OGJ Newsletter

General Interest—Quick Takes

Senate okays ANWR Coastal Plain leasing

A traditionally reluctant US Senate has shown majority support for oil and gas leasing of the Arctic National Wildlife Refuge Coastal Plain in Alaska.

By a 51-49 vote, senators rejected a proposal to remove the leasing provision from a budget bill. Supporters attached ANWR leasing to budget legislation to prevent it from being subjected to a filibuster, which would have required 60 votes to break. The Senate and House still must approve budget legislation.

The 1.5-million-acre Coastal Plain contains some of the largest undrilled onshore structures in the US. Congress designated it a study area for possible leasing when it banned leasing of the remaining 17.5 million acres of ANWR in 1980.

The Department of the Interior, after several years of geophysical study, recommended Coastal Plain leasing in 1987. Congress was close to approving leasing in 1989 when the Exxon Valdez tanker ran aground in March, spilling crude in Alaska's Prince William Sound. Support for the initiative faded after the accident.

In 1995, former President Bill Clinton vetoed a budget bill that included a leasing provision. More recently, the Senate has opposed energy bills passed by the House that approved ANWR leasing.

President George W. Bush supports exploration of ANWR's Coastal Plain.

The American Petroleum Institute called the Senate vote "a welcome critical step towards a comprehensive national energy policy that includes developing domestic oil and gas supplies."

OPEC hikes production quota to 27.5 million b/d

At Saudi Arabia's insistence, the Organization of Petroleum Exporting Countries agreed Mar. 16 to raise immediately its official production quota by 500,000 b/d to 27.5 million b/d.

That's slightly below the group's acknowledged current production of 27.7 million b/d among the 10 members other than Iraq, which is still trying to revive its production to prewar levels.

OPEC members gave Conference Pres. Ahmad Fahad Al-Ahmd Al-Sabah, Kuwait's energy minister, the authority to boost the quota by an additional 500,000 b/d should oil prices remain high prior to the group's next meeting June 7 in Vienna.

Saudi Arabia already has raised its production by 250,000 b/d to 9.5 million b/d this month and plans to increase it further in April. However, much of the kingdom's increased production is heavy, high-sulfur crude.

"Saudi influence (along with pressure from the US and Europe) seems to have trumped the concerns of the 'price hawks,' such as Iran and Libya, that oil prices could come under pressure in the next few months," said analysts in the Houston office of Raymond James & Associates Inc. "On a seasonal basis, global oil demand generally weakens in the spring."

The key point, the analysts said, is "that this decision is really not material for the oil market." The higher quota "is likely to merely legitimize existing overproduction, which we estimate was about 1 million b/d [minus Iraq] before today's decision."

The Raymond James analysts reported, "Over the past year, the Saudis have shown a willingness to ignore quotas completely at times. There is little doubt that their output policy—which in the final analysis is what really matters for the oil market—will continue to be set independently of any OPEC decisions."

They noted that Saudi Arabia and Kuwait had said they together could bring as much as 700,000 b/d of incremental production to market over the next few months. "But of course this oil is sour," the RJA analysts said. "The oil market can be expected to stay tight over the foreseeable future."

The average price of OPEC's basket of seven benchmark crudes climbed by 62¢ to a record high of $50.21/bbl on Mar. 15.

High oil, gas prices drive OCS bidding

Near-record prices for oil and natural gas led to strong bidding Mar. 16 in two Outer Continental Shelf lease sales for tracts in the Eastern and Central Gulf of Mexico.

Results from Central Lease Sale 194 drew total bids and offerings that were in line with sales of past years, while Eastern Sale 197 "exceeded expectations," according to the US Department of the Interior's Minerals Management Service, which conducted the sales.

MMS received 12 bids for 12 tracts in the Eastern Gulf Outer Continental Shelf planning area, directly south of Alabama. Total bids from the sale reached nearly $7 million.

The 124 unleased blocks on offer cover more than 714,240 acres 100-196 miles offshore in 1,600-3,425 m of water. Estimates of undiscovered economically recoverable hydrocarbons from the lease are 65-85 million bbl of oil and 0.265-0.34 tcf of gas, MMS said.

The highest bid received on a block was $2 million, submitted by Helis Oil & Gas Co. LLC, Houston Energy LP, and Red Willow Offshore LLC for Lloyd Ridge Block 272. The second highest was $1.6 million for De Soto Canyon Block 797 from Spinnaker Exploration Co. LLC and Dominion Exploration & Production Inc.

Central Lease Sale 194 drew high bids totaling nearly $354 million out of total offerings of $540.3 million by 80 companies. The sale drew 651 bids on 428 of the 4,063 tracts offered, comprising about 21.4 million acres.

Stone Energy Corp. submitted the highest single bid of this sale—nearly $21.2 million for West Cameron Block 132 in less than 199 m of water.

The second highest bid of the day was $20.2 million for Mississippi Canyon Block 819 in more than 1,600 m of water, submitted by a group that included Murphy Exploration & Production Co., Dominion, Pioneer Natural Resources USA Inc, and Spinnaker.

IOGCC issues CO2 sequestration proposals

US states and Canadian provinces should play a critical role in a carbon dioxide sequestration regulatory regime being developed, recommends an Interstate Oil & Gas Compact Commission report.

"The states' experience over the last 30 years with this and with natural gas storage provides an excellent framework," said Arkansas Oil & Gas Commission Director Lawrence E. Bengal, who led the task force.

The group also recommended that CO2 remain a commodity covered by state laws and not be classified as a waste or pollutant.

"State laws protect resources and maximize recovery," said Bengal. "The IOGCC merely is saying that CO2 should have the same designation. Classifying CO2 as a waste would limit CCGS [carbon capture and geological storage] development."

IOGCC formed the group in 2002 in response to growing governmental concern worldwide over the prospect of global climate change fueled by increased CO2 releases into the atmosphere, said IOGCC Executive Director Christine Hansen. That concern is leading to examination of methods to decrease such emissions, she explained.

"One promising option is through carbon sequestration, specifically CO2 geological sequestration—capturing carbon dioxide before it is released into the atmosphere and storing it in underground geologic formations," Hansen said.

States' existing enhanced recovery regulations covering the injection of CO2 into mature oil fields are likely to provide the best working model for CGGS, the report concluded. The taskforce hopes to participate in the program's second phase, which DOE recently announced.

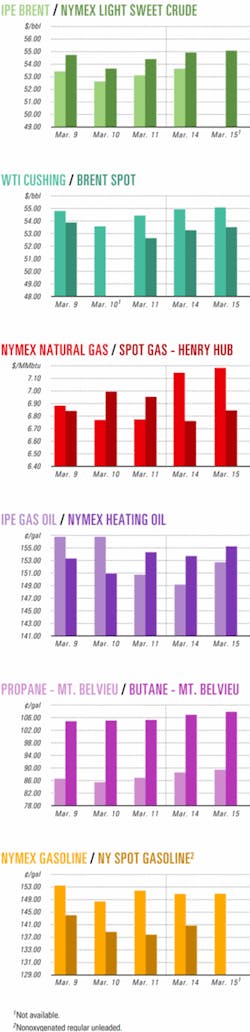

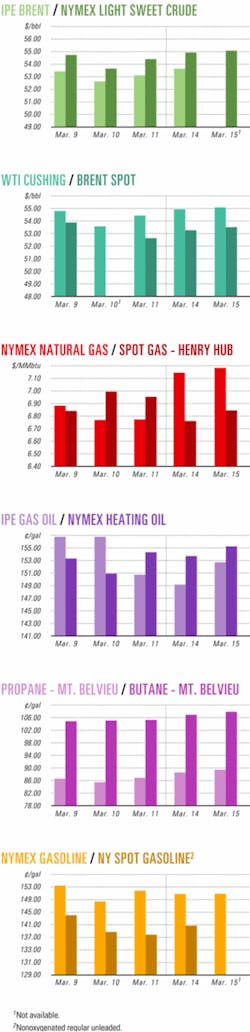

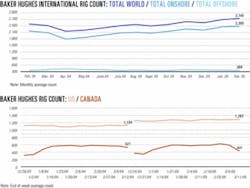

Industry Scoreboard

null

null

null

Exploration & Development—Quick Takes

Nigeria plans oil, gas licensing round

Nigeria will begin seeking bids Mar. 22 for 63 new oil and gas exploration and development licenses onshore and offshore.

Twelve of the blocks are in deep water, 12 in the Niger Delta, and the balance onshore in Anambra, the Benue River Valley, and the Lake Chad area in northeast Nigeria.

International oil and gas companies operating in Nigeria in recent years have concentrated on offshore prospects. To direct more focus onshore, Nigeria plans to introduce a production charge on offshore production contracts.

The government also will reduce the size of the blocks on offer to 1,250 sq km from 2,500 sq km and modify the terms of production-sharing contracts with Nigeria National Petroleum Corp.

Under existing PSCs, international firms may recover exploration and initial drilling costs before they share income with the state. Now, an 80% ceiling will apply to cost-recovery income, allowing the government to receive revenue from new fields immediately.

Nigerian President Olusegun Obasanjo, acknowledging the loss of more than $2 billion in oil revenues to sea piracy and other violence especially in the Niger Delta region, said the Nigerian navy is "intensifying its policing efforts to combat this act of economic sabotage" (OGJ Online, Feb. 9, 2005).

ExxonMobil to develop two more Chad fields

Esso Exploration & Production Chad Inc., whose Chad-Cameroon development project reached financial completion in fourth quarter 2004, said it will develop two more oil fields near project infrastructure in southwestern Chad. The consortium decided in mid-December 2004 to fund development of the Nya and Moundouli fields on the original Permit H exploration area, and Chad President Idriss Deby has signed concession decrees permitting their development.

Nya field is to go on production in late 2005 and Moundouli in mid-2006. Both will be produced through the Miandoum gathering station.

Nya, with 4 wells, is adjacent to Miandoum. Moundouli, with 25 wells, is 33 km west of Miandoum and will require a gathering pipeline.

Cliff Head receives development go-ahead

A five-company consortium headed by Roc Oil Co. Ltd., Sydney, has approved development of Cliff Head oil field, the first field to be developed in the offshore portion of Western Australia's North Perth basin.

Five appraisal wells have been drilled on Cliff Head since its discovery in 2001 to delineate the various parameters of the faulted structure. The most recent—Cliff Head-6—was completed as a producer.

The field is estimated to contain proved and probable reserves of 14 million bbl. Production will begin in the first half of 2006 at an initial rate of 10,000 b/d.

The $227 million (Aus.) development project calls for an unmanned offshore platform, with capacity for nine wells, in 18 m of water. Five wells will be initial oil producers and two, water injector wells. The remaining two well slots will be held in reserve for possible future wells.

Roc Oil will install dual 14 km pipelines, one to transport oil to a shore-based treatment plant at Arrowsmith and one to return produced water to the field for reinjection into the reservoir.

Roc Oil, the operator, has a 37.5% interest in the venture. Australian Worldwide Exploration Ltd. of Sydney holds 27.5%, Japan's Wandoo Petroleum Pty. Ltd. 24%, Voyager Energy Ltd. of Perth 6%, and CIECO Exploration & Production (Australia) Pty. Ltd. 5%.

Reliance, Niko discover more gas off India

Reliance Industries Ltd., Mumbai, and Niko Resources Ltd., Calgary, discovered more natural gas on deepwater Block D6 in the Bay of Bengal off India's northeast coast.

The G-1 exploration well flow-tested nearly 100 MMcfd from two intervals, one of which had not previously yielded gas, Niko said. Similar log response was seen in the M-1 well, 19 km south-southeast of Dhirubhai.

The well, which was not tested due to hole conditions, encountered one of the thickest net pay sections on the 1.9-million-acre Block D6 in the Krishna-Godavari basin (OGJ Online, Sept. 27, 2004).

G-1 was the 13th consecutive successful well drilled on Block D6. All drilling has occurred in an area covered by the first 1,800 sq km 3D seismic program, less than 20% of the block.

Another 3,165 sq km of 3D seismic data are being processed and merged with the initial 3D survey, Niko said. Reliance holds 90% interest in Block D6, and Niko 10%.

Reliance to explore Omani deepwater block

Reliance Industries acquired exploration rights to one of the largest deepwater blocks in Oman, signing an exploration and production-sharing agreement (PSA) on Mar. 12.

The PSA for Block 18 off the Batinah coast covers more than 18,000 sq km in 1,000 m of water. During an initial 3-year exploration period, Reliance plans to shoot a seismic survey.

Reliance is the block operator, holding 100% interest.

EnerGulf gets stake in block off Namibia

EnerGulf Resources Inc., Vancouver, BC, and National Petroleum Corp. of Namibia (Namcor) have entered into a memorandum of cooperation (MOC) to jointly explore, develop, and produce oil and gas in nonproducing Namibia on Block 1711 and for gas-to-liquids and related opportunities.

Under terms of the MOC, EnerGulf acquired an option for as much as 25% of Namcor's interest in Block 1711 in the Namibe basin off the northern coast of Namibia along the boundary with Angola.

Extensive seismic data identified two exploration prospects on the 8,931 sq km block:

The Kunene prospect, which has a resource potential assessed at as much as 8 tcf of gas or 1.4 billion bbl of oil, with a mean value of 5 tcf of gas or 733 million bbl of oil. Analogs to the Kunene prospect are giant oil and gas fields El Abra-Tampico in Mexico with reserves of 3 billion bbl of oil, Malampaya-Camago in the Philippines with 4 tcf of gas and 200 million bbl of oil, and Tengiz in Kazakhstan with 8 billion bbl of oil.

The Hartmann prospect in the southern part of the block, which has an assessed mean recoverable resource potential of 2.2 billion bbl of oil or 16.4 tcf of gas.

Drilling & Production—Quick Takes

Suncor plans third oil sands upgrader

Suncor Energy Inc., Calgary, applied to Alberta regulators Mar. 14 for authorization to construct and operate a $5.9 billion (Can.) third oil sands upgrader that would double production capacity at its Fort McMurray, Alta., oil sands facility to more than half a million b/d of light oil.

The upgrader would include cokers, hydrotreaters, utilities support, and a 50-km hot bitumen pipeline to connect the upgrader with Suncor's in situ operations.

Included in the application is a planned petroleum coke gasifier that would reduce the company's reliance on natural gas by processing about 20% of the proposed upgrader's petroleum coke into synthetic gas. The gasifier would add $600 million to the project cost.

The upgrader would be brought on line in phases. Production capacity will be expanded to 260,000 b/d from 250,000 by the end of 2005 with the expansion of bitumen supply and upgrading capacity. Capacity would expand to 350,000 b/d in 2008 and to 550,000 b/d in stages during 2010-12.

Later this year and in 2006 Suncor plans to submit additional applications outlining plans to provide bitumen feed to the proposed upgrader. Those costs could exceed an additional $4 billion. Suncor also foresees the need for additional pipeline capacity from Fort McMurray to Edmonton.

Inert gas injection set in Athabasca oil sands

Paramount Resources Ltd., Calgary, is evaluating a technology fix to replace pressure dissipated when gas associated with potentially recoverable bitumen is produced from the Athabasca oil sands of northeastern Alberta.

Paramount plans to inject as much as 3 MMcfd of inert compressor exhaust gases in the Surmont area into the Cretaceous Wabiskaw-McMurray oil sands in an attempt to maintain reservoir pressure while allowing the production of a similar volume of natural gas to be produced from previously shut-in gas pools.

The pilot project, to start up in April, would also enable the sequestration of as much as 400 Mcfd of carbon dioxide.

"If successful, Paramount is hopeful that this experiment will offer some resolution at Surmont to the 'gas over bitumen' issue as well as provide for sequestration opportunities for carbon dioxide," the company said.

The Alberta Energy and Utilities Board ordered the interim shut-in of gas production in September 2003 in an effort to stem pressure depletion in the oil sands (OGJ Online, July 29, 2003). The initial order, intended to protect ultimate bitumen recovery, affected 240 MMcfd of gas, then about 2% of Canada's output.

Paramount hiked its oil sands acreage 70% last year, acquiring 51,000 acres for $2.7 million and bringing the total to 120,000 acres, mainly in the Leismer and Surmont areas. The company plans to drill 15-20 oil sands evaluation wells after having drilled 17 such wells in 2004.

"The company is optimistic that the results of the oil sands evaluation program will allow it to bring forward a 3,000 b/d steam-assisted gravity drainage pilot application in 2005," Paramount said.

Cakerawala field starts gas flow

Commercial natural gas production started this month from Cakerawala field, the first field in the Malaysia-Thailand Joint Development Area in the South China Sea.

The field, on Block A-18, began producing gas through a 366-km pipeline, more than 2 years behind the original start-up date because of pipelaying delays caused by protests of Thai villagers and environmentalists (OGJ Online, May 14, 2002).

Production start followed a successful test in January of the onshore-offshore transmission system owned by both countries.

Block A-18 production-sharing contractors Amerada Hess Corp. and Petronas are delivering about 200 MMcfd of gas. By yearend, gas will flow through a 425 MMcfd gas separation plant under construction in Songkhla.

Processing—Quick Takes

PDVSA to construct three refineries

Petroleos de Venezuela SA (PDVSA) plans to build a total of 500,000 b/d of refining capacity at three sites in Venezuela to meet requirements for refined products in the Atlantic Basin that are expected to increase by 12 million b/d toward the end of the decade, said Alejandro Granado, PDVSA vice-president of refining.

Granado said action must be taken now because construction of a grassroots refinery takes 3-5 years.

The facilities will include a 50,000 b/d refinery in Caripito in the northeast that would produce primarily asphalt; a 50,000 b/d refinery in Barinas in the northwest that will supply refined products mainly for domestic use; and a 400,000 b/d plant in Cabruta in the central part of the country that will serve chiefly as a crude upgrader. Overall, PDVSA intends to increase its production capacity to more than 5 million b/d in 2009 from the current 3.7 million b/d. This would require investments of $37 billion, of which PDVSA would supply $26 billion, with the remaining $11 billion coming from private investors.

BP taps Jacobs for Cherry Point ULSD upgrade

BP PLC has contracted Jacobs Engineering Group Inc., Houston, to provide front-end engineering, design, and procurement services for an ultralow-sulfur diesel (ULSD) project at BP's Cherry Point refinery at Blaine, Wash., ahead of the US Environmental Protection Agency's mandatory ULSD regulations that are slated to go into effect June 1, 2006.

Front-end engineering is complete and detailed design is under way.

The Cherry Point refinery is designed to process more than 230,000 b/d of Alaska North Slope crude to produce 3.5 million gal/day of gasoline and 2.2 million gal/day of diesel in three grades. Nearly $500 million has been invested over the past 10 years to modernize the refinery and keep it efficient.

BP plans to invest more than $75 million on the new ULSD facilities at the plant, with mechanical completion projected for mid-2006.

Transportation—Quick Takes

Russia eyes exports of eastern gas

Russia is developing an export strategy for natural gas from its far eastern producing regions, said Alexei Mastepanov, an advisor to OAO Gazprom Chairman Alexei Miller. Mastepanov, speaking at the 2005 Russian-Japanese Economic Forum at Niigata, Japan, said gas production in Russia's eastern regions could increase to 50 billion cu m (bcm)/year by 2010 and nearly 110 bcm/year by 2020. However, development of a natural gas complex there must be based on existing infrastructure at Irkutsk, Krasnoyarsk, Yakutsk, and Sakhalin, he added.

The development, which would create large production facilities based on gas exports and gas processing, requires $40-45 billion for exploration and $15-20 billion for production infrastructure, Mastepanov said.

Yury Shchukin, director of a Sakhalin research institute, said expected production levels of 50-60 million tonnes/year of oil and 65-85 bcm/year of natural gas will make Sakhalin Island a major producing center by the mid-2020s.

Schukin said the greatest hopes are pinned on Sakhalin-3 and Sakhalin-5, which could surpass Sakhalin-1 and Sakhalin-2 in output.

Russia would aim first to satisfy domestic demand, he said, and in the future would build gas pipelines connecting its gas fields in Sakhalin with Japan and in Eastern Siberia, with China and South Korea.

Atlantic LNG debottlenecking under way

The partners of Atlantic LNG Co. of Trinidad & Tobago Ltd. expect to produce as much additional LNG as would be produced by a small LNG train when they complete debottlenecking the existing three trains in 2008, said BG Group PLC, the second largest Atlantic LNG shareholder.

The debottlenecking is expected to add 1.5-3 million tonnes/year or "about 165 MMscfd for each tonne of train capacity," said BG Group spokesman Christopher Carter.

Atlantic LNG, which operates the three existing trains, is constructing a 5.2 million tonne/year fourth train to boost combined capacity to 15 million tonnes/year.

The partners also are pursuing the possibility of a fifth LNG train (OGJ Online, Apr. 19, 2004). With the additional capacity the company could increase LNG output to 17 million tonnes/year, BG said.

Atlantic LNG partners include BP PLC, BG, National Gas Co. Trinidad & Tobago Ltd., Repsol LNG Port Spain BV, and Tractebel LNG.

GAIL leads Indo-Iranian gas line in India

India's Petroleum Ministry has designated state-owned gas transmission firm GAIL (India) Ltd. as the lead agency for its portion of the proposed Indo-Iranian gas pipeline project (OGJ Online, Feb. 25, 2005).

GAIL will operate the pipeline in India, provide necessary guarantees for gas offtakes at the Indian border, and complete agreements on gas pricing and other commercial terms.

According to the ministry, other oil and gas companies could form a consortium to provide additional financial strength.

To move the pipeline forward, the ministry is contemplating joining the Brussels-based Energy Charter Conference (ECC), which provides a legal framework for promoting international energy cooperation among Asian and European countries.

ECC representatives met recently with ministry officials, encouraging India to join, and similar approaches are being made to Iran and Pakistan, neither of which is a member, although Iran is an observer.