Upgrading Victory-class semisubmersibles cost-effective

Now that building a new fifth-generation semisubmersible would cost more than $400 million, the upcoming $250-million upgrade of Victory-class semisubmersible Ocean Endeavor appears a relative bargain.

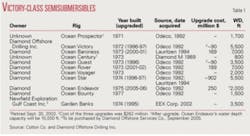

Diamond Offshore Drilling Inc. owns 7 of the 10 ODECO Ocean Victory-class semisubmersibles that were built in the 1970s for the North Sea and has a newly announced contract to buy another (Table 1).

Les Van Dyke, director of investor relations at DODI, told OGJ that the Victory hulls were overbuilt, resulting in “superstrong structures with long fatigue life,” but configured for relatively shallow water. In order to modernize the fleet to serve the deepwater market, the company decided to add new topsides and flotation. Operators want to replace reserves and have the money to drill deepwater prospects, he said.

It would take about $425 million and 36-40 months to build a new fifth-generation semisub, Van Dyke said. But a Victory hull can be upgraded to fifth-generation capability, enabling it to work in 10,000-ft water, for $250 million in less than 2 years. Also, he said that a newbuild would require a projected rate of $240,000/day to justify the investment, but a rig upgrade requires an average rate of return of only $160,000/day.

The time and cost savings have influenced Diamond Offshore’s decisions to upgrade the Victory-class fleet, along with other semisubs such as the Ocean Confidence in 1999, drill ships, and a group of jack up rigs.

Victory rigs

Diamond M Co. owned the Ocean Century semisub and acquired seven others after merging with Ocean Drilling and Exploration Co. (Odeco) in January 1992 in a $372.2-million deal. The Ocean Star was retired in 1992, sold, and then repurchased in 1994 along with the Ocean Baroness from J. Lauritzen AS.

In 1995, Diamond Offshore decided to upgrade three of the Victory hulls to fourth-generation capability. At that time, the upgrades cost about $100 million, while new semisubs cost $250-300 million each.1

The first three rigs to get upgrades were the Ocean Victory (built 1972), the Ocean Quest (built 1973), and the Ocean Star (built 1974), for a total cost of $262 million. The Ocean Quest was configured to drill in 3,500-ft water and was back to work in September 1996. The Ocean Star was upgraded to work in 4,500-ft water with a top drive and completed in March 1997. The Ocean Victory had been stacked in England but was upgraded to work in 5,000-ft water.

In the next phase, the Ocean Baroness and Ocean Rover, both built in 1973, were upgraded at the Keppel FELS Ltd. yard in Singapore. Baroness was upgraded in 2000-01 for $169 million and Ocean Rover in 2001-02 for $189 million.

Diamond Offshore announced retirement of two of its Victory-class semisubs effective Sept. 30, 2003. The Ocean Century and the Ocean Prospector had been cold stacked in the Gulf of Mexico since July 1998 and October 1998, respectively, according to the company’s third-quarter 2003 results, issued Oct. 16, 2003. They were sold in December 2003 and will not return to service as offshore drilling units.

Ocean Prospector is staked at the Newpark Shipbuilding-Pelican Island Inc. yard, Galveston. Newpark has a lien of $316,517 on the Ocean Prospector.

The Ocean Endeavor upgrade, in 2005-06, will cost $250 million, due to inflation, the increased price of steel, and enhanced scope of the work. Diamond Offshore’s Les Van Dyke explained that although the Ocean Endeavor will look similar to the Ocean Rover and Ocean Baroness, it would have larger crew quarters and an increased deck load capacity.

After the Ocean Endeavor is upgraded, the company will have only two Victory-class hulls to upgrade. In April, the Ocean Bounty was working off Australia for Italy’s Eni SPA, and the Ocean Voyager was drilling in the Gulf of Mexico for Walter Oil & Gas Corp.

On Apr. 4, 2005, Larry Dickerson, Diamond Offshore’s president and COO, said, “Our two remaining Victory-class rigs, the Ocean Voyager and Ocean Bounty, are both committed for future mid-water work at dayrates near or above $100,000/unit and not upgrade candidates at this time.”

EEX, Newfield semisub

A tenth Victory-class semisub, the Garden Banks, was owned by EEX Corp., Houston, and is cold-stacked in Galveston, Tex. The rig is a second-generation semisub upgraded in 1995, converted to a floating production facility, and used in the Cooper field, in about 2,250-ft water. The field was decommissioned in 1999 by Cal Dive International Inc. Galveston-based FirstWave/Newpark Shipbuilding, a subsidiary of First Wave Marine Inc., repaired the semisub in 1999 on Pelican Island, Tex.

In 2001-02, Enterprise Oil PLC considered the Garden Banks for use as a floating production system on the Llano field development in the deepwater Gulf of Mexico, but ultimately decided to tie back to the Auger TLP. Royal Dutch/Shell bought Enterprise Oil in 2002 for $6.3 billion.

Newfield Exploration Co. acquired EEX Corp. in late 2002, which included a 60% interest in the Enserch Garden Banks FPS. Newfield’s Steve Campbell told OGJ that ExxonMobil Corp. owns 40% of the semisub and that it has been stacked in Galveston since late 2001.

After trying to sell the “unique asset” for several years, Newfield issued a press release in January 2005 that it was writing off the $35 million book value of the FPS.

On Apr. 4, 2005, Diamond Offshore announced that it had signed an agreement to purchase the rig and related equipment from Newfield Exploration Gulf Coast Inc. and ExxonMobil for $20 million, effective September 2005.

Diamond Offshore’s Dickerson said, “As a Victory-class rig, this unit provides many options, including the potential for a significant future upgrade for ultradeepwater service.”

Ocean Endeavor

The Ocean Endeavor semisub was built in the Transfield yard, Fremantle, Australia, in 1975. Prior to the upcoming reconstruction, the rig could operate in water depths to 2,000 ft and drill to 25,000 ft.

The semisub was loaded onto the open-deck, heavy transport vessel MV Blue Marlin, owned by Dockwise, at the Ingleside yard in Corpus Christi, Tex. Van Dyke told OGJ that the 2-month tow to Singapore began Mar. 28, 2005. The rig will undergo a $250-million renovation at KFELS.

Ocean Endeavor’s water depth capability will be upgraded to 10,000 ft from 2,000 ft. It will have 50,000 sq ft deck space and a variable deck load capacity of more than 6,000 tonnes. The rig will have be able to generate 10,500 kw of power, handle 9,000 bbl of liquid mud, and accommodate 140 people.

Houston-based Hydril Co. LP will provide pressure control systems for the Ocean Endeavor, including a deepwater subsea blowout preventer stack, multiplex blowout preventer control system, and a spare blowout preventer stack (Fig. 3). The $18 million contract was announced on Mar. 29, 2005.

Van Dyke said that the availability of heavy-lift vessels is limited these days. The Blue Marlin has previously transported the Thunder Horse PDQ (production and drilling quarters) platform from South Korea to the Gulf of Mexico, moved the Murphy Medusa Truss Spar from Jebel Ali, UAE, to Mississippi, and moved the semisubmersible production platform Dai Hung I for Russo-Vietnamese joint venture Vietsovpetro in Viet Nam.

Dockwise Shipping BV, based in Breda, the Netherlands, operates a fleet of 15 vessels, including five open-deck, heavy transport vessels and four heavy transport and product carriers used for transporting drilling rigs and offshore platform components.

Demand for floaters

According to the Raymond James & Associates E&P 2004 capital expenditure survey, announced Apr. 4, 2005, operators’ E&D spending grew 35% in 2004. Initial announcements also show a rise in 2005 captial expenditure (CAPEX) budgets, which RJA analysts say will further stimulate the demand for rigs.

Operators need semisubs and ships to drill in deep water, where most of the world’s large new discoveries are being made, but availability on the rig market is already tight.

According to the 2004 report on world petroleum trends published by Epsom, UK-based IHS Energy, a privately held, wholly owned subsidiary of IHS Group, operators reported 46 discoveries of 100 million boe or greater in 2003. Of the major discoveries, 70% were in water deeper than 200 m, and 65% were in water deeper than 1,000 m.

Colton Co. lists 174 semisubs in the world, including 10 cold-stacked. They were built from 1970-2005, and the average year built is 1982 (average age is 23.4 years).2

According to Rigzone, there are 134 semisubmersibles and 32 drillships in the worldwide fleet, with 85% of the semisubs and 82% of the drillships operating worldwide in March 2005. Others are stacked and would require time and money to reactivate.

Based on ODS-Petrodata, Transocean estimates the fleet of floating rigs at 116 units.

Noble converts, buys

In the late1990s, Noble Drilling Corp. converted five submersible rigs to the fourth-generation EVA-4000 deepwater semisubmersible design (Jim Thompson, Amos Runner, Paul Romano, Max Smith, and Paul Woolf).

In early 2002, Noble spent $45 million for two newly built baredeck semisubmersible rigs from Norway’s Ocean Rig ASA. At the time, James C. Day, Noble’s chairman and chief executive, said the company’s focus was on deepwater floating drilling units. The Bingo 9000 Rigs 3 and 4 are still stacked at the Dalian yard in China and scheduled for upgrades.

Noble also bought two semisubs, Transocean 96 and Transocean 97, from Transocean Sedco Forex in 2002, for $31 million, and renamed the rigs Noble Lorris Bouzigard and Noble Therald Martin. The pentagon-shaped deepwater units (IFP Pentagone 85 series) had been upgraded in 1997. Noble spent between $25 million and $35 million each for additional upgrades and reactivated the rigs in 2004.

Noble finished upgrades to the Homer Ferrington (9500 enhanced Pacesetter semisub) in fourth-quarter 2004 and the rig began a long-term contract for ExxonMobil in West Africa in late November.

Noble Drilling now has 11 semisubmersibles. Two of its Friede & Goldman modified 9500 enhanced Pacesetter-class semisubs were undergoing modifications that were suspended in mid-2003. The Noble Clyde Boudreaux (second generation) is in the Signal Shipyard in Pascagoula, Miss., and will begin a 2-year contract for Shell Exploration & Production Co. in third-quarter 2006. Construction resumed after the new contract was announced in December 2004.3 After the upgrade, the semisub will be capable of drilling in 10,000 ft water.

The Noble Dave Beard (fifth generation) is in the Dalian yard, awaiting modifications. The Noble Paul Romano, a fourth-generation EVA-4000 class semisub, is also being upgraded.

In its annual report, released Mar. 8, 2005, Noble said it has “three ultra-deepwater hulls in inventory, ready for upgrade.” Day said, “We will continue to market our three semisubmersible hulls for ultradeep projects starting in 2007 and 2008.”

Transocean reactivates

Houston-based Transocean Inc. has 43 semisubmersibles in its fleet of 93 mobile offshore drilling units, including 5 fifth-generation semisubs, 11 other deepwater semisubs, 4 high-spec semisubs, and 23 other semisubs.

Five Transocean semisubs have been recently activated. According to its fleet status report released Mar. 31, the Sedco 712 semisub, which was built in 1983 and had been stacked in Invergordon, Scotland, since November 2003, was working in the North Sea.

The rig began a 1-year contract with Oilexco Inc. PLC in March for $103,000/day. The previous rate was $47,000/day. When the contract was announced on Oct. 6, 2004, Transocean said the Sedco 712 would require 41⁄2 months of premobilization maintenance and refitting.

A second North Sea semisub, the Sedco 706, built in 1976 and upgraded in 1994, was also back to work in the UK North Sea for Total SA, January-December 2005 at $78,000/day. The previous contract rate was $57,000/day.

Two semisubs were brought back into service in the Gulf of Mexico: Transocean Amirante and Falcon 100.

Transocean Amirante, built in 1978 and upgraded in 1997, is working for Eni SPA, February-August 2005 at $86,800/day. It will then go to work for Remington Oil & Gas Corp. until February 2006 at $102,500/day. It’s previous rate was $50,000/day.

The Falcon 100 semisub 100 is a Friede & Goldman L9000 Pacesetter design built in 1974 and upgraded 1997-99; it can drill in water to 2,400 ft deep. It began a 5-6 month contract with LLOG Exploration Offshore Inc. in February 2005 for $85,000/day, which jumps to $105,000/day in July 2005. Its previous rate was $42,500/day.

At the Howard Weil Energy Conference in New Orleans on Apr. 4, Transocean President and CEO Robert L. Long said there are limited supply additions for the deepwater fleet and newbuild construction costs are a potential impediment in the short-to-medium term.

GSF newbuilds

GlobalSantaFe Corp. took delivery of two new semisubs in first-quarter 2005. The Friede & Goldman ExD design rigs were built at the PPL’s Jurong Shipyard in Singapore. The Development Driller I was accepted on Feb. 23 and will arrive in the Gulf of Mexico in May for a 3-year contract with BP PLC.

GSF accepted the Development Driller II on Mar. 29, and it will begin a $157 million, 2-year contract with BHP Billiton Petroleum (Americas) Inc. in the Gulf of Mexico in July.

The sister rigs are designed with 18,000 sq ft of usable deck space and a variable deck load capacity of more than 7,000 tonnes. Upstream Online estimated the cost of the Development Drillers at $285 million each.

GlobalSantaFe now has 13 semisubs, one of which was in a Congo yard in March. The GSF Aleutian Key is a third-generation Friede & Goldman 9500 enhanced Pacesetter rig currently off Gabon for PanOcean Energy Corp. Ltd.

Dolphin Drilling

Dolphin Drilling Ltd., a subsidiary of Fred. Olsen Energy ASA, in Oslo, has seven semisubmersible drilling units.

The Borgsten Dolphin semisub was undergoing class renewal service at the Harland & Wolff yard in Belfast in March. It will begin work under an $18-million contract with ChevronTexaco North Sea Ltd. in the UK North Sea in May.

The rig was formerly called the Haakon Magnus and was drilling at Ekofisk in 1980 before it was renamed.

Future

There seems to be a strong market for semisubmersible upgrades that utilize a proven design and a proven project team because of the cost and time advantage of upgrades and conversions over building new units. It is unlikely that we’ll see companies building many new semisubmersibles on spec, as Global-SantaFe has done with the two Development Drillers, until existing hulls have been upgraded. The sixth generation newbuild announced on Apr. 15 is probably an anomaly. More likely, we’ll see additional conversions, some on spec, some secured by contracts such as the Noble Clyde Boudreaux.

We can probably also expect that some of the semisubs currently cold-stacked will never work again, although they may linger on the books without being formally retired. According to Rigzone, there were 16 semisubs cold-stacked around the world in early April, including 5 in the North Sea, 4 in the Gulf of Mexico, and 3 in the Caspian Sea.

A notable exception is the Garden Banks, soon to be purchased by Diamond Offshore and undoubtedly a candidate for the Victory-class upgrade program. ✦

References

1. Go Gulf Magazine, 1998 or 1999, pp. 32-35, www.gogulf.net/Back- Issues/PDF’s%20for%20Website/DiamondOffshore.pdf

2. www.coltoncompany.com/shipbldg/worldsbldg/rigbldg/semisubmersibles.htm

3. Noble contracts, www.pipeline- dubai.com/press/2004/pr_04_1079.htm