump is a variable capacity compressor-pump for use in low-productivity gas production operations. DOE says that the pump has lower initial costs and lower operational costs compared with existing technology. The compressor has four rotating chambers that provide four intake and four exhaust strokes in each 360° rotation.

One benefit DOE cites is that because the pump has no corners or “dead spots,” no fluids are trapped. It also can handle high-btu gas and is smaller and lighter than existing products on the market.

5. Chemical injector for plunger lift gas wells from Composite Engineers Inc.

DOE says this is a simple, economical chemical system for reducing wellbore corrosion and maintenance costs. The injector has five moving parts, most of which are in the chemical chamber at the top of the wellhead.

A standard oil field chemical pump charges the chemical chamber with any or a combination of liquid chemicals such as corrosion inhibitors, foaming agents, or paraffin solvents, or even alternate a combination of chemicals.

6. Low cost, real-time, downhole wireless gauge from Tubel Technologies Inc.

This gauge eliminates cables, clamps, and splices inside the wellbore, increasing reliability, lowering costs, and reducing the deployment time, according to DOE.

The tool in its current form monitors temperature and pressure, but additional parameters can be added. It can operate as a permanent downhole gauge or temporarily in well service applications.

Cano operations

One improved recovery project for a marginal field that Cano is pursuing is in the eastern part of the Delaware-Childers field in Nowata County, Okla. Discovered in 1906, the field has been extensively produced with wells on tight spacing (Fig. 1).

The Delaware-Childers field has undergone waterflooding, and several references in literature say that past studies have looked at recovering additional oil from field through additional waterflooded, in situ combustion, light-oil steam flooding, microbial, and miscellar-polymer processes.

Cano acquired its 2,601 acres in the Delaware-Childers field in September 2004, for $2.5 million. It estimates that the acreage contains about 1.6 million boe of proven reserves and 4.7 boe of probable reserves. The original oil in place in the acreage was about 58 million boe, according to Cano.

Cano operates about 220 producing wells and 180 water injection wells on 2½-acre spacing, and according to Tom Cochrane, Cano’s executive vice-president of oil and gas operations, Cano is the only operator in the area that currently is operating a sizable waterflood.

The field produces from the Bartlesville sand that is at a shallow 600-ft depth. The sand has a 21% porosity, 100-md permeability, 30-35% oil saturation, and a 500-psi pressure, which is maintained by the water injection.

Current production is about 250 bo/d and 77,000 bw/d. The oil is a light 38° gravity.

Cochrane said that most of Cano’s wells were completed in the 1980s and have 5½-in. casing and 2 3/8-in. or 2 7/8-in. tubing. For artificial lift, many of the wells have beam pumping units (Fig. 2), although some wells that produce more water are equipped with electric submersible pumps.

Cochrane estimated that the current operating costs in the field are $20-22/bbl of oil but that costs should go down dramatically once enhanced oil recovery starts.

With a alkaline-surfactant-polymer (ASP), Cano expects the oil cut to increase to 5% from the current 0.3%. This results in an estimated $10/bbl of oil operating costs once production peaks at 4,300 bo/d, which Cano expects by 2007.

Cano’s development of an ASP flood will not require investment in new wells because the field is already producing on 2½-acre spacing.

Besides ASP flooding, Cano may also try injecting surfactant alone. Cano says lab tests indicate that surfactant flooding could recover 19-28% of the original oil in place.

It expects to start the Moon-Line ASP pilot (Fig. 1) in late 2005.

Reference

- Marginal Oil and Gas: Fuel for Economic Growth, Interstate Oil and Gas Commission, 2004 Edition, Oklahoma City.