OGJ Newsletter

General Interest—Quick Takes

US refining outlook less positive for early 2005

The US refining sector's profit margins and stock prices are apt to see downward pressure in early 2005 because of strong supply levels and lower demand growth, said investment banker Friedman, Billings, Ramsey & Co. Inc., Arlington, Va.

FBR analyst Jacques Rousseau reported that he sees refining fundamentals for the first quarter as less positive than they were in the first quarters of 2003 and 2004.

"Given the poor refining industry fundamentals throughout 2002, refiners voluntarily reduced their production levels in first quarter 2003 (utilization rates averaged only 87% during this period vs. a historical 90%), leading to a decline in total refined products inventories," he said in a Dec. 29 research note.

Consequently, refining margins returned to above mid-cycle levels during the first quarter 2003. A similar trend emerged during winter 2003-04 when refining margins dipped below mid-cycle.

Dropping margins and a heavy maintenance turnaround schedule during early 2004 caused a steep decline in products inventories, resulting in record refining margins, he said.

"However, despite the current US average refining margin hovering slightly below mid-cycle levels, we expect the positive trend of falling inventories and rising margins witnessed over first quarter 2003 and first quarter 2004 to be more mild in first quarter 2005," Rousseau said.

US refined products supply is likely to remain high as the first quarter 2005 turnaround schedule appears to be light. "The lack of major refinery turnaround activity in both the US and Europe should lead to strong US refining production and possibly to above-average import levels during first quarter 2005," Rousseau said.

Additionally, light product yields from US refineries have increased 2-3% during the past 5 years, so investments in upgrading capabilities and improved technology has increased refinery output of gasoline, diesel, heating oil, and jet fuel, he said.

Rousseau expects that total refined products demand growth will slow following a 2.4% rise during 2004 vs. a historical 5-year average of 1.4%. FBR forecasts a 1.3% demand growth in 2005, partially because sustained high retail gasoline prices negatively affect consumption.

Crude oil differentials remain exceptionally strong, stemming from strong production by members of the Organization of Petroleum Exporting Countries, he said.

"Light-heavy differentials, for example, are currently averaging $6/bbl, significantly higher than $3/bbl witnessed in December 2002 and $2/bbl in December 2003. This higher level for differentials should allow complex refineries to remain profitable even when benchmark refining margins dip to low levels," Rousseau said.

Gasoline inventories are expected to continue rising, he said.

"Given our expectations for continued strong production coupled with the low demand growth, gasoline inventories could enter the spring season (second quarter) near a new record high," he said.

Most US refiners continue trading at peak-cycle valuations, he said. "The sector as a whole is fairly valued, based on our mid-cycle earnings and free cash flow analysis," Rousseau said.

ConocoPhillips drops out of Arctic Power

ConocoPhillips confirmed that it has dropped out of Arctic Power, a lobbying group based in Anchorage that promotes opening part of the coastal plain of the Arctic National Wildlife Refuge for oil and gas leasing.

"We have not been involved in the ANWR debate in many years and have focused our investment attention in Alaska toward the gas pipeline and development of other North Slope satellite fields," a ConocoPhillips spokeswoman said. "Since ANWR is currently closed to development, we feel that any resolution or pledge on our part would be moot."

ConocoPhillips decided against renewing its membership in Arctic Power in mid-year 2004, she said. BP PLC dropped out of Arctic Power in November 2002. ExxonMobil Corp. remains an Arctic Power member.

A coalition called US Public Interest Research Groups (PIRG), Washington, DC, since 1998 has targeted oil companies that expressed an interest in ANWR if drilling were to be permitted there.

Athan Manuel, director of US PIRG Wilderness Campaign, said he hopes Congress will defeat any attempt to allow drilling in ANWR.

"It appears that ConocoPhillips and BP are more enlightened than the [US President George W. Bush's] administration when it comes to drilling in the arctic refuge. Hopefully, Congress will get the message," Manuel said. Meanwhile, Green Century Capital Management Inc. of Boston said it will withdraw a shareholder resolution that it had filed last month with ConocoPhillips regarding ANWR.

A mutual fund manager, Green Century previously filed an arctic refuge shareholder resolution that received more than 9% of the ConocoPhillips shareholder vote in May 2004.

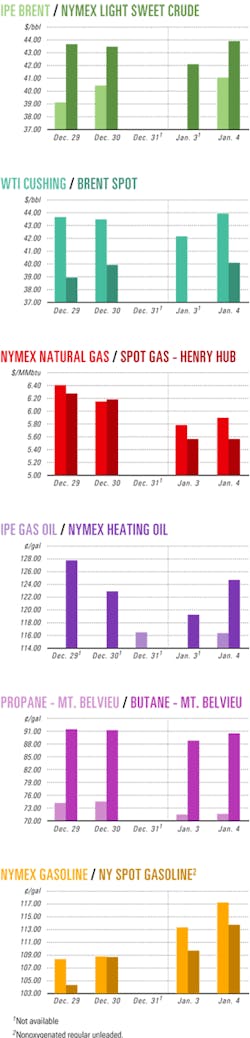

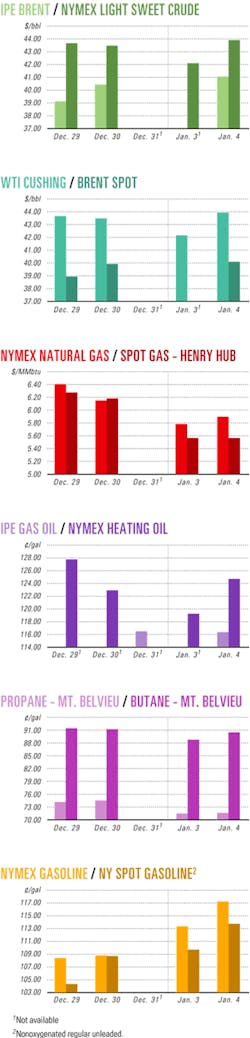

Industry Scoreboard

null

null

null

Exploration & Development—Quick Takes

ConocoPhillips, Anadarko plan Alpine satellites

ConocoPhillips and Anadarko Petroleum Corp. plan to develop two Alpine satellite oil fields on Alaska's North Slope on the border of the National Petroleum Reserve-Alaska after gaining favorable rulings from the US Department of the Interior's Bureau of Land Management and the Corps of Engineers.

The companies will drill CD 3 in Fiord field and CD 4 in Nanuq field, placing both sites within an 8-mile radius from ConocoPhillips-operated Alpine field.

Field development will be achieved by utilizing horizontal well technology exclusively and employing enhanced oil recovery.

About 40 wells are planned with first production scheduled for late 2006 and peak production expected in 2008 at about 35,000 b/d of gross oil.

Production from the two satellites and Alpine is expected to peak at 135,000 b/d in late 2007.

CD 3 is the first roadless drill site, accessible only by air most of the year. Construction equipment, facilities, drilling rigs, and supplies will be transported to the site via temporary ice roads.

CO2 clogs apparent Uganda gas discovery

Heritage Oil Corp., Calgary, is planning its next exploration well on Uganda's remote Albert graben after encountering imprecisely gauged volumes of carbon dioxide and hydrocarbon gas at its latest penetration.

Heritage drilled Turaco-3 to TD 2,850 m and logged two potential hydrocarbon-bearing zones containing a stacked sequence of sands and shales. The company calculated 84 m of net pay with 24% average porosity from logs in the sequence of more than 350 m of gross pay.

Flow rates on three through-casing drillstem tests limited by surface test equipment capacity were 8-12 MMcfd of gas through 20/64 to 28/64-in. chokes and 1,200-1,600 psi wellhead flowing pressures. Heritage extrapolated the flow rates to a combined 60 MMcfd under production conditions.

Hydrates formed during testing, and special equipment and heaters will be required for further tests.

Heritage could not quantify the hydrocarbon component of the gas stream. The well cut consolidated reservoir sands with 200-500 m MD of inferred permeability. Gas samples under pressure were shipped for analysis.

Heritage acquired a 390 sq km 3D seismic survey and launched a further 2D transition zone survey linking existing land and Lake Albert seismic data (OGJ, June 10, 2002, p. 42).

AWE makes Bass basin gas discovery

Australian Worldwide Exploration Ltd. subsidiary AWE Petroleum Pty. Ltd. reportedly has confirmed a wildcat gas-condensate discovery in Bass basin off Tasmania.

The Trefoil-1 well recorded good gas shows over three intervals in sandstones interbedded with shales—at 2,964-3,000 m, 3,015-44 m, and 3,135-56 m—and over two intervals in sandstones interbedded with volcanics: 3,382-87 m and 3,429-32 m.

The presence of gas was confirmed at seven different depths with the use of "singlepoint" formation sampling. Some of these samples have increased the gas zones previously identified on wireline electric logs.

In line with the predrill prognosis, these "single-point" gas samples are associated with a series of more vertically extensive, yet low-relief stacked gas columns in good quality sands within the lower Eastern View Coal Measures.

Preliminary analytical data on available samples indicated good quality gas that is liquids-rich with a low CO2 content (OGJ, Dec. 7, 2004).

AWE said the well has not intersected the gas-water contacts for most of the gas columns, and formation testing and sampling is ongoing to establish the downdip extent of gas accumulations.

Falkland plans 2D seismic survey

Falkland Oil & Gas Ltd. hired Geophysical Services Inc., Houston, to conduct the first 2D seismic survey in 10 years in a license area off the Falkland Islands that it holds with Hardman Resources.

FOGL holds 77.5% and Hardman Resources Ltd., Perth, Australia, 22.5% of the joint venture area, which initially covered 33,000 sq km. FOGL recently received another 50,000 sq km license of which it owns 100%.

The survey will cover both the JV and the FOGL extension, allowing mobilization and demobilization costs to be spread over both license areas.

Initial results of the seismic survey are expected to be available by mid-2005.

DTI approves Brechin field development

Paladin Resources PLC subsidiary Paladin Expro Ltd., London, and its 41.03% joint venture partner Energy North Sea Ltd., a Marubeni Corp. subsidiary, have received approval from the UK Department of Trade and Industry for development of Brechin oil field, which lies near the Montrose, Arbroath, and Arkwright (MonArb) field complex.

The estimated development cost is £21 million.

The field will achieve production through a single horizontal well tied back to Arkwright field's existing subsea infrastructure 3.4 km away. The oil will be transported via pipeline for processing on the Montrose field platform and then to shore via the Forties Pipeline System.

Production, which is slated to begin in July 2005, is expected to exceed 5,000 b/d at peak.

Field operator Paladin discovered Brechin field in May 2004 with its first UK-operated exploration well 22/23a-7, which penetrated 138 ft of oil-bearing Palaeocene Forties Sandstone.

MMS to evaluate interest in oil, gas sale in Cook Inlet

The US Minerals Management Service asked energy companies to provide feedback of their exploration interest in the potentially resource-rich federal waters of Cook Inlet, which could provide much needed energy for south-central Alaska.

Cook Inlet Sale 199 is tentatively scheduled for May 2006. It is the second such sale held under MMS's 5-Year Plan for 2002-07 (OGJ Online, May 19, 2004).

The Federal OCS area in Cook Inlet has remained relatively unexplored since 1984 when the last exploration well was drilled.

MMS is evaluating a package of economic incentives for federal leases in the area.

The MMS lease area covers about 2.5 million acres extending south of Kalgin Island to northwest of Shuyak Island in 30-650 ft of water. No leasing is proposed in Shelikof Strait.

PTTEP buys in to Thailand Phu Horm field

PTT Exploration & Production PLC (PTTEP) plans to spend $36 million over the next 2 years in developing Phu Horm field in northeastern Thailand, which is emerging as Thailand's largest onshore gas field. Preliminary estimates put gas reserves at 300-700 bcf. Amerada Hess (Thailand) Ltd. is operator.

PTTEP is acquiring a 20% stake in Block EU-1, one of two tracts on which the field lies, and it holds a 20% stake in the other tract, Block E5N.

Amerada Hess now holds a 35% share in Phu Horm, Apico LLC 35%, and ExxonMobil Exploration & Production Khorat Inc.10%.

Phu Horm is expected to come on stream in 2006 at a potential production rate of 85-100 MMcfd.

The Phu Horm structure covers 231.6 sq km in Udon Thani and Khon Kaen provinces.

Negotiations are in progress to sell the gas to PTT PLC, Thailand's natural gas distribution monopoly.

Statoil makes offshore Venezuela find

Operator Statoil ASA drilled its first wildcat on Block 4 of the Plataforma Deltana area of the Venezuelan continental shelf where it is the sole licensee for the block.

Ballena 1-X is the first of three wells the firm plans to drill on Block 4, which covers about 1,435 sq km in 200-800 m of water.

If the well proves successful, Statoil may drill one to three appraisal wells before declaring the field commercial.

Well planned off Trinidad and Tobago

ChevronTexaco Corp. and BG Group PLC plan to drill a well in 300 ft of water early this year on Trinidad and Tobago's Block 6D Manatee prospect, thought to be a northern extension of Loran gas field in Venezuela.

Loran field, discovered by ChevronTexaco, lies on Block 2 in the Plataforma Deltana area on Venezuela's Atlantic continental shelf.

BG, originally selected as operator of Loran field with ChevronTexaco as its partner, withdrew from the project when it became unclear whether the administration of Venzuelan President Hugo Chávez would allow the gas to be processed in Trinidad and Tobago. ChevronTexaco remained and made the Loran discovery, with ConocoPhillips its 40% partner (OGJ Online, Oct. 12, 2004).

"For synergistic reasons, [ChevronTexaco] will operate the well [on the Manatee Prospect] on behalf of the partnership, using the same rig that is currently drilling on Loran," BG and ChevronTexaco said. "The main purpose is to confirm the presence of hydrocarbons."

Siberia's West Salym oil field flowing

Salym Petroleum Development NV (SPD), Moscow, has begun oil production 1 year early from wells in West Salym, the largest of the Salym group of oil fields in the Khanty-Mansiysk Autonomous Okrug in western Siberia.

Other fields in the production-sharing agreement (PSA) area are Upper Salym and Vadelyp. Production also has begun from Upper Salym, but Vadelyp production is to start in 2006.

SPD is a 50:50 joint venture of operator Shell Exploration & Production BV and OAO NK Evikhon—the Russian unit of Sibir Energy PLC, London.

Road tankers will transport production from West Salym to Upper Salym until the central processing facility (CPF) in West Salym and a planned 90 km oil export pipeline are commissioned next year. The CPF is designed to handle production of 6 million tonnes/year of crude. The pipeline will transport the oil from the CPF to a tie-in with the Transneft main trunk pipeline system at Yuzhny Balyk booster station. Construction of field facilities is under way.

Drilling continues on West Salym well pad 20, and two additional rigs will begin work soon. SPD has budgeted $278 million for 2005 operations. It expects spending on Salym fields' development to reach $600 million by the end of 2006.

SPD expects production to rise steadily to 134,000 b/d in 2011 from 1,270 b/d in 2003. Peak production of 143,500 b/d is expected in 2013 (OGJ Online, Apr. 12, 2001).

James oil field producing in North Sea

Kerr-McGee North Sea (UK) Ltd., operator of James oil field in the UK North Sea, said the field is now on stream, producing more than 8,000 b/d of oil from a single horizontal well.

The well is a subsea tieback to the Janice A floating production facility, which Kerr-McGee also operates, with a 75.3% interest. Oranje-Nassau (UK) Ltd. holds an 18.2% working interest, and Svenska Petroleum Exploration UK Ltd. holds 6.5%.

James production complements the 10,000 b/d currently being produced by Janice field, which is 155 miles southeast of Aberdeen on UK Block 30/17a. James is 3 miles southeast of Janice on the same block.

Kerr-McGee said its 2005 budget includes $270 million earmarked for the North Sea, with 5-10 exploratory and appraisal wells planned.

ChevronTexaco starts up Cabinda field

ChevronTexaco Corp.'s Angolan subsidiary Cabinda Gulf Oil Co. Ltd. (Cabgoc) has started oil production from Bomboco field in Block 0, off Cabinda. Bomboco, which is expected to produce 30,000 b/d of oil in the next year, is part of Cabgoc's Sanha condensate project.

The Sanha processing facilities first received condensate from surrounding fields in December. First gas injection is expected later this month. Condensate production from Sanha field is slated for early first quarter. The Sanha floating production, storage, and offloading vessel is to begin extracting LPG early in the second quarter.

Estimated peak production of 100,000 b/d of oil and LPG from both Sanha and Bomboco fields is expected in 2007.

Jim Blackwell, managing director of ChevronTexaco's Southern Africa Strategic Business Unit, said the Sanha project will reduce gas flaring on Block 0 by 50%.

Operator Cabgoc holds 39.2% interest in the block. Its partners' interests are Sonangol 41%, Total SA 10%, and Eni Angola Exploration BV 9.8%.

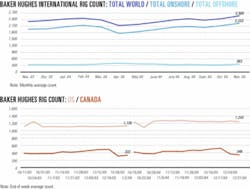

US drilling declines final week of 2004

US drilling activity dipped slightly in the final week of 2004, down by 14 units with 1,243 rotary rigs still working, Baker Hughes Inc. reported Dec. 31. That was still up sharply from 1,126 active rigs at the same period a year ago.

Land operations accounted for the bulk of the loss, down by 12 units with 1,117 rigs working. Inland waters activity was unchanged, with 21 rotary rigs drilling. Offshore operations dipped by 2 rigs to 105 working in US waters as a whole, including a decline of 1 to 100 rigs in the Gulf of Mexico.

Canada's weekly rig count slipped by 25 units to 346 that week, up from 332 a year ago.

Processing—Quick Takes

KNPC taps Fluor for Kuwait refinery FEED

Kuwait National Petroleum Co. contracted Fluor Corp. to provide front-end engineering and design services to its proposed refinery in Shuaiba about 31 miles south of Kuwait City.

After completion, the multibillion-dollar refinery with an initial throughput capacity of 450,000 b/d will provide low-sulfur fuel to be used as feedstock for Kuwait's existing and new electric power plants.

Work began on the project early last month, and completion is expected in early 2009.

Transportation—Quick Takes

West African Gas Pipeline gets go-ahead

Partners in the West African Gas Pipeline Co. Ltd. (Wapco) have agreed to move forward with construction and implementation of the West African Gas Pipeline project, ChevronTexaco Corp. announced.

The estimated $590 million project will transport natural gas 420 miles from Nigeria to Benin, Ghana, and Togo. The 20-in. pipeline is expected to have a maximum capacity of 470 MMscfd.

Wapco will immediately develop a detailed final project design. Pipeline construction, to be performed by Horizon Marine Construction Ltd, is slated for completion in October 2006, with transmission start-up expected in December 2006.

ChevronTexaco West African Gas Pipeline Co. Ltd. is the project's managing sponsor and holds 38.2% of Wapco. Other partners are Nigerian National Petroleum Corp. 26%, Shell Overseas Holdings Ltd. 18.8%, and Takoradi Power Co. Ltd. of Ghana 17%.

The governments of Benin, Ghana, Nigeria, and Togo entered into a heads of agreement, under the auspices of the Economic Community of West African States, in 1995 for the joint development of the pipeline project.

IOC gives Iranian firm pipeline contract

India's state-owned Indian Oil Corp. has awarded a contract to Iranian Offshore Engineering & Construction Co., Tehran, to lay a 22-km subsea pipeline to shore from a proposed single-point mooring buoy (SPM) off Paradip Port at Orissa on India's eastern coast.

The SPM will offload oil from large crude carriers into the pipeline, which initially will transport crude to the Haldia refinery and subsequently to a 12 million tonne/year (t/y) capacity refinery planned for Paradip.

Construction on the subsea pipeline, to begin this month, is expected to take 6 months, according to Paradip Port Trust (PPT) sources. IOC has yet to start work on a Paradip-Haldia crude oil pipeline.

Paradip port, which currently handles about 1.4 million t/y of petroleum products but no crude traffic, expects to start moving 5 million t/y of oil from the SPM in 2005-06 and 15 million t/y during a full year of operation.

The port trust has completed an $11.4 million oil jetty that has a draught of 12.7 m, ideally suited for "LR-I" crude oil tankers having a capacity as much as 65,000 dwt. The jetty will be operational shortly, port trust sources indicated. India's state-owned Oil & Natural Gas Corp. plans to drill 21 wells in the Mahanadi basin and four wells on Sagar Island. PPT has agreed to provide sheds, open space, and berthing facilities for the vessels to facilitate a 4-year drilling program, scheduled to start in early 2005.

Georgia Strait crossing project dropped

Williams Cos. Inc. unit Williams Northwest Pipeline, Tulsa, and British Columbia Hydro & Power Authority, cosponsors of the proposed $209 million Strait of Georgia natural gas pipeline crossing, have discontinued development of the project.

The US Federal Energy Regulatory Commission and Canada's National Energy Board both had already approved the project, which was to serve electric power generation facilities on Vancouver Island, BC, but the decision on whether to proceed with the 84-mile pipeline has been on hold since September 2003, pending a regulatory review of energy needs on Vancouver Island.

BC Hydro said it would "pursue other alternatives to meet short-term energy needs" and now plans to replace aging electric transmission cables.

BC Hydro has assumed responsibility for the entire $34 million expended project development costs.

KMEP expanded California pipeline on line

Kinder Morgan Energy Partners LP, Houston, has begun transporting gasoline, jet fuel, and diesel on its new 70-mile replacement common-carrier pipeline between Concord, Calif., and Sacramento.

In the $95 million North Line expansion, KMEP rerouted portions of existing pipeline away from environmentally sensitive areas and residential neighborhoods and replaced a 14-in. products pipeline with a new 20-in. line.

The expansion increased the system's products capacity to 175,000 b/d and provided necessary infrastructure to meet long-term transportation demand. Additional horsepower in the future could increase maximum capacity to 200,000 b/d, KMEP said.