Global ethylene producers add 2 million tpy of capacity in 2004

The global ethylene industry added 2.13 million tonnes/year (tpy) of capacity in 2004, an increase from the 2003 addition rate of 1.34 tpy, according to OGJ's latest exclusive ethylene survey.

Capacity as of Jan. 1, 2005, was 112.9 million tpy, an increase from a worldwide capacity of 110.8 million tpy as of Jan. 1, 2004.

Nearly 600,000 tpy of new capacity is listed in the latest survey, and no capacity was removed from the survey due to idled and shutdown plants. The remainder of additional capacity resulted from net expansions at existing sites.

Fig. 1 shows that the rise in capacity additions was the first increase since 2000.

Capacity additions had fallen each year until reaching a nearly 2-decade low in 2003.

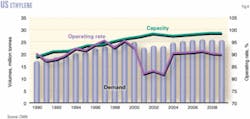

Fig. 2 shows that global operating rates were about 92% in 2004. This is a significant rise from the operating levels in 2001-03, when rates ran less than 90% due to stagnant demand growth. With a significant level of capacity slated to come online in 2005, the operating rate should drop slightly.

In North America, operating rates increased because the demand for ethylene outgained capacity additions.

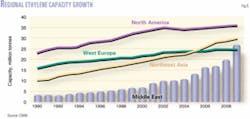

Most future growth in ethylene capacity will occur in the Middle East and Asia. North America and Western Europe will experience relatively flat capacity growth.

New units

Three new ethylene units appear in this year's survey, all installed at existing plant sites.

Thai Olefins Public Co. Ltd. reported to OGJ this year that it has a 300,000-tpy ethylene plant at its existing site in Rayong. This expands the site's capacity to a total of 685,000 tpy from a previously reported 385,000 tpy.

In Hungary, Tiszai Vegyi Kombinat Ltd. (TVK) started up a new unit at its Tiszaujvaros plant. The 250,000-tpy plant started up on Dec. 11, 2004, and expands the facilities' capacity to a total of 620,000 tpy. This is up from a capacity of 360,000 in last year's survey.

The new plant is part of a 430 million Euro petrochemical development project by TVK.

Petrobras Energia reported to OGJ that it has two ethylene plants, with capacities of 20,000 tpy and 32,500 tpy. The 32,500-tpy plant in Puerto San Martin, Argentina, was unreported in previous surveys.

Regional review

Table 1 shows rankings of the 10 largest ethylene production complexes in the world. Nova Chemical Corp.'s Joffre plant retains the top spot on the list. The facilities in the list are the same as last year, but a few changed positions due to restated capacities.

Shell Chemicals Ltd.'s Norco, La., site moved up two spots because the company restated capacity as 1.556 million tpy, up from the 1.5 million tpy that appeared in last year's survey.

Table 2 ranks ethylene production capacity by region. Asia-Pacific and North America each added more than 0.7 million tpy. Eastern Europe-FSU showed an increase of more than 0.5 million tpy. The Middle East-Africa and South America had small increases.

Western Europe was the only region that had a decline in capacity, mainly due to less stated capacity in existing plants in France and Turkey.

On a percentage basis, Eastern Europe-FSU showed the most significant growth.

The latest survey shows a 7.3% increase, which was mainly due to updated information from Russia.

Table 3 ranks ethylene production capacity by country. The US showed the largest increase in capacity of 670,000 tpy. A large portion of this increase was because Shell told OGJ that the capacity of its Deer Park, Tex., ethylene plant increased to 1.452 million tpy from 1 million tpy.

Russia, China, Thailand, and Hungary showed capacity increases of about 300,000 tpy. As previously mentioned, the increase in Russia was due to updated information.

The 350,000-tpy increase in China was due to expansions in two facilities. Sinopec's Qilu plant expanded to 720,000 tpy from the 450,000 tpy listed in the 2003 survey. Lanzhou Chemical Industrial Co. reported that the capacity in its plant increased to 240,000 tpy from 160,000 tpy.

Thailand experienced a 300,000-tpy production capacity increase due to a new unit at an existing site.

As previously mentioned, Thai Olefins reported to OGJ that it started up a 300,000-tpy unit at its Map Ta Phut, Rayong, plant.

In Hungary, nearly all the increase was due to the new TVK 250,000-tpy unit.

Closed, idled plants

Table 3 also shows that a number of countries had capacity decreases. And because no plant in the world announced a complete shutdown, the capacity decreases were due to partial shutdowns or companies restating ethylene production.

The most significant declines occurred in Turkey and Ukraine, which lost 120,000 tpy and 100,000 tpy of capacity, respectively.

Petkim Petrochemicals Holding Co., which owns the lone plant in Turkey, reported to OGJ that the capacity of its Aliaga, Izmir, plant was reduced to 400,000 tpy from the 520,000 tpy reported in the 2004 survey.

The capacity of the TNK-BP ethylene plant in Lisichansk, Ukraine, was overstated in previous surveys. The 2004 survey shows that it has a capacity of 200,000 tpy, lower than the 2003 survey by 100,000 tpy.

Japan, France, Belgium, Australia, Indonesia, and Switzerland all showed net decreases in ethylene production capacity.

Ownership, name changes

On Mar. 29, 2004, Lyondell Chemical Co., Houston, and Millennium Chemicals Inc., Hunt Valley, Md., agreed to a stock-swap merger that will create the third-largest independent, publicly traded chemical producer in North America.

The equity value of the transaction, which was finalized on Dec. 1, 2004, was $1.6 billion plus about $1.1 billion of Millennium net debt.

Although the company will operate as Lyondell, the Millennium and Equistar Chemicals subsidiaries will remain separate legal entities.

According to the 2004 survey, Lyondell operates 4.9 million tpy of ethylene capacity (Table 4).

On Apr. 27, 2004, BP PLC announced that it plans to consolidate its olefins and derivatives division of its petrochemical business into a standalone entity.

BP also said that it plans to sell the division depending on market conditions in the second half of 2005. The company plans to retain the balance of its petrochemicals portfolio, which consist of aromatics and acetyls businesses.

BP's ethylene production sites include mostly plants in Western Europe and the US, including the Ruhr Oel joint venture with Petroleos de Venezuela SA. In last year's report, PDVSA was reportedly trying to sell its 50% of Ruhr Oel. Nothing occurred in this regard in 2004.

Effective Oct. 1, 2004, Total AS, the parent company of Atofina, reorganized its chemicals operations. All the petrochemical operations, including ethylene, are now included in Total Petrochemicals.

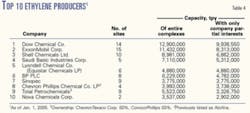

Table 4 lists the top 10 owners of ethylene capacity worldwide. There was only one change to this table in 2004.

Sinopec moved up a spot due to the expansion of the Qilu plant, as previously mentioned. As a result, Chevron Phillips Chemical Co. LP dropped a spot.

Construction

Last year, OGJ forecast that more that 5.8 million tpy of new capacity would come online in 2004, based on responses to construction surveys. Of this, only 0.6 million tpy actually started up. Similar to 2002 and 2003, many companies delayed or cancelled projects due to oversupply or unfavorable project economics.

According to the latest OGJ construction data, more than 6.8 million tpy of new capacity will come on stream in 2005 (Table 5). A number of plants scheduled to start up in late 2004 have delayed the start-up until 2005.

The survey reports that many world-scale crackers will start up in 2005. One is Marun Petrochemical Co.'s 1.1-million-tpy unit in Bandar Imam, Iran. Marun is a subsidiary of National Petrochemical Co. and the new unit is part of the company's olefin No. 7 complex. Last year, OGJ reported that the plant would start up in 2004.

National Petrochemical is significantly expanding ethylene capacity in Iran. The company is planning to start up two other world-scale ethylene crackers, both at Bandar Assaluyeh, in 2005.

One unit is a 1.32-million-tpy cracker that will be owned by Jam Petrochemical Co. The other unit is a 1-million-tpy plant owned by Pars Petrochemical Co. Jam is 100% owned by National Petrochemical and the ethylene portion of Pars is a 50-50 joint venture of National Petrochemical and Sasol Polymers.

Other plants that are slated to start up in 2005 inlcude:

- A 600,000-tpy plant in Nanjing, China, owned by BASF-YPC Co. Ltd., a 50-50 joint venture between BASF AG and Sinopec. This plant was scheduled to start up in 2004, but now the company reports that the plant will start up in mid-2005.

- A 500,000-tpy plant in Duque de Caxias, Brazil, owned by Rio Polimeros, a consortium of four companies that includes Uniao de Industrias Petroquimicas and Petroleo Brasileiro SA.

- A 800,000-tpy plant built by China National Offshore Oil Co. and Shell Petrochemicals Co. Ltd. in Huizhou, Guangdong.

Global market

Ethylene markets continued to recover in 2004. Fig. 2 shows that worldwide operating rates were 92% as the amount of demand started catching up with capacity.

Global operating rates will "remain strong through 2007," according to Mark Eramo, vice- president of olefins and elastomers for Chemical Market Associates Inc., Houston. "The market may begin to cycle down starting in 2008-09 as new capacity additions begin to outpace demand growth."

According to CMAI, global ethylene production capacity will grow at an average rate of 5.0%/year in 2004-09, up from 3.6%/year in 1999-2004. Demand will grow at an average of 4.6%/year in 2004-09, an increase from 3.3%/year in 1999-2004.

Fig. 3 shows that the Middle East producers will dominate the net equivalent ethylene trade in the future.

"Most capacity being added represents the lowest-cost production in the world and is targeting export markets because domestic demand for ethylene derivatives remains very low," Eramo said. "North America will become more and more focused on domestic market growth, holding a minor, smaller share of global trade in the future."

North American market

In 2004, ethylene demand outgained capacity growth in the US.

Fig. 4 shows that the operating rate in the US increased significantly to more than 90%, up from about 83% in 2001-03. And because capacity increases will match demand growth, the operating level should remain above 90% for the foreseeable future.

According to CMAI, average capacity growth will be 0.8%/year in 2004-09, about the same as the previous 5 years. Demand will grow at an average rate of 0.8%/year as well, but up from a decline of 0.5%/year in 1999-2004.

CMAI expects North America to become a net importer of ethylene in 2009 (Fig. 3).

Other markets

Fig. 5 shows regional trends in ethylene capacity growth. The majority of new capacity is being built in Asia and the Middle East, while Europe and North America remain steady.

"The Middle East and Asia will become the second and third largest producing regions in the world, each leveraging 'low-cost' incentives in the ethylene end-use chain," according to Eramo.

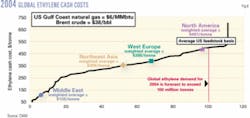

"In 2004, with natural gas increasing to $6/MMbtu and Brent crude at $38/bbl, North America held the high-cost position in the global market," he said. "Naphtha cracking in Europe and Asia benefited greatly from high coproduct values including propylene, butadiene, and benzene."

Fig. 6 shows global ethylene cash costs as a function of cumulative ethylene capacity. This shows the regional advantage for ethylene producers in the Middle East and Northeast Asia.

Because worldwide demand for ethylene will exceed 100 million tonnes, however, producers in the US will still run their plants at high operating rates.