Quick Takes

null

Bush seeks refineries on old military bases

US President George W. Bush suggested building refineries on closed military bases and, in a speech to the National Small Business Conference Apr. 27 in Washington, DC, he called for government agencies to simplify the permitting process for such construction.

Other sources said the US Department of Energy is being ordered to step up discussions with communities near closed military bases to try to get refineries built.

Bush noted: “There have been no new oil refineries built in the US since 1976. And existing refineries are running at nearly full capacity. Our demand for gasoline grows, which means we’re relying more on foreign imports of refined product.”

To encourage expansion of existing refineries, Bush said the Environmental Protection Agency is simplifying its rules and regulations.

The American Petroleum Institute also endorsed Bush’s proposal to increase US refining capacity and imports of LNG.

“It should be remembered that there are numerous and time-consuming requirements that must be met at all phases of the permitting and construction processes for refinery and LNG facilities,” said Red Cavaney, API president. “Nevertheless, both of these proposals should be given serious consideration....”

Bush said his administration would continue to encourage oil-producing countries to maximize their production and get excess capacity on the market, “so you do not destroy the consumers that you rely upon to buy your energy,’” he said.

The president also called on federal agencies to expedite reviews of the 32 proposed LNG receiving terminals in the US, and he reiterated his support for oil and natural gas exploration in the Arctic National Wildlife Refuge of Alaska. Modern drilling technology, he said, makes it possible to drill on just 2,000 acres of the 19 million acres in the reserve, “with almost no impact on land or local wildlife. Developing this tiny section of ANWR could eventually yield up to a million barrels per day of oil. That’s a million barrels less that we’ve depended on from foreign sources of energy.”

Bush also favors construction of nuclear power plants in the US.

He said he has asked DOE “to work on changes to existing law that will reduce uncertainty in the nuclear plant licensing process and also provide federal risk insurance that will protect those building the first four new nuclear plants against delays that are beyond their control.”

Noting that the US has the sixth-largest reserves of natural gas in the world, Bush promised, “We’ll do more to develop this vital resource. That’s why I signed into law a tax credit to encourage a new pipeline to bring Alaskan natural gas to the rest of the US.”

US senators question ChevronTexaco-Unocal merger

A group of 10 US senators, led by Charles Schumer, D-NY, asked the US Federal Trade Commission to examine how ChevronTexaco Corp.’s proposed $18 billion acquisition of Unocal Corp. might affect gasoline prices.

ChevronTexaco plans to acquire Unocal in a stock and cash transaction (OGJ Online, Apr. 4, 2005). The proposed acquisition represents the largest union of US oil and gas companies since Conoco Inc. merged with Phillips Petroleum Co. in a $15 billion transaction (OGJ Online, Aug. 30, 2002).

Schumer called on FTC Apr. 18 to block the pending merger and to review previous mergers involving US-based oil majors to assess their impact on gasoline prices and retail competition.

In the FTC letter, the senators said they were concerned about what they called a “dangerous level of concentration in the oil industry.” They said, “This consolidation has already drastically undermined competition, leaving American consumers vulnerable to repeated and sustained spikes in the price of oil.”

Prudential Equity Group LLC analyst Andrew F. Rosenfeld of New York said, “We don’t believe that concerted efforts by any one senator or group of senators is likely to successfully influence the FTC in these cases.”

Individually, Schumer called on President George W. Bush to initiate a crude oil swap with companies from the Strategic Petroleum Reserve similar to former President Bill Clinton’s release of 30 million bbl.

The latest proposal is for the release of 60 million bbl that Schumer believes would lower gasoline prices.

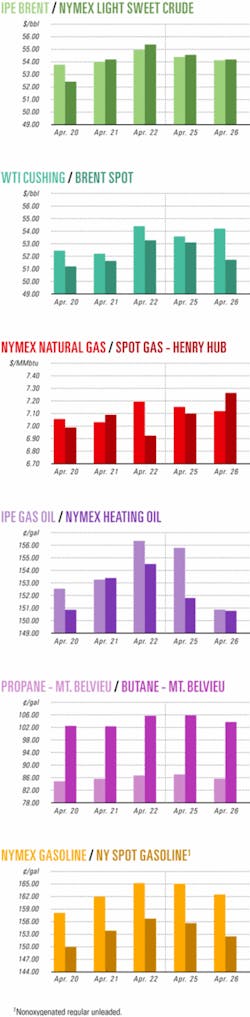

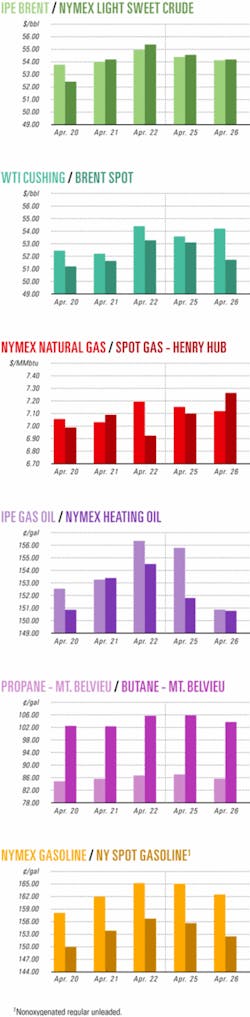

Industry Scoreboard

null

null

null

EIA allows daily gas storage revisions

The US Energy Information Administration announced a policy that provides for daily regional or national revisions of 10 bcf or more to the natural gas inventory data it publishes on Thursdays in its Weekly Natural Gas Storage Report.

On weekdays starting May 19, EIA will revise the preceding Thursday’s data if necessary at 2 p.m. EDT.

Design starts for coal gasification plant

ConocoPhillips and Fluor Corp., under an alliance agreement, are performing the front-end engineering design (FEED) of a coal gasification process for the Southern Illinois Clean Energy Center (SICEC) to be located at a coal mine in Williamson County, Ill. The SICEC project will be designed to process Illinois coal into 95 MMcfd of pipeline quality gas and generate 600 Mw of electricity.

The facility will use ConocoPhillips’s proprietary E-Gas Technology, which incorporates a gasification system design that can be applied in conjunction with gas turbine and steam power generation in an integrated gasification-combined cycle configuration to produce electric power, synthesis gas, hydrogen, and steam. The FEED package design will use Siemens SGT6-5000F combustion turbines for the facility.

Key funding for the project was provided by the Illinois Department of Commerce and Economic Opportunity and the Illinois Clean Coal Review Board.

Syntroleum, Dorset set stranded-gas venture

Syntroleum Corp., Tulsa, has created a stranded-gas venture to strengthen its ability to participate in gas-to-liquids and other gas monetization technologies.

It has entered an agreement with UK firm Dorset Group Corp., which will finance the venture with an initial $40 million.

Syntroleum may use these funds to cover the costs of evaluation and acquisition of rights to stranded gas and liquids reserves, such as its Aje project on the OML 113 permit off Nigeria near the Benin border for which Nigeria has approved the assignment of interest (OGJ Online, Apr. 14, 2005).

The approval allows the drilling of the first appraisal well on the Aje structure, to be spud in August or September.

Syntroleum will pay 10% of the cost to drill, log, and test the first two wells to earn a 32.5% cost-bearing interest in the project.

The remaining Dorset funds will be used for analyses, oil and gas project development, and acquisition of interests in oil and gas properties, including GTL projects. ✦

Exploration & Development - Quick Takes

Wintershall, Gazprom to develop Siberian field

Russia natural gas giant OAO Gazprom and Wintershall AG of Germany agreed to jointly develop Yuzhno-Russkoye gas field in western Siberia. They expect production to start in 2008.

Yuzhno-Russkoye, in the Yamal-Nenets autonomous area, has estimated reserves of 700 bcf of gas.

In 1990, Wintershall and Gazprom created a gas marketing joint venture, Wingas GMBH, that provides Gazprom direct access to the German gas market.

Now, Gazprom plans to increase its interest in Wingas to 50% minus one share from its previously held 35%. Wintershall is getting 50% minus one share in Severneftegazprom, a Gazprom subsidiary and Yuzkhno-Russkoye license holder.

Gazprom said it would join BASF AG, Wintershall’s parent, in the North European Pipeline project to build a gas pipeline through the Baltic Sea to link Germany with Russia.

Anadarko hits Miocene oil in Gulf of Mexico

Anadarko Petroleum Corp. made a deepwater discovery on its 100%-held Green Canyon Block 652 in the Gulf of Mexico.

The Genghis Khan well, drilled to 26,000 ft TD in 4,300 ft of water, tested 110 ft of high-quality net oil pay in the Lower Miocene and additional pay in the Middle Miocene.

Production is slated for 2006 via a subsea tieback to the Marco Polo platform, 2.4 miles away.

Anadarko plans to drill six more exploration wells this year in the gulf.

PTTEP has two discoveries in Oman

Thailand’s PTT Exploration & Production PLC (PTTEP) reported oil and gas discoveries at two exploratory wells drilled on its onshore Block 44 in Oman.

Shams-3, in the northern sector of a tract in the potentially gas-bearing area of the structure, was drilled to 3,400 m TD and gauged 17 MMcfd of natural gas and 2,170 b/d of condensate from a reservoir 14 m thick.

Munhamir-1, drilled to 2,845 m TD over the block’s southern area in the oil-prospective structure, flowed on test 2,367 b/d of crude oil and 900 Mcfd of natural gas in a reservoir with a total thickness of 17 m.

PTTEP executives said the Shams-3 discovery enhances the production viability of Shams gas field, which is scheduled to start production at an initial rate of 50 MMcfd in the fourth quarter (OGJ Online, Mar. 1, 2005). Shams gas will be sold to Oman’s Ministry of Oil and Gas.

PTTEP is evaluating Munhamir-1 for possible development.

Aramco Du’ayban well finds light oil

Saudi Aramco on Apr. 11 discovered light oil with its Du’ayban-1 well in the Central Region about 125 km southeast of Riyadh, reported Minister of Petroleum and Mineral Resources Ali I. al-Naimi in Riyadh Apr. 18. Du’ayban field is just east of Saudi Aramco’s Abu Rakiz oil and gas field discovered in 1995.

The 41° gravity Du’ayban oil, found at 10,260 ft, is free of sulfur, al-Naimi said. He said the well is expected to produce 3,300 b/d of oil and 3 MMcfd of natural gas.

Woodside lets contract for subsea systems

Woodside Energy Ltd. has let a $44 million contract to FMC Technologies Inc. for subsea production systems for the Perseus-over-Goodwyn (PoG) project, 81 miles offWestern Australia in 426 ft of water.

The contract includes the supply of four subsea trees, production controls, and associated equipment.

PoG is part of the North West ShelfVenture, owned equally (16.67%) by Woodside Energy Ltd., BHP Billiton (North West Shelf) Pty. Ltd., BP Developments Australia Pty. Ltd., Chevron Texaco Australia Pty. Ltd., Japan Australia LNG (MIMI) Pty. Ltd., and Shell Development (Australia) Pty. Ltd. ✦

Drilling & Production - Quick Takes

BP drills first pentalateral well in Alaska

BP Exploration (Alaska) Inc. has drilled the first pentalateral well at Orion, a satellite oil field in the western Prudhoe Bay area on Alaska’s North Slope.

Well S-213a is currently on stream, flowing at a rate of 3,000-3,500 bo/d.

The five laterals encountered five different zones in the Schrader Bluff reservoir, which covers more than 32,000 acres and is thought to have held more than 2 billion bbl of OOIP (OGJ, Aug. 6, 2001, p. 36).

Multilaterals penetrate more than 26,000 ft of pay compared with earlier vertical wells that penetrated a maximum of 400 ft of pay, BP said. Gravities at the deeper-pay Schrader Bluff are about 18-22°, a bit lighter than those in shallower-pay areas, about 16-17°.

Contract let for Agbami field subsea trees

ChevronTexaco Corp. affiliate Star Deep Water Petroleum Ltd. has let a $276 million contract to FMC Technologies Inc. for subsea systems for Agbami oil field, 70 miles off Nigeria in 4,200-5,400 ft of water in the central Niger Delta area.

FMC will supply 22 subsea trees and associated structures, manifolds and production control systems starting in the third quarter of 2006.

Star Deep Water Petroleum operates the field, which spans OMLs 127 and 128 (OGJ Online, Apr. 11, 2005).

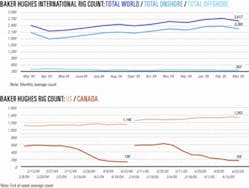

North America rig numbers drop slightly

Total drilling activity in North America dropped slightly but remained high the week ended Apr. 22, with 1,502 rotary rigs working, reported Baker Hughes Inc., Houston. That represents 226 more rigs working than at the same time last year and 6 less than April 15.

The number of rotary rigs working in US waters decreased by 10 rigs to 114 from 124, while onshore activity increased by 5 rigs to 1,229 working. Texas gained 8 additional rigs working and New Mexico, 3.

Canada had 159 rigs working that week, down 1 from 160 the previous week. ✦

Processing - Quick Takes

US House okays energy bill with MTBE measures

The US House of Representatives on Apr. 21 passed an energy bill that aims to encourage domestic oil and gas exploration by authorizing leasing in the Arctic National Wildlife Refuge Coastal Plain and streamlining federal permitting. The vote was 249-183.

The bill also contains the provision that stymied similar legislation last year when it went to conference with the Senate: defective-product liability protection for refiners that added methyl tertiary butyl ether and other oxygenates to gasoline.

House Minority Leader Nancy Pelosi (D-Calif.) called it “the disgraceful MTBE giveaway.” American Petroleum Institute Pres. Red Cavaney termed it “one of the most misunderstood, and misrepresented, issues” in the bill.

“What’s misunderstood is that the provision is very, very narrow,” he told reporters prior to the bill’s passage. “It protects companies from being sued simply for using MTBE. It does not protect them from liability for negligence.”

Cavaney said that he does not expect the Senate to address the issue in its energy bill, which will again require it to be resolved in conference. But he hopes that more Senate conference members will be more open to the idea than they were in 2004.

“We’ve personally visited over 40 senators and provided data on the issue,” he said. “We’ve encouraged them to have their staff members review government data, and several say they have changed their outlook as a result.”

Citgo boosts Louisiana refinery capacity

Citgo Petroleum Corp., Houston, has completed a crude vacuum expansion project at its Lake Charles, La., refinery, increasing the facility’s crude oil processing capacity to 425,000-440,000 b/d from 325,000 b/d. The additional capacity makes the complex the fourth largest refinery in the US, Citgo said.

The $293 million project involved installation of a crude vacuum distillation tower-the largest in the world set in one piece (see photo, OGJ, Apr. 26, 2004, p. 26). Citgo is owned by PDV America Inc., an indirect subsidiary of Venezuela’s national oil company Petróleos de Venezuela SA.

BP to add hydrotreater at Whiting refinery

BP PLC plans to invest more than $130 million to add a 36,000 b/d distillate hydrotreater at its 399,000 b/cd refinery in Whiting, Ind.

BP has begun preliminary work on the project and expects to complete construction in mid-2006. The unit will be used for production of ultralow-sulfur diesel.

Premcor refinery due new hydrogen plant

Air Products & Chemicals Inc. has signed a letter of intent to build a plant in Port Arthur, Tex., to supply 110 MMscfd of hydrogen to the Premcor Refining Group Inc.’s 237,500 b/cd refinery and other customers on Air Products’s Gulf Coast hydrogen pipeline system.

Also, Air Products will produce 100 Mw of power for its and Premcor’s use and 1.2 million lb/day of steam for Premcor’s operation.

Air Products will own and operate the plant, which is expected on stream in June 2006. ✦

Transportation - Quick Takes

Russia to lay segment of Siberian oil line

Russia’s Industry and Energy Ministry has announced it will construct an oil pipeline from Tayshet in central Siberia to Skovorodino in the Amur region, about 70 km from the Chinese border.

Officials did not announce a construction starting date but said the pipeline could become the first leg of a line to Perevoznaya on the Sea of Japan, assuming enough oil is discovered to fill it (OGJ Online, Jan. 17, 2005).

Anatoly Yanovskiy, director of the ministry’s fuel and energy department, announced the decision.

“Construction of the first stage of the pipeline is due to be finished by the middle of 2008,”Yanovskiy said during talks Apr. 27 at the Natural Resources Ministry.

Yanovskiy said construction on to Perevoznaya would depend on the results of geological studies. The proposed 4,180 km oil pipeline from eastern Siberia to the Pacific Ocean might stop at Skovordino if oil exploration results are disappointing, he said.

The decision follows an Apr. 22 announcement by Japan’s Minister for Economy, Trade, and Industry Shoichi Nakagawa who threatened to withdraw financial backing for the longer pipeline after learning a spur to China might be completed first (OGJ Online, Apr. 22, 2005).

Moscow had assured Tokyo at yearend 2004 that it would construct an oil pipeline to Nakhodka near Perevoznaya. That longer, more costly line would enable Russian oil to reach a broader Asia-Pacific market than an earlier route promoted by the Chinese government that would terminate at Daqing, in northeast China.

Hazira LNG terminal begins operations

Shell Gas & Power reported the start-up of the Hazira LNG receiving terminal, near Surat in Gujarat, India.

The Hazira terminal received its first cargo, via Shell’s time-chartered Gemmata 135,000 cu m LNG carrier, on Apr. 17 from the North West Shelf liquefaction plant in Australia.

The $600 million facility has a capacity of 2.5 million tonnes/year of LNG that can be expanded to 10 million tonnes/year.

Shell has a 74% stake in Hazira, and Total SA has 26%.

Statoil starts laying Snøhvit line

Statoil ASA has begun to lay a pipeline that will carry natural gas from its Snøhvit field in the Barents Sea to the Hammerfest LNG plant on Melkøya island in northern Norway.

The Solitaire lay barge began laying the 143-km pipeline from the west of Melkøya and will continue toward Snøhvit.

Pipelaying of the main section is to be complete at the end of May.

Corpus Christi LNG plans construction start

Corpus Christi LNG LP, a wholly owned subsidiary of Cheniere Energy Co. Inc., Houston, plans to begin construction later this year on its planned 2.6 bcfed LNG receiving terminal near Corpus Christi, Tex.

Cheniere received US Federal Energy Regulatory Commission approval in April to construct the terminal and has scheduled commercial operations to begin in late 2008.

The facility will have regasification facilities, two docks capable of handling LNG carriers as large as 250,000 cu m, and three storage tanks with an aggregate LNG storage capacity of 10.1 bcfe.

Gulf LNG lets LNG terminal FEED contract

Gulf LNG Energy LLC, Houston, has let a contract to Technip for front-end engineering and design of a 1.5 bcfd LNG import terminal to be built in the Port of Pascagoula, Miss.

The planned terminal will handle 250,000 cu m tankers and will have two 160,000 cu m full-containment storage tanks.

FERC has approved the $450 million terminal, for which construction will begin in 2006 and is expected to be complete in mid-2009.

The Pascagoula site, east of the Henry Hub, has direct access to four major gas pipelines serving the Northeast and three gas pipelines serving Florida and the Southeast.

Angola LNG group lets FEED contract

The Angola LNG project consortium, after recently signing natural gas supply agreements, has awarded front-end engineering and design contracts for a 5 million-tonne/year gas liquefaction plant to be built near Soyo in northern Angola, reported ChevronTexaco Corp.

The contracts were awarded to Overseas Bechtel Inc. and a group consisting of Kellogg Brown & Root Inc., Houston; JGC Corp., Yokohama; and Technip USA Corp.

Work is to begin immediately on the 15-month program, after which a final investment decision will be made.

Angola LNG is a joint development of state-owned Sonangol EP (22.8%) and local affiliates of ChevronTexaco (36.4%) and ExxonMobil Corp., Total AS, and BP PLC (13.6% each).

CNOOC Fujian lets contract for LNG tanks

CNOOC Fujian LNG Co. Ltd. has awarded a $100 million contract to Chicago Bridge & Iron Co. (CB&I), The Woodlands, Tex., for the design and construction of two 160,000 cu m full-containment LNG storage tanks at China’s second major LNG import and regasification terminal, which will be built at Xiuyu, in southeast China’s Fujian Province. CB&I is working with Chinese design institute Chengda Engineering Corp. and other strategic local partners on the project.

The terminal is scheduled for completion in late 2007 (OGJ, June 14, 1004, p. 58).

The terminal will have a 2.6 million tonne/year capacity that will be expanded under Phase II.

CNOOC Fujian is a joint venture of China National Offshore Oil Corp. and Fujian Investment & Development Corp.

Chinese annual gas demand is forecast to reach 160-210 billion cu m by 2010, of which 39% would be LNG. State-owned companies are considering at least eight other LNG terminals, and the government is expected to accelerate the approval process for them.

Air Products to supply Grain LNG nitrogen

Grain LNG Ltd. awarded a contract to Air Product PLC to supply nitrogen to the LNG receiving terminal under construction on the Isle of Grain’s Medway River near Kent, UK.

Grain LNG, a subsidiary of National Grid Transco, has scheduled the terminal for commissioning this year, with commercial operations expected shortly thereafter. The terminal will have 3.3 million tonnes/year of LNG capacity, which is to be increased to 9.8 million tonnes/year during 2008 (OGJ, June 14, 2004, p. 58).

Under the two-phase contract, Air Products will install a liquid nitrogen storage and delivery system followed by construction and operation of a nitrogen plant slated to come on stream later this year.

The nitrogen plant will produce more than 300 tonnes/day, Air Products said. Receiving terminal operators inject nitrogen into natural gas to dilute the heating value when the gas is too rich for pipeline specifications (OGJ, June 14, 2004, p. 69). ✦

CORRECTION

The article “US Senate offshore leasing foes reaffirm opposition” inaccurately stated that Sen. Jon Corzine (D-NJ) might be interested in a federal evaluation of New Jersey’s potential offshore resources (OGJ, Apr. 25, 2005, p. 46). Corzine opposes oil and gas exploration and production off New Jersey and has cosponsored a bill to permanently ban drilling off all North and Mid-Atlantic states.