Cold weather, petchem demand push up C3 prices

Propane and crude prices increased in first-quarter 2005, a trend that could continue into the summer.

Spot prices strengthened at the end of the first quarter, averaging 85-87¢/gal at Conway, Kan., and Mont Belvieu, Tex. West Texas Intermediate (WTI) crude prices also rose, pushing past $57/bbl on Apr. 1.

Propane stocks decreased to less than 28 million bbl at the end of the quarter, but were still well above average levels. Petrochemical demand softened near the end of the quarter but still averaged a strong 390,000 b/d.

Extraction rates were above normal at 529,000 b/d. April natural gas bid week cash prices averaged $6.78/MMbtu on the Texas Gulf Coast and $6.85/MMbtu in the US Midcontinent. Refinery production continued at below normal rates of only 328,000 b/d. Imports were an exceptionally strong 206,000 b/d in the first quarter.

Pricing

The expected higher prices in the first quarter did materialize; however, we underestimated the surge of speculative cash that flowed into energy markets this early in the cycle. Typically, spring rallies occur in April-June and are usually caused by anticipated motor gasoline demand for the summer driving season.

The consequence has been record price levels for most energy products over the last 2 weeks of the first quarter. Propane was not one of those even though prices rose to the mid-90¢/gal range in mid-March.

Mont Belvieu and Conway prices will average 87-88¢/gal and 85-86¢/gal in March, respectively (Fig. 1). The price rally may not be over, however. While the market digests the initial shock of higher crude prices, downstream demand and prices remain high.

Implied motor gasoline demand in the US continues at more than 9 million b/d, which could mean market tightness in early summer. This helps to set a floor for WTI prices, which then keep propane prices from falling as seasonal demand diminishes.

Propane prices will soften to the low-80¢/gal range in April-May, bottom out in June-July in the high 70¢/gal then head upward again in late summer. The unpredictable factors are the combined actions of unregulated hedge and bank funds and their “herd effect” buying and selling that pushes the markets to extremes beyond what the fundamentals would justify. Despite this, fundamental factors support strong prices and, as long as the economy continues to grow, price declines will remain short lived.

Propane prices will remain undervalued relative to WTI through the summer then accelerate to normal to above-normal ratios by yearend. This would push propane prices to the low to mid-90¢/gal range at Mont Belvieu and Conway.

The propane- to-Nymex natural gas price ratio increased dramatically at the end of the first quarter-to 1.85:1 on a $/MMbtu basis. The ratio should be 1.5-1.8 through the end of 2005; the lower ratios will occur near yearend when natural gas prices rise with the onset of winter.

Propane continues to be undervalued relative to No. 2 heating oil with a ratio about 0.95:1 on a ¢/btu basis, which should continue until the fall. The propane-to-WTI ratio of 66% is also less than the historical average of 75% (spot C3 cash prices vs. crude futures); this undervaluation should continue until fourth-quarter 2005.

Propane supply

Gas processing plants extracted propane at 529,000 b/d in first-quarter 2005, according to the US Department of Energy’s Energy Information Administration.1 This was about 10,000 b/d above average and was expected due to the strong processing margins during the quarter (Fig. 2).

Processing margins averaged 10-12¢/gal in April because higher natural gas prices squeezed margins. Lower natural gas prices this summer and higher crude prices will push processing margins to 15-20¢/gal through the fall.

Strong crude prices will keep NGL prices above average regardless of what natural gas prices do; this will set a floor for US Gulf Coast and Midcontinent margins.

In April 2005, bid-week cash natural gas prices averaged $6.78 and $6.85/MMbtu for the Texas Gulf Coast and Anadarko Basin, respectively. Market fundamentals do not support this price level-working gas in storage is still well above the 5-year average-but the market appears willing to pay a premium based upon strong crude oil prices.

Propane extraction will average 525-540,000 b/d through yearend. The latest natural gas build of 10 bcf left working gas in storage of 1.249 Tcf, which is 227 bcf above the 5-year average as of April.

First-quarter refinery production averaged just 328,000 b/d, which was 15-20,000 b/d below average. Production will improve in the second quarter but still remain below normal at 345,000 b/d.

Imports were a strong 210,000 b/d during the first quarter, but will decline dramatically to less than 150,000 b/d in the second quarter.

Marine propane imports, exports

Waterborne imports were less than expected at the end of the first quarter; just 1.2 million bbl of propane was discharged at US ports.2 Some scheduled cargoes did not arrive or were diverted. The normal level of about 60-65% of the cargoes came from Algeria and the North Sea. Slightly more than 60% of the cargoes were scheduled for the US East Coast with the rest headed for the US Gulf and Puerto Rico.

Spot price netbacks for the Western Mediterranean were $5 and $23/tonne into the US Gulf Coast and East Coast, respectively. Netbacks for the Atlantic North Sea were much less, at -$1 to $8/tonne to the same two locations.

Given these pricing conditions, it is unlikely that spot cargoes will move into US Gulf Coast in the second quarter. The US East Coast is a more likely destination for spot and contract cargoes. April scheduled cargoes of just 670,000 bbl are all scheduled for the US East Coast.

Waterborne exports continued to be insignificant at less than 10,000 b/d in the first quarter. The second quarter should see similar rates. Total exports should average less than 30,000 b/d.

Petrochemical demand

Cracking economics worsened considerably at the end of the first quarter due to the increase in crude and NGL prices. Cash margins were 3-11¢/lb of ethylene produced; the heavier feedstocks were at the lower end of this range. Despite the decline in cash margins, overall margins were strong due to price increases during the past several months.

There is a growing resistance to higher feedstock prices-operating rates slipped to less than 90% for the first time since September 2004.

Unadjusted feedstock demand was 1.84 million b/d.3 Propane demand, although lower at the end of the quarter, was still strong at 390,000 b/d. Higher feedstock costs should continue, although prices should decline from the March peaks.

The combination of lower feedstock prices and operating rates may force ethylene producers to cut prices to keep downstream volumes strong. The big question is whether polymer producers can continue to pass along their higher costs.

Demand in the second quarter will decline slightly, and the third quarter will be about the same. The fourth quarter should be stronger; demand will average 350-360,000 b/d for 2005.

US propane inventories

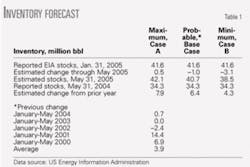

US inventories fell to less than 28 million bbl at the end of the first quarter, which is still above normal, according to EIA.1

Inventories could peak well above normal at 69 million bbl due to continued strong gas processing margins and increased imports that will enhance supplies. This build will occur despite strong petrochemical demand, which will continue to be a factor, but not a major factor, toward yearend (Table 1).

Regional inventories

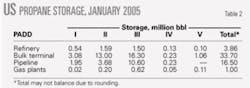

Table 2 shows propane storage at the end of February 2005.

PADD I stocks fell to 2.7 million bbl at the end of the first quarter, slightly less than the 5-year average of 2.9 million bbl. Waterborne imports will be the primary means for the US East Coast to keep stocks above normal. This is especially important for the US Northeast, which experienced severe winter storms. Newly scheduled waterborne cargoes should keep the region well supplied and at a normal stock build rate through the summer.

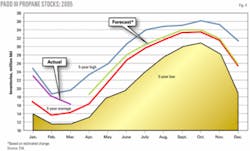

PADD II stocks were at normal levels and ended the first quarter at 9.2 million bbl, which was slightly above the 5-year average for the region (Fig. 3). Imports from Canada kept US Midcontinent inventories from falling below normal during the winter. Low stocks were a concern last fall in the Midcontinent, but that was alleviated by Canadian imports. Because processing margins will be strong, stocks will grow at normal rates with a peak of nearly 25 million bbl.

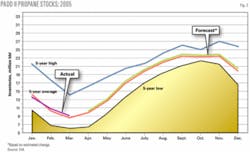

PADD III stocks ended the first quarter at just more than 15 million bbl but were still nearly 1 million bbl above normal even though strong petrochemical demand continued through the winter (Fig. 4). Inventory increases should be more robust; stocks will grow at above-normal rates due to strong gas processing margins and a moderation in petrochemical demand. Stocks will peak at 34 million bbl in late September or early October 2005.

Canadian inventories

Stocks fell to 2.3 million bbl at the end of the first quarter, which was below normal.4 The decrease, which was unusual for March, occurred due to lingering cold weather. When temperatures return to more normal levels, inventories should begin to build and actually accelerate as the summer approaches. Extraction rates will continue at normal to above-normal rates due to strong processing margins that should increase supplies. ✦

References

1. “Petroleum Supply Monthly,” US Energy Information Administration, Washington, DC, March 2005.

2. “Waterborne LPG Report,” Commercial Services Inc., Mar. 17, 2005.

3. “Hodson Report,” Jacobs Consultancy, March 2005.

4. “LPG Underground Inventories in Canada,” National Energy Board, March 2005.

The author

Michael Horvath Jr. (mhorvath @propaneletter.com) is president of M. Horvath & Associates, Houston, and author of The Propane Market Strategy Letter. He served as director of business development at Tauber Oil Co. until retiring in early 2004. Horvath has more than 35 years’ experience in the NGL, petrochemical, and consulting businesses. He holds a BS (1972) in chemistry and mathematics from the University of Houston and has taken postgraduate courses in business law and economics. Horvath is a member and past chairman of the Houston Chapter of the Gas Processors Association and the Gas Processors Suppliers Association.