World’s remote basins afford many exploration opportunities

Exploration opportunities have large and small companies devoting a greater share of budgets to new field exploration across the world.

Summarized in this article are the Taoudeni basin in Mali and Mauritania, West Africa, the Canning onshore basin in Western Australia, the Sandakan basin in the western Philippines near Kalimantan, the Gaspe Peninsula of southeastern Quebec, the Namibe basin off northwestern Namibia, the Mafia basin of Tanzania, and the eastern Black Sea off the Georgia Republic. An accompanying article updates progress in the Rajasthan basin of western India (see p. 45).

Taoudini basin, Mali and Mauritania

Oil and gas exploration in the landlocked West African country of Mali has taken significant steps forward since the international industry shunned the region in a 2002 exploration bid round.

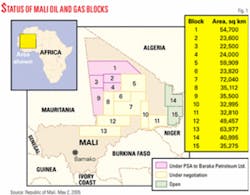

As of early May 2005, production-sharing agreements have been signed for seven of Mali’s 15 available exploration blocks, and negotiations were well advanced in another six.

The country has hosted only five exploration wells ever and none since the 1970s. A major reason for the sudden reawakening of interest has been the work of Max de Vietri, an Australian geologist and managing director of Baraka Petroleum Ltd., Perth.

De Vietri is recognized as the catalyst for the current exploration success in neighboring Mauritania, and his interest in Mali is an extension of that work.

Through Baraka he gathered a substantial amount of the existing company and government data on the vast Taoudeni basin, one of the world’s largest sedimentary basins, that straddles the Mali-Mauritania border. Noting the similarities to the geology of the proven petroleum province in Algeria to the north, de Vietri urged the Mali authorities to try again to attract exploration companies to the region.

Subsequently, Mali introduced a new petroleum code in August 2004, and Baraka signed PSAs on five permits last October-the first to be issued under the new regime.

The five permits (blocks 1, 2, 3, 4, and 9) total 193,200 sq km, one third the size of Texas, and stretch from the Algerian border in the east across to the border with Mauritania in the west (Fig. 1).

The blocks lie in the Taoudeni basin within the Sahara Desert to the north and west of the ancient city of Tombouctou (Fig. 2). The basin contains sediments from Precambrian to Carboniferous in age with Silurian black shales (in the oil window) and deeper Proterozoic stromatolite beds (possible gas generative) believed to have the best potential as petroleum source rocks.

Baraka has undertaken to spend a combined $51 million in the next 4 years on the five permits. Year 1 of the contract calls for the reprocessing and reinterpretation of past data as well as evaluation of gravity and aeromagnetic surveys and geochemical analysis of source rock outcrop at the basin margins.

Further source rock evaluation and surveys (including the possibility of stratigraphic wells) will take place in Years 2 and 3. An exploration well in each permit is not due until Year 4.

The PSA arrangements are for a 4-year initial term followed by options for two 3-year extensions. The holder must relinquish 25% of each area at the end of each term. In the event of commercial success, a petroleum exploitation permit can be excised from the exploration area. It will be available for an initial 25-year term and renewable for 10-year terms indefinitely.

Companies will be allowed to recoup exploration and production costs, after which production will be shared with the Mali government. Companies will also be subject to a 35% profits tax. However, there is no royalty regime and no signature bonus scheme. The Mali authorities have offered a $6 million reward to the country’s first petroleum producer.

Seeking help to fund its program, Baraka has opened a data room in Perth and has received farmout inquiries from a number of international explorers, major companies among them.

Other Mali blocks

In a more recent move, another Perth company, Sphere Investments Ltd., signed a PSA in Mali during early May 2005 to cover Block 8 in the Taoudeni basin and Block 10 farther east in the Gao graben. The terms are believed similar to Baraka’s, and Sphere too will seek to farm out.

In other areas, Canadian company Oceanic Exploration in joint venture with Grove Energy is undertaking a detailed review of Block 11 in the Gao graben. Grove Energy is associated with local company Mali Oil Investments.

Malaysian company the Markmore Group has applied for Blocks 5 and 6 in the eastern Taoudeni.

Energy Equity Resource of Norway plans to make application for Block 7 in the southeast Taoudeni and is considering a joint venture with Energen of South Africa for Block 13 in the Nara trough farther south where geological information is scarce but magnetic surveys suggest sediments may be as thick as 14 km. Energen on its own is also in negotiations for adjoining Block 12 in the Nara trough.

The two remaining permits, Blocks 14 and 15 covering the Iullemeden basin in the far east of the country and first explored by Soviet companies during the 1960s, have yet to receive an application, but there has been interest in the form of data requests from a number of explorers. Overall, the Mali authorities hope to have the bulk of the country’s available acreage under signed PSAs by the end of 2005.

Taoudeni in Mali

Only two wells, Atoila-1 and Yarba-1, have been drilled on the Malian side of Taoudeni, according to information provided by de Vietri’s Baraka Mali Ventures and Isis Petroleum Consultants, both of West Perth, Western Australia.

“Integrated studies of outcrop, seismic, and well data indicate that the Taoudeni basin is a large post-depositionally enhanced sag basin which prior to folding and uplift during the Hercynian orogeny around 300 Ma, was once part of a series of interconnected Paleozoic basins and platforms in North and West Africa which, today in Algeria and Libya, are host to world-class petroleum reserves,” de Vietri said.

Geologic parallels and analogues can be drawn between the North African basins, notably the world-class Illizi basin of southern Algeria, and the Taoudeni basin.

Key Taoudeni drilling objectives comprise Late Paleozoic oil plays in compaction-drape, anticlinal, and fault-block structures charged from possible Siluro-Devonian “hot shale” source rocks. Provisional maturation studies suggest that deeper Infracambrian oil-prone source rocks will be gas-mature, offering potential for large gas reserves in basement-controlled structures of Infra- and Neocambrian age.

Gas pipelines proposed to connect Nigeria and Algeria across the Sahara would pass east of and within servicing proximity to the Taoudeni basin.

The Mali portion of Taoudeni is the site of 7,000 line-km of 1970s vintage seismic data with broad coverage and a minimum of 10-50 km line spacing that casts doubt on the validity of the structural closure of the two wells. Some quite large leads could have been missed because of the large spacing of the seismic grid. Risks are the degree of maturation and quality of potential Siluro-Devonian source rocks.

Canning basin, onshore Western Australia

The sleepy onshore portion of the Canning basin in Western Australia is thought to have radically underperformed on its potential.

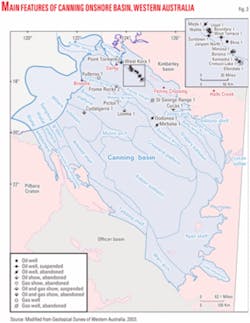

Then again, the onshore part of the basin has seen the drilling of only about 250 wells and acquisition of 78,000 line-km of seismic data in an area of about 530,000 sq km, according to a 2003 government report (Fig. 3).

The entire basin is about the size of the US Appalachian basin, where more than 500,000 wells have been drilled (OGJ, July 27, 1998, p. 91).

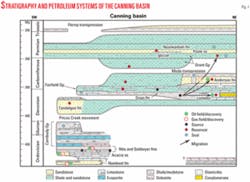

Only five small oil fields have been discovered in the onshore Canning. The largest, Blina, was discovered in 1981 about 100 km southeast of Derby and began producing in 1983. It has recovered less than 2 million bbl of 37° gravity oil through fewer than 10 wells from the Upper Devonian Nullara limestone at 1,438 m and Lower Carboniferous Yellow Drum formation at 1,142 m. Source of the 37° gravity oil is the Givetian-Frasnian Gogo formation (Fig. 4).

A Shell affiliate drilled the Looma-1 discovery in 1996 and penetrated several hundred meters of oil saturation in tight Ordovician Acacia, Nita, and Nambeet sandstones and carbonates. The seal is Silurian salt, and Shell thought the oil to have been sourced from the Willara subbasin to the south.

Reiser wrote in OGJ in 1998 that Shell selected the Broome platform area of the southern Canning basin as having significant potential in a late 1980s survey of frontier basins.

The onshore Canning basin has four petroleum systems. Government data show the Ordovician Nambeet, Willara, Goldwyer, and Carribuddy formations to be proven source-rock intervals, and global source-rock intervals for the Devonian, Givetian, and Frasnian intervals include the Gogo formation.

The Ordovician and Devonian petroleum systems (Larapintine 1, 2, and 3) are considered to provide the best prospects for liquid hydrocarbons, with the potential to generate tens of billions of barrels of oil.

Kimberley Oil NL, Alfred Cove, WA, has been attempting to interest partners in the Pictor structure on EP 431 about 140 km southwest of Blina field.

BHP’s Pictor-1 discovery flowed 45° gravity oil and wet gas from the Niga formation in 1984. The oil zone is at 944-1,019 m and the gas zone is at 905-944 m. Bridge Oil NL’s Pictor-2 in 1990 recorded a similar hydrocarbon column.

Kimberley calculated mean recoverable volumes using horizontal drilling at Pictor of 40.5 million bbl of oil, 400,000 bbl of condensate, 2 million bbl of LPG, and 84.8 bcf of gas. The company believes that “application of horizontal drilling technology into the fractured, low matrix permeability, carbonate reservoir rocks of the Nita formation of the Pictor structure has a reasonable possibility to allow economic development of the field.”

Sandakan basin, Philippines

Unocal Corp., being acquired by Chevron Corp., has operated an exploration program in distant Philippine waters off northeastern Borneo.

BHP Billiton took a farmout from Unocal in March 2004 on the 4,920 sq km SC-41 exploration block in 100-2,000 m of water in the Sulu Sea. It reprocessed 2D and 3D seismic data and acquired 2,200 line-km of 2D data.

The Zebra-1 exploration well targeted oil in Pliocene deltaic sediments in a faulted anticlinal structure in June 2004 but was interpreted as having encountered gas in tight silts or very fine sands and was plugged. A second well, Rhino-1, was plugged as a dry hole.

The permit also contains a high-potential deepwater play that targeted a separate petroleum system Unocal first identified in the Wildebeast-1 oil discovery in 2000. Interests in SC-41 were BHP Billiton and Occidental Petroleum Corp.’s Sandakan Oil subsidiary 28.1% each, Unocal 28.8%, and nine Philippine partners a combined 15%.

Gaspe Peninsula, Quebec

Montreal independents Junex and Petrolia formed a partnership to explore for oil and gas on the Gaspe Peninsula, where they hold 70% of the exploration permits in force. The identified three targets for drilling in 2005 at a cost of $5-10 million (Canadian).

Junex is transferring to Petrolia two permit blocks that total 6,366 sq km between Murdochville and Gaspe and right of first refusal on two other blocks that total 5,885 sq km. The permits adjoin blocks held by Petrolia that surround the Galt permit where Junex has a producing gas field and indications of oil (OGJ Online, Mar. 11, 2003).

Junex receives $1.3 million in Petrolia shares and back-in rights in any discovery on the Murdochville-Gaspe blocks.

Junex swabbed 120 bbl of what it called an excellent quality 45° gravity oil from the Galt-3 well in small Galt gas field near Gaspe in mid-2005. The well had encountered indications of hydrothermal dolomite at 2,105 m during drilling. Galt-3 produced oil again when opened briefly in September 2004.

This was the first demonstrated presence of hydrothermal dolomite “at great depth in Gaspe,” Junex said.

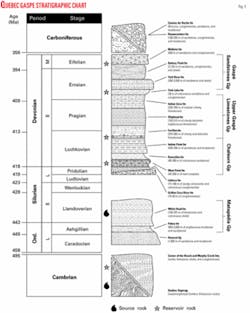

After that, Junex resolved to undertake a multiwell exploration campaign across Gaspe. The main geological objectives were to be Devonian reefs northeast of Gaspe, the York Lake, York River, Battery Point, and Malbaie sandstones, and hydrothermal breccias in the Indian Cove and Forillon limestones.

Galt field produces gas from the Basal Forillon formation. Junex is conducting oil production tests in the field from the Lower Devonian (Pragian) Basal Forillon and top Indian Point formations (Fig. 5).

Namibe basin, Namibia

Hardly anywhere in the world measures up to the recent exploration significance of Angola, and here is a block in a nonproducing and mostly unexplored basin along Namibia’s international boundary with Angola.

EnerGulf Resources Inc., Vancouver, BC, signed an agreement with National Petroleum Corp. of Namibia in March 2005 that established a working relationship with regard to joint ventures in oil and gas exploration, development, and production and gas-to-liquids opportunities in Namibia. Most immediately, the agreement pertains to Block 1711 in the Namibe basin.

NAMCOR granted EnerGulf an option for up to 25% of NAMCOR’s interest in Block 1711. This option would be a 25% working interest in an exploration license that would be granted by the Minister of Mines & Energy.

Extensive seismic data on the 8,931-sq-km block identified the Kunene and Hartmann exploration prospects.

The Kunene prospect, defined originally by 2D and recently confirmed by a 650-sq-km 3D seismic program, is a huge structure, probably Cretaceous in age. It appears to be a carbonate buildup sealed by a thick Tertiary shale sequence.

The structure forms a four-way dip closure that covers 95 sq km with 675-1,400 m of vertical closure. Abundant direct hydrocarbon indicators are associated with the prospect. The resource potential has been assessed at a mean value of 5 tcf of gas or 733 million bbl of oil.

The Hartmann prospect in the southern part of the block is identified by extensive 2D seismic and interpreted as a stratigraphic trap that covers 343 sq km with 1,600 m of vertical relief. It appears to be a carbonate buildup the same age as Kunene. Its assessed mean recoverable resource potential is estimated to be 2.2 billion bbl of oil or 16.4 tcf of gas.

Exploration veteran Dr. Bill St. John, EnerGulf’s senior advisor for African exploration, said, “Block 1711 contains the most attractive undrilled structure that I have seen in over 40 years of exploring for oil and gas internationally.”

Mafia basin of Tanzania

Aminex PLC, London, and partners drilled Nyuni-1 on Nyuni Island in the Indian Ocean off Tanzania to TD 3,895 m in the Upper Jurassic in May 2004.

The wildcat had operating and mechanical difficulties and did not flow commercial volumes of oil and gas but “did establish the presence of live crude oil from a wide-ranging Upper Jurassic source, opening up the prospectivity of the whole region,” Aminex concluded.

The company observed high mud gas counts while drilling the Mid-Cretaceous and earlier sections. Oil fluorescence and shows were repeatedly observed in cuttings below 3,000 m, throughout the Neocomian and Upper Jurassic.

Analysis of the oil shows in two independent UK laboratories identified the oil as having migrated oil from an Upper Jurassic source rock. The same oil was found in fluid recovered with the MDT tool. The general area had been thought to be gas prone.

Nyuni-1 is the first well drilled off Tanzania for 12 years and the second exploration well drilled in the offshore Mafia basin (OGJ, Aug. 14, 2000, p. 40).

Nyuni Island is 30 km off the coast and 18 km north-northeast of Songo Songo gas field.

EastCoast Energy Corp., Tortola, British Virgin Islands, started production in mid-2004 from Songo Songo, the area’s first hydrocarbon field. The field produced 4.6 bcf of gas from July 20, 2004, through the end of calendar 2004 to two customers. That included 85 MMcf of gas to fill the pipeline to Dar es Salaam. Songo Songo produces gas from Lower Cretaceous sandstones at 6,100 ft. The field’s deepest well went to TD 14,521 ft in Upper Jurassic shale.

Five customers were to be connected in the first half of 2005, tripling sales to 3.5 MMcfd by the third quarter of 2005.

EastCoast said it prepared a 500 line-km seismic acquisition program over the two field license blocks and seven adjacent license blocks in 2004. The company plans to assess drilling leads on the adjacent leases to identify potential prospects to be targeted in 2006.

The field’s proved reserves to be marketed by EastCoast doubled to 171.2 bcf as the result of data reinterpretation and pressure and production performance. Consulting engineers estimated the field’s most likely gross recoverable volume at 649 bcf.

In the past the field has been judged to contain 1.0-1.5 tcf of gas in place.

Eastern Black Sea, Georgia Republic

BP PLC and Turkish Petroleum Overseas Co. took a farmout from Anadarko Petroleum Corp., Houston, in the first quarter of 2005 on three deepwater blocks in the eastern Black Sea off former Soviet Georgia (Fig. 6).

Anadarko retained a 48% working interest in blocks IIa, IIb, and III, which cover a combined 2 million acres. The other interests are BP 38.5% and Turkish Petroleum 13.5%.

BP and Turkish Petroleum hold the license to the adjoining Rioni block and plan to drill a well there in 2005.

Anadarko said it negotiated access to seismic data and the results from an exploration well in the Turkish Black Sea. That data and results from the 1,100 sq km 3D seismic survey conducted in late 2004 will assist in the exploration program, Anadarko said. ✦