EIA: LNG will supply more than 20% of US gas by 2025

In the Annual Energy Outlook 2005 (AEO2005), the US Energy Information Administration (EIA) projects that LNG will play a rapidly expanding role in meeting the nation's future natural gas requirements, growing to more than 20% of total US natural gas supply in 2025 from slightly more than 2% in 2003.

This is a major departure from forecasts that EIA and other forecasters were making just 5 short years ago, when LNG was expected to remain a minor contributor to US natural gas supply for the foreseeable future.

The prevailing perception throughout most of the 1980s and 1990s was that LNG was not an economic source of natural gas supply for North American markets. Although the average annual US wellhead price for natural gas reached a high of $2.66/Mcf (nominal dollars) in 1984, for most of the 20-year period it remained at less than $2.00. Over the same period, average annual prices of LNG imported into the US were considerably higher, ranging from a low of $2.22 in 1989 to a high of $4.62 in 1986.

The natural gas market, and particularly the LNG market, however, were evolving: Costs throughout the LNG supply chain were declining, and a fundamental shift upwards in domestic natural gas prices was about to occur.

The shift began during the colder-than-normal winter of 2000-01, which was characterized by severe price spikes and an average natural gas wellhead price of $3.68/Mcf/year, almost $1.50/Mcf higher than the preceding year.

With the exception of 2002, natural gas average wellhead prices from 2000 on have remained greater than $3.50/Mcf/year, and preliminary estimates show a 2004 price that is close to $5.50/Mcf.

Because of the declining costs to produce, liquefy, transport, and regasify LNG, many developers began maintaining that LNG was economic at a price of $3.50/Mcf and, after the price increases of 2000-01, began considering investing in the development of new LNG receiving terminals to serve the US market.

The Cove Point, Md., and Elba Island, Ga., terminals, mothballed when gas prices fell in the early 1980s, reopened by yearend 2003. Expansion plans for all four domestic US LNG terminals were announced, and more than 50 new terminals have been proposed in the US, Canada, and Mexico to serve North American markets.

Building all the proposed terminals would add close to 26 tcf of peak annual LNG import capacity in North America. This is only slightly less than North America's total natural gas consumption for 2003: The US consumed 22.4 tcf, and Canada and Mexico consumed 3.1 and 1.6 tcf, respectively.

The proposed new US capacity totals 16 tcf, while an additional 5 tcf have been proposed for both Canada and Mexico. Although it is highly unlikely that all announced proposals will proceed, the level of activity indicates how strong is the interest in LNG throughout North America.

EIA projections

EIA projects that domestic natural gas consumption will grow from 22.4 tcf in 2003 to 30.7 tcf in 2025 (Fig. 1). More than 70% of the increase will come from increasing demand for natural gas to fuel both electricity generation and industrial applications.

At the same time, domestic gas production, at 19.0 tcf in 2003, will reach only 21.8 tcf by 2025. The growth in production needed to offset declining conventional production and to reach this level will come mainly from unconventional gas production (2 tcf) and, with the completion of an Alaska natural gas pipeline in 2016, from Alaska (1.8 tcf).

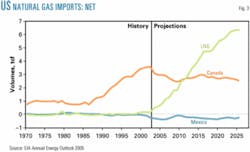

Net imports will more than double, reaching 8.7 tcf by 2025. Not surprisingly, most of the increase in net imports will come from LNG, with LNG imports projected to reach 6.4 tcf in 2025.

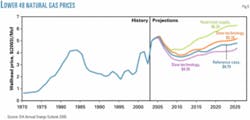

After 2005, wellhead prices will initially decline as LNG import capacity expands, making new import sources available and as production from increased drilling expands available domestic supply. Increases in unconventional gas production and Alaska production, however, will be insufficient to offset the impacts of resource depletion and increases in demand without an increase in prices.

Higher exploration and development costs associated with smaller and deeper gas deposits in the remaining domestic gas resource base will cause prices to gradually increase after 2010 to $8.23/Mcf in 2025.

Imports

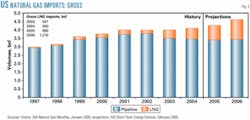

Strong growth in LNG imports is already occurring (Fig. 2). LNG imports into the existing US terminals more than doubled between 2002 and 2004 and, according to EIA's February 2005 Short-term Energy Outlook (STEO), will almost double again between 2004 and 2006.

Part of this increase results from expanded capacity at existing terminals, and part from the opening on the Gulf Coast of the first new US receiving terminal in more than 20 years, Excelerate Energy's Energy Bridge. The need for increasing LNG imports is strengthened by what appears to be the end of the historical steady increase in imports from Canada.

Over the next 20 years, the growth in LNG imports will be very strong (Fig. 3). LNG imports will increase almost tenfold between 2004 and 2025 as new terminals begin receiving supplies, existing terminals expand, and additional worldwide LNG liquefaction capacity comes online.

Imports from Canada, currently the dominant source of US imports, will decline to 2.5 tcf in 2009, increase temporarily after supplies from the McKenzie Delta come online, and subsequently decline through the end of the forecast period. The current decline in conventional natural gas production in the Western Canadian Sedimentary Basin will continue throughout the forecast period.

Although increases in production are likely from Western Canadian unconventional sources, McKenzie Delta, Eastern Canada, and LNG imports, Canada's own growing demands will likely outstrip supply increases, leaving less available for export.

While Mexico is expected to be receiving LNG from new terminals on both its West and East coasts, the expected increase in Mexico's natural gas requirements will cause it to remain a net importer of US gas through 2025.

By 2025, the US will import 6.4 tcf of LNG into newly constructed receiving terminals and expanded existing facilities. Imports into new terminals will be almost double those into the four existing terminals (exclusive of Puerto Rico), with combined imports into Everett, Mass., Cove Point, Elba Island, and Lake Charles, La., projected to reach 2.3 tcf by 2025 and those into new terminals projected to reach 4.0 tcf.

Because expansion of existing facilities is less expensive than construction of new facilities and growing demand supports more LNG import capacity in their respective regions, the AEO2005 projects that Cove Point, Elba Island, and Lake Charles will each expand sendout capacity to more than 2 bcfd. It is assumed that Everett is constrained by its physical location and will see no further expansion.

New terminals

Within the next 5 years, terminals will be constructed in the US, Canada, and Mexico. New US terminals will begin operating along the Gulf Coast by 2006; Excelerate's Energy Bridge received its first cargo at mid month. By 2010, a terminal will be operating in the Bahamas, with the gas delivered to Florida via subsea pipeline.

The new Gulf Coast terminals will have a combined peak import capacity of 3.5 bcfd by 2010, while the Bahamas capacity will be 500 MMcfd (Fig. 4).

Total imports into the new terminals in 2010, including the Bahamas, will be slightly more than 1 tcf. While a portion of the gas imported into new terminals in Canada and Mexico will reach the US, it is classified as pipeline imports and thus not included in the LNG import totals.

After 2010, construction will accelerate along the Gulf Coast. After 2015 new terminals will begin operating along the US East Coast.

Terminals located along the East Coast will be located near market areas with heavy demands. These terminals face numerous siting obstacles, however, due both to geography that limits the availability of deepwater ports and to strong local opposition near population centers that makes permitting difficult.

Partly because of these siting issues and partly because of smaller regional markets that aren't expected to grow quickly enough to absorb larger volumes, terminals in these regions will be constructed later in the forecast period and are smaller than those along the Gulf Coast. Total capacity of the new East Coast and Bahamas terminals will reach 3.5 bcfd by 2025, with imports into these facilities reaching 1.1 tcf/year.

The Gulf Coast will remain the primary location for additional capacity, both in the form of added new terminals and expansion at terminals constructed earlier in the forecast period. In 2025, more than 70% of imports into new US facilities will be received on the Gulf Coast. The combined capacity of new Gulf Coast terminals will reach 9.5 bcfd, with imports into these terminals totaling 2.9 tcf/year.

In addition to the availability of deepwater ports for onshore terminals and the perceived ease of permitting, the Gulf of Mexico offers existing pipeline systems for offshore terminals to move their gas to shore, spare capacity in existing pipeline infrastructure to move the gas to market, and the ready ability to handle high-btu LNG.

The total combined capacity of the new terminals constructed in the US and the Bahamas by 2025 represents a peak capacity of 4.8 tcf/year. With the new terminals projected to receive imports of 4.0 tcf in 2025, they will be running at an overall average capacity of close to 85%.

The projected capacity at new terminals will be achieved through the construction of facilities of varying capacities, with some of these later expanding beyond their initial sizes. While terminals of up to 3.3 bcfd (Cheniere's recently announced Creole Trail) have been proposed for the Gulf Coast, terminals with design capacities as small as 500 MMcfd have been proposed for New England and the Mid-Atlantic regions.

Scenarios

The AEO2005 reference case projections described above are EIA's business-as-usual forecasts, given known technology and technological trends, demographic trends, and current laws and regulations. The projections are not statements of what EIA believes will happen but of what might happen, given certain assumptions.

Because assumptions play a major role in any forecast, EIA examines a number of alternate scenarios each year, both within the AEO and in separate special studies, to quantify the impacts of key assumptions. Three scenarios in the AEO2005 are especially relevant for the LNG forecast.

These include the rapid and slow oil and gas technology scenarios, which varied the assumed rate of technological progress, and a restricted supply scenario that assumed a number of supply constraints, including limitations on LNG expansion at existing terminals and on the construction of new terminals.

In the reference case, technologies are assumed to increase at historical rates. In the rapid and slow technology cases, the technology parameters in the model are increased and decreased by 50%, respectively.

The restricted supply case assumes that the future rate of technological progress will be the same as that assumed in the slow technology case. It additionally assumes that an Alaska pipeline will not be built and become operational by 2025, that no new LNG facilities other than the Excelerate Energy Bridge will be built, and that there will be no expansion at existing LNG facilities beyond that which has already been announced.

While such a "worst case" scenario is unlikely, public opposition could constrain the construction of new LNG facilities or the Alaska pipeline or both.

Wellhead prices are sensitive to the rate of technological progress (Fig. 5). The slow technology case projects a wellhead price in 2025 that is 8% higher than in the reference case, while the rapid technology case projects a price that is 9% lower than in the reference case (Table 1).

A comparison of the restricted supply scenario with the slow technology scenario quantifies the impact of restricted LNG terminal expansion and Alaska pipeline development. Under this scenario, 2025 prices are 21% higher than in the slow technology case, and the consumption of natural gas is 14% lower. Restricting the supply in conjunction with lowering the technology parameters increases average wellhead prices to 31%/year above the reference case.

In both the slow technology and the restricted supply scenarios, development of more expensive domestic supply sources is required to meet demand, thereby driving natural gas prices significantly higher and reducing the overall demand for natural gas.

As shown by the restricted supply scenario, without new LNG import capacity we can expect significantly higher natural gas prices. In both the rapid and slow technology scenarios, where LNG development is not artificially constrained, LNG will make a significant contribution to domestic supply.

LNG's contribution to supply in the slow technology, reference, rapid technology scenarios is 24%, 21%, and 17%, respectively. All of these scenarios indicate that LNG will play a much more significant role in future US (and North American) natural gas supply than in the past.

Without new LNG supply, we can expect increased natural gas prices, reduced consumption, and the erosion of natural gas market share to competing fuels.

The author

Phyllis Martin is a senior energy analyst in the US Department of Energy's Energy Information Administration (EIA). She has been developing energy market models since 1974 in both the corporate and government sectors and has been an analyst in EIA's Office of Integrated Analysis and Forecasting since its inception in 1992. Her focus is on domestic and international natural gas markets, with a current emphasis on LNG. She was a key contributor to the first government sponsored comprehensive report on the global LNG market and speaks at numerous national and international energy conferences. Martin holds a BS (magna cum laude) in mathematics from Saint Lawrence University and a masters from Johns Hopkins University.