New method determines

A refinement of a “simplified” market approach for comparing refinery values using replacement cost new (RCN) and a combination of capacity and complexity has been developed.

The simplified market approach typically uses two ratios to compare refinery sales values. One ratio divides refinery sales price by RCN. This ratio represents the refinery value as a fraction of the cost to replace it-it is a refinery’s “percent good” or undepreciated value.

The second ratio divides refinery sales price by the product of refinery capacity and complexity (complexity-barrel). Refinery value is expressed in dollars/complexity-barrel.

The simplified market approach for valuing refineries should be used as a sanity check when valuing refineries for acquisition, property tax, and federal tax purposes. Neither of these ratios account for differences such as location, time, or different market conditions.

There are at least four reasons why these variables can be used as approximate indicators of a refinery’s value:

• Refineries are relatively old. No new refineries have been built in more than 25 years in the US. Most of the refineries are maintained to a level that they are not deteriorating. Sustaining capital is invested continuously to maintain refineries.

• Refineries must be upgraded to remain competitive. They generally contain upgraded equipment and technology, at least to the level of the refineries that they compete against.

• Markets for petroleum products and crude are cyclical. Margins fluctuate from very positive to negative, but profit expectations do not materially change over time.

• Refineries that do not upgrade or invest sustaining capital at a competitive rate or are too small to compete, are shut down and leave the market. These refineries do not enter the sales database.

This article illustrates how ratios using capacity, complexity, and RCN are used in refinery valuations.

Assume that a refinery has a replacement cost of $820 million, a capacity of 70,000 b/d, and a complexity of 8.5.

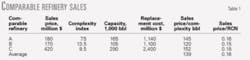

Table 1 shows comparable refinery sales data.

The averages for the two ratios were then applied to the subject refinery parameters to yield value estimates.

The indicated value of the subject refinery using the average of the complexity-barrel ratio was $139/complexity bbl * 8.5 complexity * 70,000 b/d capacity = $82.7 million.

The indicated value of the subject refinery using the RCN ratio was 0.16 price/RCN * $820 million RCN = $131.2 million.

There was a large difference between the value indicated by using the RCN ratio and the value indicated by using the complexity-barrel ratio.

The ratios assume that refinery values were proportional to the RCN and to the complexity-barrel measurements. This simplified approach neglects the possibility that there is an “offset” associated with the value of RCN and complexity-barrel when related to refinery value; each variable can also have a non-unit exponent.

Both of these assumptions were tested and a method for utilizing these measurements in a simplified market approach to refinery value estimation was developed.

Analysis

We analyzed data for refinery sales between 1995 through 2003 to see how the two measurements correlated with the refineries’ sales prices and with each other. Refinery capacities, complexity indices, and RCN were tabulated along with the corresponding sales prices.

Typically, the product of complexity and capacity was used as if each component had the same exponent (i.e., 1). RCN was also assumed to have an exponent of 1 in the expression explaining refinery value.

A test of this assumption showed that it is not generally accurate. A statistical analyses performed on the data assumed that refinery complexity and refinery capacity were correlated with the refinery value as indicated by sale price.

A natural log function was used as the model for determining an equation using complexity and refinery capacity. The coefficients associated with the natural log of complexity and the natural log of capacity were the exponents associated with each variable. For example, the form of the regression equation is Equation 1 (see equation box).

Equation 2 is the resulting equation for estimating the value of a refinery from refinery capacity and complexity.

Capacity was in bbl/day, replacement cost was in dollars, and sales price was in dollars for the regressions.

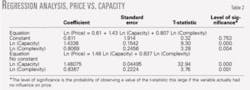

Table 2 shows the regression results.

A refinery’s indicated value is a function of complexity raised to the 0.807 power times the capacity raised to the 1.43 power. These exponents were not equal. There is a constant term of 0.61 associated with the correlation.

The t-statistics associated with the equation coefficients showed that the constant term was not statistically different from zero; therefore, a second regression was run without a constant term (Table 2).

The coefficients changed only slightly to 0.837 for the complexity variable, and to 1.48 for the capacity variable.

Using the equation without the constant term, an indicated value of $88.9 million was calculated for the example refinery. This contrasted with the $82.7 million that resulted using the simple approach.

The regression equation model used to establish a relationship between sales price and RCN is Equation 3.

The resulting equation for estimating the value of a refinery from RCN is Equation 4.

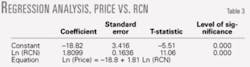

Table 3 shows the results of the regression using replacement cost to compute refinery value. The constant term and coefficient for RCN were highly significant. The indicated value was a function of RCN raised to the power 1.81 as opposed to a power of 1.

The result also depends on the constant term that is not evident in the simple approach.

Equation 4 results in an indicated value of $92.1 million for the example refinery. This contrasts with the $131.2 million using the simple approach.

The two regression equations yielded results that were very close in value, $88.9 million and $92.1 million, respectively.

Equations 5 and 6 show the regression equation model used to establish a relationship between RCN and capacity and complexity.

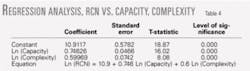

Table 4 shows the results of the regression using refinery capacity and complexity to estimate RCN (Equation 6). All of the coefficients were highly significant. The coefficient for capacity is not 1 and does not equal the coefficient for complexity.

The conclusion is that using RCN and the complexity-capacity product essentially does not yield additional information when estimating refinery value. The two measurements are, therefore, redundant.

Findings

The combination of refinery complexity and capacity can be used as an indicator of value as can RCN. Relationships derived are specific for the complexities used.

Because there are different calculation methods used by various parties for complexity, the regressions would need to be performed using a particular complexity definition. Nevertheless, the methodology would be the same and the result would be more reliable as an indicator of refinery value than the traditional ratio of sales price to the product of capacity and complexity.

RCN has a slightly higher correlation with sales price than the capacity-complexity combination. Using RCN, however, is essentially equivalent to using the combination of refinery capacity and complexity values for an indicator of refinery value. Use of both reveals essentially no additional information about refinery value than using one or the other.✦

The author

Robert Neumuller (Rneu349 @aol.com) is an independent consultant, Plano, Tex. He has 28 years’ experience in the refining and energy industries. Neumuller has also served as a consultant for Muse Stancil & Co., Arthur Consulting Group Inc., and CPN Consultants Inc. Before that, he held positions with Southern California Gas Co. and Phillips Petroleum Co. Neumuller holds a BS in chemical engineering from the University of Maryland, and an MBA from the University of Southern California. He is a member of the American Society of Appraisers and the National Association for Business Economics.