Operators spending more freely, increasing demand for rigs

Operators will increase worldwide investment by at least 6% in 2005 and compete for the dwindling supply of rigs.

At the Association for the Study of Peak Oil and Gas (ASPO) conference in Berlin, May 25-26, 2004, Matthew Simmons, CEO of Houston-based Simmons and Co. International, said that not having enough rigs or infrastructure is one of the continuing mistakes made by the energy industry over decades.1

Investment in newbuild rigs is still proceeding cautiously, perhaps tempered by fears that the market may still crash if a few weeks of warm winter weather depresses petroleum prices.

Even as new rigs are built, the fleet is aging and old rigs are being scrapped. Utilization rates are rising in general, and more complicated well plans (deep, directional wells) require more rig time.

Additional rigs will be needed to drill enough wells just to maintain current production, based on the smaller sizes of sizes of new discoveries and field depletion.

Day rates, indices

Rig availability and rates generally increased worldwide in 2004, but unevenly.

In its fourth-quarter 2004 report, released Jan. 26, 2005, GlobalSantaFe said it received higher day rates and increased utilization for jack ups in the Gulf of Mexico and the Far East and for floaters off South America and North Sea through 2004. The company experienced lower day rates in West Africa and Canada and decreased utilization in the Middle East.

Deepwater rig rates reached a new record high. ChevronTexaco recently signed an 18-month contract for Transocean Inc.'s Discoverer Spirit drillship for $270,000/day, up from its current rate of $204,000/day, and up from $140,000/day just a year ago. The previous peak for a deepwater rig was $240,000/day, according to company news releases.

According to Rigzone, average rates for 165 semisubmersibles in the world market were running between $75,000 and $120,000/day in mid-February. Contracts for jack up rigs during the same period were running about $45,000-$70,000/day.

In January 2005, utilization of jack ups was nearly 92%, semisubs nearly 85%, and drillships about 79%.

Bank of America analyst James Wicklund believes day rates will continue to climb this year. Other analysts, including Lehman Bros. Angeline Sedita, believe day rates for advanced deepwater rigs will reach $300,000/day during the year.

GlobalSantaFe Corp.'s monthly SCORE (summary of current offshore rig economics) issued Feb. 21, 2005, showed a 6% worldwide increase in profitability for January 2005 from the previous month, up 36% from a year ago, and up 128% from 5 years ago.

The rig market was improving in the North Sea (up 13% from December 2004), Gulf of Mexico (5%) and in Southeast Asia (2%). The Gulf of Mexico and North Sea showed the largest year-over-year improvements, increasing 60% and 57%, respectively, since January 2004, and 110% and 207%, respectively, in the last 5 years.

The January SCORE for semisubmersible rigs increased 6% from December, and up 140% from 5 years ago. The SCORE for jack ups also increased 6% from December and 121% from 5 years ago.

Directional wells increasing

Baker Hughes's North American rig count for the week of Mar. 4, 2005, showed the US count at 1,290, up 9 from the week before and up 161 year-over-year. There were 92 rigs drilling in the Gulf of Mexico, down 7 from the week before and down 4 from a year ago. The Canadian rig count was 593, down 24 from the week before, but up 37 year-over-year.

In the US, 793 vertical wells accounted for 61% of all wells drilling, down from 65% a year ago. There were 345 directional wells (27%), same as a year ago. The percentage of horizontal wells increased to 12% from 8% a year ago.

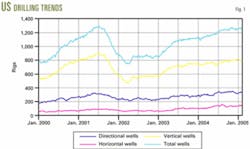

According to the historical Baker Hughes US rig counts, directional and horizontal drilling have increased significantly relative to vertical drilling in the past 5 years (February 2000-05). The number of directional wells has increased 190% (to 339 from 178) and the number of horizontal wells has increased 250% (to 145 from 58). Vertical drilling has increased only 40% (to 796 from 526) in the same time period (Fig. 1).

Rig construction update

The ENSCO 106 KFELS Mod V(B) Class jack up was christened on Jan. 17, 2005, in the Keppel FELS yard in Singapore, according to a company report. On Feb. 7, Dallas-based ENSCO International Inc. announced that it purchased the remaining nonowned 75% interest in the rig for about $80 million, for a total cost of about $108 million. The ENSCO 106 begins a 1-year contract with Apache Corp. off Australia in mid-March for about $97,000/day.

The ENSCO 107, still under construction at KFELS as the B264, will be delivered fourth-quarter this year, which will increase ENSCO's fleet to 44 premium jack ups and 11 other rigs, according to Keppel FELS' Offshore Marine magazine (January-February 2005).

Two contracts for new jack ups were announced in February, in addition to the 16 jack ups under construction recently tabulated (OGJ, Jan. 17, 2005, p. 51).

Offshore Marine also reported that the KFELS B Class jack up (B265) under construction for Odfjell Drilling AS will be undocked July 15, 2005. The keel was laid on Nov. 19, 2004, and the rig will be delivered in second-quarter 2006.

Sinvest ASA has two KFELS B Class jack ups under construction, B263 and B267, due for delivery in 2006. The keel laying for B263 took place on Nov. 18, 2004, and the yard struck steel for the B267 on Dec. 8, 2004.

Companies continue to upgrade existing rigs. The Sedco Forex Express fifth-generation semisubmersible began a 65-day upgrade at The Keppel FELS Brasil yard in January.

In fourth-quarter 2004, The Rowan Gorilla V jack up was upgraded for high-temperature, high-pressure work at the Keppel Verolme yard in the Netherlands, before going to work in the North Sea Glenelg field.

Rig sale

Pride Foramer SAS, a subsidiary of Pride International sold the Energy Explorer IV four-legged, cantilevered jack up for $40 million cash to Aban Loyd Chiles Offshore Ltd. The rig is renamed Aban VI.

The rig was refurbished in 1998 by Cairn energy PLC and sold to Pride in 1999. Pride International continues its move toward being primarily an offshore drilling company. Among others, Lehman Bros. analyst Angeline M. Sedita said in early March that the company is likely to sell its land drilling equipment and E&P service assets in the near future.

New MMS incentive

On Feb. 18, 2005, the US Department of the Interior's Minerals Management Service issued a rule proposal that would allow Suspensions of Operations (SOO) for ultradeep wells (at least 25,000 ft TVD), in order to encourage deep drilling in the Gulf of Mexico.

The proposed rule would apply to leases that have either a 5-year primary term, or an 8-year primary term with a requirement to drill within the first 5 years, granting a SOO to extend the primary term if the operator has plans to drill an ultradeep well on the lease and meets other criteria.

Leases with 10-year primary terms would not be eligible for the SOO, as the MMS deems 10 years sufficient time to develop deepwater prospects.

The MMS was accepting comments on the proposed rule until Mar. 16, 2005.

2005 drilling plans

Oklahoma City-based Kerr-McGee Corp. discussed its 2005 drilling plans at the Credit Suisse First Boston (CSFB) Energy Summit on Feb. 3. The company will spend about $380 million to drill exploration wells in US onshore (50-55), Gulf of Mexico (30-35), North Sea (5-7), and international new ventures (10-15).

Over the last 5 years in the Gulf of Mexico deepwater, Kerr-McGee drilled 50 new-field wildcats (50% success) and 100 total exploration wells (68% success), leading to 20 developments, five of them major. The company says it is now shifting from traditional amplitude to "subsalt and subtle amplitude plays."

Kerr-McGee's 2005 exploitation plans in the Rocky Mountains include $245 million to drill more than 200 wells in the greater Natural Buttes area, up from $160 million spent to drill 140 wells in 2004; and $120 million to drill 220 wells in the Wattenberg area, up from $110 million spent to drill 180 wells in 2004.

The company also expects to drill an appraisal well off southern Brazil in 2005, near the BM-C-7 discovery. It will appraise the CFD 14-5 discovery in Bohai Bay during second-quarter 2005.

At the CFSB Energy Summit on Feb. 4, Ron A. Brenneman, president and chief executive officer of PetroCanada said that the company would drill three high-impact exploration wells in the North Sea, Algeria, and Tunisia in 2005. Additionally, about 8% of the 2005 budget will be spent on exploration and new ventures, about 29% on reserves replacement in core areas, and 35% on new growth projects.

Houston independent Newfield Exploration Co. plans to increase 2005 capital spending to $950 million, according to a Feb. 9 release of fourth-quarter 2004 activity. A third of the budget, about $330 million will be spent in the Gulf of Mexico, to drill about 20 wells in shallow water and as many as three deepwater wells.

Newfield will spend about 22% of the budget, $210 million, to drill 15-20 exploration wells and 40-60 development wells on the Gulf coast in 2005. The company also intends to spend about 23%, about $220 million, drilling 200-300 wells in the US mid-continent.

Newfield will drill 175-200 wells in the Monument Butte field, northeast Utah, at a cost of about $90 million. Another $100 million will be spent outside the US, in Malaysia, UK North Sea, and Bohai Bay.

In late January, Repsol YPF announced that it would invest $1.2 billion in Argentina this year, an increase of 35% over 2004 spending. $750 million will be spent on drilling and natural gas production in 2005, according to a Dow Jones report. The company plans to spend $3.4 billion through 2009.

On Feb. 16, the company announced its 5-year plan to spend $1.1 billion in Mendoza province, western Argentina. According to the News and Observer, the investment will be in exploration, production, and development of reserves.

Repsol YPF also has major operations in Spain and works in 27 other countries. Spain's Repsol purchased Argentina's YPF in 1999 for $15 billion.

On Mar. 2, Talisman Energy Inc. Pres. and CEO Jim Buckee announced that the company will drill as many as eight exploration wells in Trinidad this year, including two onshore.

Worldwide spending

Lehman Bros. analysts Jim Crandell and Angie Sedita estimate a 5.7% increase in E&P spending worldwide in 2005, based on results of their Original E&P Spending Survey, released in December. They forecast US expenditures up 7.8% (249 companies); Canadian expenditures up 8.6% (75 companies); E&P investment outside North America up 4.5% (87 companies).

On the contract drilling side, Lehman Bros.' Sedita and Benjamin York see an upside to the estimates, as some of the major spenders, national oil companies in the Middle East, West Africa, and South East Asia, were missing from the survey. The analysts expect continued tightness in global rig markets and further escalations in day rates, for land, jack ups, and deepwater rigs. Over the long term, they see deepwater markets offering the greatest potential, now served by companies such as Transocean Inc., Diamond Offshore Drilling Inc., Noble Corp., and GlobalSantaFe Corp.

Reference

1. http://www.peakoil.net/iwood- 2004/pptBerlin/Simmonspdf.pdf