Market for intelligent wells may triple in next 5 years

The market for intelligent well completions may grow to $600 million in 2010 from the estimated $200 million in 2005, according to Kevin Wood, Susquehanna Financial Group (SFG) oil field services analyst.

This technology helps enable operating companies to develop fields by providing them with a means to control and monitor, remotely from the surface, the flow to and from multiple reservoirs within a single well.

The market

Wood estimates that 60-70% of the intelligent well completion systems installed are in high-cost critical wells with high intervention costs. Deepwater offshore wells account for most critical well applications. The remaining 30-40% of intelligent well systems are in mature oil fields for the purpose of increasing ultimate hydrocarbon recovery or accelerating production, according to Wood.

He further adds that although most intelligent well completions are in offshore wells, service providers have begun installing systems on land.

Wood says the North Sea has experienced the largest market penetration (40-60% of the installed systems) but significant opportunity exists in the Gulf of Mexico, where the rate of adoption has been slower.

Wood estimates that in the last 5 years the intelligent well market has seen a 27% compound annual growth rate and attributes the growth to two trends:

1. A shift to longer-term multiwell (10-50 wells) contracts with deliveries out to 2010, in certain cases.

2. Greater demand for intelligent completions from independent oil and gas producers, who have been late adopters of this new technology.

Main providers

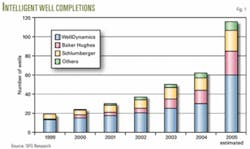

He estimates that WellDynamics Inc., a Halliburton Co. 51% joint venture with the Royal Dutch/Shell Group, has a 50% share of the intelligent well market (Fig. 1). Its main competitors are Baker Hughes Inc. and Schlumberger Ltd., each with an estimated 20-25% market share.

WellDynamics plans to install intelligent systems in 60 wells in 2005, twice the number of installations it completed in 2004, according to Wood. He adds that in 2004 WellDynamics introduced an intelligent well completion system for land injection wells. ✦