Near-record prices for oil and natural gas led to strong bidding Mar. 16 in two Outer Continental Shelf lease sales for tracts in the Eastern and Central Gulf of Mexico.

Central Lease Sale 194 drew total bids and offerings that were in line with sales of past years, while Eastern Sale 197 "exceeded expectations," according to the US Department of the Interior's Minerals Management Service, which conducted the sales (OGJ Online, Mar. 16, 2004).

The bidding showed continued interest in deepwater areas, and a large number of shallow-water tracts also drew offers.

Meanwhile, MMS recently revealed that the deepwater gulf hosted 14 field production start-ups and 12 discoveries in 2004.

Eastern Sale 197

MMS received 12 bids for 12 tracts south of Alabama in the Eastern Gulf OCS planning area. Total bids from the sale reached nearly $7 million.

The 124 unleased blocks on offer cover more than 714,240 acres 100-196 miles offshore in 1,600-3,425 m of water. Estimates of undiscovered economically recoverable hydrocarbons from the leases are 65-85 million bbl of oil and 0.265-0.34 tcf of gas, MMS said.

The highest bid received on a block was $2 million, submitted by Helis Oil & Gas Co. LLC, Houston Energy LP, and Red Willow Offshore LLC for Lloyd Ridge Block 272 (Table 1). Helis is a private New Orleans independent.

The block is just north of an undrilled four-block cluster, Lloyd Ridge 315, 316, 359, and 360, leased by Anadarko Petroleum Corp. at a previous sale.

Block 272 is also 18 miles northeast of Lloyd Ridge Block 399, where the Cheyenne exploration well cut more than 45 ft of net gas pay in a single Miocene sand in the fourth quarter of 2004. Shell drilled the discovery well, but Anadarko owns 100% working interest in the Miocene interval and will operate its development.

The second highest bid received was $1.6 million for De Soto Canyon Block 797 from Spinnaker Exploration Co. LLC and Dominion Exploration & Production Inc. This tract is four blocks south of the Anadarko-operated Spiderman gas discovery well.

Petrobras America Inc. made the sale's third highest bid of $552,384 for Lloyd Ridge Block 92, 3-4 miles southwest of Anadarko's Atlas and Atlas Northwest gas discoveries.

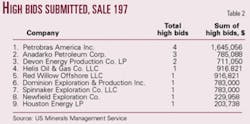

Petrobras America submitted the most high bids, with 4 high bids for a total of $1.6 million (Table 2). Anadarko submitted 3 high bids for a total of $800,000.

Central Sale 194

Central Lease Sale 194 drew high bids totaling nearly $354 million out of total offerings of $540.3 million by 80 companies. The sale drew 651 bids on 428 of the 4,063 tracts offered, comprising about 21.4 million acres.

Sale 190 for the Central Gulf in 2004 drew high bids totaling almost $369 million and received the most bids in 6 years, MMS reported (OGJ Online, Mar. 17, 2004).

Dominion and Stone Energy Corp. submitted the highest single bid of the sale, nearly $21.2 million for West Cameron Block 132 in less than 199 m of water (Table 3). The block is in a Lower Miocene Trend in the general area where El Paso Corp. operates a cluster of blocks.

Dominion, which acted as that bid's submitter, tied with Focus Exploration LLC, each with 25 bids, for the top company based on total high bids submitted (Table 4). Dominion submitted a total of $52.3 million in high bids, and Focus submitted a total of $10.2 million.

Other companies on that list included Murphy Exploration & Production Co., 23 bids totaling $28.1 million; Amerada Hess Corp. subsidiary LLOG Exploration Offshore Inc., 22 bids, $34.9 million; Energy Partners Ltd., 22 bids, $15.1 million; Chevron USA Inc., 22 bids, $8.1 million; Remington Oil & Gas Corp., 21 bids, $9.7 million; Spinnaker, 19 bids, $17 million; ExxonMobil Corp., 18 bids, $6.9 million; and Magnum Hunter Production Inc., 15 bids, $3.9 million.

Pioneer Natural Resources USA Inc. lodged 13 apparent high bids totaling a net $7.5 million. The company focused on prospects and leads in the Mississippi Canyon area. Five of the 13 blocks are near the Dominion-operated 2004 Thunder Hawk discovery in 5,724 ft of water on Mississippi Canyon Block 734.

Cimarex Energy Co., Denver, is acquiring Magnum Hunter (OGJ Online, Jan. 26, 2005).

The second highest bid of the day was $20.2 million for Mississippi Canyon Block 819 in more than 1,600 m of water, submitted by a group that included Murphy, Dominion, Pioneer Natural Resources USA Inc., and Spinnaker. This is a former BP-held block just southwest of Thunder Horse and Thunder Horse North oil fields.

Deepwater in 2004

MMS previously reported that operators made 8 deepwater discoveries in January through June 1, 2004 (see table, OGJ, June 21, 2004, p. 27).

The four deepwater discoveries completed since then in 2004 are: ChevronTexaco's Silvertip prospect in 9,226 ft of water on Alaminos Canyon Block 815; ChevronTexaco's Tiger prospect in 9,004 ft of water on Alaminos Canyon Block 818; ChevronTexaco's Jack prospect in 6,965 ft of water on Walker Ridge Block 759; and Nexen Inc.'s Crested Butte prospect in 2,846 ft of water on Green Canyon Block 242.

Tiger, Silvertip, Jack, and Unocal Corp.'s Tobago discovery in 9,627 ft of water on Alaminos Canyon Block 859 "added new excitement to the Paleogene in this area," MMS said (see map, OGJ, June 14, 2004, p. 45).

Deepwater discoveries at Atlas and San Jacinto in the eastern gulf helped bring economic viability to the $665 million, 850 MMcfd Independence gas-condensate hub planned for 8,000 ft of water on Mississippi Canyon Block 920.

Independence, a deep-draft, semisubmersible platform, will initially serve eight gas fields, six of them operated by Anadarko, in 7,800-9,000 ft of water in the Atwater Valley, De Soto Canyon, and Lloyd Ridge areas. It is to begin operation in 2007.

The most recent discovery dedicated to Independence is Anadarko's Mondo Northwest find on Lloyd Ridge Block 2. Spudded in December 2004, it was drilled and later sidetracked to an optimum production takepoint. The rig then moved to drill Mondo Northeast on Lloyd Ridge Block 47.

Anadarko set casing after Mondo Northwest's sidetrack hole cut more than 70 ft of net gas pay in three sands of Miocene age.