Severance tax change cuts North Slope asset values

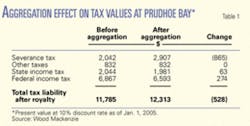

In his 2005 state-of-the-state address in January, Alaska Gov. Frank H. Murkowski announced with little warning some unexpected news. As of February 2005, the state includes Prudhoe Bay’s satellites in its severance tax calculation. Wood Mackenzie estimates that this aggregation generates an additional net tax liability of $88 million in 2005 for Prudhoe Bay’s owners. As a result of the change, the present value of the assets at a 10% discount rate (PV10) drops by $528 million. The impact would be even more severe if severance taxes were not deductible against state and federal income taxes.

Aurora, Borealis, Midnight Sun, Orion, Polaris, and Point McIntyre oil fields are now included as part of Prudhoe Bay for severance tax purposes. The satellites surrounding Prudhoe Bay have previously been all but free from severance tax due to their modest production rates. These assets are currently producing approximately 90,000 b/d. The other producing fields within the Prudhoe Bay Unit, Lisburne and Niakuk, have escaped inclusion in this ring fence through prior specific terms in their development agreements.

In the state’s view, these assets are effectively being operated as one field and not separate projects. Therefore, the whole group should be liable to the same taxes. The severance tax calculation was designed to encourage and protect marginal projects. The state does not view these satellites as marginal. The producers’ view is that the rules have been changed after investment decisions were sanctioned. This could result in marginal projects remaining undeveloped.

It has also been argued that raising the taxes on the participants of a potential Alaska gas pipeline project places the project in jeopardy. Wood Mackenzie takes the view that this will simply refocus the negotiations onto fiscal stability. The ultimate value of Alaskan gas on the open market is huge. It is unlikely that either party would want to let these negotiations falter.

The owners have exercised their right to appeal the decision. It is possible that negotiations with the state will result in some of the satellites being made exempt. The likely candidates for this exemption would be Polaris and Orion, which produce heavier crude. If the state or the producers have aspirations to change elements of Alaska’s fiscal regime, the severance tax appeal process may represent an opportunity for these to be raised.

Production decline

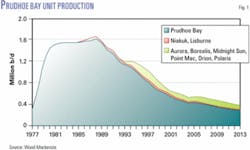

Prudhoe Bay, the largest field on the North Slope, has been producing since 1977. In the mid-1990s, the field was producing more than 1.6 million b/d. Falling production has resulted in alternative sources of oil being sought from within the Prudhoe Bay Unit.

A number of discoveries within the unit have helped stem the production decline (Fig. 1).

To date, BP PLC, operator of the Prudhoe Bay Unit, and its partners have developed eight satellite fields. Historically, the satellites’ contribution to overall Prudhoe Bay Unit production has been limited. In the future, their importance is expected to become more significant.

Taxes

Prudhoe Bay field and its satellites are taxed under standard Alaskan concession terms. These include royalties and state and federal taxes. The changes introduced by the state apply to the severance tax only. It is applied to all production from state lands after the deduction of royalties.

The Economic Limit Factor (ELF) multiplier is key to calculating severance tax liability. The higher the ELF, the larger the tax liability. The severance tax rate can vary between 0 and 15%, depending on the ELF generated. The ELF, introduced in the 1970s, was modified in 1989 to encourage development of smaller fields. As field production declines and wells become less productive, the ELF falls rapidly.

With the exception of those at Polaris, wells at the six aggregated satellite fields are more productive than the main field. Total field output from each, however, has been low enough to create a small ELF. The resultant severance tax liability was therefore very low for the satellites. From February 2005, the state will include production and individual well productivity from these satellites in the severance tax calculation. Development agreements for Lisburne and Niakuk prevent aggregation for these assets.

Aggregating the ELF calculation for Prudhoe Bay field and its satellites has two effects:

• The Prudhoe Bay ELF now applies to the production from the six satellites.

• The average satellite well has higher productivity than the average Prudhoe Bay well. The aggregated ELF is higher than the ELF for Prudhoe Bay treated alone. As a result, the severance tax liability on legacy production is also increased.

State’s reasons

The State of Alaska is entering into a period of budget deficit. This is a result of crude production from the North Slope declining and gas exports still being a decade away. Recent motions detail plans to dip into the Alaska Permanent Fund to maintain a balanced budget without dramatically cutting state spending. Oil and gas taxes have a very high profile as they contribute almost 80% of state-generated revenues.

The state treats the Prudhoe Bay Unit as a single asset and the satellites as extensions of the main field. Original agreements for the development of the six satellites did not explicitly prevent aggregation in the future.

Alaskan citizens, opposition parties, and some government insiders have been focusing on the level of severance tax contributions to the state over the past few years.

Most fields on the North Slope have been paying limited amounts of severance tax. These include Prudhoe Bay’s satellites and the North Slope’s second biggest field, Kuparuk.

Many in Alaska take the view that the ELF should be repealed altogether, effectively levying the full severance tax rate to all nonroyalty production. A petition entitled “An Act repealing the economic limit factor as it applies to oil” will be included in the 2006 Alaska ballot if enough signatures are gathered.

Reaction

The North Slope producers are unhappy with the tax decision, arguing that the rules have been changed in the middle of the game. Their investment decisions were based on tax arrangements agreed 15 years ago. It has also been claimed that the aggregation is illegal under the state’s own laws.

Any new development at Prudhoe Bay will have to be reevaluated. Projects that were marginal before aggregation could now be uneconomic and delayed indefinitely. One such development is the full-scale expansion of the heavy oil satellite Orion.

The State of Alaska claims to support the development of the heavy oil resources on the North Slope. In the future, production from these resources could grow significantly, offsetting declines from the large conventional fields. Because they produce heavy oil, Orion and Polaris are very sensitive to an increased tax burden.

Producing oil in Alaska is expensive. A competitive and stable tax regime will encourage further investment.

If the tax burden increases significantly, there is a strong possibility that companies will start to invest elsewhere. Fiscal changes and increased taxation could result in an accelerated decline in the Alaskan oil industry.

Impacts

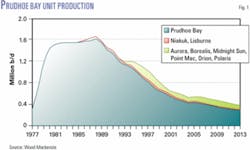

The new treatment of severance tax for Prudhoe Bay and the affected satellites results in an increased tax liability of $145 million in 2005, at an average annual price of $41.89/bbl for Alaskan North Slope crude.

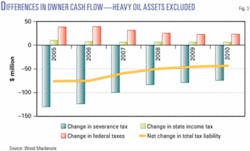

Severance tax is deductible for the calculation of state income tax (SIT), which is in turn deductible for the calculation of federal income tax (FIT). The increase in severance tax has the effect of reducing the SIT liability by $12 million and the FIT by $45 million in 2005. The net result for the field participants is an increase in total tax liability of $88 million in 2005 (Fig. 2).

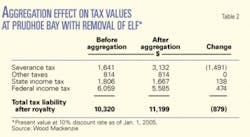

The value impact of this tax change is considerable. Wood Mackenzie estimates that the PV10 of Prudhoe Bay and satellites will decline by $528 million. The increase in severance tax alone reduces the PV10 of the assets by $865 million. The deductibility of severance tax against SIT and FIT lessens the impact significantly (Table 1).

The appeal

In their appeal of the state’s ruling, North Slope producers have cited differences between individual field operations, assurances from the state that aggregation would not take place, and the possibility of project delays or cancellations. The appeal process could take months to conclude.

It is very unlikely that the government would back down completely from its decision. Wood Mackenzie takes the view that the heavy oil assets may be negotiated out of the aggregation because of their inherently different development scenarios and marginal economics. However, the current ruling may already be viewed as lenient by many Alaskans. Softening of the state stance toward producers could increase support for the citizen’s initiative to remove the ELF from severance tax calculations.

If the heavy oil assets were excluded, the severance tax increase would wipe out $555 million of PV10. The net impact including SIT and FIT is estimated to be $342 million following aggregation (Fig. 3).

Citizen’s initiative

If sponsors of the initiative to remove the ELF from severance tax calculation are successful, the increase in resultant taxes at Prudhoe Bay would be even higher. An increase in severance taxes with a PV10 of $1.5 billion would result from the ELF being repealed in 2006. Taking deductions into account, the net impact would be a tax increase with a PV10 of $879 million (Table 2).

The impact across the entire state would be to reduce corporate asset PV10 by $3 billion.

Consternation

The decision to aggregate the satellites into Prudhoe Bay’s main field for the purposes of severance tax caused shock and consternation among the participants at Prudhoe Bay.

The state argues the decision was made because satellite fields are operated as part of the main field. On the surface this is how it appears. The owners, however, have justifiably claimed these investments were sanctioned under the original ELF terms. These investment decisions have now been undermined. The full-scale development of Orion has been suspended indefinitely as a result of the state’s decision.

Should the citizen’s initiative be successful, the actions of the state may have ultimately helped to defend the case for retaining the ELF after the 2006 ballot. Without the ELF’s sliding scale, otherwise recoverable oil could remain in place as the economics become marginal.

One party not included in negotiations is the federal government. FIT revenue with PV10 of $274 million could be lost in 2005, representing over 30% of the original severance tax increase. Removal of the ELF from the calculation in 2006 would result in FIT losses with PV10 of $474 million.

Companies look for fiscal stability before making investments. The state and the producers are in advanced stages of consultation on the largest pipeline construction project in the world: the Alaska Gas Pipeline. Although the severance tax episode has been unsettling for the operators, the consequences of developing the pipeline are much bigger. The severance tax change is unlikely to influence the final investment decision about the gas pipeline, but discussions regarding fiscal stability have now gained relevance.

When the ELF calculation was introduced and modified, oil prices of $50/bbl were unlikely. If the state or the producers have aspirations to change elements of Alaska’s fiscal regime, the severance tax appeal process may represent an opportunity to consider recommendations.

The severance tax change will be felt most severely if operators continue to defer or delay projects. Work not undertaken while oil and gas prices are high represents lost producer, state, and federal revenues. ✦

The authors

Scott Mitchell is managing consultant, North America energy, Wood Mackenzie, and a member of the North America Upstream Research Team. He joined Wood Mackenzie in 1999 following 7 years with Amoco Corp. in London. While at Amoco, he was involved in financial and strategic planning decisions as North Sea economist. Mitchell also was economic advisor to the Acquisition and Divestment Team. Since joining Wood Mackenzie, he has developed the Nigeria and Central Africa Upstream Service and the North America Frontier and Western Canada services. Mitchell graduated from Strathclyde University with a bachelor’s degree in mining and petroleum engineering and a master’s degree in management science.

Fraser McKay is a Wood Mackenzie consultant, North America energy, and a member of the North America Upstream Energy Research Team. He joined Wood Mackenzie in 2003 following 7 years with Schlumberger Oilfield Services, where he worked in management roles in various locations, including the UK, the Middle East, and Asia. McKay graduated with a BSc in optoelectronics and laser engineering from Heriot Watt University.