FACTS: Middle East production capacity to continue climb

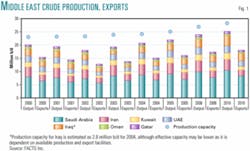

The Middle East's crude oil production capacity will continue to rise by 4.35 million b/d from 2003's estimate of 23.9 million b/d, reaching 28.3 million b/d of oil by 2010.

These figures are based on the current capacity and production situation in the region, incremental capacity additions until 2010, and the natural decline rates from the region's oil fields, according to Honolulu-based analyst FACTS Inc. (Fesharaki Associates Consulting & Technical Services Inc.) in an energy brief released this month.

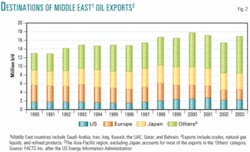

"The Asia-Pacific region has been a major market of Middle Eastern oil and the import dependency of Asian consumers on Middle Eastern crude is projected to increase," FACTS reported. Currently, more than 60% of crude and refined products exported from the Middle East reach markets in Asia, FACTS added.

"The Middle East—with more than half of the world's proven oil reserves—continues to be the epicenter of the global oil market, and the importance of the region is poised to grow further, especially with rising oil demand in countries like China and India," FACTS noted.

Production, exports

The region as a whole produced about 20 million b/d of crude and condensate, based on 2003's annual average, FACTS said. Of this total, about 5.5 million b/d were used to feed domestic refineries and fuel electric power generation. The remainder, about 14.5 million b/d, was exported, FACTS noted.

FACTS expects figures for 2004 to reflect an increase in exports from the Middle East to Asia, "as Iraq's production has increased significantly over 2003, and it is expected that well over half of Iraq's exports will go to Asian destinations."

Saudi Arabia, meanwhile, remains by far the region's largest producer and exporter, accounting for about 43% of the production from the Middle East, FACTS reported. The Kingdom is followed in production by Iran with 20%, the UAE 13%, and Kuwait 10%. Qatar and Oman each account for about 4% of the total production.

"Iraq is of particular interest, as the country suffered a severe production decline, owing to the war led by the US and allied troops in March 2003, along with recurring damage to its export and production capacity," FACTS said.

FACTS explained that crude oil production in 2003 from the Middle East increased 6.9% over 2002. This rise in production, it said, was "driven by certain key factors, such as the Iraqi war, continuing supply problems in other [Organization of Petroleum Exporting Countries] members like Venezuela and Nigeria, and higher-than-expected demand led by China and the US."

Oil prices, in turn, rose "substantially" throughout 2003-04, FACTS said, "driven more by supply worries and the 'terror premium' and less so by direct market fundamentals."

FACTS projected, "For 2004, we expect crude production to be approximately 21.5 million b/d. In recent months, Middle East producers have been producing close to capacity, with only small volumes of spare capacity—mostly in Saudi Arabia."

In the future, FACTS notes, "we project that production from the Middle East countries will increase by about 5.5-6 million b/d between 2003 and 2010 (Fig. 1).

"At the same time," the analyst added, "each year, some 600,000-800,000 b/d of new capacity will be used to compensate for the decline in the aging fields."

The Asia-Pacific region, the Middle East's biggest crude oil customer, accounts for about 62% of the crude exported from the area, followed by 16% to Europe, and 15% to North America. The remaining volumes were exported to Latin America and Africa, FACTS reported.

"This trade pattern," FACTS contends, "has more or less remained unchanged over the last several years (Fig. 2). However, in the longer run, Asian countries will constitute an even larger share of Middle Eastern exports."

FACTS said, "The geographical proximity of the two regions [Asia and the Middle East], a growing Asian deficit, and an absence of alternative sources have increased the dependency of Asian countries such as Japan, South Korea, India, China, and Taiwan on Middle Eastern crude.

"The close relationship also will foster mutually interdependent investments in producing and consuming countries," the analyst said.

"This strengthening of the supplier-consumer relationship will increase the interest of Middle Eastern oil companies to invest in key growth markets of Asia such as China, India, and Indonesia. At the same time it will trigger greater interest for Asian national oil companies to seek upstream investments in the Middle East gulf, such as those presently pursued by India and China."